Comparing MSP acquisition offers is impossible when public terms are always “undisclosed.” A simple valuation multiple misses the true value; risk, cash certainty, and founder autonomy define a successful exit. To properly assess competing deals, founders must normalize offers from firms like Evergreen acquisition offers, Dataprise, or Executech across three dimensions: economics, structure, and culture. We base this analysis on standard M&A diligence and the mechanics of the Letter of Intent (LOI). The most critical unlock is understanding each buyer’s core archetype.

1. Align Incentives: Understanding the Three Key Buyer Archetypes

Before debating the final multiple, ask: Who is actually buying your business, and why? Your MSP’s true value is defined by the buyer’s motivation, time horizon, and intended use of the platform. A successful exit requires aligning your expectations for post-close life with their financial model.

Three dominant buyer archetypes dictate post-close governance und integration appetite, critically impacting your earnout and autonomy:

| Buyer Archetype | Typical Buyer Model | Time Horizon | Success Metric (The “Why”) |

|---|---|---|---|

| Immergrün | Permanent Holdco / Platform | Buy-and-Hold (Indefinite) | Sustainable EBITDA, Cash Flow, Minimal Integration |

| Dataprise | Private Equity (PE) Sponsor | Build-then-Exit (3–5 Years) | EBITDA Growth via Scale, Add-ons, Margin Expansion |

| Executech | Strategic Regional Consolidator | Tactical Acquisition | Cross-sell opportunity, Geographic Fill, Eliminating a competitor |

Evergreen models prioritize autonomy and steady cash flow. A PE recap demands aggressive, high-integration growth for a 3–5 year exit. Strategic acquisitions often mandate fast operational absorption to eliminate redundancy.

To mitigate risk, demand proof of intent during the LOI process:

- Request the post-close organizational chart, detailing who controls pricing decisions and signs the annual budget.

- Ask for two references from sellers 12–24 months post-close who are still active under the new structure. (187 words)

2. The Core Negotiation: Normalizing the Valuation Basis

The fastest way to lose value in an MSP acquisition is accepting a vague valuation multiple. The figure is meaningless until the base is explicitly defined—the difference between a high-single-digit multiple on clean Revenue versus a double-digit multiple on heavily Adjusted EBITDA.

Most MSP offers are based on Revenue, Annual Recurring Revenue (ARR), or Adjusted EBITDA. While strategic buyers may cite Revenue, Private Equity (PE) roll-ups and Evergreen platforms focus heavily on Adjusted EBITDA. “Adjusted” means the buyer inflates the underlying profit metric by adding back discretionary owner expenses and one-time costs.

Because these adjustments directly impact your final valuation, demand the following clarification within the Letter of Intent (LOI) process:

Multiple Sanity Check

- Demand the exact definition of every EBITDA add-back: owner salary normalization, legal fees, and one-time severance costs.

- Confirm the timing: Is the multiple applied to Trailing Twelve Months (TTM), current run-rate, or a forward-looking plan?

- Require a worked example page in the LOI appendix, demonstrating the calculation from your P&L statement to their final offer price.

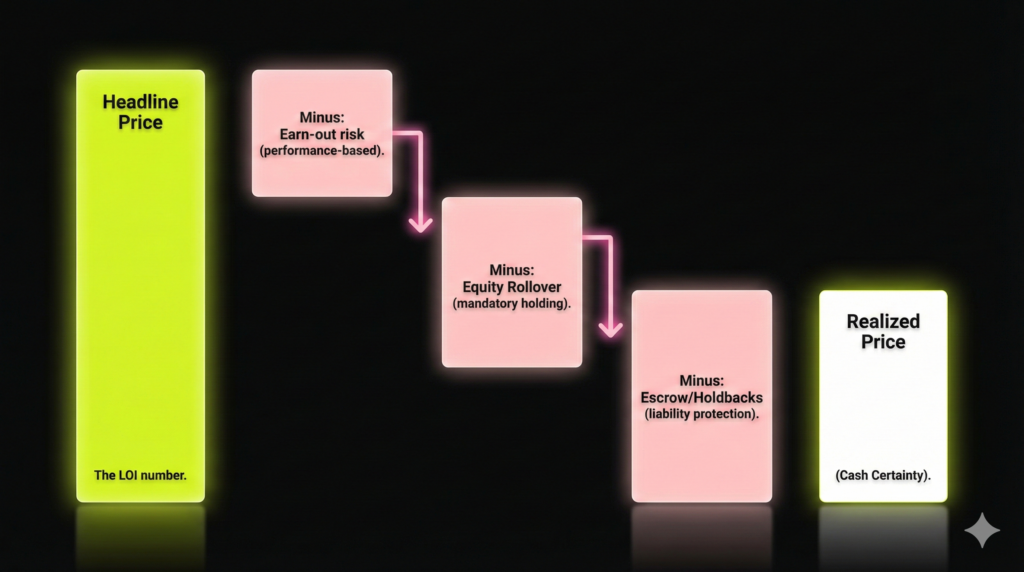

3. The True Value Metric: Understanding Deal Structure and Realized Price

The number signed on the LOI is the headline price; the cash deposited is the realized price. The realized price equals the headline price minus embedded risk and restrictive conditions imposed by the buyer. Institutional acquisition firms manage this risk using four primary deal levers that directly affect payment certainty:

| Deal Term | Funktion | Diligence Prompt (Ask) |

|---|---|---|

| Cash at Close | Immediate, unrestricted payment; the only guaranteed liquidity. | What is the minimum percentage required for working capital adjustment? |

| Earn-out | Performance-based payment tied to post-close metrics. | What are the precise metrics (EBITDA, MRR, Gross Margin) and associated control rights? |

| Equity Rollover | Converting a portion of proceeds into equity in the new holding company/PE vehicle. | Is the rollover mandatory, and what is the required holding period? |

| Escrow/Holdback | Funds held aside (6–18 months) to cover potential future liability claims. | Is this mitigated by Reps & Warranties Insurance (RWI)? If not, what is the maximum percentage? |

Die earn-out is the most volatile component of the deal terms and requires the deepest diligence. Sellers must demand specificity around three core areas to protect the full value:

- Metric Definition: Avoid red-flag phrasing like “subject to performance.” Insist on a defined KPI schedule tied to measurable outcomes (e.g., net new MRR growth or specific EBITDA targets).

- Control Rights: Define precisely who controls pricing, staffing, and capital expenditure during the earn-out period. Lack of control means losing the ability to hit performance targets.

- Dispute Mechanism: Ensure the deal includes a binding, third-party audit process to resolve any measurement disagreements immediately.

4. Negotiating the Employment Agreement: The Founder’s Post-Close Constraints

Your employment agreement dictates your next 3–5 years. This contract is the second sale: negotiate it correctly, or surrender founder autonomy and block future ventures. You cannot sell twice if the first contract locks you out of the market.

Evaluate these critical employment terms side-by-side to avoid the common pitfalls of corporate MSP ownership:

| Employment Term | Critical Due Diligence Prompts |

|---|---|

| Stay Period & Incentives | Expected minimum tenure? Are incentives performance bonuses or earn-outs? Is mandatory equity rollover attached to compensation? |

| Non-Compete Scope | Define geographical limits and duration. Does it block adjacent verticals or only direct MSP competition? |

| Key Employee Retention | Is there a bonus pool for top engineers/GMs? (Protecting A-players ensures earn-out target viability.) |

Negotiation Points MSP Owners Commonly Miss

Strategic oversight often centers on decision rights. During the earn-out period, demand clear contractual protections regarding your continued role:

- Clear Job Description: Define specific decision rights (pricing authority, hiring capacity, vendor stack control).

- Change-of-Control Severance: Protection if the buyer changes your title or scope before the agreed tenure is complete.

- Earn-out Protection: Language preventing buyer centralization of core functions (e.g., sales/accounting) from negatively impacting performance goals.

Documents to request immediately:

- Draft employment agreement

- Incentive plan summary

- Non-compete and non-solicit language

- Benefits summary and management structure.

5. Converting Cultural Fit into Contractual Commitments

When evaluating an MSP acquisition, “culture” is an operational blueprint that dictates integration risk. Buyer choices on margins and client churn directly impact your earn-out potential. Convert promises of autonomy into binding, contractual commitments.

Operational Autonomy: A Due Diligence View

Operational autonomy is defined by governance decisions. Use this comparative view during Sorgfaltspflicht to assess the buyer’s integration appetite:

| Element | Low Integration (Autonomy) | High Integration (Synergy) |

|---|---|---|

| Markenidentität | Local brand retained; decision-making autonomy. | Mandatory rebrand/sunset within 6–12 months. |

| Tech Stack (PSA/RMM) | Optional standardization; local vendor choice retained. | Mandatory stack standardization (cost synergy focus). |

| Service Delivery | Localized sales and account management retained. | Centralized NOC/SOC/Helpdesk mandated for efficiency. |

Contractualizing Independence

If your LOI guarantees “operating independently,” translate that language into binding terms within the purchase agreement to protect targets and talent:

- Define Budget and Spend: Stipulate minimum local marketing and capital expenditure budgets for the earn-out period.

- Control Talent: Require final sign-off for key hiring and compensation changes for your local General Manager or technical leads.

- Protect Margins: Define exceptions or approval mechanisms for retaining profitable vendor relationships if stack standardization is mandated.

Vet integration claims by checking references from acquired founders. Ask specifically: What changed operationally in the first 90 days? What integration decision caused the most surprise? Did any client churn tie directly to process or tool changes? (178 words)

6. Managing Diligence Fatigue: LOI Guardrails for the Founder’s Workload

When the Letter of Intent (LOI) is signed, the deal immediately becomes the founder’s second full-time job. The intense, compressed diligence phase is often designed to wear down the seller and force late-stage concessions. Structure the LOI to manage this process from the start.

Diligence is executed by third-party Quality of Earnings (QoE) firms and specialized counsel, scrutinizing finance, legal structure, and security posture. Your core defense against fatigue is the organized diligence pack required for investor-grade scrutiny.

MSP Diligence Pack Essentials:

- Revenue Outcomes: Revenue breakdown by service line (MSP, projects, resale).

- Margin & Client Health: Gross margin by client, customer concentration, and SLA metrics/ticket volumes.

- Einhaltung der Vorschriften: Security posture documentation (SOC2, HIPAA, CMMC, if relevant).

Negotiate two essential LOI guardrails to protect your leverage during this stage:

- Exclusivity Length: Keep the window short (30–45 days maximum) unless the purchase price and terms are firm. Extended exclusivity grants the buyer significant leverage.

- Conditions Precedent: Clearly define specific closing outcomes (e.g., satisfactory QoE within 5% variance, confirmed third-party financing). This prevents the buyer from introducing new, non-standard requirements late in the process.

7. Converting Buyer Culture into Measurable Governance Artifacts

In an MSP acquisition, culture is not defined by amenities; it is the buyer’s underlying incentive architecture—how they force you to operate to maximize profit. Convert “cultural fit” promises into hard, measurable governance artifacts protecting your earn-out. Culture is defined by: decision rights, KPI cadence, and required investment levels.

Proof Points for Governance Diligence

Do not accept commitments. Demand documents revealing the buyer’s internal operating mechanisms and post-close intentions.

- The 100-Day Blueprint: Request the draft integration plan. This reveals which budgets and core functions are centralized for synergy capture, and who loses control.

- The Reporting Rhythm: Request a sample Monthly Operating Review (MOR) agenda. Which KPIs (Revenue retention, EBITDA, security compliance) are prioritized? This dictates team focus.

- The Escalation Path: Demand the new organizational chart, detailing local autonomy versus centralized approval thresholds for CapEx, pricing, and staffing changes.

The High-Signal Seller Reference Script

When conducting seller references, uncover changes to the governance structure:

- Did operational autonomy decrease month-over-month, even if your title remained the same?

- Were core performance metrics (KPI cadence) changed mid-stream during the earn-out period?

- Did the buyer invest in people, tools, and marketing, or only focus on cost cuts and profit extraction?

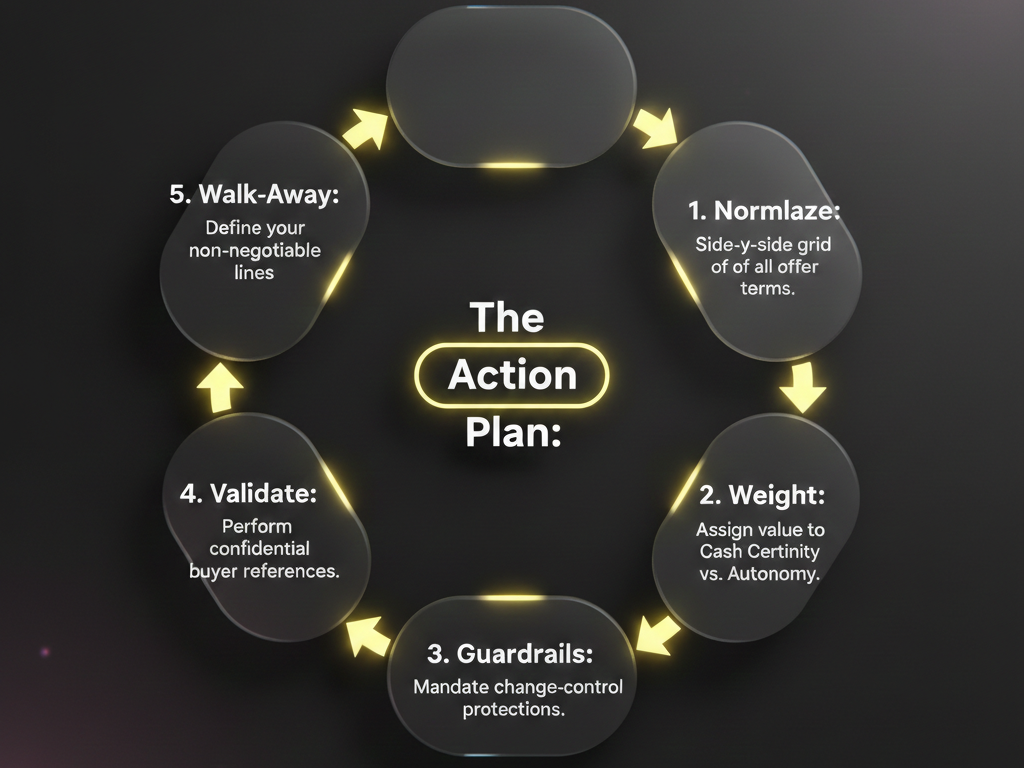

The Exit Scorecard: A 5-Step Action Plan to Evaluate Competing MSP Acquisition Offers

When you receive a draft Letter of Intent (LOI) or a formal Indicator of Interest (IOI), the valuation debate shifts to operational diligence. To assess true risk and certainty, transform competing offers into a single, normalized comparison. This scorecard converts qualitative promises of governance and culture into measurable, contractual artifacts.

Step 1: Normalize Offers into a Single Diligence Grid

Create a side-by-side comparison chart using buyer archetypes (e.g., Evergreen, PE Sponsor, Strategic). Standardize the definition of the headline price across all offers.

- Valuation Basis Clarity: Define the EBITDA calculation basis, including the policy on add-backs. Demand the TTM (Trailing Twelve Months) or run-rate definition.

- Consideration Mix: Quantify immediate Cash at Close versus contingent risk (earn-out, escrow, rollover equity).

- Control Rights During Earn-out: Document which entity controls key operational budgets (pricing, CapEx, staffing) during the performance period.

- Founder Role & Restrictions: Compare the employment agreement’s expected tenure, scope, and the geographical/vertical reach of the non-compete/non-solicit clauses.

- Integration Model: Detail the buyer’s required integration path (Brand, Stack, Centralized Service Desk). Recognize that high-integration models carry higher operational risk.

- Investment Posture: Confirm the buyer’s commitment to post-close CapEx for security/compliance uplift and necessary tool investments.

- Governance & Culture: Clarify the required KPI cadence, decision rights for local management, and the central escalation path.

Step 2: Weight What Matters for Your Exit Profile

Assign a weighted percentage to the deal structure based on your personal priorities and risk tolerance.

| Weighting Factor (Example) | Weight | Zielsetzung |

|---|---|---|

| Cash Certainty | 30% | Maximize immediate liquidity and minimize escrow. |

| Autonomy & Control | 25% | Protect founder decision rights during the earn-out. |

| People Outcomes | 20% | Guarantee retention bonuses and stability for key employees. |

| Upside Participation | 15% | Potential value of the earn-out and/or equity rollover. |

| Process & Timing | 10% | Ensure certainty of close and manageable diligence workload. |

Action: Calculate your Weighted Score by applying these percentages to the normalized terms of each LOI. This reveals the true comparative value, not merely the headline multiple.

Step 3: Mandate Contractual Guardrails (Must-Have Clauses)

Protect your earn-out and equity value. Demand the explicit contractual inclusion of these four governance artifacts within the LOI or Purchase Agreement draft:

- Worked Earn-out Examples: Include detailed, numerical examples showing how the final EBITDA/MRR target is calculated within KPI definitions.

- Change-Control Protections: Require language preventing the buyer from unilaterally changing the earn-out KPIs or underlying accounting methodologies mid-stream.

- Role/Decision-Rights Exhibit: Attach a signed exhibit defining your specific pricing, hiring, and CapEx approval thresholds during the earn-out period.

- Integration Commitments: Secure written commitments that centralized services (e.g., NOC/SOC) will maintain or exceed current SLA metrics.

Step 4: Validate Intent via Confidential Diligence

Fill the gaps often excluded from the LOI by demanding non-public reference materials under NDA.

- Buyer Reference Calls: Request calls with three sellers 12 to 24 months post-close. Ask specifically about integration risk and post-close operational support.

- Redacted LOI Structure: Ask the buyer for a redacted example of a similar recent deal structure. Confirm their standard approach to escrow and working capital adjustments.

Step 5: Define Non-Negotiable Walk-Away Lines

Do not allow diligence to erode your leverage. Define the deal elements that immediately terminate negotiations, regardless of the headline price.

- Exclusivity Period: Do not exceed 45 days without a firm closing commitment.

- Undefined Add-backs: Fix any ambiguity in the definition of Adjusted EBITDA or owner salary normalization before legal diligence commences.

- Buyer-Controlled Earn-out: Reject any structure where the buyer retains unilateral control over budgeting, pricing, or staffing decisions that inhibit hitting performance targets.

FAQ

The primary reasons are competitive confidentiality and deal complexity. Buyers, especially Private Equity platforms, treat transaction terms as proprietary competitive signals. Furthermore, the true value of an MSP acquisition is contingent on the earn-out performance and working capital adjustments. Since the headline price is rarely the final realized price, disclosing an initial valuation can be misleading to the public and the broader market.

No, Dataprise is a platform backed by private equity. The confusion often arises because both Dataprise and Evergreen Services Group are highly active buyers in the MSP space. However, they represent fundamentally different buyer archetypes. Evergreen employs a permanent hold strategy focused on autonomy, while Dataprise operates under a PE-style recapitalization model, optimizing for high integration and growth toward a defined 3- to 5-year exit. (See Section 1 for buyer archetypes.)

There is no single “good” multiple, as the valuation is defined by the basis. Multiples range widely (e.g., 5x Revenue to 12x Adjusted EBITDA) based on factors like size, high-margin vertical specialization, and client retention rates. Buyers prioritize predictable Annual Recurring Revenue (ARR) and superior gross margins. Founders should focus on normalizing the Adjusted EBITDA calculation and deal structure certainty rather than chasing an arbitrary headline number.

Protection begins by converting promises into binding contractual deal terms. Demand specific, measurable KPI definitions (e.g., net new MRR or specified gross margin targets) and guarantee that the buyer cannot unilaterally change your accounting methodology mid-term. Crucially, secure defined control rights over operational levers like pricing, capital expenditure, and staffing during the performance period. Refer to Section 3 for essential due diligence prompts.

Limit the exclusivity period to a maximum of 30 to 45 days. Before signing the Letter of Intent (LOI), demand clear guardrails, including a defined diligence plan and a firm timeline. Insist on a complete list of Conditions Precedent, which are the non-negotiable closing outcomes (e.g., acceptable Quality of Earnings results). This prevents the buyer from introducing new, burdensome requirements later and maximizes your leverage.