Maximizing your MSP’s exit valuation requires more than searching for a generic list of msp buyers. Those search results rarely show the Private Equity and strategic capital entities actually driving M&A valuation. To accelerate shortlisting and maximize your Letter of Intent (LOI), you need a functional buyer map, not a provider directory. This framework classifies 10 core buyer segments: detailing what each pays for, standard terms, and M&A readiness essentials. Developed from inside investor diligence rooms, this is the operator’s view for MSP owners optimizing valuation. We start with the segment currently bidding most competitively.

1. The PE-Backed Roll-Up: The Consolidation Engine

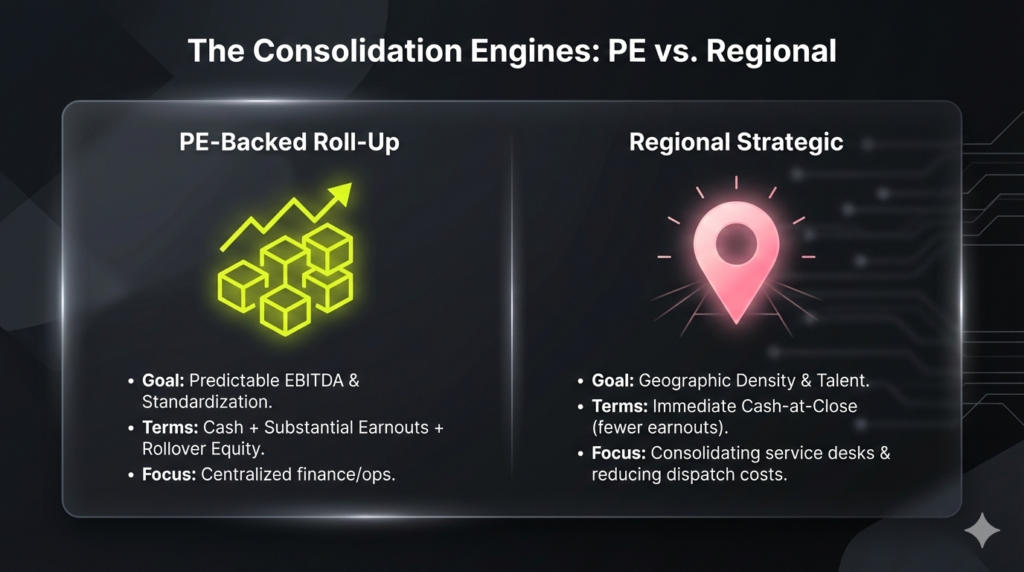

The PE-backed platform is the dominant consolidation engine on the list of MSP buyers, executing aggressive multi-acquisition roll-ups. They seek predictable EBITDA and repeatable delivery models, not bespoke genius. The platform optimizes for standardization, centralized finance/ops, and control, executing high-volume deals focused on geographic density or specialized vertical expertise (e.g., finance, healthcare compliance).

Exit terms are structured to mitigate investor risk. Expect cash at close, substantial post-closing earnouts tied specifically to retention and integration milestones, and mandatory rollover equity. This rollover equity is critical: it converts the previous owner into an incentivized partner to maximize the final enterprise valuation for the subsequent exit. If your RevOps lack repeatability, or contain SEO valuation risks, expect working capital adjustments.

2. The Regional Strategic: Geographic Density and Talent Acquisition

The regional strategic buyer offers a fast, practical exit, often prioritizing immediate cash-at-close over complex earnouts. This segment includes established MSPs ($10M–$50M revenue) acquiring smaller firms in contiguous markets to achieve geographic density and reduce dispatch costs.

The tactical M&A strategy focuses on consolidating service desks, immediate vendor standardization, and securing essential talent. Deal terms prioritize upfront cash or a seller note over complex, multi-year earnouts.

- Key Terms: Expect significantly tighter non-competes and a requirement for the selling owner to remain for a defined, quicker handoff period.

For owners seeking immediate cash flow and quick M&A readiness, aligning with a regional peer that needs a specific vertical niche or 24/7 support gap filled is a high-probability path.

3. The MSSP Strategic: Buying Security Maturity and Compliance Footprint

The MSSP strategic buyer pays a premium for dedicated MDR/XDR resources and a strong vertical compliance footprint, acquiring only what enhances their security tooling or GRC capability. Security diligence is ruthless: buyers audit everything, demanding robust evidence of operational maturity to justify high-margin revenue.

Achieving security diligence readiness for this specialized list of MSP buyers requires specific evidence:

- MFA Coverage: 100% deployment on all administrative and client accounts, confirmed and logged.

- Backup Testing: Documented evidence of regular, successful backup and recovery testing.

- Incident Narrative: A clean, auditable incident history showing events were contained and remediated.

Expect heavier reps and warranties and larger escrow holdbacks tied to security posture integrity. Earnouts often attach specifically to the retention and attach-rate of security-bundled clients.

4. The CloudOps Strategist: Buying Platform Engineering and Automation

The CloudOps Strategist acquires high-margin delivery capability, not recurring tickets. This Platform Engineering buyer seeks technical depth: established automation IP, mature Infrastructure-as-Code (IaC) pipelines, and SRE-focused talent, avoiding traditional SMB helpdesk services.

Diligence centers on technical runbooks and client revenue mix. To pass the fit test, your book of business must demonstrably drive high-value cloud services.

- Percentage of revenue derived from proactive cloud operations (not reactive break-fix).

- Ratio of project versus recurring managed services revenue.

- Concentration within key tech stacks (AWS/Azure/GCP).

Exit terms focus on retention milestones for key engineering talent and performance targets tied to increasing cloud revenue mix post-close. This buyer pays for repeatable, scalable cloud delivery.

5. The Vertical Strategic Acquirer: Buying Domain Expertise

For MSPs specializing in a compliance-heavy niche, the highest multiple comes from a peer already committed to the vertical. This type of vertical strategic acquirer pays a premium for established domain expertise and defensible playbooks that ensure repeatability and compliance credibility. Their acquisition strategy is focused on expanding territory or cross-selling specialized services.

Valuation sensitivity focuses intensely on customer concentration and documented process. To maximize your exit, you must provide ‘vertical proof’: standardized stack documentation, audit-ready compliance artifacts, vendor certifications, and templated Quarterly Business Review (QBR) cadence.

These elements signal scalable, low-risk revenue. Exit terms frequently include robust retention incentives for account managers to guarantee continuity of the sticky client workflows. This buyer seeks institutional process, not just headcount.

6. The Enterprise Strategic Acquirer: Buying Delivery Footprint and Governance

When a large IT services firm or global consultancy targets an MSP, the valuation shifts from simple recurring revenue to integration risk mitigation. This buyer is procurement-driven, seeking a regional foothold or specialized services (NOC/SOC, cloud) to enhance their delivery footprint without governance friction.

Their strategic acquisition goal is capability, logos, and immediate scale. Expect longer diligence cycles with intense scrutiny on security, contracts, and compliance.

Standardized contracting and formal governance are non-negotiable prerequisites. You will face heavier reps and warranties and less flexibility on post-close operations.

When to engage: If your MSP serves enterprise clients, operates multi-site delivery, or holds regulated contracts (e.g., FedRAMP, HIPAA), this buyer pays a premium for proven operational maturity that plugs directly into their corporate systems.

7. The Connectivity Strategic: Buying ARPU and Churn Mitigation

This buyer segment—Telecoms, ISPs, and cable providers—acquires MSPs primarily to bundle high-ARPU offerings (security, compliance) that mitigate churn on core connectivity circuits. Managed services are valued for their role as a sticky retention layer and cross-sell engine.

Diligence centers on standardization and margin exposure. Acquirers rigorously audit contracts for circuit margin visibility and dependence on a single wholesale carrier. Clean network documentation and documented practices are essential for M&A readiness.

Exit terms reflect the bundling strategy: Cash at close is standard, but earnouts are tied directly to post-close cross-sell success and client attach rates of the combined product portfolio. Expect immediate pressure to standardize your vendor stack and align delivery SLAs with their operational scale.

8. The Channel Partner Strategic: Converting Transactional Revenue

The Channel Partner Strategic—a large reseller or distributor building a managed services layer—acquires MSPs purely for their predictable, high-margin contract base and robust renewals machinery.

This sales-led organization scrutinizes two elements: clean MRR/ARR metrics and defensible service packaging. To maximize appeal, you must explicitly separate transactional revenue (hardware resale) from true recurring revenue and demonstrate verifiable gross margin by service line. Expect post-close earnout terms heavily weighted toward client retention and the increase of attach rates for high-value security or cloud products onto the established customer base. This buyer pays a premium for operational clarity and integrated channel growth.

9. The Cross-Border Acquirer: Buying the Global Landing Pad

This specialized entry on the list of MSP buyers represents non-domestic platforms (PE firms or global consultancies) acquiring established MSPs to secure a compliant beachhead in a new geography. They are transactionally rigorous and driven by institutional requirements, viewing your firm as an immediate operational asset, not just recurring revenue.

Deal terms reflect significant complexity: expect extensive legal and tax scrutiny, demanding due diligence, and significantly longer closing timelines. This buyer pays a premium tied directly to risk mitigation and verifiable M&A readiness, seeking immediate operational asset status.

To survive cross-border diligence, institutional quality is mandatory:

- GAAP-Quality Financials: Clean, auditable accounting (not cash basis).

- Compliance Posture: Documented, centralized governance across all services.

- Leadership Depth: Proven bench strength beyond the founder to guarantee post-close continuity.

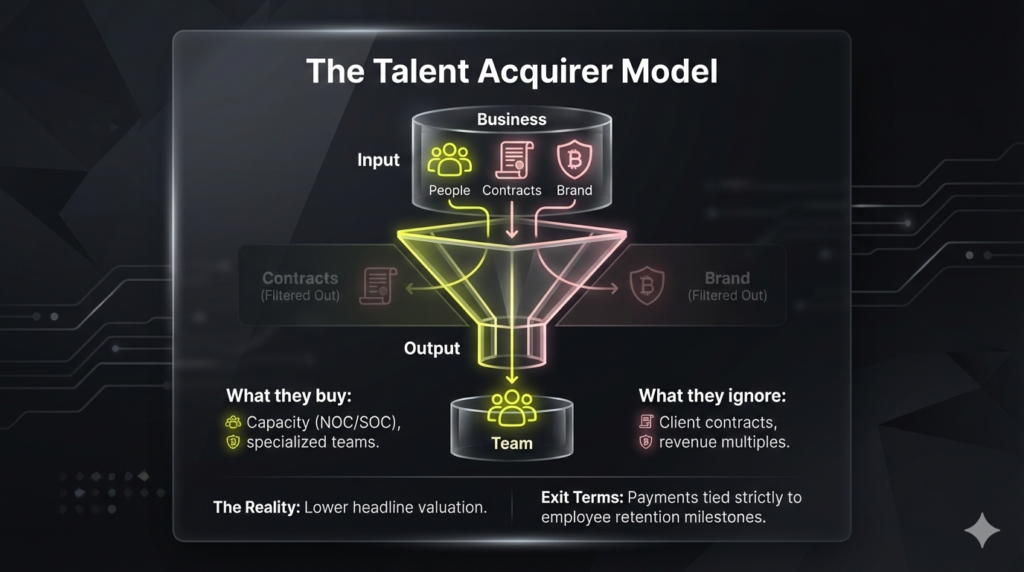

10. The Talent Acquirer: Buying Capacity, Not Client Contracts

When high customer concentration, weak contracts, or founder-dependent delivery undermines traditional revenue multiples, strategic list of MSP buyers pivot to the “talent acquirer” model. This segment is not interested in the client book, but in acquiring specific teams, specialized service desk capacity, or capabilities (like NOC/SOC). Diligence centers entirely on technical documentation, tool standardization, and staff retention viability before integrating the team into existing delivery frameworks. Because the primary asset is headcount, expect a lower headline valuation. Exit terms mandate retention bonuses and contingent payments tied strictly to employee retention milestones, underscoring that the sale is based on infrastructure and specialized expertise, not recurring revenue.

The Structured 5-Step Action Plan for MSP Exit Readiness

Maximize your valuation by converting strategy into an execution schedule. Use this 5-step guide to structure shortlisting and data preparation, ensuring you approach the list of MSP buyers with assembled, institutional-grade M&A readiness assets.

Step 1: Define Your Strategic Fit Filter (Before Engagement)

Lock down non-negotiable exit parameters. Define the minimum acceptable Adjusted EBITDA and the verifiable percentage of الإيرادات الشهرية المتكررة (MRR). Decide what you are optimizing for: Maximum Cash at Close (favoring Regionals or Strategics) versus Legacy Continuity (favoring PE Roll-ups with earnouts). This filter removes 80% of unsuitable first calls.

Step 2: Build an Investor-Grade Target Shortlist

Based on Step 1 objectives, select 2–3 buyer segments (e.g., PE-Backed Roll-Up, Vertical Strategic). Use PitchBook, PE portfolio sites, and M&A press releases to compile a 10–15 name target list of firms actively executing MSP deals. Verify recent acquisitions in your vertical or region to confirm their geographic density goals.

Step 3: First-Call Screening Questions (Filter Intent)

Treat initial calls as efficient filters. Determine if the buyer is a platform (PE-backed Roll-up) or a pure strategic. Ask directly: What is the Capital Source? How many MSP deals closed in the last 24 months? Query their Integration Model (centralized versus decentralized approach) and the precise offer shape (cash at close versus Rollover Equity).

Step 4: LOI Term Hygiene: Protecting Your Payout

Protect your final payout by focusing on LOI terms. Define the Working Capital Target and the size/trigger conditions of all Escrows/Holdbacks. Review the Non-Compete Scope (duration and geography). If an earnout is included, demand crystalline definitions for measurement Cadence and Control before signing.

Step 5: Assemble M&A Readiness Assets

Initiate your lightweight data room now to prove technical and financial M&A readiness. Assemble a clean Service-Line P&L, a verifiable MRR/ARR bridge, and a complete client contract list. For specialized security diligence (critical for MSSP Strategics), prepare a high-level security posture summary, including documented Backup/DR Test Evidence and key vendor runbooks.

الأسئلة الشائعة

The three differ by capital source and operating structure. A PE firm is the capital sponsor; they own the funds and often several platform companies. An aggregator is an operating company (the “platform”) executing the acquisitions, typically backed by a PE firm. A strategic buyer is an independent corporate operator, usually acquiring for capability, geographic access, or talent acquisition, funding the deal from its own balance sheet or debt.

Valuation multiples highly depend on quality, size, and vertical specialization. Most high-quality MSPs trade between 6x and 10x Adjusted EBITDA. Crucially, the headline multiple rarely equals the cash at close. The difference is absorbed by escrow holdbacks, required rollover equity, and post-closing earnouts tied to retention targets. Seek an independent valuation early to establish baseline expectations.

Focus on the ratio of cash at close versus contingent consideration (like earnouts). Key non-price terms include the definition and measurement controls of any earnouts; the final working capital target calculation; and the duration and scope of the non-compete agreement. Employment expectations for the owner and key staff are equally critical, as they dictate post-exit involvement.

Immediately verify their financial backing and track record. Ask for proof of funds, the name of their capital sponsor (if PE-backed), and deal references from owners they have recently acquired. Watch for undue pressure to sign an exclusivity agreement quickly, which is a hallmark of non-serious or underfunded buyers. Use a robust NDA, but avoid sharing a full data room with any firm that cannot prove its institutional depth.

Using an experienced M&A advisor is highly recommended if you prioritize competitive tension, require optimal terms, or lack the time to run diligence independently. A quality advisor provides three services: generating a competitive list of MSP buyers, structuring the process, and expertly negotiating complex terms related to escrows and earnouts. Their expertise typically results in a net higher final valuation outcome.