The multiple is a vanity metric in any MSP/MSSP acquisition negotiation. The true premium valuation is negotiated during due diligence, tied entirely to the risk you remove for the buyer. Premium mssp acquisition offers and de-risked earn-outs show up when your provable specialization accelerates the buyer’s strategy. This guide delivers 9 buyer-tested signals that increase offer quality, alongside a fast workflow for screening and comparing bids. To understand what a premium means for your enterprise valuation, we must first define who is buying. Evaluating different msp buyer profiles exit strategy is the first step in identifying which suitor will value your specific assets most highly.

1. Define the Buyer Archetype: What They Pay For, Not What You Ask For

For MSSP sellers, no two mssp acquisition offers are equal. Price is not dictated by trailing EBITDA but by how efficiently you solve the buyer’s strategic problem. Mapping your firm against buyer archetypes determines the premium ceiling and dictates the structure of the earn-out.

- The Private Equity (PE) Engine: Pays for clean, repeatable EBITDA and clear scale levers. Premiums mean higher upfront cash, but include stringent covenants tied to integration speed and documented RevOps.

- The Strategic Acquirer: (Large MSSP, Telco, VAR). They pay for capability gaps, immediate cross-sell opportunity, or critical geographic footprint. The premium appears as milestone-based earn-outs tied to integration success and talent retention.

- The Specialized IT Builder: Niche operators buy operational clarity. They pay for a tightly defined ICP and a flawless, replicable operational playbook. Valuation centers on market dominance and replication, not just scale.

Before negotiating, map what you are “the answer” to—be it capability, vertical focus, or efficiency engine. Aligning this focus de-risks diligence and helps maximize valuation selling msp by highlighting your unique competitive advantages.

2. Validate Vertical Focus: Turn Specialization into a Bankable Asset

Buyers do not pay a premium for claimed specialization; they pay for risk mitigation. The specialization premium materializes when your vertical focus (e.g., HIPAA healthcare, CMMC defense supply chain) demonstrably reduces the buyer’s sales friction and guarantees high retention within a regulated market.

To maximize enterprise valuation, prove specialization using diligence-ready artifacts—objective metrics confirming defensibility over dependency:

- Documented Compliance Delivery: Repeatable workflow for audit preparation, evidence collection, and reporting cadence.

- Packaged Offering: Structured service stack (vCISO, compliance-as-a-service, MDR) that is easily sold and scaled.

- Customer Concentration Analysis: Stable niche concentration that proves market dominance without relying on key client dependency.

This preparation creates a crucial earn-out connection. Specialization enables the use of objective performance metrics—retention rates in the regulated vertical or the attach rate of compliance add-ons—which are easier to measure than general “growth.” Self-Test: If the founder were removed, would your niche still be obvious from processes, case studies, and contract structures? If not, your final mssp acquisition offers will be negotiated down.

3. Structure Objective Earn-outs: Prioritize Metrics and Seller Protection

The earn-out is often where mssp acquisition offers erode into complex, unfulfilled discounts. Guarantee seller protection by converting this subjective risk into a clear, measurable scorecard.

Rigorously limit earn-out metrics to one or two; complexity is the buyer’s leverage. Focus on objective, RevOps-driven measures derived from your systems, such as defined trailing twelve-month (TTM) EBITDA, Net Revenue Retention (NRR), or contracted MRR. Reject vague metrics like “synergy achievement” or “client sentiment.”

Minimize judgment calls by defining the calculation method inside the Purchase and Sale Agreement (PSA). For EBITDA, explicitly state permitted add-backs and ensure historical accounting policies are immutable. For revenue-based targets, define recognition rules and establish a “reasonable efforts” covenant, preventing the buyer from making material changes—like increasing prices or changing packaging—that destroy your ability to hit targets.

Protect your future enterprise valuation payout. Demand audit rights to verify metric calculations and robust dispute mechanisms (e.g., expert determination). The one-line warning that saves millions: delete any language that grants the buyer “sole and absolute discretion” over operating decisions that directly impact your earn-out metrics. This is non-negotiable seller protection.

4. How Contract Stability Translates to Up-Front Cash and Valuation

High revenue built on weak contracts is discounted immediately. Buyers of MSPs and MSSPs underwrite the stability of future cash flows and the likelihood of client renewals post-close; soft contract structures translate directly into high risk and lower up-front cash.

To maximize premium mssp acquisition offers, focus on three critical revenue quality levers:

- Convert to Term Contracts. Shift clients from month-to-month to 12-month or longer agreements to establish predictable revenue runway, dramatically reducing the risk profile.

- Make Retention Measurable. Demonstrate strong, verifiable cohort analysis and high Net Revenue Retention (NRR) as the primary indicator of future enterprise valuation stability.

- Reduce Customer Concentration. Ensure no single client exceeds 10% of ARR, or proactively document risk mitigation strategies for the top five accounts.

Impact on Structure: Proven stability supports higher cash at close. In contrast, a weak contract base pushes buyers toward retention-based earn-outs, shifting performance risk entirely back to the seller. Prepare your contract inventory, renewal calendar, and a detailed “top customers” memo explaining relationship owners and renewal plans now.

5. Operational Maturity: De-Risking the Transferable System

In mssp acquisition offers, buyers seek a transferable system that generates predictable cash flow, not just trailing EBITDA. Undocumented workflow is the highest-signal discount driver, translating directly into integration and crushing keyman risk dependency.

To command a premium enterprise valuation, the business must be demonstrably auditable. Use operational maturity to frame delivery as a predictable, replicable manufacturing process, not a personalized C-suite service.

During Sorgfaltspflicht, these non-negotiable artifacts signal high process quality:

- Incident Response: SOC escalation paths, breach notification playbooks, and case management standards.

- Veränderungsmanagement: Access control policies, client onboarding/offboarding checklists, and reporting cadence.

- Tool Ownership Map: Definitive index detailing vendor agreements, administration ownership, and license management.

By mitigating keyman risk, you reduce the buyer’s need for contingent consideration. Mature, repeatable processes provide performance predictability, yielding cleaner, higher up-front cash and significantly improved seller protection on the earn-out. This proves your system is worth more than the sum of its people.

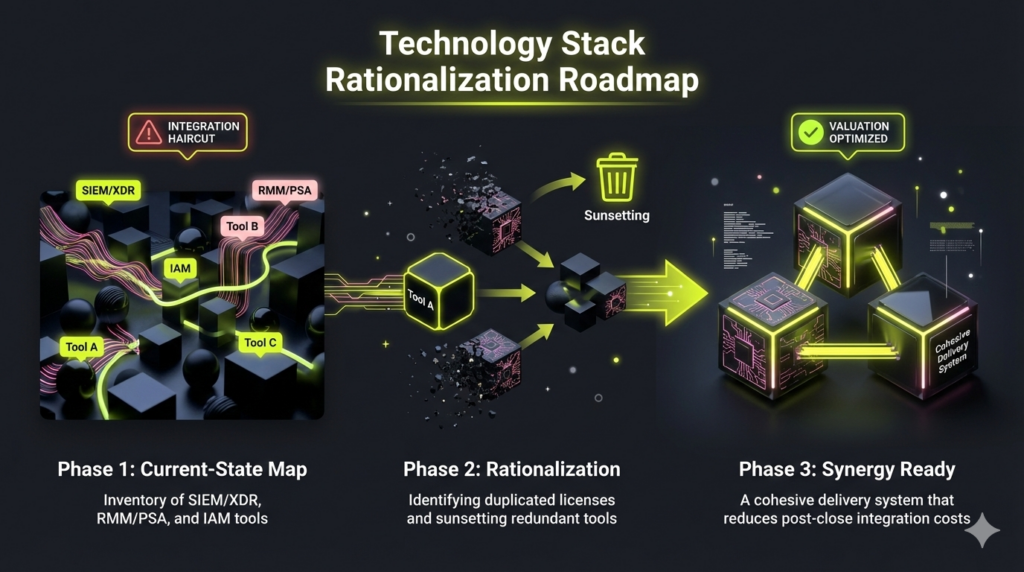

6. Technology Stack Rationalization: Securing Synergy and Avoiding Integration Haircuts

A messy technology stack is a calculated liability that drives down your final enterprise valuation. Buyers apply a direct “integration haircut” to the multiple, modeling costs from duplicated licenses and analyst retraining. High integration costs immediately reduce the buyer’s projected synergy.

To command a premium, shift from a collection of disparate tools to a documented, cohesive delivery system. This commitment to technology stack rationalization proves you have already completed the buyer’s integration homework.

During Sorgfaltspflicht, prepare three critical components:

- Current-State Architecture: A map of all security (SIEM/XDR, MDR), RMM/PSA, IAM, and backup tooling.

- License and Contract Schedule: Schedule renewal dates, termination clauses, and minimum volumes for every tool.

- Rationalization Roadmap: A defined plan detailing what stays, what sunsets, and the migration timeline.

The documentation allows you to state: “We know our consolidation path; integration won’t break detection coverage.” This clarity significantly lowers the risk profile. Consolidating endpoint security from three vendors to one, for instance, drastically improves post-close margins and centralizes analyst training—an efficiency highly valued by strategic acquirers.

7. Talent Retention: Mitigate Keyman Risk and Protect Earn-Out Integrity

For buyers, MSSP service delivery is inherently talent-constrained; churned analysts trigger immediate client flight, destroying revenue predictability. Keyman risk is the fastest way to miss your earn-out target.

To address this critical diligence concern, present a Pre-Close Retention Plan—a direct financial artifact proving the security of future cash flows. The plan must detail three components:

- Role Map: Mission-critical staff and established backups.

- Anreize: Compensation harmonization plan and stay bonuses.

- Client Ownership: Inventory of personnel owning relationships for the top 10 accounts.

Die earn-out risk linkage is explicit: if contingent consideration is tied to NRR or EBITDA, losing delivery staff guarantees failure. Operational maturity must mitigate this binary dependency. Document runbooks and reduce tribal knowledge to showcase that the system is greater than the individual. Crucially, design incentives to promote long-term client health, not short-term metric chasing that could jeopardize future mssp acquisition offers. This preparation transforms staff dependency into a measurable, manageable risk, upholding your premium enterprise valuation during final Sorgfaltspflicht.

8. Financial Clarity: Preparing the Investor-Grade Due Diligence Package

The true measure of a superior mssp acquisition offers is the speed and surgical cleanliness of the Sorgfaltspflicht package. Financial surprises are the primary cause of valuation haircuts and pushbacks on up-front cash.

To withstand investor scrutiny, present a normalized EBITDA schedule justifying ‘add-backs’ (owner comp, non-recurring tool spend, one-time legal fees). Map revenue streams clearly: differentiate managed services, project work, compliance, and incident response, detailing gross margin and cohort retention by service line.

Understand deal mechanisms: contingent consideration (earn-out) can be structured as purchase price or compensation. This technical difference dictates negotiation tactics and tax liability. Ask your advisor early about contingent consideration tax outcomes.

Deliver a one-page “due diligence map” listing where every core answer lives (e.g., contracts in SharePoint, financials in QuickBooks, security program in Vanta). The speed of your response reduces the buyer’s leverage to push operating risk into the earn-out, maximizing final enterprise valuation.

9. Eliminate Compliance Debt to Secure the Earn-Out

Latent compliance debt—the gap between claimed controls (e.g., SOC 2, ISO 27001) and verifiable audit evidence—is the single greatest threat to post-close enterprise valuation. This liability is discounted dollar-for-dollar from up-front cash and destroys revenue-based earn-outs.

To maximize premium mssp acquisition offers, prove your certification scope aligns with operational reality. Buyers surgically probe these areas during Sorgfaltspflicht:

- Governance Proof: Evidence that access reviews, logging audits, and incident response rehearsals are formally performed and logged.

- Contract Linkage: Central inventory mapping customer SLAs and breach notification requirements to operational runbooks.

- Pre-Close Control Validation: Execute validation on 5–10 high-risk controls (e.g., termination, privileged access), providing time-stamped execution evidence for the last 90 days.

Protect your seller protection with an “integration-safe” plan detailing post-close changes that preserve customer contractual obligations. Compliance failure triggers client churn, ensuring you miss the Net Revenue Retention (NRR) target and lose the earn-out.

| Top 6 Compliance Artifacts Buyers Request |

|---|

| 1. Current SOC 2 / ISO 27001 Reports |

| 2. Vendor Risk Assessment Policy |

| 3. Customer Contract Matrix (SLAs) |

| 4. Incident Response Plan (Evidence Log) |

| 5. Access Review/Control Matrix |

| 6. Sub-Processor List |

The 10-Day Valuation Triage: Your Acquisition Pre-Diligence Schedule

The core economics of an MSSP acquisition sit in integration risk and earn-out mechanics, not the headline multiple. This shift reflects the new calculus of MSP consolidation, where buyers prioritize operational harmony over raw growth. Use this 10-day roadmap to structure competing offers, triage buyer fit, and establish negotiation priorities before formal due diligence.

Day 1–2: Buyer-Fit Triage and Value Thesis Modeling

Categorize the bidder (PE, Strategic, or Specialized IT). Define their primary strategic goal for acquiring you (e.g., capability gap fill, geographic roll-up, IP acquisition). Output: Create a three-bullet Value Thesis for each buyer, outlining what they are truly paying for.

Day 3–4: Deconstruct Earn-Out Risk and Seller Protection

Review contingent consideration clauses. List proposed metric definitions, measurement period, and reporting cadence. Define audit rights and the necessary operational standard (e.g., “reasonable efforts” covenant). Output: Detail 5 necessary seller protection clauses for the Purchase and Sale Agreement (PSA).

Day 5–6: Score Operational and Integration Risk

Tally estimated costs for post-close technology stack rationalization. Score key talent dependency to mitigate Keyman Risk. Identify latent compliance debt exposure. Output: List 3 high-cost integration liabilities the buyer will model as a valuation haircut against the base mssp acquisition offers.

Day 7–8: Model Payout Scenarios and Cash Flow

Model best, base, and worst-case earn-out scenarios against Net Revenue Retention (NRR) projections. Define the minimum acceptable up-front cash required at closing to de-risk your position. Output: Establish the Go/No-Go Cash-at-Close threshold.

Day 9–10: Finalize Negotiation Strategy

Define 5 priority asks that enhance operational control or payout certainty (e.g., anti-gaming language, covenant on operational spend). Determine 3 acceptable trade-offs (e.g., extended reps, warranties, or escrow terms). Output: Produce a structured negotiation playbook for your advisory team.

FAQ

Yes, but the premium is conditional. Specialized buyers offer higher total enterprise valuation when your proven niche (e.g., CMMC compliance) accelerates their time-to-market or significantly reduces their execution risk. The premium often appears as higher total consideration, rather than just higher upfront cash.

Revenue (specifically MRR or ARR) is often simpler to track and less subject to buyer manipulation. EBITDA is common but requires rigorous definition of accounting policies and explicit add-backs within the Purchase and Sale Agreement (PSA). We recommend one objective metric tied to revenue retention.

Most earn-outs span one to three years. Buyers often push for three, but shorter periods are preferable for sellers seeking quicker liquidity and less exposure to the buyer’s future operational changes. Avoid terms longer than three years, as prediction accuracy and seller protection decrease over time.

Sellers often lose control over crucial operating decisions post-close, enabling buyers to change spending or packaging that impacts targets. Disappointment stems from poorly defined metrics, ambiguous “reasonable efforts” covenants, and a lack of explicit audit rights to verify final calculations.

Build a due diligence-ready data room and create a one-page “specialization proof pack.” This pack documents vertical outcomes, high Net Revenue Retention (NRR) rates, and a detailed map of your standardized operational processes. This establishes authority and secures cleaner mssp acquisition offers.