The real question isn’t “should I sell my MSP?” It is whether you should sell now or build for the next 12-18 months for a higher valuation. Buyers consistently pay a premium for predictable, defensible cash flow and low integration risk. This framework, developed from my experience advising businesses through M&A, quantifies your readiness to exit. To know when to sell my msp, we examine the critical financial, operational, and signals you must master, starting with an understanding of current MSP buyer profiles. We start with the highest-leverage signal: the quality and predictability of your revenue.

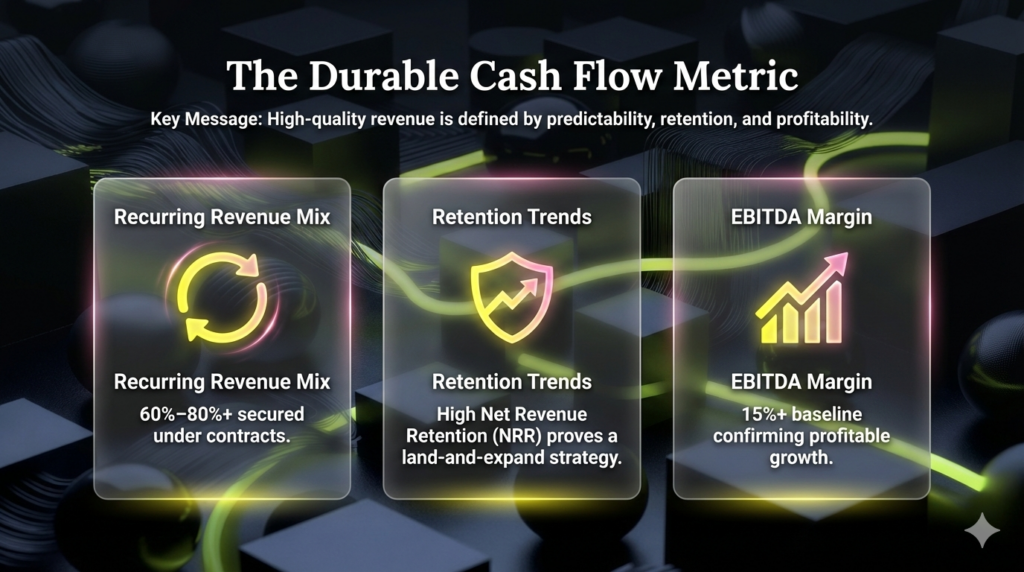

1. Quantify Your Revenue Quality: The Durable Cash Flow Metric

The quickest way to accelerate your valuation multiple is to demonstrate utterly predictable revenue growth. Underwriters, especially in Private Equity-backed acquisitions, pay for durable cash flow, not fleeting project spikes. This concept of M&A readiness hinges on provable financial data, often detailed in a comprehensive private equity MSP valuation guide.

Focus must be on maximizing contracted recurring revenue (ARR) and ensuring defensible margins.

Here are the non-negotiable financial metrics buyers use during due diligence:

- Recurring Revenue Mix: Buyers require 60% to 80% or more of total revenue secured under recurring contracts. This signals stability and dramatically reduces integration risk.

- Retention Trends: Focus heavily on Net Revenue Retention (NRR). High NRR proves a successful land-and-expand strategy is working; logo retention verifies core service satisfaction.

- EBITDA Margin: A baseline EBITDA margin of 15%+ offers a crucial sanity check, confirming that growth is profitable and not driven by unsustainable operational costs.

If your metrics are close to these thresholds, the answer to when to sell my msp is: after prioritizing retention initiatives and aggressively converting project clients to long-term managed service agreements. Every percentage point added to your recurring mix translates directly into a higher enterprise valuation for the MSP through the lens of MSP valuation reverse engineering.

2. Guarantee Operational Transferability: Demolish Keyman Risk

Achieving a target EBITDA margin is insufficient if the founder remains the ultimate escalation point and sales engine. Buyers define operational transferability as the business’s ability to generate predictable revenue the day after the owner exits. Founder dependence creates integration risk, leading directly to discounted valuations or restrictive earnouts.

This keyman risk is heavily scrutinized during العناية الواجبة. To demonstrate high M&A readiness, the operation must run on systems, not individuals.

Buyers look for three signals of low dependency:

- Institutional SOPs: Documented, repeatable SOPs covering critical functions: service desk, security incidents, client onboarding, and technical delivery.

- Management Depth: A clearly defined second-tier leadership, including non-owner heads of Service Delivery and Sales/Account Management.

- Scalable Pipeline: New qualified leads and renewals generated without reliance solely on the founder’s referral network.

If the owner closes 80% of major deals or major clients rely solely on the owner, this signals a need to “wait and prepare.” True understanding of when to sell my msp requires a targeted 90-day plan to offload these dependencies. Treat process documentation as the foundation of your data room story.

3. Define the Founder’s Personal Exit Signal: Knowing When Enough is Enough

Valuation relies on operational and financial levers, but the biggest pitfall for technical founders is staying too long, chasing one extra quarter of growth only to suffer burnout that tanks metrics. If you are asking when to sell my msp, personal readiness is the third, often overlooked, layer of M&A readiness.

A transaction aligns with goals when personal de-risking prioritizes securing wealth over marginal valuation increases. Buyers sense founder fatigue during due diligence; a dip in enthusiasm or culture is an immediate justification for a lower offer or a harsh earnout.

Monitor these personal indicators:

- Burnout: Loss of motivation that starts affecting team culture or client experience.

- De-Risking Need: Secure personal net worth by moving wealth out of a single, illiquid asset.

- Post-Exit Identity: Possessing a clear plan for your next role, identity, and path forward.

Before engaging a banker, define your “walk-away number” tied to a specific acceptable structure (e.g., 70% cash at close, 30% earnout). If a deal hits that floor, the risk of waiting for a higher valuation—only to have performance dip due to founder fatigue—is too great.

4. Master the Financial Narrative: The Signal of Clean EBITDA

Optimal exit timing is driven by internal execution: hitting a proven scale tier and telling an investor-grade equity story with defensible numbers. The market pays a premium for predictable execution and documented growth, not anticipation of the next macro upswing.

While general Enterprise Value (EV)/EBITDA medians exist, specific multiple uplift is determined by size, margins, and critically, the quality of recurring revenue. Firms with robust client contracts and standard SLAs consistently achieve premium multiples compared to smaller, less standardized peers.

The core lever for M&A readiness is presenting a “clean EBITDA.” Buyers heavily discount P&Ls that are difficult to verify during due diligence. This requires normalizing owner compensation to a justifiable market rate, removing all personal expenses, and documenting every add-back with specific, ironclad justification.

Stop guessing. Obtain a baseline valuation now. Isolate the 2–3 key levers—such as increasing recurring margins, reducing client concentration, or strengthening the balance sheet—that will generate the most multiple uplift in the next 6–12 months. Master the internal preparation; do not attempt to time the external market.

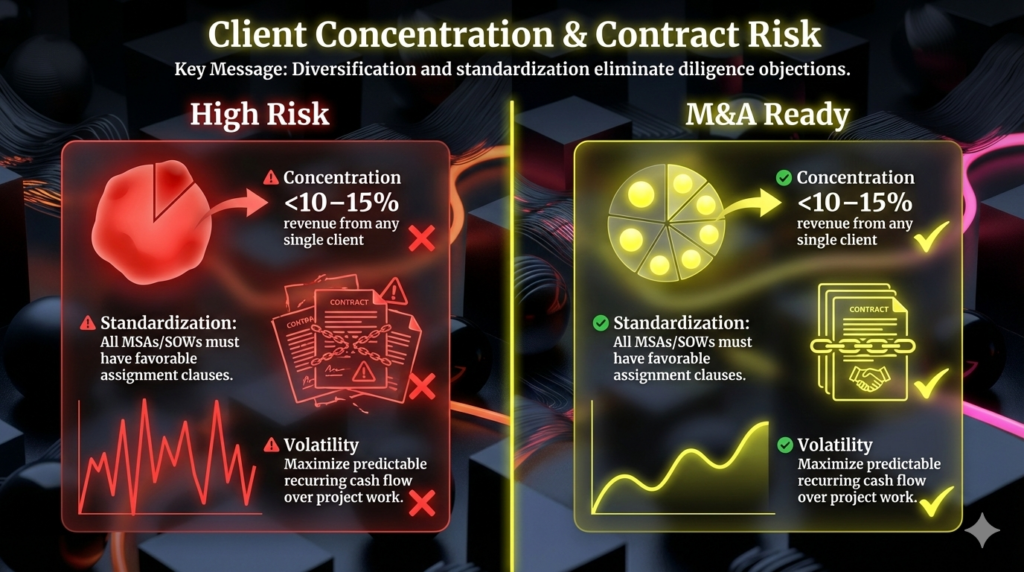

5. How to De-Risk Client Concentration and Contract Standardization

A high-quality revenue stream is worthless without defensibility in العناية الواجبة. Nothing signals operational risk faster than reliance on a single client or non-standard contracts. Buyers see high client concentration (e.g., 15%+ of ARR in one logo) not as success, but as immediate risk warranting severe price chips or holdbacks on your enterprise valuation.

عالية M&A readiness requires diversified revenue secured by controlled contract risk. Address these three areas:

- Concentration Metrics: Calculate the revenue percentage from your top 1 and top 5 clients. If this exceeds 10–15%, aggressively grow mid-tier accounts now to dilute dependence before market outreach.

- Contract Standardization: Standardize all MSAs and SOWs. Ensure favorable assignment clauses and termination rights to guarantee transferability.

- Revenue Volatility: Analyze quarter-to-quarter composition, reducing volatility from project work and maximizing predictable, recurring cash flow.

Prioritize standardization and renegotiation قبل outreach. Eliminating these core diligence objections and building a retention narrative is essential for achieving your target price when to sell my msp.

6. Define Your Exit Structure: Sell-In vs. Sell-Out Strategy

Once operationally ready (Section 2) and financially clean (Section 4), the core strategic decision dictates when to sell my msp: pursue maximum liquidity (full exit) or retain equity for a second exit. This choice dictates the type of buyer you target and fundamentally changes your valuation narrative.

- Selling-Out (Full Liquidity): A clean break maximizing the cash component at close. This structure rewards founders seeking personal de-risking and predictability, attracting Strategic Buyers (competitors) or PE Add-Ons who value immediate, predictable EBITDA.

- Selling-In (Retained Equity): Taking chips off the table while retaining a significant equity stake (20%–40%). The goal is a second, larger payday in 3–5 years under a PE platform. This demands confidence in your future growth runway and requires the founder to remain active in an executive or integration role.

Personal readiness is the core prompt: Do you have the energy for 3–5 more years of accelerated scaling, or is securing wealth today the priority?

If you choose to sell-in, you must focus on finding a growth-focused PE platform that aligns with your operational vision. If you sell-out, prioritize a strategic buyer أو PE add-on who will pay a premium for stability and immediate market dominance.

7. How to Read External Market Signals for Optimal MSP Sale Timing

The biggest mistake founders make is attempting to time the external market cycle. You cannot perfectly predict when private equity appetite peaks or when consolidation waves will hit. The true signal defining when to sell my msp is simple: verifiable market demand exists for durable, profitable MSPs right now.

While M&A readiness hinges primarily on internal factors (EBITDA margin, recurring revenue), you must remain aware of three external triggers that impact a buyer’s ability and willingness to pay:

- Financing Conditions: High interest rates restrict the debt buyers use to leverage deals. This often lowers the initial offer price, especially from financial sponsors like Private Equity. Monitor rate shifts closely.

- التركيز على الأسهم الخاصة: Aggressive consolidation in your specific niche (e.g., MSSP, compliance-heavy IT) signals short-term pricing power. A sudden roll-up strategy by major platforms creates urgency.

- Regulatory/Tax Uncertainty: Anticipated shifts in capital gains rules or major regulatory changes often spur a rush of transactions, attempting to close before new structures take effect.

The core principle: Do not wait for theoretically perfect market conditions if your internal risks are rising (e.g., keyman dependency or client churn threat). Maintain an “always ready” posture instead. Conduct a light market check—obtain a baseline valuation and hold soft conversations with investment bankers—at least once per year. This proactive due diligence ensures you understand your potential enterprise valuation and can rapidly accelerate when a favorable macro opportunity appears. (174 words)

The 12-Month Operational De-Risking Schedule for Maximum Enterprise Valuation

Achieving genuine M&A readiness requires a commitment of 12 months, not a 90-day sprint. Cleaning financials and de-risking operations systematically maximizes your enterprise multiple and minimizes friction during العناية الواجبة. Use this schedule to control the execution plan.

Months 12–9: Establish the Financial Baseline

Establish the Clean EBITDA necessary for a high enterprise valuation.

- Normalize Financials: Aggressively separate all personal expenses from the P&L. Normalize owner salary to market rate.

- Validate Revenue: Confirm the recurring revenue mix and LTM EBITDA.

- Identify Levers: Engage an advisor to obtain a valuation range and identify the top 2–3 value drivers (e.g., concentration, margin).

Months 8–5: Engineer Operational Transferability

Mitigate keyman risk and standardize the revenue engine. Buyers pay a premium for systems, not people.

- Standardize Contracts: Convert non-standard MSAs and update SOWs with favorable assignment clauses.

- Document SOPs: Institute SOP documentation for critical Service Delivery, Security Incident Response, and Client Onboarding.

- Build Management Depth: Delegate 80% of tactical decisions to non-owner department heads to demonstrate operational transferability.

Months 4–2: Build the Diligence Narrative

Reduce risk and control the story during due diligence.

- Assemble the Data Room: Finalize the core data room (3 years normalized financials, contracts, NRR/churn KPI reports).

- Staff Retention: Implement retention bonuses for key, non-owner technical and sales staff.

- Compliance Posture: Confirm all security and compliance certifications (SOC2, HIPAA, CMMC) are current and documented.

Month 1+: Controlled Market Execution

Execute the Market Process with Control, defined by your exit strategy.

- Define Exit: Reconfirm your Sell-In vs. Sell-Out structure.

- Shortlist Buyers: Define 3–5 ideal buyer archetypes (PE platform vs. Strategic Add-On).

- Manage Process: Launch outreach. Run the process with strict financial control, adhering to your “walk-away number.”

If clarity is elusive or if you need an outside view on the gap between current EBITDA and target enterprise valuation, conduct an M&A readiness audit. This is the necessary first step before engaging any buyer.

الأسئلة الشائعة

Optimally, you should begin preparing for an MSP exit 12 to 18 months before approaching the market. This window allows ample time to execute critical operational de-risking, clean your financials, and standardize contracts. If your metrics are already buyer-grade, this process accelerates, but the systematic preparation outlined in the 12-Month Schedule above is crucial for maximizing your enterprise valuation.

Once you formally launch the process, expect the transaction to take 6 to 9 months to complete. This timeline includes outreach, submitting Indications of Interest (IOIs), negotiating the Letter of Intent (LOI), conducting intensive financial and operational due diligence, and finalizing closing requirements. Strategic timing must account for this duration to ensure leadership stability.

Buyers focus on KPIs that guarantee future cash flow and minimal integration risk. The highest-leverage metrics are high-quality Recurring Revenue Mix (80%+ is ideal), strong Net Revenue Retention (NRR), and a verifiable 15%+ Clean EBITDA margin. These metrics directly dictate the achievable valuation multiple.

You should only postpone the sale if you have a clear, documented plan to significantly improve a specific value driver, such as reducing client concentration or pushing EBITDA margin past a new threshold. Do not wait if founder burnout is setting in or if rising client churn or keyman risk threatens to destabilize your current performance and lower your M&A readiness.

The headline multiple refers to the Enterprise Value (EV) applied to your EBITDA. Your final net proceeds are impacted by the deal structure, specifically holdbacks and earnouts, and critical working capital adjustments. These adjustments ensure the buyer receives the business with adequate cash to operate immediately, which can significantly alter the cash received at closing.