Securing an attractive term sheet when selling msp to aggregator feels like the finish line, but the headline price is always conditional. That multi-million dollar valuation is only the beginning. The actual value is defined by the deal mechanics: cash, equity rollover, and long-term risk allocation. Successful MSP owners look past the headline price and map these contingencies before signing. This guide dissects seven common deal structures, detailing their inherent traps and the protections you must negotiate prior to the Letter of Intent (LOI). We start with the highest post-close risk: the earnout.

1. Earnouts: Mitigating the Post-Close Risk to Your EBITDA

The earnout provision is the single largest risk factor when selling MSP to aggregator. Though presented as a compelling deferred payment contingent on 18–36 month post-close EBITDA targets, this structure primarily serves the buyer by shifting future growth risk and creating immediate leverage for retention and cost initiatives.

The headline price is worthless if the buyer controls the operational levers. The risk is twofold:

- EBITDA Games: Buyers manipulate “Adjusted EBITDA” by reallocating corporate overhead, centralizing management fees, or renegotiating vendor contracts to artificially depress reported profit.

- Operational Interference: Integration teams unilaterally change the operating model (PSA standardization, tool stack mandates, pricing adjustments) causing short-term client churn that destroys targets.

To protect your realized enterprise valuation, secure contractual protections before the LOI is signed. Negotiate precise, ring-fenced EBITDA definitions that clearly cap corporate allocations and disallowed add-backs.

Crucially, insist on strict operational covenants. These covenants must prevent the buyer from making unilateral changes to staffing levels, client pricing, key vendor agreements, or the core service delivery model, mitigating the common problems with corporate MSP ownership during the earnout period. Mandate strict monthly reporting requirements and define a non-litigious dispute mechanism, such as mandatory independent accountant arbitration.

When deciding when to sell your MSP, an earnout is only viable if targets are realistic under integration and if you retain meaningful contractual control over the variables that drive revenue and margin.

2. Clawbacks: Defining the Protected Revenue Base

Clawbacks define the minimum revenue floor required for full earnout payment. If the acquired Annual Recurring Revenue (ARR) or Monthly Recurring Revenue (MRR) drops below pre-defined retention thresholds, the deferred payment is reduced or eliminated. This mechanism effectively penalizes the seller for outcomes the buyer now controls, presenting three core perils when selling MSP to aggregator:

- KPI Ambiguity: Imprecise language regarding Gross vs. Net Revenue, inclusion of project revenue, or treatment of hardware/pass-through licenses can instantly crater the metric.

- Buyer-Driven Churn: Aggressive integration mandates (forced PSA migration, price hikes, altered ticketing experience) cause post-close churn that triggers penalties.

- Repricing Risk: Aggregator-led contract standardization or package restructuring—even if the client stays—can shift the revenue metric and trigger the clawback.

To neutralize these risks, define the revenue base using an explicit client cohort list set at closing. Mandate contractual integration guardrails requiring service continuity and granting approval rights over pricing changes or tool migrations during the earnout. Crucially, separate the retention KPI from any growth KPI; you guarantee the book sticks, but not growth reliant on the buyer’s sales engine.

3. Rollover Equity: Negotiating Upside Without Sacrificing Liquidity

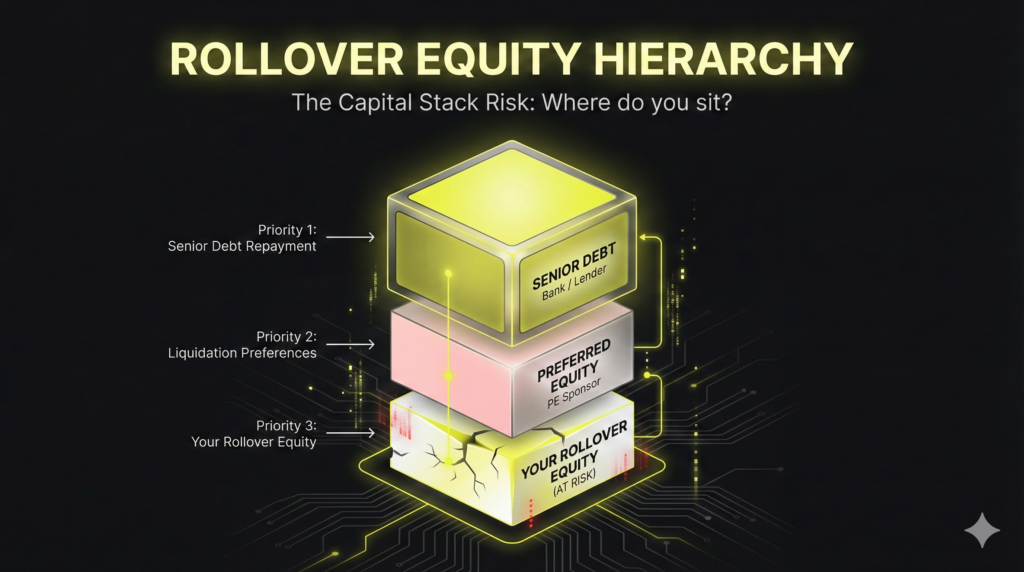

Rollover equity trades guaranteed, liquid cash for an illiquid stake in the buyer’s holding company (HoldCo). This mechanism preserves the aggregator’s cash and aligns the seller to drive future platform growth, directly boosting the private equity sponsor’s Internal Rate of Return (IRR).

The primary risk: you become a minority investor with limited control, exposed to capital structure risk. Your common equity sits beneath the massive acquisition debt placed on the HoldCo. A minor market downturn or operational misstep can wipe out this position, regardless of your segment’s performance. Furthermore, liquidity is entirely tied to the PE firm’s exit timeline, often a volatile 2-7 year wait.

Protect your stake by establishing contractual guardrails:

- Capital Structure Clarity: Demand full disclosure on HoldCo debt levels, preferred equity, and liquidation preferences that rank ahead of your common equity.

- Governance Rights: Insist on robust information rights, anti-dilution provisions, and tag-along rights.

- Defining Your Role: Contractually define post-close operational responsibilities, ensuring the planned growth underpinning your rollover value is feasible.

Rollover equity is attractive only with deep trust in the aggregator’s platform thesis and aggressive contractual guardrails against leverage risk.

4. Seller Notes: Underwriting the Buyer’s Credit Risk

When an aggregator proposes a seller note (a promissory note) as deferred payment, understand this framing—”cash later”—is misleading. It is quasi-debt, making you a creditor subject to direct default risk.

Aggregators favor this structure to preserve immediate cash and reduce third-party financing needs. The seller, however, assumes direct credit risk. If the platform struggles, you are unsecured or, worse, subordinated to senior debt, placing your repayment priority at the bottom of the capital stack.

A critical trap occurs when note repayment is implicitly tied to post-close performance metrics or operational covenants; the note effectively morphs into a disguised earnout, destroying your expected enterprise valuation certainty.

Protect your position by negotiating hard on priority and securing collateral where feasible. Define crystal-clear default and cure terms, including an immediate acceleration clause allowing the entire principal to become due upon a major breach. If the deal involves both an earnout and a seller note, rigorously model the combined downside to avoid double jeopardy. Accept seller notes only if you are comfortable underwriting the buyer’s balance sheet strength.

5. Escrow: Preventing the Purchase Price Erosion

Escrow is the most common mechanism for covering post-close exposure related to reps and warranties claims or adjustments like the working capital true-up. The buyer typically withholds 10–20% of the cash proceeds into a ring-fenced account for 12 to 24 months. While necessary to cover unforeseen liabilities (undisclosed security incidents, client billing disputes, contract breaches), a broad indemnification clause risks turning this fund into a silent discount.

The inherent downside lies in scope creep: Aggregators often push for wide-ranging indemnities, treating escrow as a catch-all for basic operational fluctuations.

To protect your realized enterprise valuation, cap the buyer’s ability to claim aggressively by focusing on three contractual guardrails:

- Defining Claims Tightly: Ensure the escrow only covers breaches of specific representations, not general business losses or issues arising from the buyer’s post-close integration.

- Setting Thresholds: Demand a basket (the deductible threshold before any claims are paid) and a deductible (the seller only pays above this amount). This prevents minor, everyday issues from draining the fund.

- Capping Exposure: Define a hard cap on total liability (the escrow limit) and insist on tight sunset clauses and prompt notice requirements.

Sanity-check the indemnities: Are you underwriting operational risk you no longer control, such as a major cybersecurity event that occurs after the buyer assumes control of the infrastructure? Escrow must cover historical risk, not the buyer’s future integration mishaps.

6. Employment Covenants: The Golden Handcuffs and Leaver Traps

عندما selling MSP to aggregator, the deal is split: an asset sale and a multi-year employment contract. Your continued role (as CEO, vCIO, or transition lead) is explicitly bundled with the economics—your earnout and rollover equity are contingent upon the term. This creates “golden handcuffs” designed to secure continuity and reduce client churn during integration.

The transition from owner to employee means carrying owner-level performance risk without retaining corresponding authority. The primary trap is the “good leaver” vs. “bad leaver” covenant. Termination for cause or voluntary resignation can forfeit all deferred compensation and unvested rollover equity—a total loss of expected valuation.

Demand contractual protections to mitigate this operational risk:

- Role Clarity: Define specific decision rights, staffing commitments, and budget authority to prevent control being stripped while performance is still expected.

- Good Leaver Protections: Define termination without cause و constructive termination (severe duty or salary reduction) as “Good Leaver” events, ensuring earnouts remain intact if the partnership sours.

- Non-Compete Scope: Rigorously narrow non-compete clauses (time, geography, and service restrictions) to preserve viable future career options.

This arrangement is best suited for owners who genuinely seek a second chapter operating within the larger platform, not those aiming for a clean break.

7. Asset Sales: Monetizing MRR Blocks Without Selling the Business

When an MSP cannot command optimal enterprise valuation due to concentration risk or low-margin legacy clients, an asset sale provides strategic optionality. Instead of selling the entire entity, the owner sells a specific block of Monthly Recurring Revenue (MRR), a business line, or specific client contracts. This structure achieves partial liquidity, sheds low-fit clients that depress EBITDA quality, and proactively improves M&A readiness for the remaining core business.

Within the broader landscape of IT business sales, asset sales introduce three primary risks that necessitate a pricing discount:

- Consent and Assignment Risk: Most Master Service Agreements (MSAs) require explicit client consent for contract transfer. Refusal or renegotiation can derail the transaction or trigger lengthy legal review.

- Valuation Discount: Buyers factor in the operational transition burden and expected client churn, resulting in significantly lower multiples compared to a full corporate sale.

- Stranded Costs: The seller is left with residual overhead (tools, staff, facilities) that was sized to support the departed MRR block, creating short-term cost inefficiency.

To protect realized value, execute rigorous due diligence on assignment clauses قبل marketing the assets. Define a highly specific, time-boxed transition support scope (e.g., 90 days) and ensure clean operational separation of documentation and access credentials to minimize future disputes. The goal is to monetize non-core revenue now, using proceeds to boost the enterprise valuation of the remaining core business for a future, higher-multiple exit.

Execution Schedule: Building Your Offer Scorecard for Maximum Certainty

The seven structures dictate your realized net payout. Before moving past diligence, translate these variables into a quantifiable scorecard. This provides clear metrics for certainty, control, and downside risk to ensure your enterprise valuation is maximized, not just headlined.

Step 1: Translate Price into Certain Cash vs Conditional Value

Map the headline price into three buckets: Cash at Close (Certain), Escrow (Contingent, Risk 5), and Deferred (Earnout/Note/Rollover, Risks 1, 3, 4). Calculate the certain vs. conditional split. If the conditional portion exceeds 40%, flag the deal for high inherent risk.

Step 2: Map Control to the KPI

For metrics tied to an Earnout or Clawback (Risks 1, 2), define the operational control structure. If the buyer dictates the tool stack, centralizes billing, or controls staffing (Risk 6), the seller lacks control. Apply a Control Discount to the conditional value. A KPI you cannot control is a valuation you will not realize.

Step 3: Stress-Test Three Scenarios

Model the total downside exposure. Run three sensitivity tests against the conditional value: Base Case (100% payout), Downside (50% payout from integration friction), and Ugly (0% payout from key manager exit or client repricing). Quantify the minimum guaranteed payout in the Ugly scenario.

Step 4: Compare Buyer Types Using the Same Lens

Strategic buyers offer higher synergy premiums but demand faster, riskier integration. Financial buyers (aggregators) use more deferred components (Rollover, Note), focusing on platform economics. Score the offer based on inherent integration risk. A strategic offer provides a higher peak but guarantees a lower floor.

Step 5: Negotiate Protections Before LOI “Hardens”

Use the completed Scorecard to prioritize negotiations. Do not rely on definitive agreements (DAs) to fix core issues. Lock in operational covenants (Risks 1, 2), define precise KPI methodologies, and secure Good Leaver protections (Risk 6) before the LOI becomes legally binding.

Output: Complete this exercise with a 1-page Offer Scorecard. The scorecard must clearly show the gap between the headline price and the risk-adjusted expected payout, enabling rigorous comparison across multiple bidders.

الأسئلة الشائعة

No, an earnout is not inherently a red flag; it is a mechanism for aligning incentives and addressing performance uncertainty. The true risk arises from ambiguity. It becomes a red flag only when the targets are based on unclear metrics or when the buyer prevents you from retaining operational covenants over the variables that drive revenue and profit, destroying your expected enterprise valuation.

Treat the earnout as conditional, not guaranteed. Build a three-scenario model: Best Case (100% payout), Base Case (50-70% payout considering integration friction), and Ugly Case (0% payout). Crucially, apply a discount rate to the deferred cash, factoring in the time value of money and the high risk associated with post-close execution when selling MSP to aggregator.

It depends on your exit goals. Strategic buyers typically offer higher upfront cash and synergy premiums, providing maximum liquidity and a cleaner break. Financial buyers (aggregators) use more deferred value (rollover equity, seller notes), offering high upside if the platform thesis succeeds, but requiring you to stay involved for a potentially longer, less liquid exit.

The most vital protection is securing precise operational covenants combined with a mandatory independent dispute resolution mechanism. These covenants legally restrict the buyer from making unilateral changes—such as pricing, staffing, or tool stack—that would negatively impact the agreed-upon KPI during the earnout period.

The process rarely moves quickly. Expect a timeframe of 4 to 8 months from the signed Letter of Intent (LOI) to the definitive close. Speed is governed almost entirely by the cleanliness of your financials, client contracts, and legal documentation. Being M&A ready with a clean data room can reduce this timeline significantly.