The true sting of an MSP acquisition is not the headline valuation, but the fine print confirming 20% to 40% of that value is contingent. An msp earn-out is a critical risk-allocation mechanism, distinct from time-based escrows or deferred payments. The certainty you crave hinges on negotiating specific contract levers that prevent post-close surprises and metric manipulation. This guide provides the strategic benchmarks for structuring cash versus contingent value to maximize guaranteed dollars. We start with the only number that truly matters: the cash received at close.

1. Benchmarking Your Deal: Maximizing Cash at Close

If you are an MSP founder focused on maximizing enterprise valuationby optimizing key MSP valuation drivers, the only number that matters is the certainty of funds. In most lower-to-middle market IT services deals, you should anchor your expectations on a standard split: 70–80% cash at close, with the remaining 20–30% allocated to contingent consideration or escrow/holdback.

It is crucial to distinguish between these risk buckets. Escrow protects the buyer against indemnity risks such as warranty breaches or undisclosed liabilities. Conversely, the msp earn-out is performance-based, tying future payments strictly to specific revenue or EBITDA targets.

Your primary negotiation move must be converting performance-based risk into guaranteed cash flow. Push to cap the total contingent consideration as a percentage of the overall valuation. Furthermore, reclassify a portion of the earn-out as a deferred payment with a calendar-based payout schedule, removing the performance hurdle entirely. This strategic re-engineering increases guaranteed cash flow and improves the quality of your sale proceeds.

2. Structuring Contingent Value: Earn-outs, Notes, and Deferred Consideration

MSP founders often treat all post-close payments as an identical msp earn-out, accepting the buyer’s terminology and negotiating only the target number. This is a tactical error. To maximize guaranteed proceeds, strategically match the payment instrument to the specific risk the buyer aims to mitigate.

Here is the essential instrument taxonomy for contingent value:

- Earn-out: Performance-Based. Payment is strictly contingent on hitting specific post-close targets (e.g., revenue, EBITDA, or client KPIs). This is rational only for bridging a true valuation gap or securing critical seller involvement.

- Deferred Consideration: Time-Based. Payment is made on a fixed calendar schedule regardless of performance, subject only to general contractual conditions (e.g., no material breach). Use this instrument to cover integration runway or working capital normalization risk.

- Seller Note: Debt-Like Obligation. This is a contractual repayment obligation featuring interest, covenants, and default remedies. It represents the seller’s strongest option, offering secured, high-certainty cash flow when the buyer has capital constraints.

When contingent consideration is demanded, always ask: “Which specific risk are you mitigating?” If buyer uncertainty relates to the business’s core fundamentals, the solution must be a low-risk deferred payment or a seller note. Do not allow the buyer to use an msp earn-out as a substitute for adequate diligence.

3. Avoiding Valuation Disputes: Selecting the Right MSP Earn-Out Metrics

The critical risk in an msp earn-out is relying on metrics easily manipulated post-close. Standard accounting metrics fail MSPs: Adjusted EBITDA is highly vulnerable to the buyer’s post-acquisition accounting policy changes or integration allocations. Revenue targets are distorted by pricing re-bundling or the reclassification of project revenue, inevitably muddying the baseline.

To secure your payout, shift the focus to auditable operational metrics that reflect the core customer and revenue health the buyer valued. This requires an investor-grade metric hierarchy defined in the purchase agreement:

- Safest (High Certainty): Gross MRR Retention, Client Logo Retention, and tightly defined Net Revenue Retention (excluding integration activity). These metrics track the core customer relationships you sold.

- Medium Certainty: Gross Margin Dollars on managed services. This requires clearly locked definitions of Cost of Goods Sold to reflect true service profitability.

- Riskiest: Adjusted EBITDA without pre-defined, auditable accounting policies locked into the agreement.

The final, critical step is embedding RevOps rigor. Define your source-of-truth systems (PSA/RMM plus GL) and detail exactly what constitutes “MRR” and how it is sourced. This institutionalizes reporting consistency, making the metrics auditable from day one.

4. Structuring the MSP Earn-Out Duration and Payout Cadence

The optimal msp earn-out duration typically sits between two and three years. In the current era of MSP consolidation, exceeding this 3-year threshold maximizes the seller’s exposure to integration disruption and significantly reduces contingent value certainty.

Duration must be calibrated against core MSP operational realities, specifically client agreement lengths and renewal cycles. Pre-empt buyer-initiated destabilization by assessing post-close risks: planned pricing changes, packaging shifts, or platform (RMM/PSA) migrations necessary to hit targets. A longer window affords the buyer more time to compromise your revenue baseline.

To mitigate calendar risk, use payout frequency as a certainty lever. Push for quarterly or semi-annual measurement and payout cadences instead of a single annual “cliff.” This de-risks the capital by distributing volatility and offering more frequent opportunities to secure revenue tranches.

If the duration must be longer for deal completion, insist on partial guarantees or revenue floors for the initial 12–18 months. This seller-friendly guardrail establishes a minimum payout percentage before integration activities fully impact measurement metrics, securing predictable short-term cash flow.

5. Contractual Rigor: Locking Down Definitions and Audit Rights

Operational certainty evaporates when robust metrics encounter vague legal language. The ultimate defense against a zero-payout MSP earn-out is embedding contractual rigor that converts chosen metrics into auditable, investor-grade requirements. Use this four-point checklist to secure your capital:

- Metric Definitions and Baseline: Define all performance terms (MRR, client count, NRR) with granular specificity. Crucially, explicitly exclude one-time projects, hardware sales, and pass-through costs from the baseline calculation to eliminate post-close noise.

- Reporting and Audit Levers: Mandate reporting frequency (quarterly is optimal), delivery deadlines, and format. Insist on the right to review the underlying data (client-level schedules from the PSA/RMM), not just summary numbers, ensuring the metrics are transparent and auditable.

- Pre-Agreed Dispute Mechanics: Define a strict escalation path: Seller notice $\rightarrow$ buyer response $\rightarrow$ mandatory independent expert determination. Include specific deadlines for each step (preventing “delay equals deny”), and pre-agree the fee coverage structure.

- Escrow Separation: Contractually separate the indemnity escrow fund from the MSP earn-out and deferred consideration. This prevents the buyer from netting an unrelated indemnity claim against and reducing your performance payout.

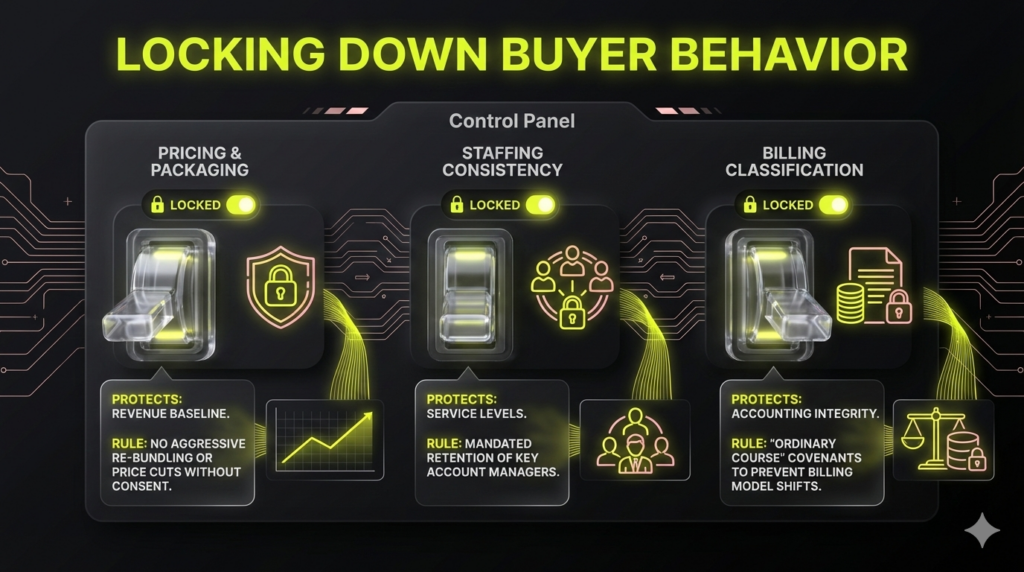

6. Locking Down Buyer Behavior: Contractual Control Levers for Your MSP Earn-out

The hardest truth of an msp earn-out is that it is fundamentally a control problem, not a math problem. The buyer possesses operational authority post-close and can tank metrics by aggressively integrating, changing pricing, or cutting key staff.

Your defense requires negotiating precise control levers. Insist on “ordinary course” or consistency covenants in the purchase agreement. These provisions mandate the buyer operate the acquired business in a manner materially consistent with pre-close practices, specifically concerning the metric drivers.

Key areas to protect:

- Pricing and Packaging: Limit the buyer’s ability to re-bundle high-margin services into low-margin platforms or drastically cut prices without seller consent, particularly if revenue drives the metric.

- Staffing: Require retention of critical account managers or technical staff for the performance duration to ensure service levels are maintained.

- Billing Classification: Demand adjustment mechanics to prevent the seller from being punished if the buyer integrates the accounting or changes the billing model post-close.

If you accept an msp earn-out target with zero authority to influence the outcomes, zero out the expected payout in your internal valuation model.

7. The Final Decision: Cash vs. Earn-out and the Contingent Value Calculus

Maximizing enterprise valuation requires treating the cash vs. contingent value structure as a strategic risk-management exercise. A cash-heavy deal (80%+ cash at close) guarantees capital, ensuring a clean, low-dependency exit and transferring all integration risk to the buyer. An earn-out-heavy deal (40%+ contingent value) purchases a significantly higher headline price by bridging the buyer’s valuation uncertainty gap.

Accept high contingent value only if you commit to the full performance window and possess extreme confidence in client retention, coupled with guaranteed buyer alignment on protecting the revenue baseline.

Push hard for guaranteed cash or a seller note if: client concentration risk is high, integration plans are vague, or the buyer plans aggressive re-bundling that would distort the baseline revenue metrics.

If the earn-out is material, demand contractual protections to counter buyer manipulation:

- A partial guarantee (floor)

- Short measurement periods

- Locked contractual definitions for revenue and EBITDA

- Seller influence rights over operational decisions (preventing destabilization)

8. Buyer Profiles: Negotiating Your MSP Earn-out Based on Strategic vs. PE Buyers

Effective MSP earn-out negotiation requires recognizing the buyer’s incentive structure. Strategic Buyers and Private Equity (PE) platforms mitigate entirely different risks, demanding a distinct negotiation posture.

Strategic buyers seek integration synergies and rapid platform consolidation. Their drive to merge systems and eliminate redundancy creates significant metric risk (client migration, staff cuts). With a strategic buyer, focus on adjustment mechanics: insist that revenue losses from forced rebranding or system consolidation are excluded from the earn-out calculation.

PE/Platform buyers prioritize repeatable roll-up playbooks and tight KPI governance. They will push for stronger reporting and tighter metric definitions. Negotiate with PE by focusing on payout certainty: demand hard caps and floors, clear calculation rules, and strict operational control boundaries to prevent unexpected post-close policy shifts.

The practical takeaway: ask early, “What is your integration plan in the first 180 days?” Map this answer directly to your MSP earn-out risk exposure, identifying where they disrupt your revenue baseline and which metrics require protection.

The Founder’s Playbook: Negotiating Your MSP Earn-out on a Live LOI

When a Letter of Intent (LOI) includes material contingent consideration, shift your focus from theoretical valuation to execution certainty. Use this five-step playbook to convert strategic concepts into an actionable negotiation sequence. Stress-test the risk allocation of any proposed MSP earn-out.

Step 1: Quantify and Reclassify Contingent Value

Quantify the total proposed valuation into a guaranteed vs. conditional structure.

- Create the Certainty Table: Categorize every proposed dollar: Cash at Close, Deferred Consideration (time-based certainty), Escrow/Holdback, or Earn-out (performance contingent).

- Negotiate Reclassification: Push to convert at least 50% of the proposed earn-out into simple Deferred Consideration, effectively removing the performance hurdle.

Step 2: Lock the Core Metric Stack

Immediately challenge Adjusted EBITDA as the primary metric.

- Insist on Retention Metrics: Anchor the earn-out to Gross MRR Retention oder Client Logo Retention (the clearest indicators of the business you sold).

- Add a Growth Kicker: If growth is required, use Net New MRR (excluding project work) as a secondary, verifiable metric.

Step 3: Define the Source of Truth and Auditing Rights

Contractual rigor protects metrics from post-close manipulation.

- Mandate RevOps Consistency: Lock the definitions of MRR and NRR into the agreement. Define the specific source systems, such as ConnectWise/Autotask PSA and the QuickBooks GL, that will produce the measurement report.

- Secure Auditing: Insist on the right to review the underlying client-level schedules, not just summary P&L numbers, for verification.

Step 4: Negotiate Control Rights and Non-Destabilization Covenants

Mitigate the control problem.

- Price Protection: Demand a consistency covenant that limits the buyer’s ability to aggressively re-bundle or cut pricing on core services for the earn-out duration.

- Staffing Guarantees: Require the retention of key account management or technical staff critical to maintaining client relationships tied to the targets.

Step 5: Implement Failure Modes and Dispute Mechanics

Protect against zero-payout scenarios using defensive mechanisms.

- Floors and Caps: Demand a minimum revenue floor for the first year (e.g., 50% partial payout guarantee) to secure cash flow before integration fully impacts results. Include a cap to define maximum exposure.

- Dispute Process: Lock down a mandatory, swift dispute resolution process involving an independent expert determination with pre-defined deadlines.

This level of diligence is non-negotiable. Have your M&A counsel, QoE provider, and experienced MSP M&A advisors review the final metric definitions and covenants for your MSP earn-out. To prepare your systems for this scrutiny, NUOPTIMA offers an M&A Readiness Audit focused specifically on optimizing your KPI hygiene, retention reporting, and RevOps consistency.

FAQ

Most successful lower-to-middle market MSP deals allocate 70–80% cash at close. The remaining 20–30% is split between performance-based earn-outs and time-based deferred consideration or escrow. Deals exceeding 30% contingent value usually indicate significant risks, such as high client concentration or volatility, which the buyer is unwilling to price into the guaranteed cash offer. Focus on maximizing the cash at close.

The optimal msp earn-out duration is two to three years, aligning with client contract cycles. Avoid exceeding three years, as this maximizes exposure to post-close market and integration risks. To increase certainty, negotiate quarterly or semi-annual measurement periods and payouts instead of an annual true-up, which distributes volatility and allows the seller to secure revenue tranches more frequently.

The best metrics focus on client retention, as they are the hardest for buyers to manipulate post-close. Prioritize Gross MRR Retention and Client Logo Retention as the primary metrics, as these track the quality of the core customer base you sold. If growth is required, use tightly defined Net New MRR or bookings, ensuring project revenue and hardware sales are explicitly excluded from the calculation baseline.

Sellers should actively avoid loosely defined Adjusted EBITDA as the primary metric. EBITDA is highly susceptible to the buyer’s changing accounting policies, centralized cost allocations, and post-close staffing cuts, significantly reducing the payout certainty. If Adjusted EBITDA must be used, insist that pre-close accounting policies, adjustment schedules, and allocation methodologies are locked into the definitive agreement.

Disputes are reduced by anticipating them in the contract. Mandate contractual rigor by locking down granular metric definitions, specifying the source-of-truth systems (PSA/RMM), and guaranteeing the seller the right to audit the underlying client-level data. Crucially, pre-agree on a binding dispute resolution process that involves a mandatory, independent expert determination to prevent the buyer from delaying or denying payment.