Forget the simple revenue multipliers you have heard. When a corporate consolidator or PE-backed platform assesses your practice, the true question is: what would they pay? Valuation is not an arbitrary multiple of EBITDA; it is that profit multiplied by a risk/growth factor. This factor explains precisely why two similar practices receive radically different offers. This 9-point checklist arms you with a buyer-grade self-audit to identify the specific drivers that dramatically increase your multiple and secure maximum enterprise value. While tailored for veterinary businesses, these principles share common ground with metrics used in msp valuation. We begin with the driver influencing both profitability and risk.

1. Document a Repeatable Growth Engine

The most valuable asset you sell is the buyer’s confidence that next year’s EBITDA will be significantly larger. Flat managed-services revenue, regardless of current margins, signals an unacceptable risk of stagnation to a sophisticated buyer. Buyers underwrite future cash flows; flat performance proves the platform is not scalable or lacks a predictable sales engine.

To secure a premium msp valuation, you must demonstrate quality growth. Show consistent expansion via Year-over-Year managed-services revenue growth, net-new MRR (Monthly Recurring Revenue), and margin stability. Growth relying on deep discounting or hiring ahead of process maturity lowers the effective multiple, as it appears chaotic and unsustainable.

The key quick win is establishing a 12–18 month growth narrative built entirely on numbers. Map pipeline coverage, lead conversion rates, and capacity plans to prove growth is repeatable—not heroic. Buyers demand mechanical, documented processes that guarantee continued maximum enterprise value long after you exit. (141 words)

2. Prioritize Contracted Recurring Revenue (MRR)

If your practice relies heavily on project-based work, resale, or break-fix services, you are systematically leaving value on the table. Sophisticated corporate buyers apply a deep discount to revenue that is not contracted and predictable. True enterprise value is driven by stability.

The goal: shift the highest possible percentage of your top line into recurring revenue backed by enforceable Master Service Agreements (MSAs) or Statements of Work (SOWs). Consistent invoicing and transparent renewal calendars stabilize cash flow and justify a higher multiple. Buyers see this structure, similar to high-performing msp valuation models, as a mechanical guarantee of future الأرباح قبل احتساب الفوائد والضرائب والإهلاك والاستهلاك والإطفاء.

A quick win: Convert the top 10% of high-margin project work into packaged, managed agreements. Simultaneously, remove any “special” or owner-dependent pricing indefensible post-close. That 10% shift alone can move your effective multiple by half a point, delivering a significantly higher final sale price.

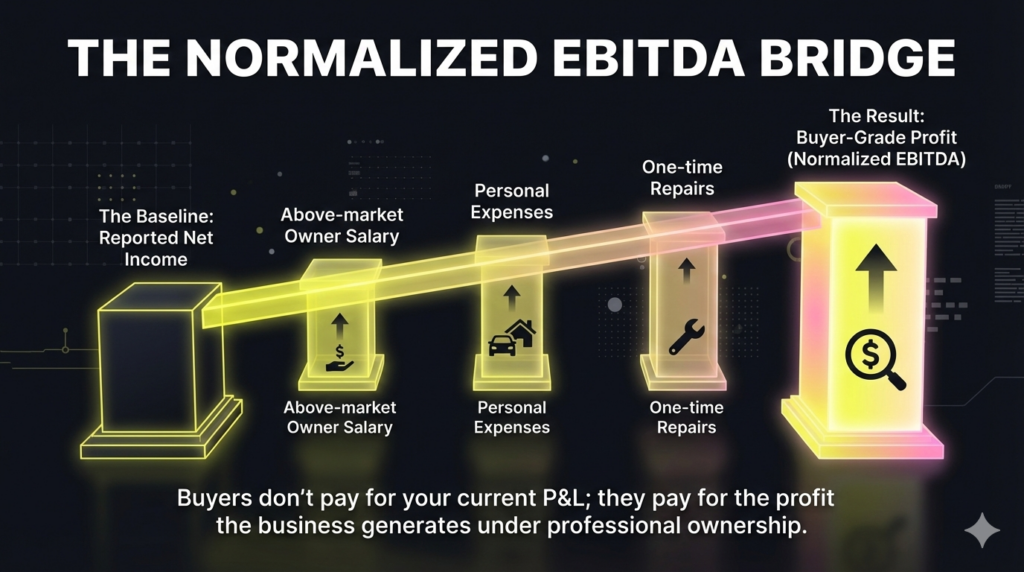

3. Financial Hygiene: Normalized EBITDA is the True Profit

The profit figure on your P&L is not what the buyer assesses; this discrepancy is the leading source of deal friction. Sophisticated buyers base offers on Normalized EBITDA multiplied by the market multiple (Valuation = Normalized EBITDA × Multiple). Normalized EBITDA is the profit the MSP would generate under new, professional ownership, stripped of all owner perks and one-time expenses.

Buyers scrutinize “add-backs”—including owner compensation above market rates, personal expenses, and unusual vendor spikes. Messy records or questionable adjustments result in a trust penalty, systematically discounting the effective multiple.

To maximize enterprise value, track gross margin by service line (managed services versus projects). Stable, high margins, even during rapid growth, signal operational maturity and efficiency. Before discussing price, build a clean, one-page normalized EBITDA bridge that defensibly walks the buyer from your GAAP books to the true, buyer-grade profit. (147 words)

4. Defuse Client Concentration Risk

Buyers purchase predictable, diversified assets, not single relationships. An outsized client share hands the buyer significant negotiation leverage, as this single point of failure risks revenue walking out post-acquisition. This concentration enforces a steep valuation discount, often reducing your multiple or imposing a punitive earn-out structure.

To protect maximum enterprise value, you must mitigate client concentration by proving revenue is sticky and durable without the owner. Effective mitigation involves three key moves:

- Push for longer contract terms with enforceable termination provisions.

- Multi-thread relationships: Ensure three non-owner contacts (exec, ops, finance) exist with the top client.

- Proactively diversify: Build a documented 12-month plan to reduce concentration via targeted ICP acquisition, co-sells, or referral engines.

If this risk cannot be rapidly resolved, structure expectations early. A high-risk profile may necessitate accepting deal structure (like a moderate earn-out) rather than fighting for an unattainable straight cash-at-close multiple.

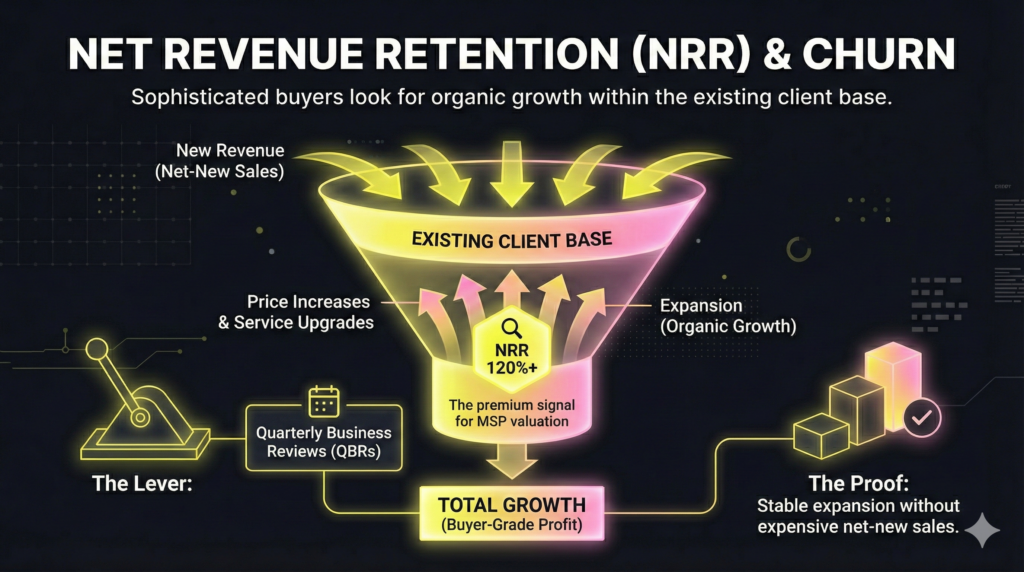

5. Master Net Revenue Retention (NRR) to Boost Your Multiple

You cannot outgrow bad retention. For the sophisticated buyer, customer churn is simply revenue walking out the door; Net Revenue Retention (NRR) is the revenue kept plus revenue expanded. This metric signals a premium msp valuation because low churn indicates a sticky service and strong account management.

High NRR (often 120%+) is the single best premium signal, proving your client base grows organically through price increases or service upgrades. This happens without the need for constant, expensive net-new selling.

Buyers specifically scrutinize revenue churn % (not logo churn), gross margin erosion from downgrades, and stable expansion revenue. To establish this operational maturity, implement formal Quarterly Business Reviews (QBRs) with your top clients.

These reviews must be tied to measurable outcomes: compliance reports, uptime SLAs, or security posture enhancements, not just activity reports. This focus proves base durability, reducing the risk factor that determines your effective multiple and maximum enterprise value.

6. Prove Operational Maturity with Hard Delivery KPIs

Valuation demands more than the P&L; sophisticated buyers purchase the operational engine’s capacity to deliver revenue efficiently and at scale. Failure to optimize delivery translates immediately to EBITDA compression, eroding enterprise value despite strong revenue growth.

To secure a premium multiple, you must prove operational maturity with metrics showing efficient delivery:

- Technician Utilization: The ratio of productive vs. total available hours. Low utilization coupled with rising headcount signals that future growth will disproportionately cost you margin.

- SLA Compliance Rate: Reliability is non-negotiable. Consistent failure to meet Service Level Agreements increases perceived technical risk during diligence.

- Revenue per Employee (RPE) & Gross Margin per Service Line: RPE indicates scalability and leverage. Consistent gross margin tracking validates pricing power across your entire service portfolio.

The practical move is simple: prepare a single-page KPI pack detailing these metrics with 6–12 months of trend lines. Buyers pay significantly more for documented control than they will for operational excuses accompanying growth. (153 words)

7. Eliminate the “Tribal Knowledge” Discount via Process Maturity

The sophisticated buyer is not just purchasing current cash flow; they are purchasing a platform that can run without the founder. The number one question in diligence is whether the practice relies on founder-specific, tribal knowledge. If critical functions (client onboarding to security incident response) are undocumented, the buyer must account for massive integration risk, resulting in a severe “operational maturity” discount to the effective multiple.

A premium asset signals competence via documentation: standard Master Service Agreements (MSAs), clear Statement of Work (SOW) templates, standardized pricing schedules, and defensible SOPs for escalation and Quarterly Business Reviews (QBRs). Conversely, value erodes when your practice relies on custom, “one-off” agreements or undocumented client environment configurations.

Operational clarity is not busywork; it is the physical proof of scalability. To secure maximum enterprise value, identify the top 10 processes that drive margin (dispatch, renewals, new client intake) and document them first. Value is margin multiplied by confidence, and process maturity is the only thing that generates that confidence. (148 words)

8. Eliminate Founder Dependency to Secure a Clean Exit Multiple

If the founder is the chief deal-closer, sole pricing authority, primary client escalation point, and manager of all major accounts, the buyer is acquiring a job, not an asset. This owner dependency guarantees a steep discount to your effective multiple, mandatory multi-year employment contracts, or a punitive earn-out structured solely around your continued performance.

To secure maximum enterprise value, you must prove the platform can function autonomously. Implement a quick 90-day plan to formalize the revenue engine:

- Assign clear account ownership to your DVMs or managers.

- Implement a tiered escalation model that routes client issues away from your direct inbox.

- Formalize clear policies for pricing authority across the leadership team.

Crucially, document the entire sales process—from ICP identification through discovery to proposal and close—into a repeatable playbook. Buyers pay for mechanical operations that guarantee continued growth, not for heroic, single-person efforts.

9. Why Deal Structure Trumps the Headline Valuation

You’ve optimized your Normalized EBITDA and justified a premium multiple. Now, protect the output. The headline valuation presented by a corporate consolidator is a ceiling, not a guaranteed check; your financial freedom depends entirely on the deal structure.

The buyer type dictates this structure. Strategic buyers may pay more for rapid expansion or geographical fit, while financial (PE) buyers are laser-focused on standalone, normalized EBITDA performance, adhering strictly to msp valuation models.

Most high-value deals split proceeds between upfront cash and performance components. The true risk lives in the earn-out. A robust earn-out negotiation strategy is essential to avoid vague post-close profit definitions, buyer-controlled cost allocations, or retention targets.Beware of vague post-close profit definitions, buyer-controlled cost allocations, or retention targets designed to claw back your maximum enterprise value.

Before debating the multiple, define your non-negotiables: the minimum cash required at close, the maximum transition period, and objective KPI definitions the buyer cannot control. Secure the right structure, and the headline valuation becomes irrelevant.

The Maximum Enterprise Value Execution Plan (24-Hour Audit)

This execution plan provides a mandatory, high-impact self-audit to assess your true market value. Complete these steps to identify the strategic moves that maximize your enterprise value and defend a premium multiple في MSP valuation process.

Step 1: Build Your Normalized EBITDA Baseline (1–2 Hours)

Do not rely on your P&L alone. Compile your Trailing 12-Month (TTM) revenue and detail gross margin by service line. Construct the Normalized EBITDA bridge, listing all defensible add-backs (e.g., excess owner salary, personal expenses) to establish a clean profit figure.

Step 2: Pressure-Test the Multiple Drivers (30 Minutes)

Run a rapid diagnostic against the key risk factors. Rate your MSP (High/Med/Low) on growth, contracted recurring mix, client concentration, NRR, utilization, documentation, and owner dependency. Identify the two levers that, if improved over the next 6–12 months, would most aggressively expand your effective multiple.

Step 3: Assemble the Diligence Binder (Half Day)

Pre-empt due diligence by eliminating the “tribal knowledge” discount. Organize financials: 2–3 years of P&L/BS, monthly closes, AR aging, and the MRR customer list. Gather commercial proof (MSAs/SOWs, renewal schedules, top vendor contracts). Collect operational maturity evidence: org chart, KPIs (utilization/NRR), critical SOPs, and risk summaries (insurance/security policies).

Step 4: Decide Your Strategic Next Move

Based on the audit, define your path. If Normalized EBITDA and the current multiple are highly defensible, engage an M&A advisory team and commission a Quality of Earnings (QofE) report immediately. If the audit flagged gaps, commit to a defined 6–12 month value-creation plan focused on fixing those defects before returning to market.

الأسئلة الشائعة

There is no fixed industry standard. Your final multiple is calculated by the market range, which is then adjusted upward for proven growth and stable, recurring revenue, or discounted for operational risk (see the 9 drivers above). Ultimately, buyers pay for confidence in future cash flow. Improving your Normalized EBITDA baseline and demonstrating high operational maturity are the only ways to lift both the profit number and the factor applied to it.

While strong profitability is critical, small MSPs often face a size discount because buyers prioritize durable, transferable assets. Buyers pay a quality premium for documented processes and low owner dependency, which ensures the cash flow persists post-close. If your profitability relies heavily on an owner-operator model or complex, undocumented processes, the buyer will discount the multiple due to the transfer risk.

No, but it will be heavily discounted unless mitigated. High client concentration is a serious risk factor (refer to Section 4). To defend your enterprise value, you must demonstrate mitigation via three levers: securing longer contract terms, multi-threading relationships across your top client’s organization, and presenting a documented 12-month plan to reduce that concentration through diversified sales.

The duration typically ranges from 12 to 36 months, driven primarily by the required client handoff, integration complexity, and the structure of your earn-out. If the buyer perceives high founder dependency (Section 8), they will mandate a longer, more structured transition period to secure client retention. Defining your preferred exit timeline early is crucial before engaging with any buyer.

Yes, but geography is often secondary to the fundamental risk factors. Differences arise from regional pricing disparities, the density of local buyers, and Private Equity (PE) saturation in specific markets. The practical takeaway is to stop guessing. The surest way to maximize your msp valuation is to run a competitive sale process that creates bidder tension across multiple types of potential acquirers, regardless of location.