Private Equity (PE) roll-up offers look like generational de-risking events, but selling your MSP is rarely just a financial transaction. The true cost of a bad deal is not tax liability; it is the massive post-close regret driven by staff churn, loss of control, and client disruption. Dealing with corporate msp ownership problems post-exit destroys more long-term value than any headline multiple delivers. As an advisor who has worked on the PE side, I optimize for measurable, long-term outcomes. We detail 10 specific pitfalls that create the most seller’s remorse, providing the pressure-test points you need for due diligence. We start with the root cause of most failure: selling without absolute clarity on your non-negotiable red lines.

1. Define Your Non-Negotiable Red Lines Before Signing the LOI

Post-M&A remorse stems from optimizing for the headline price while selling the business’s most valued assets: team, culture, and autonomy. Founders confuse financial de-risking with strategic fulfillment, often failing to implement rigorous msp succession planning, which leads to corporate msp ownership problems later.

Before the Letter of Intent (LOI) is drafted, define your “Post-Close Life Plan.” Ask: What must my day-to-day role look like six months post-close?

To avoid negotiating blind, write three explicit red lines. If the buyer cannot meet these, walk away. Non-negotiables must cover:

- Staff Protection: Explicit retention budgets or non-layoff guarantees for key engineering or sales talent.

- Client Quality: Defined service parameters, such as restricting offshore Tier 1 support for top enterprise accounts.

- Decision Rights: Clear authority over a specific domain (e.g., product roadmap or R&D budget) throughout the earnout.

Solely focusing on EBITDA multiples risks trading predictable value for high-risk earnout environments and long-term M&A regret. (147 words)

2. Secure Operational Control: Autonomy is a Governance Design Problem

The classic M&A trap: the buyer promises, “Keep running it like you always have,” until the realities of post-sale integration economics hit the first quarterly review. Losing operational control is the fastest path to corporate msp ownership problems and earnout failure.

Autonomy is not a verbal promise; it is an explicitly defined governance design problem. Clarify in writing who retains decision rights throughout the earnout:

- Hiring/Comp: Who signs off on new headcount, defines compensation bands, and approves terminations?

- Vendor Stack: Can you mandate RMM/PSA tools, or are you forced onto the standardized platform?

- Pricing Authority & Scope: Who approves price increases, client exceptions, and fundamental service scope changes?

A critical pressure test: Ask the buyer for three examples of decisions prior sellers made unilaterally post-close versus those escalated to the PE operating partner. True autonomy is possible, but it must be secured through explicit contractual governance that aligns incentives, not generalized goodwill. (146 words)

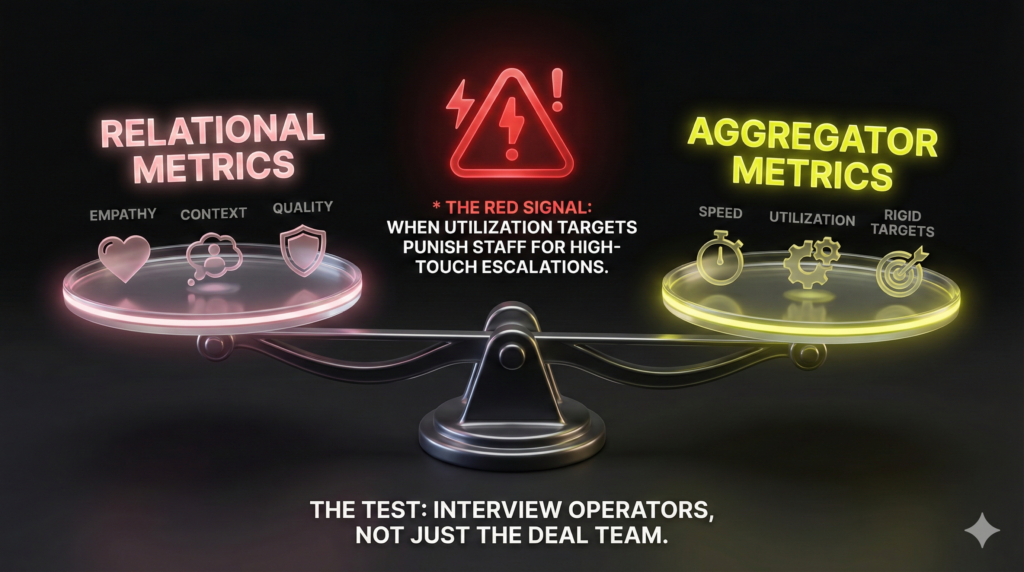

3. Audit the Incentive System: Culture Follows the Metrics

You cannot effectively “out-culture” a new incentive system. When a buyer talks about “culture fit,” they mean vibes; when they discuss governance, they mean metrics. Acute corporate msp ownership problems post-close stem from implementing a metrics system that destroys the MSP’s relational core. This clash manifests when ticket metrics (speed, utilization) become paramount, overriding customer empathy and crucial local context.

For due diligence, bypass the corporate development team entirely. Instead, interview operators: the service desk lead, the vCIOs, and the TAMs. Ask precisely how exceptions are handled for the top three high-value accounts.

The red signal is an incentive structure that actively punishes staff for doing the right thing. If the utilization target is rigid, service desk leads cannot buffer time for high-touch escalations, forcing the prioritization of speed over essential quality. If leadership compensation ties to metrics that ignore customer relationships, the culture will fracture. (150 words)

4. Pressure Test Leadership Stability: The Post-Close Hand-Off Risk

The most destabilizing corporate msp ownership problems arise when the people who signed the deal are not the people who execute the integration. Post-close leadership turnover is a critical failure point: executive swaps immediately re-route decision-making from domain experts (your team) to new VPs of Operations who fundamentally lack local context or understanding of client technical debt. This managerial disruption creates operational churn that jeopardizes the earn-out environment.

During due diligence, rigorously assess leadership stability metrics: What is the average tenure of the buyer’s key operations and integration leaders? How often do they replace local General Managers or former owner-operators? If high leadership churn is proven to be the internal playbook, expect the immediate fracturing of staff morale and service quality downstream.

Contractually, demand structural protective terms: secure a defined role scope for the selling founder, establish clear escalation rights for client-impact decisions, and mandate a named, senior integration owner for the first 18 months. Without these assurances, the trust network stabilizing long-term service delivery dissolves rapidly. (141 words)

5. Audit the Earnout Calculation: Don’t Bet on Metrics You Don’t Control

You accepted an earnout to bridge the valuation gap, but that payout is defined by future EBITDA targets the buyer unilaterally controls. Post-close, the buyer controls all payout levers: they can change shared service fee allocations, adjust software tool costs, reprice contracts, or mandate costly integration timelines. These strategic moves shift the goalposts, leading to acute corporate msp ownership problems when the founder realizes the metrics are being manipulated.

To mitigate this systemic risk in the earnout calculation, demand strict contractual safeguards:

- Tight Definitions: Explicitly define allowable expenses, limits on related-party charges, and standardized service fee allocations.

- Audit Rights: Secure contractual rights for a third-party accountant to audit the buyer’s calculation methodology and underlying data.

- Governance Trade: Trade earnout exposure for governance. Demand veto rights on any strategic decision (like pricing changes or required vendor stack migration) that materially affects the earnout calculation.

Never bet your retirement on metrics that the opposing party has every incentive to control or repress.

6. Audit Operational Leverage: The “Grow First, Staff Later” Staffing Trap

The most acute corporate msp ownership problem stems from the toxic growth model: surging new logo targets while service desk and engineering headcount remain flat. This artificial operational leverage directly causes SLA misses, pager fatigue, rising ticket backlog, staff attrition, and client churn, destroying the value you intended to protect.

Diligence must scrutinize the buyer’s historical ops-to-revenue hiring ratios. Do they invest in automation and robust tooling, or merely consolidate and demand impossible efficiency from existing teams? If the latter, quality decline is imminent.

To protect value, require a contractual post-close ops hiring plan tied to measurable revenue milestones, not vague assurances. Mandate named roles: Service Delivery Manager (SDM), NOC engineers, and security operations staff. If the implicit plan is “grow first, staff later,” you guarantee burnout and a short runway toward M&A regret.

7. Fund Core Staff Retention: Secure Service Continuity

Technicians rarely leave due to the M&A transaction itself; they quit when the buyer fails to fund retention, breaks trust regarding compensation, or disrupts autonomy and workload. The true drivers of the earnout—Service Desk Leads, senior engineers, vCIOs, and Technical Account Managers (TAMs)—are responsible for service continuity. If they walk, the revenue engine stalls.

Due diligence must verify explicit retention mechanics. A serious plan includes funded stay bonuses, absolute clarity on post-close compensation alignment, and defined career paths within the new organization. The highest red flag for future corporate msp ownership problems is any proposal to eliminate bonus structures or remove key benefits purely to extract immediate operational synergy.

If you cannot point to a specific budget and a named executive responsible for staff retention and comp clarity throughout the earnout, you are gambling the asset’s service continuity foundation against short-term savings.

8. Measure Client-Facing Disruption: The Price of Service Erosion

Integration failures are not contained to the data center; client disruption surfaces before your earnout payment hits. Long-tenured SMB and mid-market accounts—the bedrock of recurring revenue—feel corporate msp ownership problems instantly.

What do clients see first? They watch familiar faces disappear, witness crucial escalations taking longer, and recognize when tailored support becomes standardized, scripted, and inflexible. The relationship exceptions vanish. This decline makes re-pricing and packaging changes—an inevitable part of the buyer’s strategy—a non-starter, often triggering immediate renegotiation or total client churn.

During due diligence, ask the buyer for their post-close pricing philosophy and their explicit handling plan for long-term legacy clients. The bottom line: if the buyer cannot articulate how high-touch service quality is contractually protected during integration, assume it will be sacrificed. You are trading your brand’s authority for operational synergy.

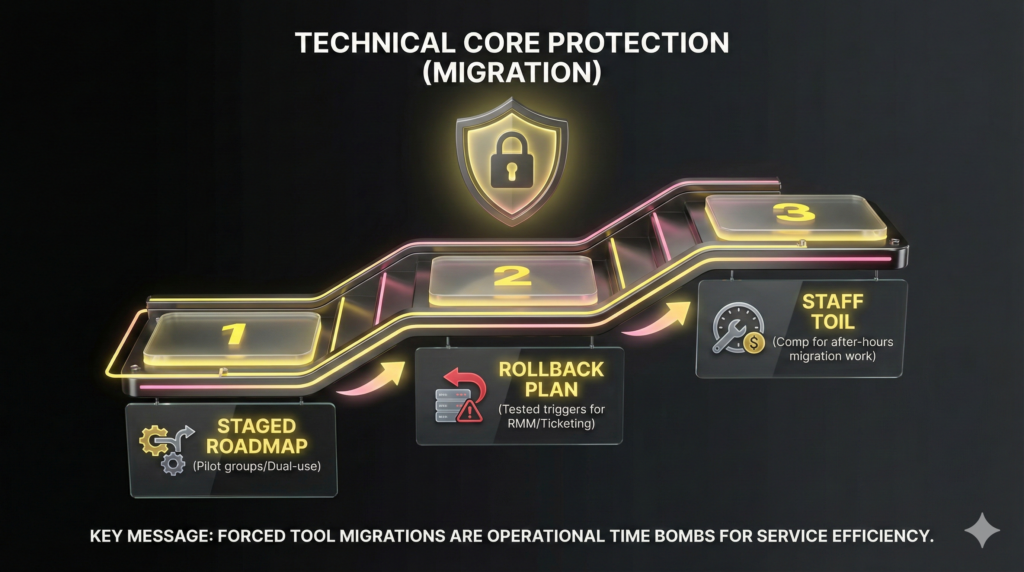

9. Scrutinize the Integration Plan: Protect Your Technical Core

Corporate buyers target your RMM, PSA, and security stack as duplicative costs. Forced tool migrations are operational time bombs, not spreadsheet exercises. They immediately disrupt monitoring, scripting, patching, and identity workflows, destroying service efficiency and alerting fidelity. This misalignment causes systemic corporate msp ownership problems post-close.

If the integration plan is simply “rip and replace by date X,” expect massive operational turbulence and accelerated staff burnout from after-hours migration loads.

You must mandate specifics:

- Roadmap: Require a non-negotiable, staged migration roadmap including pilot groups and dual-use periods.

- Rollback: Mandate tested rollback plans for every critical system (RMM, ticketing).

- Staff Protection: Define compensation or time-off in lieu (TOIL) for staff managing mandatory after-hours migration work.

Do not accept a plan assuming technical muscle memory or complex endpoint policies transfer seamlessly. If they cannot demonstrate protection during migration, they are trading service integrity for immediate synergy realization. (145 words)

10. Audit the Buyer’s Capital Structure: Debt Service Defines the Budget

The central cause of corporate msp ownership problems post-close is often not managerial malice, but the buyer’s leveraged capital structure. High debt service on PE financing immediately translates to intense, sustained budget pressure. This operational constraint forces the platform to centralize functions, raise prices aggressively, delay critical tooling refresh, and freeze hiring—even when leadership knows those decisions degrade service quality.

During due diligence, shift focus from revenue to financing. Distinguish an “extract-to-hit targets” model from an “invest-to-grow” one by asking specific, non-adversarial questions:

- How are they funding the acquisition (debt-to-equity ratio)?

- What post-close investment in tooling (RMM, security stack) and headcount is contractually committed?

- How do they budget for security improvements and operational refresh?

You are not selling to a brand name; you are selling into a financial model where the capital structure dictates the operational levers you will be forced to pull.

الأسئلة الشائعة

Regret is common, though it rarely concerns the initial transaction price; it centers on loss of control, cultural misalignment, and staff attrition post-close. The greatest predictor of M&A regret is an unclear strategic “why” combined with the failure to secure non-financial governance terms in the contract. Founders must define non-negotiables regarding staff roles and client service quality before the Letter of Intent (LOI).

Layoffs are not automatic, but they are a high risk if the buyer pursues operational synergy solely through cost reduction rather than growth investment. Expect staff churn if the buyer imposes rushed tool migrations, standardizes compensation downward, or fails to fund a key employee retention budget. Diligence the buyer’s historical Ops-to-Revenue hiring ratios to identify the “Grow First, Staff Later” staffing trap discussed in Section 6.

Earnouts are not inherently bad; they are a tool that shifts valuation risk onto the seller. However, they become toxic when the buyer retains unilateral control over the levers (pricing, expenses, staffing) that influence the target metric. Mitigation requires demanding tight definitions for allowable expenses, securing audit rights for calculation methodology, and obtaining veto power over strategic decisions that materially affect the earnout calculation.

Bypass the corporate development team and interview operations staff: talk to their service desk leadership, engineers, and Technical Account Managers (TAMs). Ask for three specific examples of how they handle client exceptions or regulatory issues for their high-value accounts. Demand to see a detailed 90-to-180-day integration plan that includes staffing assumptions, which will reveal their true operational playbook.

Protecting clients requires structured transition communication, named client owners who remain stable, and defined Service Level Agreements (SLAs) throughout the transition period. Avoid immediate, aggressive repricing changes; stage any necessary packaging shifts over time. The goal is to ensure account teams and escalation paths remain functionally stable through the migration phase to prevent avoidable client churn.