If you are planning an exit or partner buyout, you may be frustrated trying to determine how to value an MSP business. Stop chasing the mythical 5x revenue multiple. Private Equity (PE) and strategic buyers do not purchase revenue; they underwrite risk and predictable profit. Your enterprise valuation is a range, defined entirely by operational maturity and low handover risk to a new owner. This guide breaks down the exact financial and operational factors that drive your multiple up or down. To start, you must first calculate the correct earnings number—every valuation method requires it.

1. Normalization: Why Your P&L Profit Is Not the Buyer’s EBITDA

The P&L is optimized for tax efficiency, not M&A readiness. Confusing Net Income with the buyer’s earnings base is the most common valuation mistake. Strategic buyers and PE firms ignore traditional net profit, underwriting risk against a different metric.

Buyers utilize الأرباح قبل احتساب الفوائد والضرائب والإهلاك والاستهلاك والإطفاء (Earnings Before Interest, Taxes, Depreciation, and Amortization) for larger, manager-run MSPs, or SDE (Seller’s Discretionary Earnings) for smaller, owner-led operations.

To calculate this, you must perform normalization (or “add-backs”). This cleans the expense line by returning owner-specific or one-time costs to the profit, establishing the true, repeatable earnings a new owner expects.

Accepted normalization add-backs typically include:

- Excessive owner compensation/perks

- Personal travel or meals

- One-time legal or consulting fees (e.g., litigation)

- Non-recurring R&D or equipment write-offs

Flag “grey area” add-backs—expenses the buyer must continue paying, such as essential marketing spend or necessary employee bonuses. Claiming these raises skepticism in due diligence. To support a credible MSP valuation, build a three-year adjusted earnings schedule detailing every add-back with clear receipts and notes. This documentation is the foundation of a premium enterprise valuation.

2. Defining Quality: Why Recurring Revenue Multiplies Your Enterprise Valuation

After normalizing EBITDA, maximizing enterprise valuation requires validating income quality. Not all revenue is weighted equally in M&A due diligence. Buyers value income that is reliably predictable without requiring a monthly re-sell. This predictable stream is the essence of recurring revenue.

Buyers pay significantly higher multiples for recurring revenue because it reduces future risk, ensuring predictable cash flow and limiting churn vulnerability.

Proving M&A readiness requires verifiable contract mechanics focused on three key metrics:

- Recurring Percentage: Calculate the exact percentage of income derived from Managed Service Agreements (MSAs) versus one-off projects or break-fix. A high MSA ratio directly leads to a higher multiple.

- Contract Mechanics: Detail the average contract length (24 or 36 months are superior), the required notice period for cancellation, and the presence of mandatory auto-renewal clauses.

- Pricing Clarity: Standardized packages and clear Scope of Work (SOWs) are essential. Buyers scrutinize inconsistent pricing, which signals high churn risk and inefficient operations.

Enhance pipeline quality by converting month-to-month deals to standardized, term-based contracts. Critically, ensure reporting isolates project income from true recurring revenue. For example, two MSPs with $2M annual revenue: the one showing 70% contracted recurring revenue receives a far higher valuation multiple than the one reliant on 30% contracts and high project volatility. Quality drives valuation.

3. Retention Metrics: Why Churn Directly Reduces Your MSP Valuation Multiple

Maximized الأرباح قبل احتساب الفوائد والضرائب والإهلاك والاستهلاك والإطفاء is meaningless if client commitments vanish post-term. M&A buyers are not acquiring historical profit; they are underwriting predictable future cash flow, treating high churn as a structural liability, not a business asset. High churn forces the new owner to constantly “replace revenue,” a factor that directly elevates perceived risk and collapses the valuation multiple.

To withstand investor-grade scrutiny and prove operational maturity, you must track retention consistently:

- Client Retention Rate (CRR): The number of customers retained over a defined period.

- Revenue Retention Rate (RRR): The critical metric—the dollar value of recurring revenue retained (Net Revenue Retention or NRR). RRR explicitly measures expansion revenue versus lost revenue, providing insight into account growth potential.

Due diligence teams require detailed data demonstrating a multi-year churn trend (improving versus deteriorating). They will scrutinize documented account health protocols, including QBR cadence, escalation paths, and comprehensive contract renewal history. You must categorize the top three churn drivers—moving beyond hand-wavy excuses—to identify and prove operational control. If those drivers are fixable operational issues—inconsistent delivery, slow response times, or unclear scope—remediate them immediately. Consistent, low-churn recurring revenue is the ultimate evidence of operational strength and maximized MSP valuation.

4. Why Your EBITDA Margin Is the True Measure of Scalability

Two MSPs with identical EBITDA can receive vastly different valuations. The differentiator is the EBITDA margin: the percentage of revenue retained after all operating costs.

Buyers (especially PE operating partners) view margin as the explicit metric of operational maturity and scalability. High margins prove rigid pricing discipline and standardized delivery costs, signaling M&A readiness. Low margins signal operational chaos and reliance on owner intervention.

To withstand investor-grade scrutiny, you must distinguish between Gross Margin and EBITDA margin. Gross margin focuses only on the cost of delivery (salaries, tools, COGS). EBITDA margin captures the total operating expenses. Efficiency is judged by performance in both metrics.

Your multiple collapses when buyers identify common margin killers:

- Custom Work: One-off services absorbed into fixed-fee packages.

- Stack Sprawl: Inconsistent technology stacks leading to excessive tool costs per user.

- Legacy Pricing: Undercharging long-term clients for enterprise-level demands.

To demonstrate premium profitability, implement a “profitability by client” view in your PSA/CRM. Identify the bottom 10–20% of accounts consuming excess resources. Remediate, renegotiate, or offload them immediately. This active control validates the margin used for the final enterprise valuation.

5. Why Revenue Concentration and Hardware Pass-Through Shrink Your Valuation

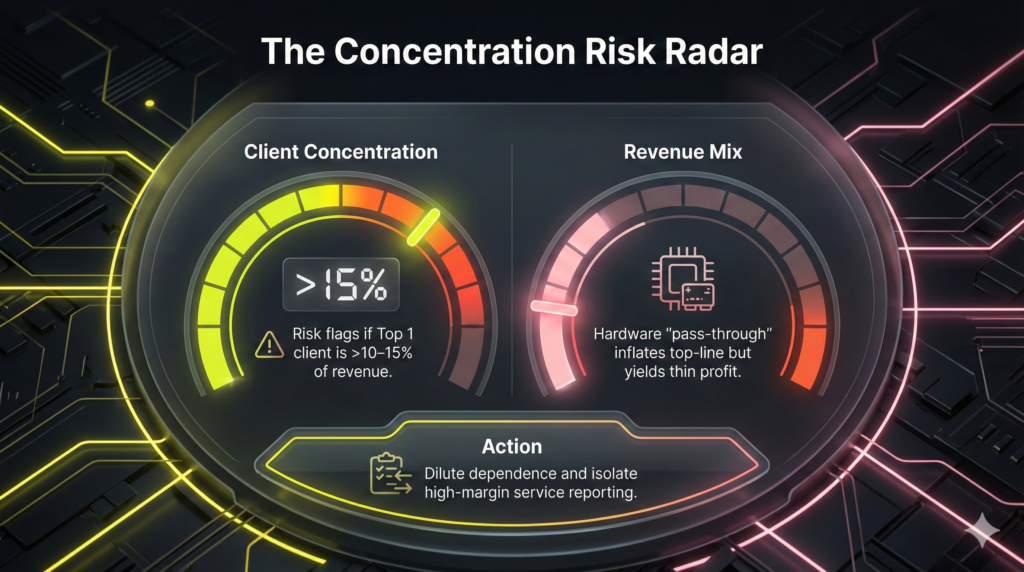

Concentration risk is the threat that if one large client or revenue stream vanishes, your cash flow forecast is invalidated. Due diligence teams immediately discount revenue relying on limited sources, as buyers require predictable, resilient earnings and concentration signals fragility.

Two primary checks determine this risk profile:

- Client Concentration: Buyers check what percentage of revenue comes from the top 1 and top 5 clients. Reliance on any single client for more than 10–15% often triggers significant valuation adjustments.

- Revenue Mix Quality: Quality separates core managed services from transient revenue streams like project work and hardware resale (pass-through). Project-heavy models require you to “resell every month,” while hardware inflates top-line revenue but yields thin profit.

For example, a $1M hardware component may inflate total revenue, but if it carries only a 5% margin, buyers often exclude this revenue entirely, as it contributes just $50,000 to quality EBITDA.

Before seeking offers, set a clear concentration target. Critically, ensure reporting isolates true, high-margin Managed Services from all other revenue buckets so buyers do not discount everything by default, maximizing your final MSP valuation.

6. Operational Standardization: Why Documentation Multiplies Your MSP Valuation

The core objective for strategic buyers or Private Equity is minimizing handover risk. If your MSP relies on the founder’s institutional memory, your operational maturity is zero, which suppresses your MSP valuation multiple. Buyers pay a premium for a business that runs like a machine, not a memory.

Due diligence teams require tangible evidence that your earnings are repeatable under new ownership, demanding standardized delivery:

- Documented Delivery: Clear workflows for service desk triage, client onboarding/offboarding, and technical escalation paths, existing outside the PSA.

- Client Runbook Library: A centralized repository detailing unique client configurations, security baselines, and primary contacts.

- Standardized Stack: Utilizing consistent tools and configurations across clients to guarantee efficient support and simplified integration into a larger roll-up.

Standardization significantly lowers transition risk post-sale, enabling faster onboarding for new technical staff and reducing post-acquisition chaos.

Standardization Checklist

To demonstrate investor-grade operational control, document the following essentials:

- Central contract repository and scope definitions.

- Ticketing, QBR, and review cadences.

- Asset inventory and software licensing logs.

- Minimum security baseline and compliance standards.

Do this next: Select your top 10 most repeatable processes and create a formal, searchable Standard Operating Procedure (SOP) for each. This delivers the highest immediate ROI during العناية الواجبة.

7. Key Person Risk: Why Key Dependencies Kill Your Valuation Multiple

M&A due diligence flags key person risk the instant a buyer suspects revenue will walk out the door with the founder or a “hero tech.” If your MSP functions as an exceptional job you created for yourself, it is not a transferable business, and your multiple collapses.

Structural fragility kills deals. Buyers (especially Private Equity) flag concerns when:

- The owner is the primary salesperson and relationship holder.

- One “hero tech” holds all institutional memory and complex configurations.

These dependencies signal zero bench strength, requiring verifiable evidence that the machine runs itself.

Prove transferability. Provide an organizational chart showing functional ownership (sales, service delivery, finance, vCIO). Implement a key employee retention plan, using stay bonuses or defined career paths to protect essential staff during transition. Finally, map client relationships to ensure no key account relies on interaction with a single person.

Practical steps: Delegate your top three recurring owner tasks today. Introduce clients to a second-in-command قبل the sale process begins. Reducing this systemic key person risk transforms your business from a volatile asset into a reliable system, increasing the final MSP valuation multiple and deal certainty.

8. How to Calculate Your Enterprise Valuation: The Multiple and the Range

To estimate your enterprise value, start with the foundational M&A rule: Value ≈ Adjusted Earnings × Multiple. Arriving at a defensible valuation range requires a three-step process:

Step 1: Define the Earnings Base. The multiple calculation relies on Adjusted EBITDA (for scale MSPs) or Seller’s Discretionary Earnings (SDE) for smaller, owner-led operations. This adjusted earnings figure is the foundation of the valuation.

Step 2: Select a Defensible Multiple Range. The multiple reflects perceived risk and repeatability. Smaller MSPs (sub-$10M revenue) carry a “size discount” due to concentration risk, often seeing multiples in the 4x–7x Adjusted EBITDA range. Standardized MSPs with lower churn and documented operations can command 8x or higher.

Step 3: Overlay Buyer Type. Strategic buyers may pay a premium for synergy (e.g., critical vertical or geography). Private Equity (PE) firms prioritize highly scalable, repeatable cash flow and robust EBITDA margins.

MSP valuation calculators are useful for a quick sanity check, but they cannot replace the full diligence process. he final price is dictated by operational documentation and specific deal terms, especially when selling MSP to aggregator platforms that utilize complex structures like earn-outs or equity rollover.

For example, if your Adjusted EBITDA is $800,000, a 6x multiple sets the enterprise valuation floor at $4.8 million. If you achieve standardization and low churn, you might justify a 7x or 8x multiple, driving the valuation to $5.6–$6.4 million, plus the value of your working capital.

الأسئلة الشائعة

The multiple is a range, typically falling between 4x and 8x Adjusted EBITDA or SDE for most MSPs. It is not static. Your final enterprise valuation multiple is earned by reducing future risk: high recurring revenue percentage, low client churn, strong EBITDA margins, and, critically, low owner dependence. Start modeling at a conservative 5x, then prove operational maturity through documented processes and clean financials to justify a higher number. (See Section 8: How to Calculate Your Enterprise Valuation).

Add-backs, or normalizations, are adjustments made to your Net Income to calculate true earnings (EBITDA/SDE). They typically cover non-recurring, one-time, or strictly owner-specific expenses—like excessive travel, personal perks, or litigation fees. Buyers will accept only what is documented, verifiable, and genuinely non-essential to the ongoing operation of the business. You must provide clear supporting evidence for every expense claimed to maximize your Adjusted EBITDA without raising skepticism. (See Section 1: Normalization).

Project revenue is not inherently bad, but buyers discount it because it lacks the predictability of contracted Managed Service Revenue (MRR). Project volatility increases perceived risk, as it requires constant monthly reselling. To maximize your MSP valuation, ensure you report project income separately from recurring revenue. Best practice is to convert high-margin, repeatable project work (like compliance audits or standardized migration packages) into productized offerings or minimum viable packages, shifting them closer to a predictable recurring model.

A preparation window of 12 to 24 months is ideal to maximize your exit value. Preparing for sale is about implementing structural changes that reduce operational risk, which takes time to show a measurable trend. This includes shifting client contracts to longer terms, achieving standardized delivery via SOPs, improving Gross and EBITDA margins, and reducing client or key person risk. These improvements increase the multiple you command, even if you ultimately decide not to sell.

Earn-outs are portions of the purchase price tied to the post-sale financial performance of the MSP over a set period (usually 12–36 months). They reduce buyer risk by ensuring the founder remains incentivized to meet cash flow projections. Retention bonuses are payments designed to keep essential, non-owner staff (e.g., hero techs or key account managers) with the company during and after the transition. Both mechanisms demonstrate a lack of confidence in the MSP’s transferability; pre-sale focus on standardization and owner-independence reduces the need for them.