Whether you are buying for scale or planning an exit, navigating msp acquisitions is rarely just a numbers game. M&A is a systems problem balancing financial risk, valuation drivers, and operational integration. Leveraging a founder-to-founder perspective and a deep Private Equity roll-up lens, this playbook delivers 10 practical strategies. These strategies focus on maximizing your enterprise value through revenue and operational readiness. Let’s start with the one lever that changes every conversation: how value is actually defined.

1. Define Value by Risk-Adjusted Cashflow, Not Revenue Vanity

The core truth of msp acquisitions is that value derives from repeatable, risk-adjusted cashflow, not revenue vanity. Buyers, particularly Private Equity, underwrite future reliability based strictly on adjusted EBITDA. Multiples are a range, moved by scale and defensibility, often dictated by current PE valuation trends. High-quality Recurring Revenue (MRR) demands long-term contracts, low churn, and minimal client concentration.

For the seller, M&A readiness means pre-empting due diligence adjustments. Clean schedules now by normalizing owner compensation and removing one-off expenses. The strongest valuation narratives are built on documented service delivery, low technical debt, and demonstrable security maturity. These elements reduce perceived risk and instantly justify a premium multiple.

2. Recognize That Valuation Is Relative to the Buyer’s Playbook

The same MSP is not valued uniformly. Its worth depends entirely on the strategic lens of the acquirer, which determines the eventual multiple, terms, and your post-close operational reality.

A strategic buyer seeks capability fit, geographical expansion, or competitive elimination. These transactions typically demand rapid, complete integration and absorption of assets into the existing structure.

Conversely, a Private Equity roll-up or platform underwrites the purchase based on a defined growth playbook within the broader context of MSP consolidation, frequently leveraging rollovers and earn-outs to align incentives and manage capital risk.

Before signing, assess the integration plan: Will your brand be absorbed, kept semi-autonomous, or melted into a standardized operating model? If you intend to stay on post-acquisition, deep analysis of cultural alignment and decision-rights is mandatory. This protects both your deal structure and your operational sanity.

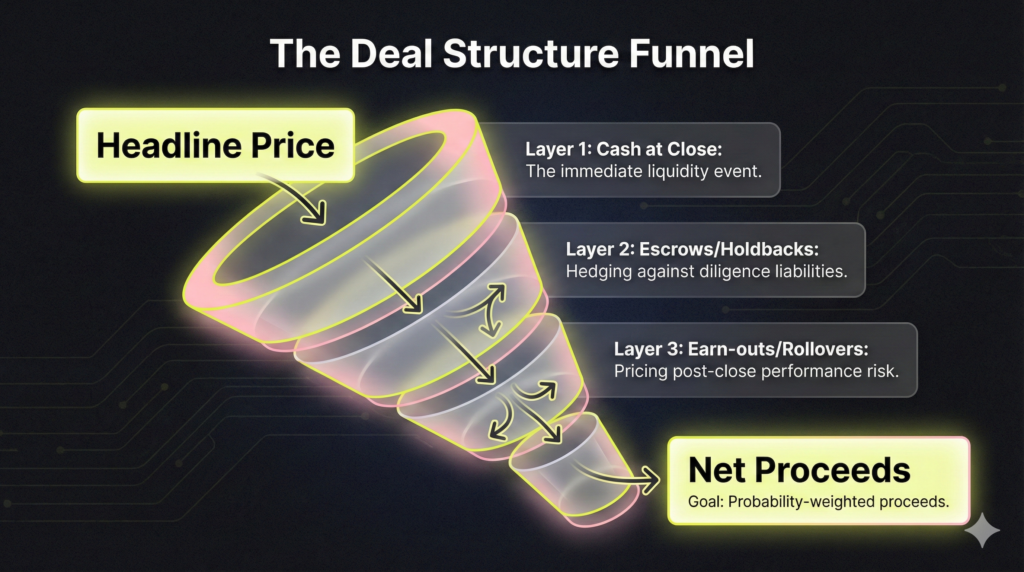

3. Structure the MSP Deal: How Escrows, Earn-Outs, and Rollover Price Risk

Deal structure translates the Letter of Intent (LOI) price into a binding agreement by pricing uncertainty—specifically M&A signals like churn risk and integration liability. High headline values are often conditional, relying heavily on the structure’s mechanics.

Buyers use escrows and holdbacks to mitigate unknown liabilities exposed during diligence. Earn-outs hedge against retention and future performance risk, aligning the seller with revenue outcomes post-close. Consider using rollover equity or seller notes when integration is the chief value-creation plan.

Sellers must translate the headline price into probability-weighted proceeds. Protect the ultimate realization from conditional structures by demanding precise definitions for performance metrics, clear payout timing, and specific decision rights post-close.

4. Negotiate Earn-Outs: Protect Your Capital Post-Close

In an earn-out, the seller loses operational control post-close, yet deferred capital remains tethered to the buyer’s execution. Ambiguity silently evaporates value. Sellers must insist on defined, auditable protections. Demand objective metrics like Gross Revenue, which is far harder to manipulate than adjusted EBITDA. Mandate a strict reporting cadence, specific access to the books, and clear calculation examples written into the PSA.

For buyers, the earn-out must be clean, financeable, and integrated seamlessly into the RevOps stack. Use metrics trackable by your PSA (ConnectWise/Autotask) and accounting systems. Critically, avoid incentives that encourage short-term behavior, such as margin metrics that pressure the seller to cut service quality or vital R&D. This protects the acquired asset’s long-term health.

5. Operational Due Diligence: Prep the Data Room for Buyer Scrutiny

Financial due diligence is table stakes; operational due diligence is where MSP acquisitions often stall. Buyers must verify the technical reality behind the revenue, ensuring the asset is scalable and not reliant on heroic effort.

This scrutiny focuses on two key areas. Revenue Quality verifies contract enforceability, renewal mechanics, and top-client churn risk. Delivery Risk assesses the true security posture, technical debt, tool sprawl, and disaster recovery history.

Sellers must pre-empt risk by creating an institutional-grade data room vor the Letter of Intent (LOI). Populate it with standardized SOPs, a full vendor agreement list, the security incident log, and documentation of all key dependencies. Demonstrating a process-driven operation minimizes friction and protects your multiple.

6. Technology Stack Integration: Harmonizing Assets or Inheriting Chaos?

Are you harmonizing stacks, or inheriting chaos? Buyers use due diligence to quantify integration costs and potential margin erosion. Acquirers must decide immediately: keep the target’s stack or migrate to yours. This requires quantifying time, licensing fees, and critical training overhead for staff and clients. Identify “cannot break” systems—RMM/PSA, backup, and the core security stack—to establish precise migration sequencing.

For the seller, M&A readiness demands standardizing and documenting your entire tech stack vor the LOI to reduce perceived technical debt and integration risk. Be transparent about shadow IT and one-off client environments; the buyer’s operational due diligence team will find it anyway. Clean documentation of standardized technology platforms directly supports a higher enterprise valuation.

7. Mitigate Keyman and Client Retention Risk Post-Close

MSP value is fragile, resting on three assets: recurring contracts, relationship capital, and the delivery staff who maintain trust. Losing a technical owner or major account instantly triggers an escrow release or invalidates an earn-out. Neutralize this “keyman dependency” by establishing an iron-clad 90-day continuity plan before the Letter of Intent (LOI). The plan must define targeted retention bonuses and detail immediate client communication. Buyers require clear role clarity for critical staff. Sellers must prep client messaging detailing acquisition benefits, confirming service continuity, and naming responsible contacts. Protecting client retention is the ultimate defensive measure in msp acquisitions, ensuring full enterprise valuation.

8. Design the Seller’s Post-Acquisition Role (Owner to Employee)

The transition from owner to employee is a structural role change, not merely a title update. This friction point often fractures post-acquisition relationships, jeopardizing deferred value tied to earn-outs.

For the buyer, success hinges on defining transition expectations: clear handoffs for major clients, internal leadership, and vendor relationships. Mitigate future keyman dependency by setting strict deadlines for documented knowledge transfer.

For the seller, protect operational sanity by negotiating scope, reporting structure, and clear decision rights vor signing. Contractually define the time horizon (typically 6–18 months). Finally, clarify which performance failures or unilateral terminations trigger a material adverse event, impacting remaining earn-out proceeds or rollover equity.

9. Asset vs. Stock Deals: The Fundamental Tax and Liability Trade-Off

This choice is the core conflict in nearly all msp acquisitions: buyers prefer asset deals for liability control; sellers prefer stock deals for cleaner tax outcomes.

Asset deals are preferable as they allow buyers to selectively assume liabilities, effectively ring-fencing unknown risks. The major friction, however, is customer consent: managed services contracts often require formal assignment, creating operational complexity and the potential for client attrition.

Sellers must model after-tax proceeds early. While stock sales offer superior capital gains treatment, they require warranting against alle undisclosed liabilities. Prepare to negotiate the scope and duration of indemnities, reps, and warranties, as deal structure impacts personal risk as much as the immediate tax burden.

10. Integration Failure: Prevent Churn and Culture Clash Post-Close

The greatest risk in msp acquisitions is not the price, but the integration failure that follows. Failure modes include significant client churn, key-staff exits, and debilitating drag—stemming from process breakdowns, not intent.

Buyers must mitigate this risk by demanding phased integration to protect established service levels and guarantee continuity. Crucially, enforce incentive alignment so the acquired team is never treated as a second-class asset.

If you are the seller, protecting your deferred capital requires negotiating precise terms. Confirm the metrics tied to your earn-out are achievable, and that you possess the resources and decision authority necessary to hit them. Choose a buyer whose operating model ensures the asset you built is sustained long enough to release your full enterprise valuation.

The 90-Day M&A Readiness Execution Schedule

M&A value erosion often results from poor timing, such as initiating cleanup only after due diligence begins or planning integration after closing. This schedule sequences critical activities into a proactive 14-week roadmap designed to maximize the valuation multiple and protect deferred capital.

Step 1: Pre-LOI Readiness and Value Locking (Weeks 0–4)

This phase establishes a defensible enterprise valuation before buyer interest crystallizes, ensuring an institutional-grade profile.

- Finalize adjusted EBITDA metrics and normalize the financials.

- Build the structured data room, populating it with SOPs, vendor contracts, and security logs.

- Assess Keyman and Client Retention Risk, identifying critical staff and accounts needing retention bonuses.

- Define the valuation range based on preferred buyer type (PE roll-up vs. Strategic Acquirer).

Step 2: LOI to Operational Due Diligence (Weeks 4–10)

Upon receiving the Letter of Intent (LOI), focus shifts to verifying claims and accurately pricing risk.

- Deploy the technology integration cost model, quantifying stack migration and training overhead.

- Confirm target deal structure assumptions: escrow percentage, indemnity limits, and earn-out mechanics.

- Generate the full diligence checklist to track all outstanding documentation requests.

Step 3: Definitive Agreement Drafting (Weeks 10–14)

This legal drafting phase requires locking down protections for deferred capital.

- Lock precise, auditable definitions for earn-out calculation metrics (e.g., Gross Revenue over adjusted EBITDA).

- Formalize the seller’s post-close role, scope, and clear decision rights.

- Draft internal and external communication plans to manage staff anxiety and client continuity messaging.

Step 4: Close to Day 90: Integration & Value Capture

Success is measured by continuity and retention, not the closing price. This phase protects deferred capital tied up in the deal structure.

- Execute staff retention bonuses and launch pre-prepared client continuity messaging.

- Begin phased stack migration sequencing only after the risk assessment is complete.

- Launch the KPI dashboard tracking client churn and SLA health to ensure the acquired asset remains stable.

- Verify the buyer adheres to the mandatory earn-out reporting cadence.

FAQ

Multiples typically range from 4x to 12x adjusted EBITDA, but your outcome depends heavily on size, service defensibility, and risk. Buyers underwrite high recurring revenue quality (MRR), low client concentration, documented processes (SOPs), and mature security posture. Focus on cleaning your financials and formalizing your operations to anchor your valuation at the high end of the range. MSPs over $10 million in revenue generally command premium multiples.

The pay-at-close percentage is a measure of perceived risk. Highly secure assets with institutional-grade operations and minimal keyman dependency usually receive 75–85% cash at close. Deals with high churn risk, reliance on the owner, or significant integration uncertainty often require a larger portion (20–40%) to be paid through contingent structures like escrows and earn-outs, aligning the seller’s proceeds with future performance.

Revenue is generally simpler to track and less susceptible to post-close manipulation than EBITDA. We recommend demanding that earn-out metrics be based on Gross Revenue and/or MRR retention. If profitability (EBITDA) is used, ensure the agreement mandates explicit definitions for cost allocations and operational expenses. Crucially, regardless of the metric, mandate auditable reporting and access to the books to protect your deferred capital.

The largest red flags are intertwined: excessive client concentration (over 10% of revenue from one client) and the reliance on the selling owner (Keyman Risk). Other major deal killers include messy contracts lacking renewal clauses, undocumented service delivery processes (tribal knowledge), and weak, unaudited security postures. Proactive sellers neutralize these by standardizing operations and neutralizing key dependencies well before the LOI.

A strategic buyer often absorbs your brand, integrating you into existing silos, and demanding adherence to their systems. A Private Equity-backed platform typically seeks standardization and operational discipline, introducing strict KPI management and centralized RevOps. In either case, success hinges on cultural fit. Sellers must conduct deep diligence on the buyer’s post-close support model, interviewing operational leaders to ensure aligned expectations.