The inbound email from a Private Equity (PE) fund promises accelerated growth and life-changing liquidity, but the reality of a high-EBITDA valuation often overshadows the complex mechanics of the deal. The difference between a true exit and a leveraged roll-up depends entirely on your valuation drivers and post-close structure. For MSP owners considering a partial or full sale, we must focus on what truly matters: cash at close, rollover equity, and maintaining control. Let’s clarify what msp private equity interest practically means for your business by analyzing deal structure, not the marketing hype.

1. Why Your “Exit” Is Rarely a Clean Break: Retained Risk and Rollover Equity

Eine erfolgreiche msp private equity deal is rarely a clean walk-away. While structured as a formal change of control acquisition, the financial reality of a leveraged platform roll-up is complex: owners typically remain employed under a management agreement, retaining a minority equity stake. Your total ‘real payout’ is a formula: cash at close + value of any earnouts + the eventual value of rollover equity at the next exit.

Frame the negotiation as a continued investment, drilling immediately into these critical questions:

- What percentage are you rolling, and are the terms the same as the sponsor’s security (or subordinate)?

- What is your minimum time commitment and post-close operational role?

- What specific events—such as termination, missed budgets, or a major debt refinancing—can fundamentally change your economics?

These factors define your true retained risk and determine if the deal is a true success or a temporary liquidity event.

2. The Quality of Earnings (QoE) Reality: Why Your EBITDA Will Be Adjusted

The greatest financial risk in a successful msp private equity transaction is not the multiple you achieve, but the earnings number the buyer applies it to. While you may calculate valuation using an MRR multiple or internal EBITDA, the buyer operates exclusively on adjusted EBITDA.

This is not a bookkeeping tweak; it is the output of the buyer’s rigorous Quality of Earnings (QoE) analysis during due diligence. The QoE process validates the sustainability and quality of your earnings. Surprises here, like undocumented or questionable “add-backs,” invariably trigger a re-trade, reducing your price.

To protect your headline value, execute a pre-QoE cleanup immediately:

- Normalize Owner Comp: Ensure all owner salaries and discretionary spending are normalized to market rate.

- Document Add-Backs: Formally document and remove all one-time expenses (legal fees, relocation, non-recurring hardware).

- Show Revenue Quality: Be ready to segment recurring mix, churn rate, and gross margin by service line.

If your EBITDA story cannot survive investor-grade scrutiny, your initial multiple promise means nothing.

3. Decoding the Capital Stack: Leverage, Debt Service, and Covenants

The capital structure—the stack of debt and equity—defines your post-close operational freedom. While the Quality of Earnings (QoE) review defines the earnings base, the debt stack sets constraints on the future budget. Most msp private equity deals are Leveraged Buyouts (LBOs), financed primarily by debt and expressed as a leverage multiple of adjusted EBITDA.

This structure matters because debt service is the first line item subtracted from cash flow monthly. High leverage demands hyper-efficiency, restricting budgets for hiring, tooling, and necessary organic investment.

Treat this as technical due diligence. Demand clarity on these key questions:

- What is the leverage multiple carried by the business at close?

- What is the mix of fixed versus floating rate exposure, and what are the refinance assumptions?

- What are the specific covenants (financial promises) and the covenant headroom? What happens if your team misses a target?

A red flag: if the PE model only works under aggressive, uninterrupted growth, the debt is too tight. Your over-leveraged downside risk is priced directly into your future upside.

4. Platform vs. Tuck-In: Why Your Due Diligence Questions Keep Changing

Due diligence questions shift wildly between Private Equity buyers, dictated by whether your MSP is viewed as the platform or an add-on. Your msp private equity valuation and post-close operational structure hinge entirely on this distinction. Negotiating effectively requires understanding the buyer’s vehicle.

Definitions That Drive Value:

- Platform Acquisition: The foundational business used by a PE sponsor to execute a regional or vertical roll-up, expected to absorb smaller firms.

- Add-on/Tuck-in: Acquired primarily to expand geographical footprint, specific capabilities (e.g., MSSP), or customer density for an existing platform.

Operational Scrutiny Varies:

| Acquisition Type | Primary Scrutiny Focus |

|---|---|

| Plattform | Leadership bench depth, systems/RevOps maturity, minimal customer concentration. |

| Add-on | Integration speed, contract transferability, customer retention rates, operational overlap. |

To maximize your EBITDA valuation and secure your future role, ask these core questions immediately:

- “Are you building a new platform or adding to an existing one?”

- “What specific integration milestones (systems, branding, contracts) are expected in the first 90 days post-close?”

- “How do you measure operational success post-close (retention, margin, cross-sell)? What KPIs drive my earnout?”

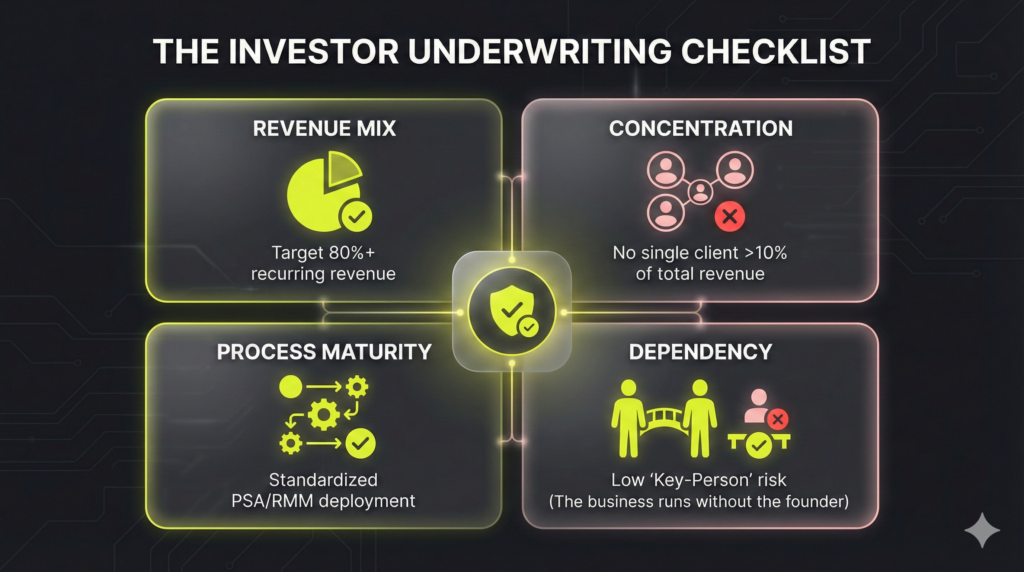

5. The Investor Underwriting Checklist: Proving Recurring Revenue Quality

Private Equity buyers underwrite risk, not your technical stack. The core msp private equity thesis relies on sticky, predictable recurring revenue within a fragmented market. Your valuation depends on proving your business structure is robust enough to withstand consolidation. During due diligence, financial buyers use a checklist to identify weaknesses that justify discounting your EBITDA multiple. Focus on optimizing these four core drivers of value:

- Revenue Quality & Mix: Target 80%+ recurring revenue. Buyers analyze the mix between high-margin labor (services) versus low-margin product resale, scrutinizing gross retention and net churn rates.

- Customer Concentration: Any client generating over 10% of total revenue triggers a discount. Ensure contracts are assignable and include favorable, clear renewal terms and SLAs that minimize legal risk.

- Process Maturity: Operational standardization is key. Demonstrate the business runs without key personnel through disciplined PSA/RMM deployment, robust security posture, and a clean financial reporting cadence.

- Key-Person Dependency: Identify the single-person risk: who drives 80% of sales, manages top accounts, or acts as the sole vCIO? Mitigation of these dependencies is mandatory.

The self-audit prompt is straightforward: list the top three reasons a buyer would discount your EBITDA multiple—like high concentration or reliance on a single salesperson—and resolve those issues before the Letter of Intent arrives.

6. The Deal-Killers: Understanding Earnouts, Working Capital, and Indemnities

The initial Letter of Intent (LOI) delivers a headline valuation, but the final cash-at-close hinges on adjustment clauses—the primary source of a price re-trade in msp private equity deals. Focus beyond the top-line multiple to master the three levers that swing your final check:

- Earnout Structure: Defines metrics (EBITDA targets, measurement period) and, critically, your control over the operational levers required to hit those targets. An earnout without guaranteed post-close control is often an illusion.

- Working Capital Adjustment: Buyers define a “Target Working Capital.” If the actual net working capital at close falls short of this target, the deficit is deducted directly from closing proceeds. This mechanism frequently triggers disputes.

- Reps & Warranties (R&W) and Indemnities: These clauses define post-closing risk. Buyers use indemnity caps und escrow to hold back a portion of the purchase price, protecting against liabilities missed during due diligence.

Operational or accounting surprises during post-LOI diligence trigger the buyer’s right to re-trade the price. Protect your initial value with these practical prompts:

- Ask for a clear example of how the buyer handled price adjustments or re-trades in prior deals—then reference check those former owners.

- Clarify how “adjusted EBITDA” will be calculated consistently across the LOI, Quality of Earnings (QoE), and final purchase agreement.

7. Operational Standardization: Protecting Employee and Client Moats

Your MSP was built on expertise, but the Private Equity mandate demands standardization. The buyer seeks consistency as the path to repeatable margin, immediately demanding uniformity across the tech stack: PSA/RMM tooling, security platforms, reporting/QBR cadence, procurement, and pricing models.

Standardization is not inherently negative; it improves margins and enables rapid platform scaling. However, this operational shift triggers the two biggest post-close risks: employee churn and client friction. If high-performing engineers reject the new, rigid system, delivery capacity collapses.

To protect the human and customer capital the buyer just paid for, due diligence must extend beyond the balance sheet. Demand clarity on the integration process:

- Post-Close Blueprint: Ask for the detailed 90-day integration plan and the long-term operational rhythm.

- Key Staff Retention: Request references from owners and employees who are 12–24 months post-deal at other platform firms.

- Identify Non-Negotiables: Define core service levels, client communication standards, and key staff retention plans that cannot be compromised.

Failing to manage this integration risk directly undermines the adjusted EBITDA fought for earlier in the msp private equity process.

8. The Pre-Diligence Timeline: Achieving Investor-Grade Readiness

The first outreach from a msp private equity fund creates the illusion of immediate liquidity. Realistically, most MSPs require a minimum of 12 months of structured preparation to achieve investor-grade diligence readiness. Skipping this timeline significantly increases the likelihood of a re-trade or deal collapse.

Preparation is an exercise in de-risking the business, not just reporting growth. True investor-ready status requires institutional maturity across three core assets:

- Financial Cleanliness: Clean Quality of Earnings (QoE) readiness, fully documented add-backs, and consistent KPI reporting (Gross Margin, Gross Retention).

- Legal Hygiene: Standardized client contracts with clear assignability, defined security obligations, and renewal terms that protect stickiness.

- Operational Depth: A documented leadership bench and reduced key-person dependency, ensuring the business runs without founder reliance.

Prioritize fixes that eliminate re-trade risk (financials and contracts) before focusing on value levers (margin improvement or vertical focus). If you are unready for diligence, treat the initial outreach as a diagnostic—capture the audit questions, then spend the next year fixing them.

The 6-Phase Execution Schedule for Your MSP Private Equity Exit

Founder regret in M&A often stems from misunderstanding the timeline: terms are set early, but price adjustments occur late. Since definitive agreements, working capital adjustments, and indemnity caps are complex, the LOI headline price is an assumption, not a guarantee. Use this schedule to link legal phases to the strategic actions required to protect your EBITDA valuation and maximize cash at close.

Phase 1: Defining the Buyer Thesis (Pre-LOI)

Begin rigorous self-analysis. Engage under an NDA to determine the buyer’s strategic intention (Platform vs. Add-on). Develop a one-page ‘deal thesis’ defining minimum acceptable cash-at-close and required operational control.

- Action: Secure confidentiality, vet the buyer type, and draft your non-negotiable term sheet.

- Output: Signed NDA; validated Buyer Type and Strategic Fit.

Phase 2: Locking Down the LOI and Price (Days 0–30)

The indicative offer establishes headline valuation and exclusivity. The LOI dictates price structure (cash, earnout, rollover equity). Protect this number by completing internal pre-QoE cleanup first.

- Action: Negotiate the headline price, confirm achievable working capital target definitions, and ensure the earnout structure offers genuine control.

- Output: Signed LOI; Exclusivity Period commenced.

Phase 3: The Diligence Gauntlet (Days 30–90)

This is the re-trade phase. The buyer executes the financial Quality of Earnings (QoE) review and full operational diligence (legal, contracts, cyber posture). Expect intense scrutiny on recurring revenue quality and key-person dependency.

- Action: Provide immediate access to clean, documented financials; conduct management presentations; proactively address contract assignability risks.

- Output: Adjusted EBITDA validated; diligence complete.

Phase 4: Negotiating Definitive Docs (Days 90–120)

Attorneys convert the LOI into the binding Purchase Agreement. Indemnities, Reps & Warranties (R&W), and escrow terms are finalized, dictating post-close holdbacks. Do not concede on escrow or indemnity caps without justification.

- Action: Direct counsel to focus on the R&W schedule and ensure the final working capital adjustment calculation is clear.

- Output: Definitive Purchase Agreement signed.

Phase 5: Close and Operational Integration (Day 120+)

Cash changes hands, but operational work accelerates. Focus on the first 100 days of integration: standardizing tooling, aligning RevOps, and managing retention risk. Success here dictates future earnout viability.

- Action: Execute the retention plan; standardize PSA/RMM tooling across the platform; finalize financial reporting alignment.

- Output: Cash at close received; operational integration initiated.

Phase 6: The Second Bite of the Apple (Year 5–7)

For owners who retained rollover equity, the final payout occurs when the PE sponsor exits the integrated platform. The value of this “second liquidity event” depends on the combined entity’s success and leverage management.

- Action: Maintain strict oversight of KPIs for organic growth and margin expansion; monitor debt covenants and refinancing events.

- Output: Final, second liquidity event payout realized.

FAQ

Platform acquisitions, which set the basis for an msp private equity roll-up, generally require $3 million to $5 million in adjusted EBITDA, alongside robust systems and a mature leadership team. Conversely, add-on acquisitions are focused on strategic density or capability and can start at the $750,000 to $1.5 million EBITDA range. Focus less on total revenue and more on predictable EBITDA margins, high gross retention, and a clean recurring revenue mix (80%+).

Yes. The majority of msp private equity transactions are partial exits, requiring the owner to remain for a minimum of three to five years to secure the full value of the rollover equity and potential earnouts. Your employment agreement should clearly define your post-close role, responsibilities, and control parameters. This continuity ensures the platform maintains stability and hits growth targets, maximizing the eventual payout (see Section 1).

Price adjustments (re-trades) occur when due diligence uncovers financial or operational risks that deviate from the LOI assumptions. The best defense is proactive financial preparation. Execute a third-party Quality of Earnings (QoE) review before going to market. This audit validates your Adjusted EBITDA, documents all add-backs, and confirms the integrity of recurring revenue data, removing surprises the buyer might use to justify a price cut (see Section 2).

Not inherently, but pressure on margins is inevitable. The impact depends entirely on the PE sponsor’s integration strategy and the resulting leverage multiple of the new entity. High leverage forces rapid standardization, which can frustrate high-performing staff and disrupt established client relationships. Demand clear 90-day integration blueprints and conduct reference checks with previous owners and employees acquired by the specific PE fund to gauge their approach.

If the demands of an msp private equity partner are too restrictive, several alternatives exist. Options include selling to a strategic buyer (a larger MSP seeking immediate synergies), establishing an Employee Stock Ownership Plan (ESOP), or taking on minority growth equity for expansion capital without ceding control. The best option aligns with the owner’s goals for retained involvement, control, and immediate cash needs.