The mythical 4x or 5x revenue multiple is irrelevant when serious capital is on the table. Whether preparing for M&A due diligence, a partner buyout, or crucial SBA financing, MSP owners need a defensible, method-based opinion—not market chatter. This core distinction separates simple market value from a formal, investor-grade msp appraisal. Drawing on our experience scaling technical firms for exit, this playbook clarifies the required valuation methodologies, the necessary data, and the operational levers that truly maximize your enterprise value. We begin by defining these core concepts.

1. Separating the Valuation Opinion from the Final Deal Price

MSP founders often confuse a method-based MSP appraisal with the resulting market value or final deal price. These two numbers are fundamentally different; failing to recognize this distinction means negotiating with the wrong anchor.

أن MSP appraisal is a formal, defensible valuation opinion. It is derived from documented assumptions and accepted financial methodologies (DCF, asset-based approaches), using clean, normalized EBITDA. This provides the institutional, theoretical enterprise valuation based purely on the business’s financial structure.

Conversely, market value is the price a specific buyer pays under specific terms. This number is fluid, influenced by buyer mix (strategic roll-up, Private Equity, Search Fund), risk perception, and deal structure. The gap appears because elements like an earn-out, a working capital peg, or aggressive customer concentration will dramatically alter net proceeds, even if the underlying appraisal remains static.

Use the professional appraisal not as the final price, but as a crucial decision tool and a negotiation floor. Validate this formal valuation opinion against current market comps to ensure realism. The appraisal delivers the non-negotiable data required to maximize the final sale price, irrespective of the deal’s structure.

2. Core Valuation Methods Institutional Buyers Use

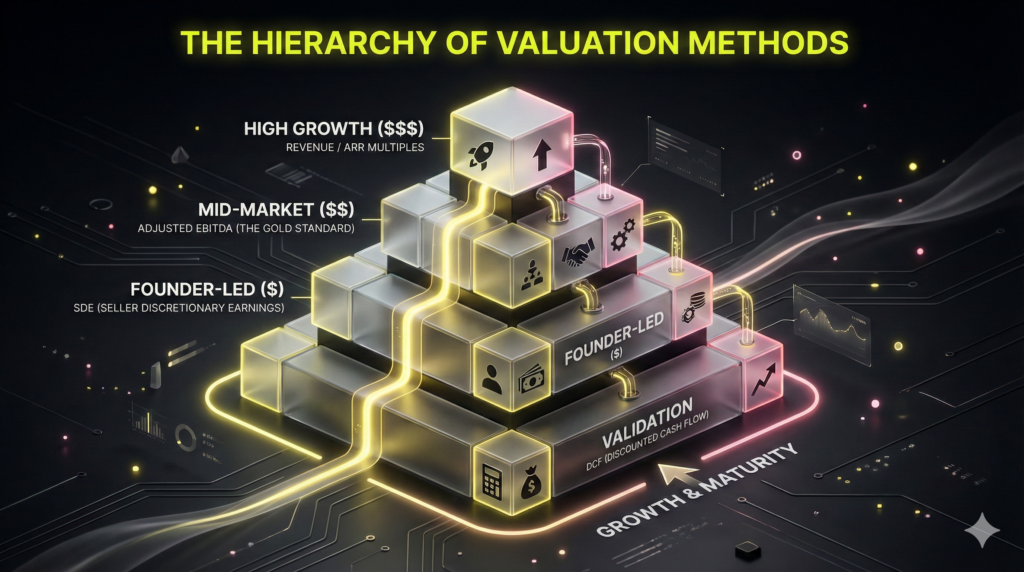

MSP value is not a single number, but a defensible range determined by methodologies appropriate for your firm’s stage and buyer type. An investor-grade MSP appraisal must reconcile these core institutional valuation methods.

- SDE (Seller Discretionary Earnings): Best for owner-operated MSPs, typically under $1.5M EBITDA. It adds back owner salary and non-recurring expenses to show the total economic benefit derived by the singular founder.

- Adjusted EBITDA: The gold standard for Private Equity and mid-market M&A. This investor-grade metric normalizes earnings for a hypothetical new owner by removing owner compensation and applying necessary add-backs for non-recurring or unusual expenses.

- Revenue/ARR Multiples: Used as a sanity check or for high-growth firms with predictable Annual Recurring Revenue (ARR). However, they are misleading if margins are inconsistent or client concentration is high.

- Discounted Cash Flow (DCF): A secondary validation tool, primarily used when cash flows are stable and highly forecastable. It is extremely sensitive to long-term growth and discount rate assumptions.

- Asset-Based Approach: Calculates value based on the fair market value of hard assets minus liabilities. This method is the floor value of the business, relevant if the MSP holds significant IP or fixed assets.

To deliver an investor-grade appraisal, always reconcile at least two views, typically earnings-based (Adjusted EBITDA) and market-driven (Revenue/ARR multiple), defining a defensible range backed by clean data.

3. Preparing Your Financials for Normalization (Add-Backs)

Presenting financials riddled with personal expenses destroys buyer confidence during العناية الواجبة. Normalization adjusts the income statement to reflect the ongoing, sustainable, and transferable earning power for a new owner. The resulting Adjusted EBITDA is the metric investors use to apply their multiple.

Common MSP add-backs, which increase your valuation, fall into two categories:

- Discretionary/Personal: Owner compensation above market rate, personal vehicles, discretionary family travel, above-market rent paid to an owner entity, and personal health premiums.

- One-Time Costs: Non-recurring legal settlements, extraordinary data center migration fees, severance packages, or single-instance hardware purchases.

Chronic underinvestment (e.g., skipping essential RMM or security licensing) signals a necessary expense the new owner يجب incur, resulting in a negative adjustment. Wishful future growth expenses do not count. When normalizing for the owner’s role, you must replace the owner’s salary with the verifiable, market-rate compensation required for a professional Service Delivery Manager or General Manager to perform that function.

The final deliverable is a clean, 1-page normalization schedule—an Adjusted EBITDA bridge linking book value to the investor-grade value opinion, ready for the appraiser. This allows you to accurately compare MSP acquisition offers by ensuring all buyers are bidding against the same normalized data.

4. Operational & Revenue Quality Metrics That Drive Your Multiple

Once Adjusted EBITDA is calculated, the valuation multiple is driven entirely by revenue quality and operational transferability. Investors, particularly Private Equity, seek predictable cash flow and maximum risk reduction. They do not buy chaos.

Here are the operational and revenue metrics that form the buyer’s due diligence checklist:

- Recurring Revenue Quality: Buyers demand predictability: 90%+ contracts must include annual auto-renewal clauses, price escalators, and firm minimum term commitments, proving contractual stability and pricing power.

- Net Revenue Retention (NRR): NRR is the true measure of growth quality. Consistently over 105% signals expansion revenue (clients buying more services) and low churn risk, which translates directly to a higher multiple.

- EBITDA Margin Consistency: Due diligence requires three years of stable EBITDA margin consistency. Volatility—often signaling reliance on one-time projects or uncontrolled costs—immediately caps the valuation multiple.

- Customer Concentration Risk: Concentration risk is a severe cap. No single client should represent more than 10% of total revenue, as losing an oversized client severely impacts the acquired entity’s foundational cash flow.

- Transferable Operations (SOPs): Buyer confidence relies on integration speed. Documented SOPs for client onboarding, security escalation, and Service Desk activities are mandatory, proving the business can operate reliably without founder dependency.

- Standardized Stack & Security: A standardized tech stack (RMM, PSA) is critical to reducing integration friction. Buyers expect a modern security baseline, including EDR/MDR solutions and privileged access controls, guaranteeing enterprise-level hygiene.

Focusing on these levers moves your business from merely profitable to truly M&A ready.

5. The Multiples Game: Sanity-Checking Your Valuation Range

The market chatter surrounding headline multiples—often citing varied 4x or 6x figures—creates an unrealistic anchor for MSP founders. The multiple is, fundamentally, a market-driven shorthand for risk, growth velocity, and cash flow predictability applied to your Adjusted EBITDA.

What shifts this multiple? Buyers, especially Private Equity, pay higher EBITDA multiples for specific factors: larger size bands (mid-market), high recurring revenue mix, low customer concentration, and documented operational maturity. Conversely, high churn or poor security posture instantly depress the range.

While brokers cite rule-of-thumb EBITDA multiple ranges based on size, the actual outcome hinges on institutional expectations. For high-growth firms, an ARR multiple may be cited, but this implies rigorous margin expectations; high ARR multiples require a clear path to exceptional profitability.

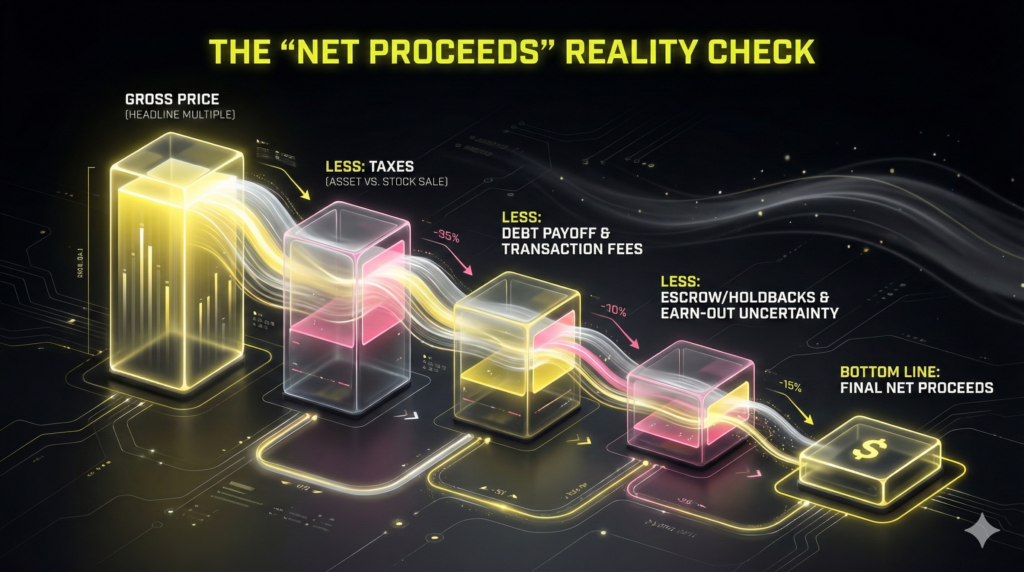

Do not anchor your expectations on public data until you have reality-checked internal metrics. An NRR of 95% will not achieve the multiple of a competitor reporting 110%. The final msp appraisal must align your metrics with buyer quality standards. Crucially, the headline multiple is never your net proceeds; deal terms, working capital, and taxes fundamentally dictate the final cash received.

6. The Operational Roadmap: Timeline and Deliverables for Your MSP Appraisal

Getting an investor-grade msp appraisal is a project requiring a clear operational roadmap to prevent costly due diligence back-and-forth. The scope typically falls into three tiers: informal valuation range (fastest, lowest cost); a formal, defensible valuation report (the core deliverable); or a full sell-side M&A advisory/go-to-market strategy (higher cost, often retainer plus a success fee).

A formal appraisal follows a predictable 60–120 day arc: discovery, data request, normalization, methodology selection, draft review, and final delivery. Clean, centralized data provided upfront is the primary driver of this timeline.

Core Data Sets for Appraisal Readiness

To maximize efficiency and reduce professional fees, centralize these artifacts before kickoff:

- Financials: 3 years of audited/reviewed financials, a clean General Ledger (GL) for quick add-back identification, and the normalized Adjusted EBITDA schedule.

- Revenue Metrics: Detailed MRR/ARR segmented by client and service line, documented net and gross churn rates, and centralized contractual terms (especially auto-renewal clauses).

- Operational Maturity: Current organizational chart, stack inventory, comprehensive SOPs for key functions (e.g., Service Desk, Onboarding), and current security/compliance posture documentation (SOC 2, HIPAA, etc.).

Centralized contracts and a clean General Ledger are the primary levers for reducing appraisal friction and fees. The final output is a defensible valuation range, detailing the underlying assumptions and sensitivity drivers (e.g., churn rate impact). Treat this preparation as a mandatory step toward M&A readiness.

7. The Crucial Impact of Deal Structure on Net Proceeds

An investor-grade MSP appraisal sets the negotiation anchor, but a strong enterprise valuation can yield disappointing net proceeds. The difference is the deal structure, which dictates liability transfer and capital gains taxation, radically altering your final cash take-home.

The primary choice is between a stock sale (transferring the entire corporate entity, preferred by sellers for tax treatment) and an asset sale (transferring specific assets and contracts). Each path carries different implications for the future of MSP ownership and the transfer of legacy liabilities. PE buyers typically prefer asset sales to contain legacy liabilities and gain a “step up” in asset basis for future tax depreciation.

The appraisal supports defensible pricing, but it does not dictate the final structure. Since deal structure defines after-tax returns, the seller’s focus must shift to maximizing purchase price allocation away from categories taxed as ordinary income (like equipment or non-competes). Ignoring this allocation battle means paying dramatically higher taxes, even on a top-line deal.

The purchase price is often conditional. Recognize the impact of earn-outs (future performance payments contingent on hitting growth metrics) and holdbacks (escrows protecting the buyer from unknown liabilities). If 20% or more of your calculated value is tied to post-close metrics, your immediate proceeds are drastically reduced. Action: Model these structural scenarios with a transaction attorney and CPA early. Never negotiate solely on the headline multiple.

الأسئلة الشائعة

An MSP appraisal is a formal, defensible valuation opinion rooted in accepted financial methodologies (e.g., DCF, Adjusted EBITDA). It is necessary for M&A due diligence, financing, or legal processes. A broker’s opinion of value (or online calculator) is directional and based purely on market comps or rule-of-thumb multiples. Use a broker’s opinion for internal planning, but always use a professional appraisal for negotiations, financing, and transactional readiness.

You should present both, but Adjusted EBITDA is the required standard for institutional buyers like Private Equity firms and sophisticated strategic acquirers. SDE (Seller Discretionary Earnings) is appropriate for smaller, owner-operated MSPs (typically under $1.5M EBITDA) as it captures the owner’s total economic benefit. Adjusted EBITDA normalizes earnings by removing owner compensation, showing the true, transferable earning power for a new, non-operator owner.

Multiples vary significantly based on size, quality, and deal terms, making a single number irrelevant. High-quality MSPs (90%+ recurring revenue, NRR over 105%, low customer concentration) command premium multiples, often ranging from 4x to 8x Adjusted EBITDA. Lower multiples are applied to smaller firms, those with volatile margins, high key-person risk, or messy documentation. The multiple is a shorthand for risk and predictability, not a guaranteed price.

A formal, defensible MSP appraisal typically takes 60 to 120 days from engagement to final report. The timeline is highly dependent on the quality of your centralized data. Messy General Ledgers, missing client contracts, or unavailable operational KPIs will drastically increase the timeline and, consequently, professional fees. Valuation-only services cost less than full sell-side advisory, which includes go-to-market and buyer outreach strategies.

Focus on operational transferability and financial hygiene. In the next 90 days, produce a clean normalization schedule ready for audit, lock down pending client contract renewals (ensuring auto-renewal clauses are active), and calculate verifiable key metrics like Net Revenue Retention (NRR) and customer concentration. Standardize your tech stack (RMM/PSA) and document core Service Desk SOPs to reduce key-person dependency, signaling maturity to buyers.