Every MSP owner knows the friction: You are asset-rich, yet liquidity-poor because your business is the primary retirement vehicle. Retirement isn’t a date; it is a strategic liquidity event. Success requires specific retirement planning for msp owners, aligning personal financial needs with M&A-grade readiness. This framework, built from guiding founders through eight-figure exits, outlines 8 moves to de-risk your operation and fund your future on your terms. Start with the one number that dictates everything: your financial target.

1. Calculate Your Freedom Number: Defining the Personal Exit Target

Technical founders often fixate on the headline purchase price. Real retirement planning for msp owners requires aligning that exit number with a guaranteed lifestyle, not maximizing the valuation multiplier.

Define the gap your MSP must fill. Quantify your total future annual spending (including healthcare and leisure), then subtract existing non-business investable assets. The remainder is the liquid capital target your MSP’s net proceeds must generate—via sale or sustained predictable cash flow from retained equity.

Your true exit target is always the net proceeds after advisor fees, capital gains taxes, escrow holdbacks, and earn-out structures. Creating a precise, single-page ‘Personal Balance Sheet + Target’ today defines the minimum required enterprise valuation, providing your Fraktionelle GMO and CFO a quantifiable revenue goal.

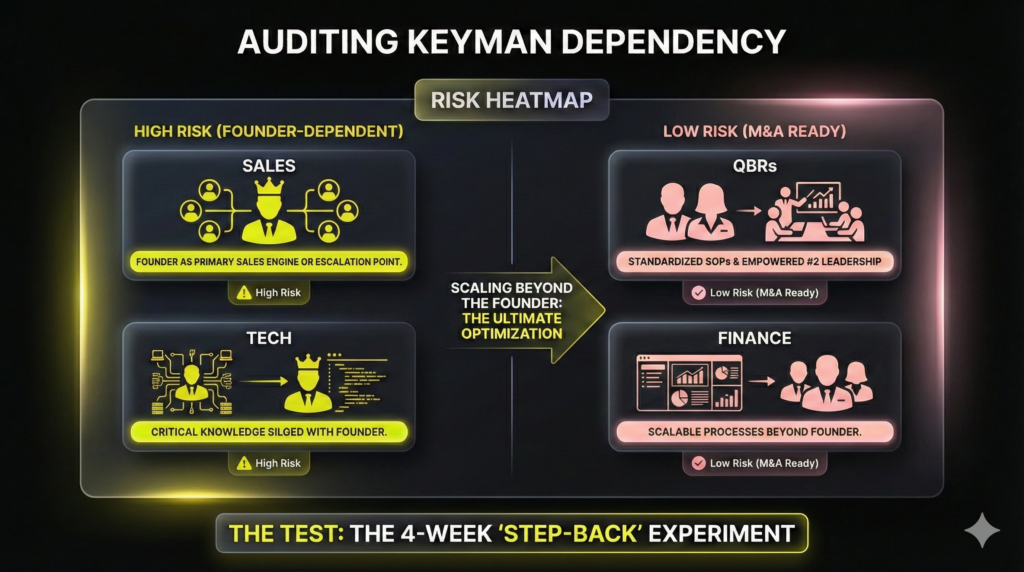

2. Operationalize Delivery: Eliminate the Keyman Dependency

Achieving your exit target requires proving the business is transferable and repeatable. If you remain the primary sales engine, ultimate escalation point, or QBR owner, buyers will price that extreme Keyman Dependency risk directly into your enterprise valuation multiple. True retirement demands operational readiness.

Maximize your enterprise valuation by establishing these documented systems:

- Standardize SOPs: Create runbooks for high-friction areas: client onboarding, incident response, and the vCIO/QBR cadence. This proves consistency over tribal knowledge.

- Empower the #2: Promote a manager trained to own service delivery and critical client relationships. This is non-negotiable for a successful exit.

- Build KPI Visibility: Performance must not rely on intuition. Establish clear dashboards tracking margin, churn, MRR mix (managed services vs. projects), and ticket SLA adherence.

Test the system: Execute a two-to-four-week “step-back experiment.” Take a true vacation, log everything that breaks, and systematically fix the operational gaps. This de-risks the asset and directly increases your M&A readiness. (148 words)

3. Valuation is a Diagnostic, Not a Vanity Metric: Focus on the Drivers

In M&A readiness, enterprise valuation is a diagnostic tool identifying risk and operational blind spots, not a final number. When engaging an advisor, demand more than a simple multiple. Request a defensible valuation range, complete with comparative analysis by size band and service mix.

The critical value drivers dictating this range must be your core focus:

- Percentage of recurring revenue (high MRR mix is premium).

- Client concentration (low concentration reduces risk).

- Quality of adjusted EBITDA margin.

- Consistency of growth and low client churn.

To show true adjusted earnings, your advisor must normalize owner compensation and remove one-time project spikes. The actionable result must be a “12-Month Value-Driver Plan,” outlining the top three controllable levers and the monthly metrics (e.g., net MRR gain) required to increase your defensible valuation range. This is the difference between hoping for an exit and engineering one.

4. Diversify Your Exit Vehicle: Mitigating the Single-Asset Risk

You would never anchor 100% of your retirement planning for msp owners in a single, volatile tech stock. Yet, many founders treat their MSP—a singular asset—as the only guaranteed liquidity event. The risk is immense: a market downturn, a failed deal, or unexpected regulatory changes can instantly jeopardize your intended enterprise valuation.

Diversification is smart risk management and a core part of a sound exit strategy, not a lack of confidence in your company. Start building your financial runway now. Automate a monthly transfer of net business profits into conservative personal investable assets. This deliberate strategy reduces reliance on the future sale price, removing the pressure to accept a low-ball offer when the time comes.

Timing is crucial: synchronize distribution with operational cash flow cycles, carefully budgeting around Q1 vendor true-ups or large CapEx needs to avoid starving working capital. Treating future sale proceeds as a guaranteed retirement fund is a critical operational pitfall. Your “freedom number” demands you prioritize liquid assets outside the business heute. (142 words)

5. Leverage Advanced Retirement Plans (Cash Balance) to Minimize Pre-Exit Tax Burden

Highly profitable founders approaching exit often hit the ceiling on standard 401(k) and SEP IRA contribution limits. Advanced retirement plan design solves this acceleration gap, functioning as a critical tax lever for retirement planning for msp owners.

Start by maximizing all existing employer plans (401(k), profit sharing). If you maintain substantial, consistent predictable cash flow near your exit, evaluate a Cash Balance or Defined Benefit plan. These vehicles enable massive, accelerated, tax-deductible savings in a compressed timeframe, potentially adding millions to the retirement pool before sale.

MSPs must account for non-discrimination testing: these plans require proportional contributions for key staff. Alignment with your employee retention strategy is therefore crucial. Furthermore, the plans demand rigorous actuarial discipline and stable finances; inconsistent cash flow makes them unsustainable and risky. Used correctly, this strategy significantly lowers pre-exit Adjusted EBITDA tax liability.

6. Selecting Your Exit Path: The Trade-Off Matrix

The most critical mistake in retirement planning for MSP owners is defaulting to the first inbound offer. A successful exit requires deliberately managing strategic trade-offs: cash at close vs. control vs. culture. Evaluate your M&A readiness against these primary paths:

- Strategic Buyer/PE: Optimizes for rapid liquidity and high multiples, introducing high integration risk and significant staff upheaval.

- Internal Promotion: Maximize cultural continuity and owner control, but often involves slower, less concentrated cash flow via owner-financed buyout.

- Employee Group (ESOP/Partnership): Protects culture and legacy; requires significant legal complexity and slower external liquidity realization.

Regardless of the chosen route, the transferability of your recurring revenue and guaranteed service continuity for high-LTV clients remain the universal make-or-break factors for maximizing valuation. To engineer your exit, rank your top two priorities now—cash, staff retention, or client peace of mind—and avoid the default option that merely showed up first.

7. Master the Deal Structure: Prioritize Certainty Over Headline Price

The high valuation multiple is worthless if the deal structure prevents access to net proceeds. Retirement planning for MSP owners is about maximizing certainty as much as price. Define your non-negotiables before signing a Letter of Intent (LOI):

- Asset vs. Stock Sale: Understand the buyer’s preference; the tax basis and liability implications differ drastically.

- Earn-outs: These are dangerous. Tie them to clear, controllable metrics (e.g., MRR renewal rate, not EBITDA growth). Ensure operational control to hit targets and seek protective liability caps.

- Escrow and Holdbacks: These delay liquidity, protecting the buyer against breaches of your Representations and Warranties. Minimize the term and the percentage held back.

Advanced Consideration: Die QSBS (Qualified Small Business Stock) exclusion can eliminate millions in capital gains taxes, but it requires specific entity and stock-holding compliance that must begin years before M&A readiness. Do not treat this as a last-minute switch.

Document your “Terms Wishlist” and hand it to your M&A advisor. The structure, not the headline price, dictates your retirement timeline. (152 words)

8. Ensure Contract Transferability: De-Risking Your Recurring Revenue

Discovering critical client agreements are non-transferable after signing an LOI is a prime source of deal friction and the fastest way to incur a valuation haircut. A buyer’s valuation relies entirely on the bankability of recurring revenue; non-transferable contracts lead to immediate risk discount.

To ensure high M&A readiness and seamless transfer during diligence, focus on contractual hygiene today. Begin a lean review of client MSAs/SOWs, focusing on assignment, novation, and change-of-control clauses. Confirm core vendor agreements (RMM, PSA, security tooling) are transferable or re-paperable.

Map your top 10 accounts to relationship owners other than yourself, documenting Quality Business Review (QBR) history to prove institutional, not personal, client relationships. Do not wait for diligence to surface this foundational risk; contractual clarity is a mandatory pre-exit audit item.

The 90-Day Execution Plan for Engineering Your MSP Exit

Succession is a marathon, but the first 90 days must be a sprint. This strategic roadmap converts abstract retirement planning intent into an executable schedule designed to maximize M&A readiness by establishing clarity, mitigating risk, and securing your professional team.

Weeks 1–2: Define Your Foundation and Target

Phase 1 establishes the personal metrics that dictate business actions. The deliverable is a clear understanding of your minimum liquidity requirement.

- Calculate Your Freedom Number: Conduct a personal balance sheet gap analysis (referencing Tip #1). Determine the required net proceeds after estimated taxes and fees.

- Set the Exit Timeline: Define your firm exit window (e.g., 18, 36, or 60 months). Identify non-negotiable terms for the eventual deal structure.

- Das Ergebnis: A quantifiable enterprise valuation target and a committed timeline for your retirement planning for MSP owners.

Weeks 3–6: Operationalizing Value Drivers

Focus on institutional capability. Proving repeatability eliminates massive Keyman Dependency discounts during diligence.

- Baseline Readiness: Establish the core dashboard tracking recurring revenue mix, adjusted EBITDA margin, and client churn (referencing Tip #3).

- Systematize Expertise: Complete the Keyman Dependency assessment. Create SOPs for QBRs and technical escalations, ensuring staff owners handle execution, not the founder.

- Draft the Value-Driver Plan: Outline the 3–5 levers that will increase your defensible valuation range in the next 12 months (e.g., achieving a 20% net MRR gain).

- Define Successor Track: Select a successor development path (internal promotion plan or external hire profile).

- Das Ergebnis: A proven, repeatable delivery system documented for buyer review.

Weeks 7–10: Advisory and Structural Choices

Secure the professional expertise necessary to navigate the tax and legal complexity of a final transaction.

- Interview the Triad: Conduct structured interviews with an M&A attorney, a CPA specializing in transactional tax, and a third-party valuation specialist. Define clear roles and fees.

- Choose the Exit Path: Select your likely exit route (Strategic, PE, or Internal), based on the Trade-Off Matrix (referencing Tip #6). Define what “good terms” means regarding culture versus liquidity.

- Das Ergebnis: A vetted advisory team and consensus on the target deal structure.

Weeks 11–13: Paperwork and People

Finalize contractual hygiene to de-risk the asset and prepare key stakeholders for eventual communication.

- Contract Transferability Review: Audit the top 10 client MSAs and vendor agreements (referencing Tip #8). Ensure seamless assignment or novation clauses are present. Fix non-transferable agreements immediately.

- Stakeholder Communications Outline: Draft the internal and external communication plan, defining who hears what, when, and from whom.

- Final Deliverable: Create a one-page “Retirement + Succession Operating Plan.” Include target dates, owners for each value driver, and required quarterly cash flow Metriken.

- Das Ergebnis: A controlled communication strategy and complete M&A readiness checklist.

FAQ

You should initiate formal retirement planning for MSP owners three to five years before your ideal exit date. This extended runway is essential for de-risking the business, which maximizes your enterprise valuation. Key tasks requiring this lead time include contract cleanup, implementing tax optimization strategies (like Cash Balance plans), eliminating Keyman Dependency, and developing a trained internal successor. Starting later narrows your options and increases operational risk.

Real-world MSP valuation is driven by the quality and predictability of future earnings. Buyers underwrite: high quality recurring revenue percentage, low client churn, client concentration (less than 10% from any single customer is ideal), and the strength of the adjusted EBITDA margin. Crucially, the absence of the founder from daily operations proves transferability, leading to higher multiples.

Earn-outs are not inherently bad, but they introduce risk and reduce cash-at-close liquidity. They can be rationalized when bridging a significant valuation gap. If you accept an earn-out, ensure it is tied to metrics you directly control, such as MRR renewal rates or specific service line growth, rather than broader (and easily manipulated) company-wide EBITDA. Always seek a maximum cap and clear dispute resolution terms. (See Tip #7 above for deal structure details.)

No. Qualification for the QSBS capital gains exclusion requires holding C-corp stock for a specific period (five years) and meeting numerous regulatory requirements from the date of issuance. Converting an S-corp or LLC immediately before a sale generally does not qualify the existing equity retroactively. This is a complex transactional tax matter that must be reviewed by tax counsel years in advance to assess eligibility, entity type, and stock holding periods.

The decision hinges on your top priorities. A sale to a strategic buyer or Private Equity typically maximizes immediate liquidity and provides a higher enterprise valuation multiple, but often results in significant integration risk and cultural change. Internal succession or a phased buyout prioritizes cultural continuity and staff retention but usually offers slower, less concentrated cash flow to the founder. Define your liquidity needs first, then align the path (see Tip #6).