Stop viewing your MSP valuation as a reward for effort. For $5M+ owners in the critical 12 to 36-month M&A readiness window, the msp sales and appraisals process is simple: Buyers, especially Private Equity, purchase de-risked, transferable cash flow, not revenue. Uncertainty justifies a valuation haircut. This guide reveals five core financial red flags buyers penalize, along with specific fixes you can implement now to defend your multiple. We start with the fastest hit: unreliable EBITDA.

1. Prove the Quality of Earnings (QoE) to Defend Your Adjusted EBITDA

Your MSP valuation is most vulnerable when the buyer’s Quality of Earnings (QoE) team reviews your books. The core red flag for Private Equity is an inconsistent P&L—the primary driver of discounted msp sales and appraisals. If your Adjusted EBITDA relies on unsubstantiated add-backs, mixed personal expenses, or cash-basis accounting swings, you offer a risk premium, not a growth premium. Uncertainty in earnings quality gives buyers leverage to demand a valuation haircut, enforce a larger escrow, or trigger a re-trade late in diligence. Shift from “Founder Math” to “Investor Math.”

The 30-Minute Financial Hygiene Test

Preempt damage with a rapid internal diagnostic:

- P&L vs. Bank Statements: Compare the last 24 months of monthly P&L against bank statements. Determine if margin volatility is masked by unclear timing.

- Document Add-Backs: List every owner adjustment. Mark which claims have verifiable invoices vs. estimates. Target 100% documentation.

- Owner Normalization: Identify if owner compensation is above or below market rate. Detail any “working owner” roles requiring replacement and estimated cost.

Fix It Now: Building the Investor-Ready Ledger

Produce an indisputable Adjusted EBITDA schedule immediately:

- Separate Spend: Transition discretionary and personal expenses into clearly coded, distinct General Ledger accounts.

- Accrual Bridge: If cash-basis, build a monthly bridge to accrual reporting to reflect MRR and project completion accurately.

- Diligence File: Collect proof now: monthly financial packages, detailed GL exports, payroll reports, and a dedicated add-back folder with supporting receipts.

This proactive approach converts risk into measurable, transferable value, ensuring your multiple holds steady. By institutionalizing these retention playbooks, you not only de-risk the asset but also create the leverage needed to maximize exit price during final negotiations.

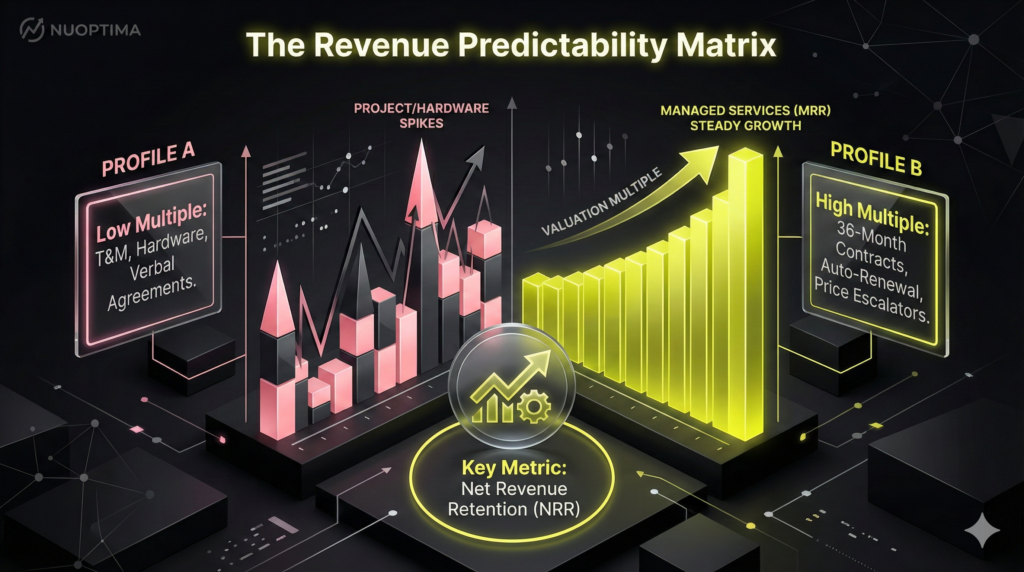

2. Standardize Client Contracts to Prove Revenue Predictability

While a Quality of Earnings (QoE) audit proves Adjusted EBITDA is reliable, buyers—especially Private Equity operating partners—prioritize revenue durability. Heavy reliance on one-time projects, hardware sales, or easily terminable contracts signals volatility. This uncertainty slashes your مضاعف التقييم and often mandates a large earnout. Due diligence severely penalizes revenue based on verbal agreements or MSAs lacking auto-renewal and clear price increase language, signaling low predictability and high churn risk.

Diagnosing Revenue Durability

To demonstrate transferable cash flow, audit your revenue streams and client agreements:

- Revenue Breakdown: Segment the last 24 months of revenue into Managed Services (MRR), Managed Security Add-Ons, Cloud Resale, Projects (T&M), and Hardware. The goal is migrating non-MRR streams into recurring categories.

- Contract Audit: Review your top 20 client MSAs for: mandatory term length (36+ months ideal), termination for convenience clauses, explicit auto-renewal language, and embedded annual price increase mechanisms.

Action Plan: Building Your Recurring Revenue Bridge

Migrate “project dependency” into predictable MRR streams immediately.

- Repackage for Recurring: Bundle managed security, vCIO services, and annual compliance programs that were once sold piecemeal. Standardize these offerings into non-negotiable tiers.

- Refresh Contracts: Implement a standardized contract library. All new/renewed MSAs must include mandatory auto-renewal, 90-day termination for cause only, and annual price adjustment language linked to scope/tooling costs.

Prove this shift by preparing an MRR cohort report (starts, expansions, downgrades, and churn by month). This data, alongside your full contract library (signed PDFs), establishes the indisputable recurring revenue bridge necessary to secure a premium multiple.

3. Optimize Unit Economics to Prove Scalable Gross Margin

Private Equity operating partners focus relentlessly on gross margin health, as it dictates model scalability. Fragile margin, where EBITDA looks defensible but profitability is compressed by tooling overlap, high ticket volume, or clients consuming unlimited support without matching price, is a critical red flag. Buyers view margin collapse as the highest post-close risk. They heavily discount the multiple or enforce onerous earnout structures if repeatable unit economics cannot be proven.

Diagnosing Margin Fragility

To convert fragile margin into investor-grade value, diagnose core operational weak points:

- Client-Level Profitability: Calculate MRR minus direct service labor estimates (ticket time or allocated FTE hours) and direct tool costs per contract.

- Identify “Noisy” Clients: Sort clients by tickets/user/month. If the loudest clients sit in the cheapest pricing tiers, they destroy unit margin.

- Audit Tooling Overlap: Locate redundant RMM, PSA add-ons, security stack elements, and backup licenses purchased in silos.

Fix It Now: Building Defensible Cost Structures

Implement a strategic shift to standardize operations and guarantee margin transferability (key to M&A readiness):

- Enforce Stack Standardization: Standardize the security and infrastructure stack across all clients. Negotiate vendor consolidation to leverage volume and eliminate unused licenses.

- Operational QBRs: Introduce profitability review during Quarterly Business Reviews (QBRs). Align client scope, user count, and security requirements to the required price tier.

- Document Efficiency: Improve service delivery via automation (patching, monitoring). Document runbooks and enforce strict SLA/OLA reporting to reduce escalations and labor waste.

Collect proof now: client profitability snapshots, margin reports (segmented by service line), and documented service delivery playbooks. This proves the margin is transferable and repeatable, not reliant on heroic effort.

4. De-Risk Customer Concentration to Protect Your Valuation Multiple

Concentration risk is the clearest red flag in the MSP sales and appraisals process. When 15–20% of total revenue resides in a single client, or the top five clients drive over 40% of cash flow, buyers see fragility. This high concentration signals immediate downside, resulting in a lower مضاعف التقييم, significant escrow requirements, or an earnout tied directly to retaining those key accounts post-close.

Diagnosing and Quantifying Transfer Risk

To quantify transfer risk before due diligence, translate dependency into hard metrics. Buyers use these to model worst-case scenarios:

- Concentration Ratio: Calculate MRR percentage from your Top 1, Top 5, and Top 10 clients. (Target: No single client exceeds 5%–7%.)

- Relationship Dependency: Identify which major accounts require the founder’s direct involvement for renewal or satisfaction. This revenue is non-transferable.

- Net Revenue Retention (NRR): The critical metric. NRR must exceed 105% annually to prove stickiness and offset gross churn via expansions.

Fix It Now: Institutionalizing Retention

To guarantee transferability and improve NRR for maximum M&A readiness, relationship ownership must shift from the founder to the organization:

- Implement Account Management (AM): Assign top clients to a vCIO or AM who handles all QBRs and renewals, systematically removing the founder from the service delivery loop.

- Formal Retention Cadence: Mandate a Quarterly Business Review (QBR) schedule for all high-value clients and implement a health scoring system in your PSA/CRM to track risk proactively.

- Execute De-Concentration: Establish a formal 12-month plan focused on acquiring smaller, profile-fitting accounts to quickly diversify the revenue base and lower the concentration ratio.

Proof to Collect: Supply NRR dashboards, documented QBR schedules, and an org chart detailing team member ownership for each key account renewal.

5. Optimize Your Cash Conversion Cycle to Avoid Purchase Price Adjustments

A stack of 90-day unpaid invoices is a massive liability, not cash. Private Equity buyers prioritize cash flow and view poor AR aging, inconsistent invoicing, and weak billing hygiene as immediate red flags that erode enterprise value. Valuation models assume a working capital target; weak collections often trigger a purchase price adjustment at closing, reducing your cash received dollar-for-dollar.

Diagnosing Collections and Billing Accuracy

To prove financial discipline and shorten the cash conversion cycle, isolate sources of friction and cleanup the General Ledger:

- Review AR Aging: Analyze current / 30 / 60 / 90+ days past due ratios. Isolate habitual late payers requiring updated terms or account termination.

- Audit True MRR: Separate high-margin recurring services from low-margin hardware resale, reimbursements, and project pass-throughs. Buyers apply a lower valuation multiple to non-recurring revenue.

- Identify Leakage: Track the backlog of services delivered but not yet invoiced (unbilled time) and patterns of unauthorized discounting or excessive credits.

Fix It Now: Institutionalizing Payment Discipline

Institute strict RevOps controls to guarantee collections and minimize risk:

- Tighten Invoicing Process: Implement same-day billing for project completion; strictly enforce automated monthly invoicing cycles.

- Mandate Autopay: Require autopay (ACH/Credit Card) for accounts below a specific revenue threshold, reducing manual collections labor.

- Clean Chart of Accounts: Separate recurring managed services revenue from all other revenue streams in the accounting system to ensure transparency.

Proof to Collect: Provide the formal AR policy, documented collections cadence, a 12-month cash conversion cycle trend line, and a clean MRR definition (excluding pass-through revenue). This documentation proves transferable financial discipline.

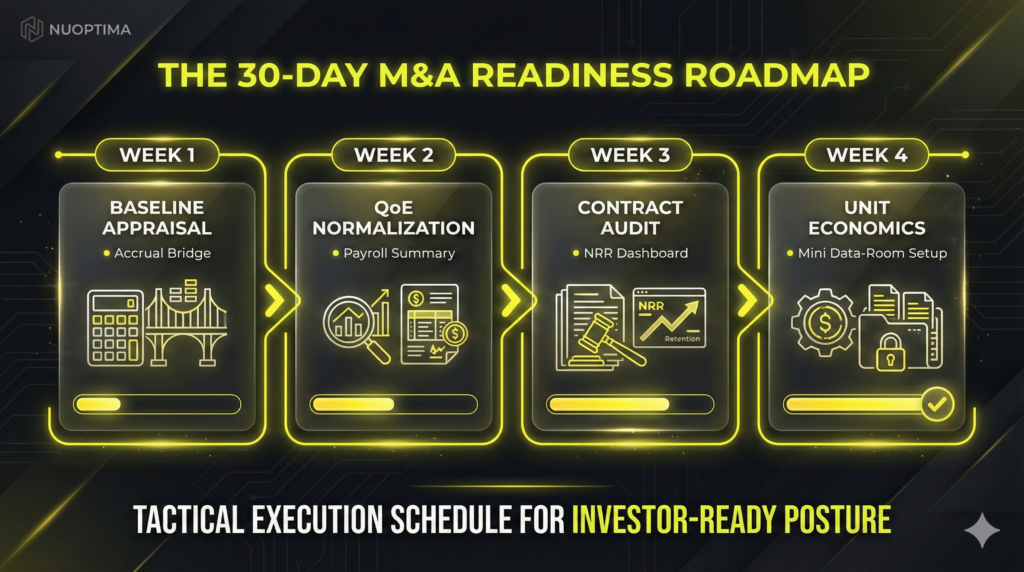

The 30-Day M&A Readiness Plan: Defending Your Valuation Before Due Diligence

Owners over-focus on the multiple and under-build the evidence required to sustain it. In the 30 days before formal engagement, make your MSP’s value provable, transferable, and defensible across all identified red flags. Use this tactical execution schedule to establish an Investor-Ready RevOps posture.

Week 1: Baseline Appraisal & Financial Foundation

- Build a simple valuation range using both EBITDA and revenue lenses. Sanity-check this range against current MSP transaction multiples, accounting for the size effect (smaller MSPs trade lower than large platforms).

- Finalize the Adjusted EBITDA add-back schedule by collecting all verifiable receipts and invoices (Ref. Quality of Earnings).

- Establish the Accrual Bridge. If cash-basis, model Trailing-Twelve-Month (TTM) and Trailing-24-Month (T24) financials on an accrual basis to reflect Monthly Recurring Revenue (MRR) accurately.

Week 2: Quality of Earnings (QoE) Normalization Pack

Focus on financial hygiene to eliminate purchase price adjustments and mitigate cash conversion cycle risk.

- Produce the TTM and T24 financial package, including General Ledger (GL) exports and a detailed payroll summary.

- Finalize Owner Compensation Normalization by documenting the market replacement cost for the owner’s operational roles.

- Execute the Collections Cadence Fix. Mandate autopay for small accounts and implement a formal Accounts Receivable (AR) policy (Ref. Cash Conversion Cycle).

Week 3: Revenue Quality and Contract Pack

Prove that revenue is recurring, sticky, and transferable to a new buyer (Ref. Contract Standardization).

- Create the MRR Bridge, Churn/Net Revenue Retention (NRR) Dashboard, and Concentration Table. Identify any client exceeding the 7% concentration risk threshold.

- Audit and organize all signed customer contracts. Flag specific change-of-control and termination-for-convenience clauses.

- Implement Account Management (AM) ownership for the top 10 clients to strategically de-risk founder dependency.

Week 4: Operational Transferability & Deal Decisions

Institutionalize the model and confirm scalable margin health for due diligence success.

- Calculate client profitability snapshots to confirm defensible gross margins (Ref. Unit Economics). Enforce stack standardization to eliminate tooling overlap.

- Decide on advisor engagement (broker or M&A counsel) based on projected deal size and internal complexity.

- Draft a Deal Structure Preferences One-Pager: Define desired cash at close, acceptable escrow terms, and earnout flexibility.

Deliverable: Assemble a structured, indexed mini data-room (Finance, Customers, Contracts, Ops) that proves transferable value and accelerates buyer diligence timelines.

الأسئلة الشائعة

Valuation multiples for MSPs in this segment typically range from 6x to 10x Adjusted EBITDA. This wide range is the outcome of a buyer’s risk scoring. Factors such as high quality of recurring revenue (MRR), contract length (36+ months), concentration risk, and demonstrably clean financials determine if you land at the lower or upper end of the spectrum. The multiple is the result of de-risking the business.

Choose based on deal complexity and size. Brokers typically handle smaller deals, focusing primarily on finding a buyer, often with less rigorous process management. Sell-side M&A advisors manage larger, complex transactions ($10M+ Enterprise Value). They run structured, competitive processes to optimize deal terms, not just headline price, and often command higher retainers for their specialization.

The primary difference is tax treatment. In a stock sale, sellers generally pay lower capital gains tax on the entire sale, leading to more cash take-home. In an asset sale, the buyer acquires specific assets and leaves liabilities behind. However, the seller is often taxed at higher ordinary income rates on certain asset categories, severely reducing net proceeds. Always model after-tax outcomes, not just the headline price.

Buyers demand a complete view of transferability and financial hygiene. This includes 3–5 years of GAAP-compliant financials, detailed General Ledger (GL) exports, current Accounts Receivable (AR) aging reports, and full support for all Adjusted EBITDA add-backs (Ref. Section 1). Operationally, they require signed customer MSAs, vendor contracts, HR/payroll records, and documented service delivery playbooks.

Both terms protect the buyer by reducing cash at close. An escrow (typically 10–15% of the price) is held for 12–18 months to cover unexpected financial or legal liabilities. An earnout is a contingent payment tied to the MSP hitting specific performance metrics (e.g., EBITDA or NRR targets) post-close. You reduce both by presenting clean financials, low customer concentration, and strong contractual language.