When billion-dollar MSP platform deals hit the news, owners often dismiss them as industry gossip irrelevant to the mid-market. That is a critical misunderstanding of M&A readiness. High-profile deals are not background noise; they are fundamental valuation signals that change what Private Equity (PE) and strategic buyers pay for. A deeper major msp merger analysis shows these deals reprice risk (vendor dependency, client retention), directly impacting current valuation multiples and shifting due diligence scrutiny. We examine these market structure changes purely through the lens of enterprise valuation mechanics. Here are the six merger signals sellers must translate into action this year.

1. Vendor Concentration: The Stack Risk That Tanks Upfront Cash

Your firm may perceive its revenue as diverse, but when a dominant platform executes a major acquisition (e.g., Kaseya acquiring Datto), your core dependency shifts. This centralizes power and concentrates execution risk in fewer hands, creating a quantifiable risk the buyer must underwrite.

Buyers model downside scenarios stemming from this vendor concentration, extending beyond current margins. If your delivery relies heavily on a single ecosystem, the buyer accounts for potential margin compression, forced re-tooling costs, and churn spikes if the vendor enforces painful billing changes or collapses support quality post-acquisition. We have concrete evidence: partner reports of post-merger friction related to support decline and account manager churn are the specific volatilities buyers fear.

This uncertainty impacts valuation directly. Higher perceived execution risk leads to heavier reps and warranties, lower upfront cash at close, and a greater portion of the purchase price structured into complex earn-outs or holdbacks.

To mitigate this drag during due diligence, you must demonstrate foresight:

- Vendor Concentration Map: Detail revenue and gross margin contribution for every vendor-dependent service line.

- Contract Audit: Document all auto-renewal clauses, price escalators, termination provisions, and change-of-control risks.

- Plan B Strategy: Create a credible alternative stack migration plan, including estimated re-tooling and migration costs, proving your business is not locked in.

2. Operational Maturity: When Integration Speed Becomes the Valuation Premium

The largest buyers today are MSP Private Equity-backed platform entities executing a major MSP merger analysis. They are not seeking simple revenue bolt-ons; they blend MSP, cloud, and consulting assets to sell repeatable, multi-region “enterprise outcomes.” The valuation premium now accrues to MSPs that can be integrated fast and scaled without service degradation, requiring predictable delivery across a standardized operating system. Buyers underwrite assets that prove:

- Predictable Delivery: A clear rhythm of KPIs, SLAs, and Quarterly Business Reviews (QBRs) that align with enterprise reporting standards.

- Process Maturity: Standard operating procedures (SOPs) for ticket triage, escalation paths, and robust security operations management.

- Geographic Acceleration: Footprint density or vertical expertise that immediately enhances a regional or national service platform’s go-to-market strategy.

Valuation is defined by integration speed. Messy, non-standard operations become a direct discount, as the buyer faces significant post-close spend and 12–18 months rationalizing disparate technology stacks and culture. To translate operational maturity into upfront cash, sellers must proactively create an integration-friendly ops packet:

- Standardize Everything: Minimize bespoke “hero work” and move toward defined, reproducible service tiers.

- Ops Documentation: Prepare a complete SOP index, a full tool stack diagram, and a detailed service catalog with standardized pricing tiers.

- Platform Fit: Demonstrate precisely how your reporting metrics and process maturity plug into the platform buyer’s existing infrastructure, directly mitigating execution risk.

3. Security Offerings: Valued Outcomes vs. Project Revenue

If the strategic buyer seeks enterprise-grade security, they are not buying technology; they are buying defensible margins and reduced churn risk. During a major msp merger analysis, acquirers prioritize security solutions that guarantee stickiness and measurable security outcomes for their existing client base, buying continuity, not projects.

This creates a critical division in how your security revenue is weighted:

- Valued Security: This is repeatable, high-margin, recurring revenue, including MDR/SOC offerings, compliance-as-a-service, and clear Service Level Agreements (SLAs) tied to measurable metrics like MTTR (Mean Time To Respond) and coverage percentages. This composition commands a premium.

- Discounted Security: This is transient, margin-eroding work: one-off assessments without integrated conversion paths, or underpriced bundles that dilute gross margin. It is flagged as “project revenue in disguise” during due diligence and discounted heavily.

To ensure your cybersecurity investment translates directly to a higher valuation multiplier, prepare data showing high-margin growth. Document the composition of your recurring security revenue by segment and demonstrate a documented, repeatable incident response process. Sellers must package security as a defined, repeatable tier with clear unit economics, proving it is an asset that can be scaled across the larger platform immediately.

4. Deal Mechanics: Protecting the Upside of Fragile Earn-Outs

A high headline valuation is a vanity metric if the underlying structure is fragile. In a consolidating market defined by platform roll-ups, buyers leverage deal structure—earn-outs, escrow, and holdbacks—to shift execution risk back to the seller.

This pressure intensifies during a large-scale MSP consolidation phase where mergers and acquisitions are frequent. Integration uncertainty—from tool migrations and account manager turnover to aggressive synergy realization—means the buyer is unwilling to underwrite 100% of projected revenue growth. If a buyer pays a premium, they require the seller’s future performance to justify it.

Sellers must implement a practical, pre-close modeling checklist to protect their valuation:

- Scenario Mapping: Model base, bull, and bear earn-out scenarios tied to granular metrics (churn rate, ARPU changes, gross margin targets).

- Sensitivity Testing: Analyze how decisions you no longer control post-close (like forced pricing increases or tooling switches) impact your projected targets.

During due diligence, focus negotiation leverage on operational covenant protection. This means clearly defining KPI terms (is it booked revenue or collected gross profit?) and securing control rights. Without these covenants, a buyer can sabotage targets by withholding resources or changing strategy, making the entire earn-out fragile. A high multiple attached to an unprotected earn-out can yield far less cash than a lower multiple paid entirely up front. Define the success metrics and control mechanisms before signing.

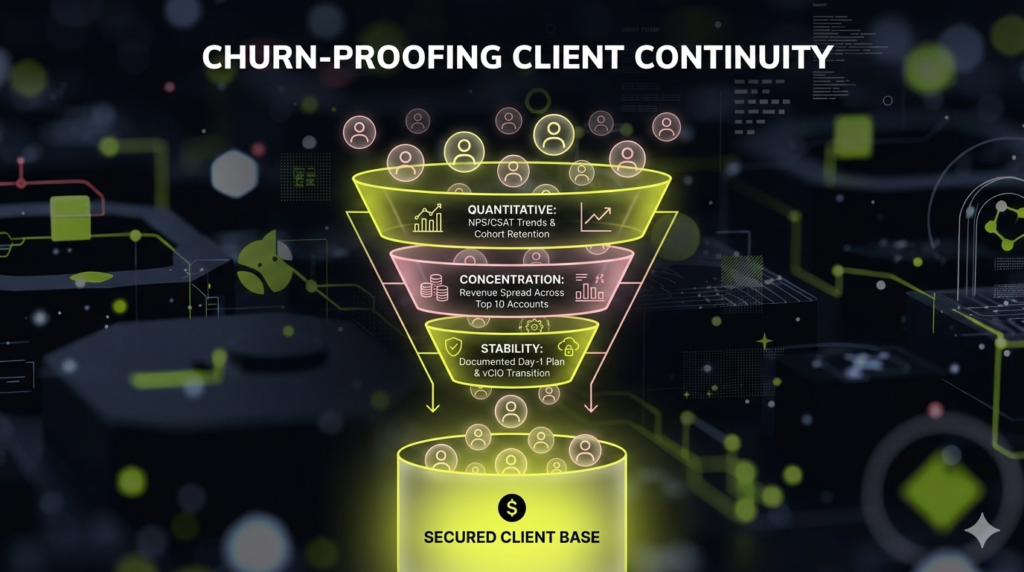

5. Client Continuity: Churn-Proofing Your Enterprise Valuation

Während einer major msp merger analysis, the greatest risk a buyer underwrites is service disruption. While sellers focus on systems, buyers know consolidation introduces immediate client friction: chaotic billing, support degradation, and difficult contract renewals.

This directly impacts valuation. Buyers assume integration risk, asking: “What happens to retention and gross margins when we integrate the stack or replace the account management team?” Client sentiment uncertainty or heavy reliance on the founder translates into heavier holdbacks and lower multiples. Predictable client continuity underwrites higher upfront cash at close.

During due diligence, buyers seek concrete evidence of retention stability:

- Quantitative Metrics: Historical retention by cohort, NPS/CSAT trends, and ticket backlog/response metrics.

- Concentration Risk: Analysis of revenue concentration and dependency on top 10 accounts.

- Contract Hygiene: Terms that allow for price adjustments or service changes without major client blowback.

To churn-proof your business and secure that premium, preparation is critical. Proactively reduce concentration (or detail credible mitigation plans) and build a “client continuity file.” This file must document the top 20 accounts, including decision-makers, contract renewal dates, specific known risks, and an immediate, drafted Day-1 client communication plan emphasizing stability and clear escalation paths.

6. Talent Flight: The Keyman Dependency That Discounts Your Valuation

The MSP model’s core value is delivered by people, yet M&A advice dangerously underweights the risk of post-close talent flight. If top talent walks, margins evaporate, regardless of standardized tools or CRM integration. In a major msp merger analysis, buyers routinely see the platform process clash with the “local hero MSP” culture. This friction causes account ownership shifts, slower resolution times, and the rapid loss of relationship capital.

This instability is fundamentally a valuation problem. High reliance on a single founder or a few key service delivery leaders creates keyman dependency, increasing perceived risk and often resulting in structured payments or discounts. Conversely, the presence of strong, documented second-line leadership translates directly into a valuation premium, signaling a sustainable, scalable asset built to withstand integration.

Sellers must mitigate this structural risk before due diligence by implementing these actions:

- Identify Must-Retain Roles: Clearly map out your vCIOs, top account owners, and specialized service delivery managers. Success hinges on ensuring these high-leverage personnel are retained through the transition.

- Build a Holistic Retention Plan: Retention must move beyond simple cash bonuses. The plan requires concrete elements like transparent role clarity, defined career pathing opportunities within the acquiring platform, and documented decision rights.

- Document Tribal Knowledge: Formalize institutional knowledge into client playbooks and complex Standard Operating Procedures (SOPs). Pulling critical information out of individual heads ensures asset continuity and protects gross profit during key personnel transitions.

The 90-Day Execution Schedule for Investor-Grade M&A Readiness

Valuations often suffer not due to flawed grand strategy, but because of preventable diligence gaps and execution risks. This guide converts the consolidation signals into a structured, time-bound action plan. The primary objective is creating verifiable documentation that reduces perceived integration risk, maximizing your upfront cash payment and minimizing reliance on fragile earn-outs.

To execute this sequence, you must first establish Investor-Grade Readiness; your company must be positioned as acquirable, regardless of whether you plan to sell immediately.

Week 1–2: Build the Core Diligence Pack (Securing Financial Hygiene)

Without verifiable financials, every other metric is suspect.

- Normalize EBITDA: Define clear, defensible add-backs for one-time expenses (T&E, discretionary salary).

- Create the MRR Bridge: Demonstrate monthly recurring revenue (MRR) consistency and growth, broken down by cohort retention.

- Identify Concentration Risk: List the top 10 clients and their precise revenue contribution to prove the business is not reliant on a single relationship.

Week 2–4: Document Operational Maturity (Buyers Pay for Integration Speed)

Translate your service delivery into a reproducible system.

- Develop the SOP Index: Formalize all delivery workflows (triage, escalation, onboarding) to prove processes are independent of key personnel.

- Map the Tool Stack: Diagram RMM, PSA, BDR, and documentation platforms, including all licensing costs and renewal cycles.

- Standardize the Service Catalog: Define clear, non-bespoke service tiers and pricing structures to enable rapid scaling across the buyer’s platform.

Week 3–5: Quantify Vendor Exposure Risk (Mitigate Concentration Drag)

Proactively mitigate dependency on concentrated vendors.

- Execute a Contract Audit: Document all major contract terms, termination clauses, and required change-of-control notices.

- Estimate Migration Costs: Develop a credible Plan B, including estimated hard costs and labor hours required to shift from your most concentrated vendor. Output: Vendor Exposure Map.

Week 4–8: Churn-Proof Top Accounts (Protect Revenue Stability)

Stabilize client relationships before due diligence begins.

- Build Client Continuity Files: For the top 20 accounts, document decision-makers, known relationship risks, and the cadence of Quarterly Business Reviews (QBRs).

- Draft Day-1 Communication: Pre-write the client communication template emphasizing stability and continuity post-acquisition.

Week 4–10: Reduce Keyman Dependency (Eliminate Founder Reliance Discount)

Eliminate the valuation discount associated with reliance on specific individuals.

- Implement the Delegation Map: Identify backup owners for top accounts and core technical roles (vCIO, SOC lead).

- Formalize a Retention Plan: Define non-cash retention elements for must-retain talent, focusing on role clarity and growth opportunities within the future platform.

Complete this sequence to convert advice into tangible deliverables: a company easier to buy, integrate, and scale. This ensures buyers pay more in predictable upfront cash, not vulnerable promises.

FAQ

Valuation multiples remain highly variable, typically ranging from 5x to 10x EBITDA, or 1x to 3x ARR, depending heavily on size and quality. Smaller, highly specialized firms with high gross margins (60%+) and low client churn (<5% net revenue retention) command the highest end of this range. Multiples are discounted for high vendor concentration or low recurring security revenue. Avoid anchoring on headline deals from $500M+ platforms; focus only on controllable drivers that improve your integration readiness.

Earn-outs have become common in the current consolidation cycle, primarily used by buyers in a major msp merger analysis to shift integration risk onto the seller. To protect your upside, negotiate operational covenants that prevent the buyer from changing resources, client pricing, or strategic direction in a way that sabotages your targets. Critically, ensure KPI definitions are clear (e.g., booked revenue versus collected gross profit). See “Deal Mechanics” above for a detailed modeling checklist.

Consolidation often promises greater investment, but the real-world outcome can include billing friction and support degradation during integration. Buyers underwrite this risk. To protect client relationships, you must proactively manage the transition. Document current service KPIs and build a detailed client continuity plan, including pre-drafted Day-1 communications emphasizing stability. Proving client stability maximizes your upfront cash and protects against earn-out failure.

Timing the market is secondary to achieving Investor-Grade Readiness. You want the flexibility to run a competitive process when terms are favorable. Look for ‘green lights’: stable monthly recurring revenue (MRR), low client churn, and strong second-line leadership independent of the founder. If you have keyman dependency or messy financials, waiting while you clean up the RevOps ensures you don’t face a steep discount in any msp merger and acquisition scenario.

Buyers focused on scale and defensibility concentrate on five key metrics during due diligence: Recurring Revenue Mix: Percentage of total revenue that is contracted MRR (ideally >85%). Gross Margin: The raw profitability of service delivery (target 60%+). Net Revenue Retention (NRR): Revenue retained after accounting for churn and expansion (target 100%+). Client Concentration: The percentage of revenue tied to your top 10 accounts. Recurring Security Attach Rate: The penetration of high-margin, repeatable security services (MDR/compliance) into the core client base.