When founders ask how to sell an MSP, they make one costly assumption: that the process is a marketing push. Achieving a high valuation is not about attracting buyers; it is about surviving institutional-grade M&A diligence, especially given current MSP consolidation trends. Deals collapse when underlying RevOps, client contracts, and financials are not investor-ready. The process is an exercise in M&A readiness. This guide defines the rigorous path required to protect enterprise value, starting now with the foundational decision: what exactly are you selling?

1. Define the Transaction Structure: Asset vs. Equity Sale

When selling an MSP, the transaction structure dictates diligence, liability, and valuation—this decision must be made before the Letter of Intent (LOI). An Asset Sale transfers specific assets (contracts, IP), leaving historical entity liability with the seller, requiring strict transferability management. Conversely, an Equity (Stock) Sale transfers the entire legal entity, assuming all associated assets and liabilities.

For MSPs, an Asset Sale critically complicates client contract assignability, key personnel retention agreements, and vendor consents for stack licenses. Implement a transferability inventory on your top clients immediately. Discovering a change-of-control clause post-LOI is the fastest way to crater valuation. Your preferred exit (clean break vs. ongoing involvement) must align with the chosen structure.

2. Prepare Investor-Grade Financials: The Adjusted EBITDA Cleanse

M&A diligence is a financial audit. Buyers underwrite four core outputs: TTM Revenue, Gross Margin by service line, churn/NRR data, and Adjusted EBITDA. If your numbers do not reconcile quickly, you invite skepticism that will crater the price.

Start normalization immediately by separating true business expenses from owner compensation and personal perks (the rejected add-backs). Clearly delineate recurring managed services revenue from one-time projects or hardware sales. The most costly mistake is “EBITDA definition roulette,” where the seller’s number is immediately rejected.

Deliver monthly P&L and Balance Sheet consistency, including clean AR/AP and clear deferred revenue schedules. Flawless, standardized books ensure you control the narrative, align with modern MSP profit shifts, and maximize valuation.

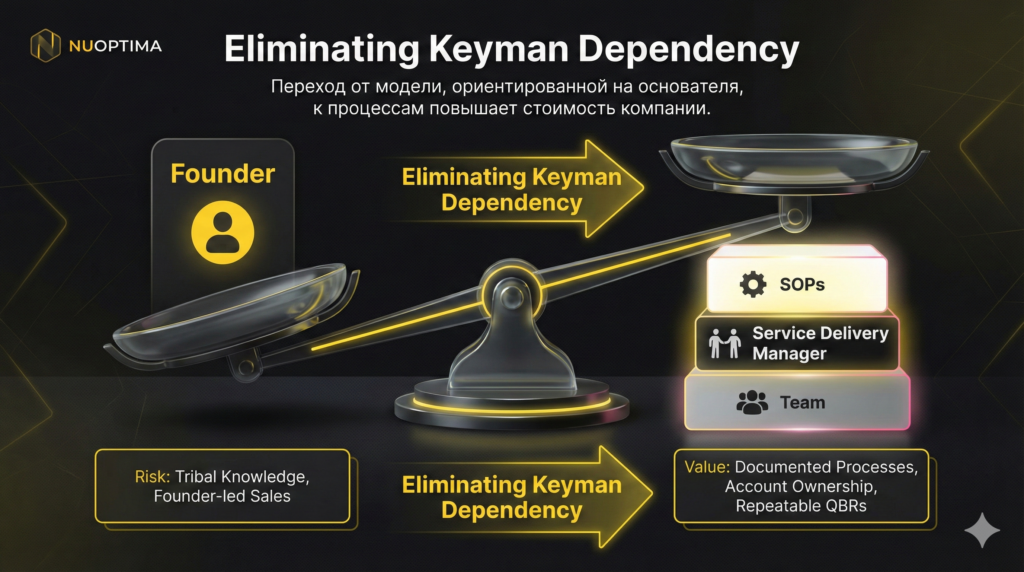

3. Eliminate Keyman Risk for Operational Readiness

The greatest drag on your enterprise value when selling an MSP is the fear of “Keyman Dependency.” Buyers underwrite assets, not founders. If your pipeline or service delivery depends solely on your relationships or technical knowledge, the acquirer assumes immediate client churn and revenue instability post-close, leading to a major valuation haircut. Mitigate this risk by transitioning immediately from a founder-centric model to documented, repeatable processes and structured MSP transition services. Implement named account ownership and appoint a clear operations lead or Service Delivery Manager. Buyers demand proof points like a comprehensive SOP library covering ticketing, patching, and incident response, along with repeatable QBR cadence reports. The costly mistake is relying on “tribal knowledge” discovered during M&A diligence. Structure your MSP so it runs flawlessly without your daily input, ensuring the business can be priced without the founder.

4. Validate Revenue Quality: Control Concentration, Churn, and Contract Risk

High Adjusted EBITDA means nothing if revenue sources are unstable; buyers will issue massive price chips. Diligence teams pay a premium for predictable, low-churn recurring revenue. The goal is to prove transferable cashflow, not just high topline revenue.

The Concentration Check: Identify your top 5–10 clients by revenue percentage. If a single client exceeds 10–15% of total revenue, prepare a specific mitigation plan proving retention is not a risk.

The Contract Quality Check: Standardize Master Service Agreements (MSAs), Statements of Work (SOWs), and SLAs, clarifying term length, automated renewal mechanics, and termination rights. Reliance on weak, non-committal contracts sinks deals. Month-to-month agreements or 30-day termination rights signal revenue instability and dramatically reduce valuation. Secure multi-year terms to maximize perceived client longevity.

5. Inventory the Consent Risk Register (Client & Vendor)

The ultimate firewall before M&A diligence is a meticulous inventory of contractual hurdles. Non-transferable client and vendor relationships lead directly to discounted assets and painful re-trades. Proactively build a “Consent Risk Register” focusing on two critical areas.

First, identify all client MSAs with assignment/change-of-control clauses. If consent is required, secure it pre-close; otherwise, the buyer will carve out or escrow that value. Second, audit key vendor agreements (RMM, PSA, security tools) for transferability and potential post-acquisition pricing changes. Surface all data/privacy exposure, including HIPAA, PCI, or SOC2 obligations.

Waiting until diligence to request these consents is a costly mistake that grants the buyer maximum leverage. Controlling this register ensures fewer surprises and a faster close when selling an MSP.

6. Assemble the M&A Readiness Package for Seamless Diligence

Maximizing buyer confidence and securing premium offers requires a perfectly structured M&A package. This standardized presentation proves internal M&A readiness and signals operational maturity. The core package must include the anonymous Teaser (high-level financials), the detailed Confidential Information Memorandum (CIM) that frames your strategic growth story, and the organized Data Room.

Diligence success hinges on specific exhibits within that data room. Key requirements include: monthly financials broken down by service line, client concentration reports, detailed churn metrics, the SOP index, and a clear organizational chart.

Critically, include sales/marketing/RevOps reporting that validates pipeline hygiene and predictable close rates. The costly mistake is sending buyers raw exports and forcing them to interpret the data; you must deliver curated evidence and a defensible narrative. This standardized package guarantees smooth, high-speed Sorgfaltspflicht. (126 words)

7. Aligning Your Exit Strategy to Buyer Type (Cash vs. Earn-Out)

Optimize for structure, not the headline multiple, as the structural burden dictates your post-close life. Define your personal exit strategy: a clean break (full cash at close) or a stay-and-scale model utilizing roll-over equity? Strategic buyers (seeking operational synergy) prioritize higher cash at close and shorter transitions. Conversely, Financial/PE buyers (focused on a roll-up) rely on structured deals with significant earn-outs, demanding multi-year performance commitments and intense post-close reporting. Determine your non-negotiables now: minimum cash required, ideal post-close role, and risk tolerance for earn-out uncertainty. Accepting an LOI that mandates a life you do not want is a costly mistake. Pre-defining this clarity ensures cleaner negotiations and fewer late-stage reversals.

8. Decipher the Letter of Intent (LOI) Clauses That Move Economics

Die Letter of Intent (LOI) often shifts leverage entirely to the buyer. Your job is to ensure the non-headline clauses protect the final deal economics. Scrutinize the form of consideration (cash, seller note, or rollover equity) and the stipulated working capital target; a high target means less cash for the seller at closing. Define the scope of escrow and reps/warranties. A costly mistake is granting prolonged exclusivity without firm buyer diligence deadlines. Insist on a defined re-trade trigger (e.g., specific liabilities) and clear dispute resolution mechanisms. Controlling these parameters ensures the buyer must prove they can close on the agreed-upon economics before your business is locked down.

9. How to Structure MSP Earn-Outs to Guarantee Payout

Earn-outs address buyer uncertainty regarding client retention, owner dependence, or aggressive growth claims identified during Sorgfaltspflicht. The risk is not the structure, but the toxic ambiguity that allows the acquirer to intentionally fail the metric post-close. To maximize payout probability, strip complexity immediately.

Limit Key Performance Indicators (KPIs) to one or two (Gross Revenue or Adjusted EBITDA). Insist on clear, binary definitions of what revenue streams count and what do not. Secure ironclad measurement cadence and audit rights upfront.

Crucially, protect against buyer-controlled failure. Define specific operating constraints the acquirer cannot violate: limits on staffing reductions, major pricing changes, or service line cuts that directly impact delivery.

Tying earn-outs to vague “performance” without robust governance is a costly mistake. Secure reporting rights and a defined dispute resolution cadence now. Ensure the agreement legally compels the buyer to facilitate the upside you sold.

The 24-Month M&A Readiness Timeline: An MSP Exit Execution Schedule

Enterprise value loss often occurs before buyer contact, stemming from chaotic preparation. To maximize your MSP valuation, transition from founder-centric operations to investor-grade readiness. This calendar converts M&A theory into a strict execution schedule, ensuring control during institutional diligence.

Month 24–12: Foundation and Financial Discipline

- Define your ultimate Ausstiegsstrategie (clean break vs. stay-and-scale) and preferred Buyer Type (Strategic vs. PE/Financial). [Item 7]

- Umsetzung strict monthly Adjusted EBITDA discipline. Normalize financials by removing discretionary owner add-backs and clearly segmenting recurring revenue. [Item 2]

- Eliminate Keyman Risk. Map all critical founder roles (Sales, Engineering oversight) to new internal owners and execute documented knowledge transfer. [Item 3] Outcome: Achieve a repeatable, clean monthly close process and a defined M&A thesis.

Month 18–12: Operational Proof of Concept

- Construct the comprehensive SOP library [Item 3]. Cover onboarding, ticketing, patching, backup verification, and standardized Incident Response (IR).

- Institutionalize RevOps hygiene. Clean the CRM, solidify pipeline stages, and establish a repeatable internal QBR (Quarterly Business Review) reporting cadence to prove client governance [Item 7 support]. Outcome: Demonstrate a business driven by process, ready for operational diligence.

Month 12–9: Legal and Contractual Firewall

- Execute a comprehensive Contract Inventory [Item 5]. Flag all client MSAs containing assignment oder change-of-control clauses.

- Audit key vendor agreements (PSA, RMM, Security Stack) for transferability and renewal schedules. Create an action plan to secure required consents immediately. Outcome: Develop a zero-surprise Consent Risk Register.

Month 9–6: Packaging and Narrative Control

- Draft the Teaser and outline the strategic narrative for the Confidential Information Memorandum (CIM) [Item 6]. Focus the story on defendable growth, not theoretical ideas.

- Bauen Sie the structured Data Room hierarchy. Populate it with clean financials, legal documents, and RevOps reports. Outcome: Deliver a polished M&A package that controls the buyer’s perception of value.

Month 6–3: Go-to-Market and Staff Control

- Interview advisors or brokers. Define confidentiality rules and the outreach methodology.

- Finalize the management retention strategy and communication plan to prevent staff panic and attrition during due diligence.

Month 3–0: LOI to Close Control

- Define LOI Guardrails [Item 8]: Establish exclusivity limits, defined escrow amounts, and the minimum acceptable working capital target.

- Struktur Earn-Outs [Item 9] with robust governance, clear, binary KPIs, and protective operating covenants.

- Execute final client handoffs and define transition milestones.

Final Outcome: Run a controlled process, minimize re-trade risk, and close without operational panic.

FAQ

The typical range from market launch to final closing is six to nine months, though preparation for M&A readiness should begin 12–24 months prior. The timeline accelerates or stalls based on your organization’s preparation. Key delays often stem from financing conditions, securing critical client/vendor contract consents, and the state of your data room. Maintaining operational capacity during the diligence period is critical; slippage in client delivery invites price renegotiations.

Valuation multiples are not fixed, but rather defined by risk. Buyers focus on Recurring Revenue (ARR), not total revenue. Multiples are highest for firms exhibiting low client concentration, low churn, high gross margins on managed services, and documented operational maturity (eliminated Keyman Risk). While industry benchmarks exist, build your financial plans on a conservative valuation model. A clean Adjusted EBITDA and proven, transferable cash flow maximize your leverage during negotiations.

our commitment post-sale depends heavily on the buyer type and the deal structure defined in the LOI. Strategic buyers often demand a shorter transition period (6–12 months) for operational handoff. Financial/PE buyers, however, almost always require the founder to stay for a multi-year performance commitment tied to an earn-out structure. Define your non-negotiable exit milestones, required authority, and compensation before accepting any letter of intent.

Non-transferable contracts (those with change-of-control clauses) introduce significant financial risk, as the buyer cannot guarantee the revenue transfer. Best practice is to flag these top contracts early and plan a consent strategy before diligence begins (see Item 5: Consent Risk Register). Buyers will either mandate that consent be secured pre-close, carve out the revenue from the total consideration, or place its value into an escrow account, effectively discounting the asset price.

Staff retention is crucial, as losing key technical talent during diligence craters the valuation. Identify mission-critical roles (e.g., Service Delivery Manager, core engineers) immediately and define targeted stay bonuses or transition incentives contingent upon closing. Confidentiality is paramount; communications must be tightly controlled by leadership. Protect your company culture and clarify that ‘Day 1’ expectations post-close will remain predictable, reassuring employees about their future role under new ownership.