The headline valuation promised in MSP acquisition emails is frequently a trap. The true difference between a lucrative exit and an operational nightmare is rarely the multiple; it is the autonomy retained, the integration timeline, and the final deal structure. From an operator/PE lens, we provide a neutral framework focused strictly on what changes after closing. This founder-friendly breakdown will compare the dominant M&A models—from decentralized holdcos like Evergreen Services Group and Lyra Technology, where Evergreen Services Group acquisition multiples are often discussed, to aggregators such as The 20 and UPSTACK.

1. Evergreen Services Group Acquisition Multiples: The Decentralized Model

The Evergreen Services Group/Lyra Technology model addresses the core fear of MSP founders: brand and culture destruction post-acquisition. As a decentralized holding company, Evergreen emphasizes long-term ownership with a “keep the leadership, keep the brand” mandate.

The Autonomy Narrative and Integration Shock

This approach appeals to founders seeking liquidity without losing operational control. The value proposition offers capital and network resources while avoiding the integration shock of typical roll-ups. However, decentralized autonomy creates necessary ambiguity: founders must interrogate the institutional framework governing KPIs, financial rigor, shared services, and standardization.

Evaluating the True Multiples

Since Evergreen/Lyra rarely publishes deal prices, founders must shift focus from the headline multiple to the offer’s technical structure, where true value resides:

- Cash at Close: Immediate liquidity.

- Rollover Equity: Deal percentage tied to equity in the larger holdco, dictating long-term alignment.

- Retention Requirements: Contingent payouts or earnouts requiring specific performance thresholds post-close.

Before signing, demand clarity on the enterprise value basis and normalization policy (treatment of owner compensation/add-backs).

Founder-Fit Test: This model suits owners seeking partial liquidity to de-risk while remaining engaged operators backed by capital. It is unsuitable for those requiring a clean, total exit without ongoing governance or performance obligations.

Key Questions for Lyra/Evergreen: Interrogate autonomy boundaries, non-negotiable KPI reporting, expected leadership timeline, and constraints on shared services (HR, finance).

2. The 20: The Standardization-First Aggregator

The 20 operates a distinct, dual model: a membership peer group and an active acquisition vehicle. Unlike aggregators promoting non-committal community, The 20 requires MSPs to standardize processes and tooling vor any acquisition is tabled. This duality is the fundamental feature founders must analyze.

The Logic of Pre-Alignment

This pre-alignment fundamentally shifts integration expectations. Because process and tooling standardization (PSA, RMM) are often complete pre-close, the acquiring entity faces significantly reduced post-close technical debt. This model favors MSPs seeking operational rigor, demanding tighter integration than decentralized holdco approaches.

The “Zero Earnouts” Signal

The 20 famously offers zero earnouts—a critical negotiation anchor that de-risks the exit for founders. However, due diligence must confirm that performance contingencies are not disguised as deal components. Scrutinize prolonged retention bonuses, post-close compensation structures, or holdbacks tied to specific contract performance.

Founder-Fit Test: This model is ideal for owners who recognize their valuation ceiling is limited by chaotic processes. They must be willing to adopt a common operational stack (PSA, RMM) in exchange for a cleaner, streamlined M&A ready exit, making it unsuitable for those prioritizing total bespoke autonomy.

| Critical Questions for The 20: |

|---|

| What are the required process and stack adoption rules (pre- and post-close)? |

| What alternatives replace the traditional earnout structure? |

| What decision rights (pricing, hiring, vendor selection) remain with local leadership? |

3. UPSTACK Acquisition: Clarifying the “Partner” Economic Model

UPSTACK often frames acquisitions not as a buyout but as an invitation to “join the platform as a Partner.” This differs significantly from traditional MSP consolidators. While other models focus on technology standardization, UPSTACK centers on integrating the founder’s book-of-business and commercial capabilities into a broader advisory ecosystem.

What “Partner” Means in Practice

The core structural difference is that the founder’s post-close compensation relies on variable compensation (commissions, bonuses, performance targets) and long-term equity, not a fixed, multi-year earnout. This necessitates ongoing, intensive commercial activity.

- Employment & Role: Post-close duties maintain high revenue responsibilities, including relationship ownership, client retention, and cross-sell execution across the larger platform.

- Anreize: Partner economics replace traditional earnouts. Scrutinize performance metrics for equity vesting or variable pay; these function as earnouts tied directly to sustained individual production and sales momentum.

If you are an owner seeking minimal post-close client obligation, this variable compensation structure may be unsuitable.

| Critical Due Diligence for UPSTACK Acquisition |

|---|

| Book-of-Business Ownership: Who officially owns client assignments and pricing rules post-close? |

| Performance Obligations: What minimum revenue targets are required to unlock equity or variable compensation? |

| Non-Compete/Non-Solicit: What is the scope if the founder decides to step back entirely? |

| Support Resources: What specific marketing, back-office, and operations support is provided to boost sales efforts? |

The UPSTACK model suits commercially active owners who want to secure liquidity while embracing the role of a highly incentivized producer within a broader sales engine.

4. MSP Acquisition Multiples Decoded: Quality of Earnings vs. Deal Structure

While most MSP acquisition multiples reference EBITDA or revenue, focusing solely on the 7x or 8x headline number ignores the core financial risk. The ultimate valuation is decided by two factors: the quality of EBITDA and the final deal structure. A high multiple on poor earnings is worthless; a deferred payment is simply risk transfer.

What Determines Your Multiple Range?

Institutional MSP buyers evaluate the durability of your revenue, which directly moves the valuation range:

- Recurring Revenue Quality: Longer contracts, high retention rates, and clear pricing power signal revenue durability and justify a premium.

- Security/Compliance Maturity: Standardized security/compliance capability reduces post-close integration risk and ensures margin durability.

- Scale & Concentration: Low customer concentration (no single client >10% revenue) and depth in non-owner leadership drastically lowers key-person risk.

Why Two “8x” Offers Are Never Identical

The headline EBITDA multiple is only the starting point. Two offers with the same number can yield vastly different “cash-at-close” figures:

- EBITDA Normalization: Acquirers adjust historical financials using different add-back policies (owner comp, non-recurring costs). Identical headline multiples are often calculated on two different EBITDA baselines.

- Payment Timing: Deal structure defines risk. A payment of 80% cash at close vs. 50% cash/50% contingent earnout represents a direct risk assessment of your forecast.

- Post-Close Expectations: Integration mandates, salary adjustments, or excessive retainership demands can compromise founder autonomy, making a high multiple functionally crippling.

The imperative is to compute the “cash-at-close multiple,” separating guaranteed money from contingent pieces (seller notes, rollover equity, earnouts) dependent on future performance. To effectively standardize multiple offers, the following 20-term checklist provides the framework necessary to compare every element of the final agreement.

5. The 20-Term Checklist for Standardizing Every Deal Structure

Comparing differing LOIs (cash, equity, or earnout-focused) requires standardization. Before reacting to the headline multiple, use this 20-term checklist to force every offer into the same template and compute a unified risk profile.

Standardizing the 20 Critical Terms

Price & Metric

- Valuation Metric: The multiple basis used (TTM EBITDA, Forward, or Revenue).

- EBITDA Definition: The buyer’s precise calculation and definition.

- Add-Back Policy: Owner compensation, non-recurring expenses, and normalized costs allowed.

- Trailing Period: The 12-month financial period used as the baseline.

- Growth Adjustments: Contracted increases or recent strategic investments factored in.

Payment Mix

- Cash at Close: Guaranteed liquidity transferred on the closing date.

- Deferred Consideration: Fixed payments scheduled for specific post-close dates.

- Earnout (If Any): Payments contingent on meeting post-close performance metrics.

- Seller Note: Amount, interest rate, and maturity of the founder’s debt carried.

- Rollover Equity: Percentage of the deal value taken in the acquiring entity’s equity.

Protections & Adjustments

- Working Capital Adjustment: Target and method for calculating the true-up or down payment.

- Cash-Free/Debt-Free: Assumptions regarding excess cash and existing debt treatment.

- Indemnities/Escrow/Holdback: Duration and amount of funds held to cover warranty breaches.

- Reps & Warranties Scope: Breadth and duration the founder is financially liable for representations.

People & Role

- Your Employment Terms: Length of mandatory service contract and fixed salary.

- Management Incentives: Bonus or incentive pools for the non-owner leadership team.

- Retention Expectations: Specific tenure commitments required for key staff members.

Control & Future

- Autonomy/Decision Rights: Decisions that remain local (pricing, hiring) vs. corporate (finance, major CapEx).

- Brand/Integration Commitments: Required changes to the name, operational stack, or service packaging.

- Non-Compete/Non-Solicit: Scope, duration, geography, and the future exit path.

Scoring Methodology

To quickly score multiple offers, define the Must-Haves (e.g., Cash at Close) versus Nice-to-Haves. Then, map each term to one of the three core strategic outcomes:

- Cash Certainty (Liquidity)

- Upside (Rollover/Earnouts)

- Kontrolle (Autonomy/Employment)

Once the scorecard is finalized, ensure counsel or an M&A advisor reviews the LOI against this structured checklist to safeguard the true enterprise value.

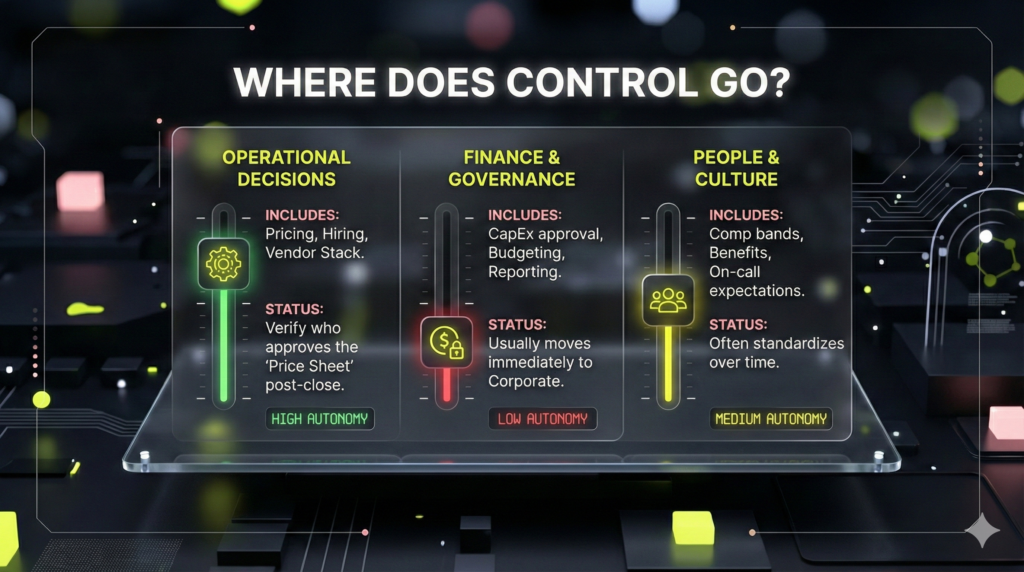

6. Defining Operational Autonomy: From “Vibe” to Vetted Decision Rights

Operational autonomy is not a cultural “vibe”; it is a set of verifiable decision rights and documented constraints. Failing to define these rights concretely in the Letter of Intent (LOI) or final employment agreement guarantees integration shock. You must identify precisely where operational control moves—or where it remains—across the three dominant M&A models:

- Holdco-Style (e.g., Evergreen/Lyra): Integration is minimal initially. Autonomy remains high, but confirm which shared services (security stacks, insurance minimums) become mandatory, non-negotiable standards over time.

- Operator-Platform Style (e.g., The 20): Standardization drives value. Autonomy centralizes around process and technology stack. Confirm which governance decisions (KPI reporting, security standards, PSA/RMM usage) move immediately to corporate control.

- Partner-Platform Style (e.g., UPSTACK): Autonomy is tied to commercial roles. While local decision rights stay strong, confirm the consequence if your role-driven economics require high production and you reduce sales momentum or client portfolio.

The Autonomy Diligence Script

Translate soft claims into concrete diligence questions verified in writing. Demand specificity on these controls:

| Area of Control | What to Verify in Writing |

|---|---|

| Operational Decisions | Pricing authority, hiring/firing approval limits, local vendor stack control, client acceptance criteria, security and compliance standards. |

| Finance & Governance | Financial reporting cadence, budget approval thresholds (CapEx/OpEx), investment approval processes. |

| People & Culture | Right to set comp bands, outsourcing/offshoring policies, benefits changes, and on-call expectations. |

Contractual Red Flags

Watch for vague integration language (“aligning for maximum synergy”), undefined “shared services,” or non-competes so broad they prevent future employment. A high multiple is meaningless if you lose control over your day-to-day business.

FAQ

The EBITDA multiple is highly situational, typically ranging from 5x to 9x, but this depends entirely on size and quality. A higher multiple is justified by strong recurring revenue (90%+ MRR), high net margin (20%+), and low client concentration (no single client exceeding 10% of revenue). Focus less on the headline number and more on the effective multiple, which is the guaranteed cash at close divided by your normalized EBITDA baseline.

The decentralized holdco model (Evergreen, Lyra) involves private, proprietary deals; they are not publicly traded entities required to disclose terms. This lack of public data makes reference checks critical. As a seller, you must underwrite the value based on the specific terms in the Letter of Intent (LOI): the strict normalization rules, the valuation metric used, and the cash/equity breakdown. See Section 1 for a detailed review of this model.

Earnouts are common, serving as a primary risk mitigation tool for acquirers, especially when forecasts are aggressive. You should not necessarily avoid them, but manage them strictly. Ensure the metrics are simple, measurable, and directly controllable by your team (e.g., specific revenue retention targets, not corporate EBITDA). If an earnout is present, define clear dispute resolution mechanisms and robust governance to protect against controllable accounting shifts post-close.

The UPSTACK “partner” model primarily translates into a variable compensation structure post-close, focusing on ongoing sales and relationship management for equity vesting and performance pay. Classic consolidators typically offer fixed salaries with contingent earnouts tied to overall business performance. Compare them by defining the cash certainty, the ongoing revenue obligation required to unlock upside, and the flexibility you have to exit the sales role later. Review Section 3 for more on UPSTACK’s specific economics.

Serious institutional buyers will move quickly to establish financial clarity and define the post-close world. The three immediate asks that separate real buyers from time-wasters are: A detailed Letter of Intent (LOI): Must include a clear valuation metric, normalization policy, and specific payment mix (cash, note, earnout). A specific diligence request list: Focused heavily on Quality of Earnings (QoE) and contract quality. A defined post-close role outline: A non-ambiguous employment agreement outlining your title, compensation structure, and required retention term. Optional: Ask for references from recent sellers of similar size.