Stop chasing the “magic multiple” advertised on LinkedIn. Any MSP valuation based on a single number (like 6x or 7x EBITDA) is fiction. As advisors who engineer RevOps for PE-backed roll-ups, we know the truth about how much private equity is paying for msps: the multiple is an output, driven by rigorous buyer underwriting. This guide provides realistic, size-based ranges and the specific risk adjustments necessary to sanity-check an inbound Letter of Intent (LOI). We begin with the only benchmark that truly matters: your scale and the quality of recurring profit.

1. Why Adjusted EBITDA is the Only Metric That Matters (And What Bands to Expect)

The anchoring metric for nearly every PE deal is Adjusted EBITDA, a standard frequently scrutinized during an MSP acquisition. This measures profit before interest, taxes, depreciation, and amortization, adjusted for owner benefits and non-recurring expenses (like above-market owner salary or one-time consulting fees). Getting your books clean for accurate Adjusted EBITDA is the first, non-negotiable step toward M&A readiness and successful MSP exit planning.

Once this metric is established, size dictates valuation. Multiples expand significantly at higher revenue tiers because quality platform assets are scarce, driving multiple expansion for PE sponsors. This explains why larger MSPs command higher prices.

Here are the realistic size-based valuation ranges utilized by operating partners today:

- Sub-$1M Adjusted EBITDA: Low-to-mid single digits (3x–5x). Multiples are depressed by heavy key-person dependency and concentration risk.

- $1M–$5M Adjusted EBITDA: Mid single digits to high single digits (5x–8x). Valuation in this quality zone relies entirely on demonstrable proof of predictable, sticky revenue (MRR).

- Platform-Scale ($5M+): Higher bands (8x+) are commanded by rare, large assets designated as platform assets. These firms anchor roll-ups, achieving a premium smaller add-ons cannot match.

Owner Takeaway: Place your firm in the correct size bucket first. Then, utilize quality levers—such as optimized RevOps and high contract retention (as we cover next)—to negotiate at the high end of your established valuation range, which helps determine when to sell an MSP for maximum value. This is the mechanism for maximizing your sale outcome.

2. Define the Deal: The Three Buyer Lenses That Set Your Multiple

Your valuation multiple depends entirely on the buyer’s intent, resolving the confusion over how much private equity is paying for msps. The specific role your business plays in their M&A strategy determines the price. Three key buyer lenses structure the deal:

- Add-on Acquisition: Priced for tuck-in value and integration risk. Acquired for geography or customer contracts, these deals feature lower upfront cash and higher structural earnouts.

- Platform Acquisition: The premium category, priced for leadership depth, scalability, and predictable growth infrastructure. This asset anchors the roll-up, driving future multiple expansion.

- Merger-of-Equals (MOE): Two similar firms combine for immediate scale. The immediate valuation is often lower, trading equity in the combined entity for reduced tax liability and access to higher future exit multiples.

The same MSP can be priced cheaply (3x EBITDA) as a simple add-on, yet command a premium (8x EBITDA) as a platform candidate due to its team depth and clean reporting.

Self-Check: Are You a Platform? You are underwritten as a platform if the buyer prioritizes a repeatable GTM (go-to-market) strategy, clean, audited books, and deep organizational structure beyond the founder.

Always benchmark your Letter of Intent against the correct deal type, not the highest multiple advertised online.

3. The Due Diligence Checklist: Operational Levers That Maximize Valuation

The valuation multiple is not arbitrary; it represents the price paid for a risk-adjusted profit stream. Buyers assess your size and roll-up fit, then conduct intense due diligence to adjust Adjusted EBITDA based on operational risk. To secure a premium offer, MSPs must use the following criteria as an actionable checklist.

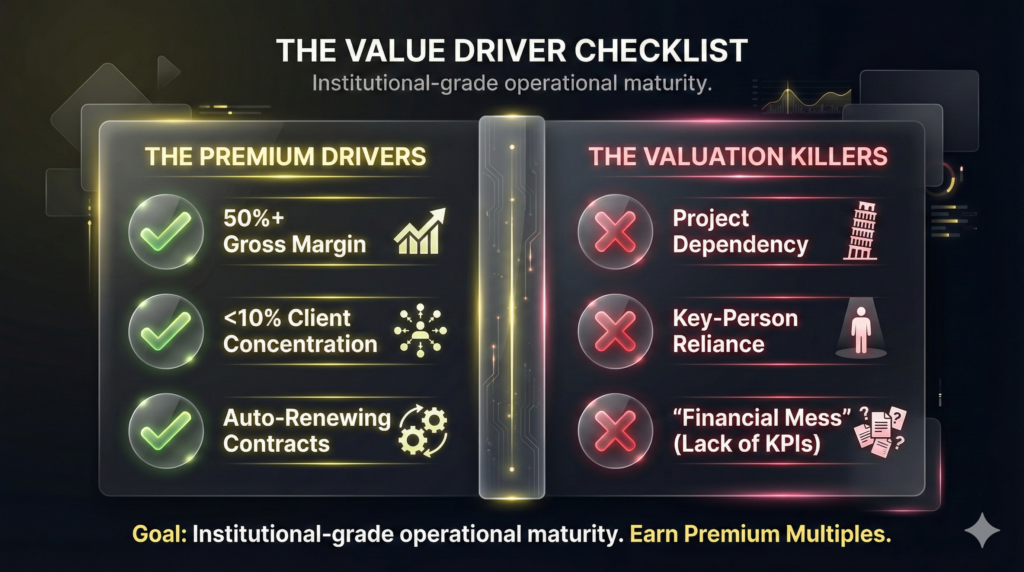

Value Drivers That Command Premium Offers:

- Recurring Revenue Quality: Contracts must mandate automatic renewals, defined SLAs, and minimal month-to-month noise. High Net Revenue Retention (NRR) proves client stickiness and low future sales friction.

- Service Gross Margin: Margins (ideally 50%+) must confirm scalable delivery, pricing discipline, and robust cost controls.

- Risk Mitigation: Dilute customer concentration (no single client greater than 10% of revenue). Operational documentation must eliminate key-person risk by proving the business runs without the founder.

Value Killers That Depress Multiples:

- Project Dependency: Volatile, project-heavy revenue masks weak managed services bases. Buyers heavily haircut recurring revenue masked by one-off projects.

- Financial Mess: Unclear add-backs or a lack of standardized monthly reporting and KPIs signal integration difficulty.

The exit goal is simple: eliminate controllable risk before the LOI. Actively managing these levers allows you to dictate why your firm commands a top-tier multiple, not just ask for one.

4. The Role of MRR Quality in Driving Your EBITDA Multiple

Forget SaaS metrics: MSPs are fundamentally underwritten on cash flow. When analyzing how much private equity is paying for msps, Adjusted EBITDA remains the absolute primary yardstick.

Monthly Recurring Revenue (MRR) serves as a powerful proxy for the predictability of the EBITDA stream. Buyers use MRR quality metrics to gauge the likelihood that current profit margins will hold or improve post-acquisition. High MRR quality justifies greater confidence in future profitability, thereby warranting a higher overall EBITDA multiple.

To maximize this lever, focus on predictability benchmarks:

- Contract Term Coverage: Longer terms (36+ months) reduce churn risk and demonstrate client stickiness.

- Renewal Cadence: Mandatory auto-renewal provisions prove pricing power and contract durability.

- Mix of Revenue: A high ratio of recurring to project revenue (ideally 85%+) signals operational stability.

If an LOI references MRR multiples, demand transparency: ask exactly how they bridge revenue to EBITDA. Challenge their specific assumptions for your churn rate and service delivery margin; never accept a raw revenue multiple without understanding the underlying profit assumptions.

5. Why Revenue Multiples Are a Dangerous Sanity Check

The single biggest valuation trap for MSP owners is focusing on the top-line revenue multiple. This metric is a blunt instrument in MSP M&A because the margin variance across providers is enormous.

Consider two $10 million ARR firms: one running 60% service gross margin, the other 35% due to inefficient delivery or heavy resale. Their Adjusted EBITDA will be radically different, rendering the raw revenue multiple meaningless for determining true enterprise value.

Use revenue multiples only as a quick screening tool. If the headline multiple looks stellar but the resulting EBITDA multiple is weak, the buyer is pricing in material risk (e.g., high churn or operational inefficiency). Immediately drill down into your service gross margin.

To use this metric safely, always pair it with two core metrics: your service gross margin and your adjusted EBITDA margin. High revenue coupled with low margins signals ‘revenue inflation,’ often fueled by low-margin resale or heavy project work.

Challenge their assumptions: demand to know which risk is depressing the EBITDA multiple and how they calculated their post-acquisition cost of goods sold.

6. The Consideration Mix: Structure and Risk in Every LOI

A $50 million MSP valuation structured as 80% cash at close and one structured as 40% cash, 40% rollover, and 20% earnout are fundamentally different outcomes. The biggest mistake founders make when assessing how much private equity is paying for msps is anchoring on the headline EBITDA multiple while ignoring the consideration mix that dictates risk-adjusted proceeds. PE uses structure to bridge valuation gaps and manage retention risk.

Analyze the three crucial components:

- Cash at Close: Certain, liquid proceeds received at close.

- Rollover Equity: Alignment capital, offering illiquid upside in the platform’s future exit.

- Earnout: Contingent proceeds based on specific post-close performance metrics.

To compare offers with identical multiples, evaluate the fine print:

- Earnout Metrics: Is the payout driven by aggressive top-line revenue or the Adjusted EBITDA of the combined entity?

- Budget & Control: What control rights (veto power or budget authority) are tied directly to earnout achievement?

- Employment Terms: Are non-compete clauses or clawbacks linked to the payout schedule?

An identical headline multiple results in radically different risk profiles. Focus on the certain cash flow and the realistic path to realizing contingent proceeds to protect your risk-adjusted outcome.

7. Why Quality MSP Demand Remains Strong (Even in a Slow Market)

While M&A headlines suggest the market is cooling, demand for high-quality MSPs remains fundamentally inelastic. Private Equity funds hold deployment mandates, sustained by critical sector drivers: recurring revenue stability, mission-critical managed services, and regulatory tailwinds from escalating security and compliance mandates.

Why the perceived slowdown? Higher interest rates raise the minimum required hurdle returns for sponsors, leading to hyper-selective buying. Average assets get repriced or structured with heavy earnouts; however, quality assets—firms with clean books, high NRR, and scalable delivery—still clear at competitive prices.

This dynamic dictates timing:

- If your firm is a demonstrably top-quartile asset (8x+ EBITDA candidate), running a competitive sale process to achieve multiple expansion outweighs the risk of waiting for a speculative market peak.

- If you are a mid-tier firm, spending the next 6 to 12 months de-risking operations—diluting customer concentration and boosting service gross margin—is a superior strategy to hoping for multiple uplift.

The takeaway: Benchmark your business quality first. That quality level, not the macro environment, determines whether speed-to-exit or value-maximization through operational refinement is the best strategy for maximizing what private equity is paying for msps.

8. Pricing in People: How Integration Risk Tanks Your Earnout

A successful closing is not the finish line; many founders forfeit their full earnout because the acquiring platform fails the integration. Buyers purchase technically sound MSPs but often mismanage the people and processes, resulting in critical technician and account manager (AM) churn, client experience dips, and eventual revenue loss. This inherent integration risk directly necessitates the upfront discount buyers apply to valuation.

PE underwriters aggressively price in staff churn and the resulting loss of client relationships and tribal knowledge. Operational fragility signals major discount triggers. If the founder acts as the chief salesperson, vCIO, and operational lead, the buyer flags unsustainable key-person dependency. Undocumented delivery processes are not “efficient”; they are unscalable liabilities that signal high integration cost.

To protect yourself when assessing how much private equity is paying for msps, demand seller-protective moves in the Letter of Intent (LOI). Insist on clear post-close roles, defined decision rights, and resourcing commitments. Structure earnout terms to reflect integration realities, not inflated pro forma growth targets. A fair multiple incorporates realistic integration costs; avoid any offer that requires operational miracles post-close.

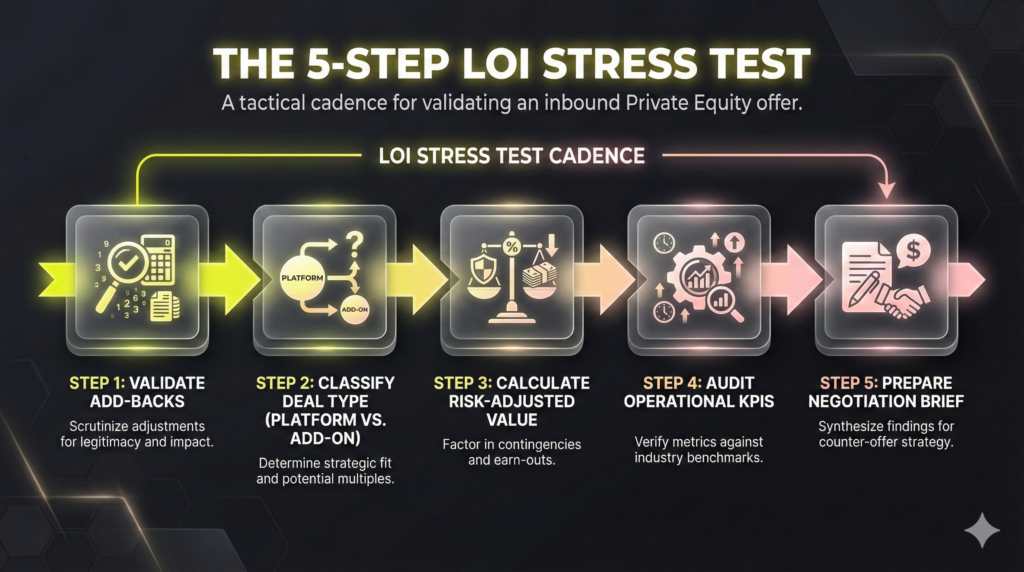

How to Stress-Test a Private Equity Offer: The 5-Step LOI Review Schedule

The critical work involves applying rigorous due diligence to the buyer’s offer. Use this five-step tactical schedule to perform a concrete, risk-adjusted assessment of the deal.

Step 1: Normalize and Validate Adjusted EBITDA

List every proposed add-back the buyer included in their model. Critically assess if these are defensible non-recurring costs or “storytelling” designed to inflate the denominator. Normalize all owner-related expenses and salaries to current market rates to prevent hidden profit deflation.

- النتيجة: Define your defensive, verifiable Adjusted EBITDA figure for negotiation.

Step 2: Classify the Deal Type to Set the Range

Determine the buyer’s intent by classifying your firm as a Platform, Add-on, or Merger-of-Equals. If your firm achieves the scale and repeatable Go-To-Market (GTM) strategy required for Platform status, challenge any multiple below the 8x platform benchmark. Adjust expectations if the deal is structured as an Add-on, as these multiples are typically lower.

- النتيجة: Identify the realistic, high-end target multiple for your established category.

Step 3: Translate Structure into Risk-Adjusted Value

Separate the consideration mix in the Letter of Intent (LOI). Identify certain proceeds (Cash at Close) versus contingent proceeds (Rollover and Earnout). Calculate the actual, immediate cash proceeds that are not dependent on future performance or the platform’s subsequent exit. Demand clarity on the specific post-close EBITDA metrics tied to any earnout provision.

- النتيجة: Determine the true, risk-weighted cash flow you control immediately post-close.

Step 4: Run the Quality Profile Checklist

Verify operational metrics that justify a premium multiple. Audit your Recurring Revenue percentage and Net Revenue Retention (NRR) evidence. Note that a gross margin exceeding 50% is required to demonstrate scalable service delivery. Document proof of low customer concentration (no single client exceeding 10% of revenue) to neutralize key-person risk.

- النتيجة: Gather specific, quantifiable data points that justify demanding top-of-range pricing.

Step 5: Prepare Your Negotiation Brief

Structure your counter-offer based on the gathered evidence. Prepare three specific data points (e.g., NRR, 36-month contract terms, 60% Service Gross Margin) that anchor your demand for a higher multiple. To build trust, acknowledge two specific risks (e.g., documentation gaps, sales pipeline maturity) and provide proven, mitigating action plans.

- النتيجة: Label the offer definitively as Fair, Aggressive but Risky, or Underpriced for your quality profile.

الأسئلة الشائعة

A realistic multiple for an MSP in this size bracket typically falls between 5x and 8x Adjusted EBITDA. The exact placement within this range is determined by key risk factors, including Net Revenue Retention (NRR), customer concentration, quality of service gross margin, and the demonstrable repeatability of the sales motion. High-quality operations achieve the top end of the band.

No. While buyers reference Monthly Recurring Revenue (MRR) to sanity-check growth and contract coverage, all final underwriting converts revenue into cash flow (Adjusted EBITDA). If an LOI quotes a raw MRR multiple, demand transparency; ask for their implied assumptions regarding your service delivery margin and churn rate to bridge that revenue multiple back to the underlying EBITDA.

The delta is nearly always driven by size and role in the Private Equity strategy. Multiples expand significantly for assets generating over $5M in Adjusted EBITDA, which are priced as rare Platform Acquisitions. If your firm is smaller or structured as an Add-on Acquisition for a larger roll-up, the multiple will be lower due to higher integration risk and key-person dependency.

Compare the risk-adjusted value, not just the headline multiple. Cash at Close is certain and liquid. Rollover Equity offers illiquid upside tied to the platform’s success. The Earnout is contingent, so you must evaluate the metrics (revenue vs. EBITDA) and control rights post-close. Prioritize the offer that provides the highest guaranteed cash flow and clear, achievable earnout conditions you can directly influence.

You must present investor-grade data. The foundational metrics required are verifiable Adjusted EBITDA (with clear add-back documentation), trailing 12-month Net Revenue Retention (NRR), Service Gross Margin (ideally 50%+), and low customer concentration (no client exceeding 10% of revenue). These elements prove predictability and scalability, which are mandatory for premium pricing.