Mid-market MSP owners watch the Thrive, Ntiva, and All Covered roll-ups, desperate to decipher if 2026 buyers are paying higher multiples. Chasing undisclosed deal terms is a waste of strategic bandwidth; you need decision-grade inferences, not rumors. Leveraging my Private Equity background, I focus on reverse-engineering true buyer appetite. We offer nine specific lenses connecting company size directly to risk and the achievable EBITDA multiple. Stop searching for rumors like the exact Ntiva purchase price 2026, and start structuring your business for optimal investor value.

1. Decode the Silence: Why the Ntiva Purchase Price (2026) Will Stay Secret

The vast majority of lower-middle-market MSP deals, particularly those in the $5M to $50M revenue range, publicly conclude with the phrase, “Terms of the deal were not disclosed.” This PE-backed disclosure norm confirms you will almost certainly never locate the exact Ntiva purchase price 2026. Relying on replicating rumored multiples means basing your M&A strategy on inherently incomplete data.

The strategic context is far more valuable than the alleged EBITDA multiple. What you kann infer from these silent deals is the buyer’s platform thesis. PE partners, exemplified by the Ntiva acquisition model, deploy capital specifically to acquire clean, established platforms (geographic or vertical) for rapid scale build-up and market dominance. For many sellers, aligning with these msp consolidators best exit strategy involves proving the business can thrive under a larger corporate umbrella. Your M&A readiness is thus measured not by size, but by the clarity and scalability of your operation.

Since your eventual deal will likely remain private, the practical takeaway for $3M–$15M MSPs is controlling the internal narrative. Start compiling a formal internal valuation file today: TTM revenue, normalized EBITDA, client retention data, and client concentration risk metrics. Do not anchor your valuation to rumored prices; anchor it instead to verifiable proof of de-risked cash flows and recurring revenue quality.

2. Reverse-Engineering Your Price: The Three MSP Buyer Archetypes

Achieving desired MSP valuation multiples depends on matching your business structure to the buyer archetype. Lower-middle market sellers encounter three main classes, each optimizing for distinct financial outcomes:

- The Financial Sponsor (PE Platform): They chase EBITDA scalability and margin expansion, paying for clean, de-risked cash flows that can absorb other acquisitions. Their goal is a higher multiple re-rate at exit (e.g., buying at 7x and selling at 12x).

- The PE-Backed Operator (Add-on): Existing platform companies focused on rapid building. They pay for tuck-in synergies, density within a specific geography, and integration readiness. Their economics support higher effective multiples by realizing immediate cost savings.

- The Strategic/Corporate Buyer: (E.g., Konica Minolta/All Covered.) Strategics pay for customer access, geographic expansion, or filling capability gaps (like adding an MSSP segment). They prioritize cross-sell opportunities, making customer lifetime value the core metric.

A smaller MSP ($3M–$6M ARR) often sells as a pure “integration project” (Type 2). A larger firm ($8M–$15M ARR) has better optionality, serving as a “mini-platform” for Type 1 buyers. Ultimately, the best multiple is the one your business is strategically built to survive and sustain.

3. Size vs. De-Risked EBITDA: How Revenue Thresholds Dictate Your MSP Multiple

Anchor valuation multiples to internal maturity, not just revenue. Buyers pay a premium for de-risked, transferable EBITDA. Many owners utilize an msp appraisal guide valuation to identify specific operational gaps that may be suppressing their current multiplier.

Moving up the valuation ladder requires mitigating risks specific to your size band:

- $3M–$6M (Founder Trap): Key-person risk and client concentration lead to deep discounting; integration burden is high.

- $6M–$10M (Emergent Management): Repeatable delivery and a management layer signal transferability and boost buyer confidence.

- $10M–$15M (Platform Premium): Process maturity and rigorous KPI cadence maximize PE buyer competition due to minimal integration risk.

Mid-market buyers only pay a premium when integration risk is low. To justify a higher multiple and achieve “Platform Status,” prove organizational maturity using these investor-grade artifacts:

- Formal SOP Stack: Documented procedures for client onboarding, incident management, and QBRs.

- KPI Pack Cadence: Monthly reporting of normalized EBITDA, Net Revenue Retention (NRR), and cost-to-serve metrics.

- Cohort Retention Data: Longitudinal proof of client sticky-ness by annual acquisition group, minimizing concentration risk.

Focusing on these elements transforms the business from a risky integration project into a scalable asset.

4. The Recast EBITDA Checklist: How to Normalize Your MSP’s True Profit

For MSPs ($3M–$15M), the reported EBITDA is irrelevant to valuation. Buyers pay for Recast EBITDA: a standardized figure representing repeatable, post-acquisition profitability. Private Equity and large strategics underwrite only repeatable margin, not heroic founder effort or owner-inflated expenses.

The valuation multiple is anchored to this defensible, normalized figure. To prove transferability and prepare for a Letter of Intent (LOI), deploy this simple normalization checklist:

| Normalization Item | Adjustment Required |

|---|---|

| Owner Compensation | Adjust owner salary/benefits to the market rate for a non-owner CEO or CTO. Eliminate salaries paid to non-working family members. |

| Non-Recurring Costs | Add back one-time legal fees, specific spikes in recruiting, large non-recurring capital purchases, or severance payments. |

| Discretionary/Personal | Remove owner’s life insurance, personal travel, or excessive vehicle leases run through the business. |

| Revenue Quality | Segregate and discount non-recurring project margins (e.g., hardware sales) from high-value recurring services. |

When deal terms remain silent, such as the specifics of the Ntiva purchase price 2026, your only defense is having your internal numbers prepared and defensible. Recast EBITDA is the metric that demonstrates your operation’s structural M&A readiness.

5. Revenue Quality: The Traits Buyers Pay Higher Multiples For

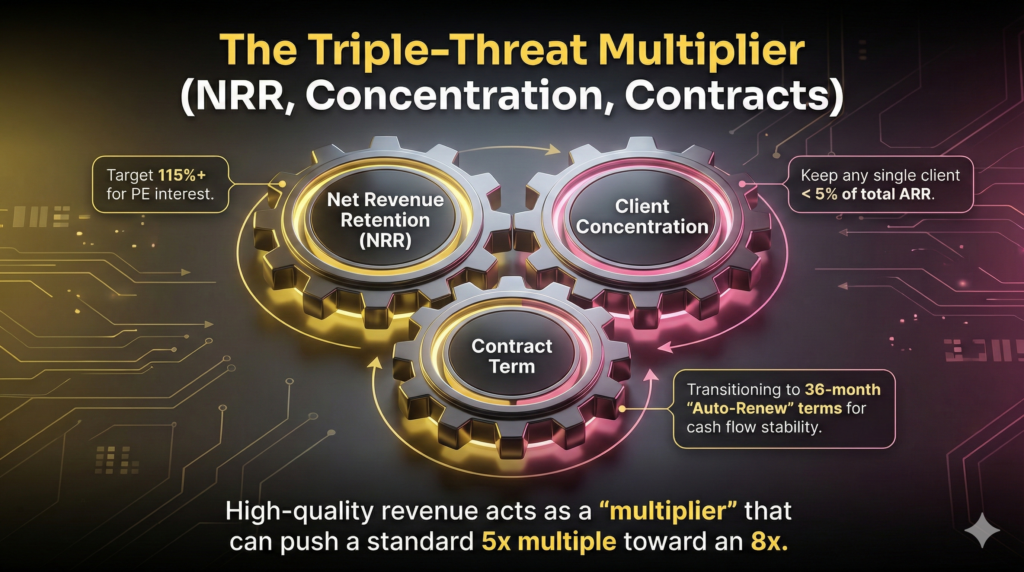

Pristine Recast EBITDA is necessary, but revenue quality dictates the final multiple. Sophisticated buyers pay a premium for specific, non-negotiable traits that guarantee recurring revenue stability and expansion potential.

To justify the highest MSP valuation multiples (8x+), you must prove:

- Contracted Revenue: Long-term contracts with defined scope boundaries and clear auto-renewal clauses.

- Client Concentration: No single client representing more than 5% of total ARR (less than 3% is investor-grade). In the $3M–$15M revenue range, concentration directly compresses the multiple as even a few clients can swing the entire risk profile.

- Net Revenue Retention (NRR): An NRR of 115%+ is highly prized by Private Equity, demonstrating a built-in expansion motion through cross-sell and upsell.

Strategic buyers often overweight cross-sell potential and capacity fill, while PE typically obsesses over retention, scalability, and gross margin stability. If you seek a higher valuation, build a one-page cohort table today detailing your top 10 clients: list their contract term, margin profile, tenure, and expansion history. This simple artifact proves your de-risked cash flows.

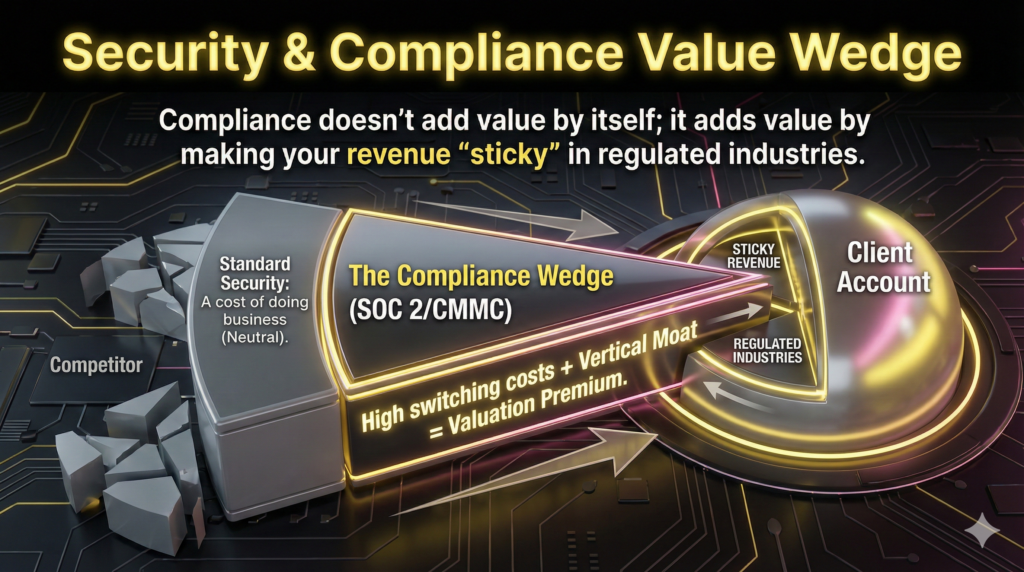

6. Security as a Value Multiplier: When Compliance Justifies a Premium

Investment in cybersecurity tooling and compliance audits rarely moves the MSP valuation multiples needle. Buyers do not pay a premium for compliance alone; they pay for predictable revenue outcomes. Security adds enterprise value only when it increases wallet share and aggressively reduces client churn, proving service stickiness.

Buyers identify two critical premium conditions that maximize the value of your security offering:

- Productized Managed Security: Delivery must be standardized, repeatable, and demonstrate clear margin visibility. Selling security as pass-through tooling or relying on non-repeatable engineering signals high risk and thin margins.

- Compliance-Driven Verticals: Targeting regulated industries (finance, healthcare) allows a narrow compliance wedge (e.g., SOC 2, CMMC) to establish real switching costs. This proven stickiness justifies an EBITDA premium.

For the mid-market MSP ($5M–$15M ARR), sharp vertical focus transforms generic security into a scalable asset. To prove M&A readiness and process maturity, formalize your security delivery immediately by documenting:

- Incident response boundaries.

- SLA evidence and performance metrics.

- Repeatable QBR processes focused on risk management.

This proof of process maturity converts compliance costs into valuation drivers.

7. Ntiva’s Playbook: How Tuck-Ins Drive Platform Scale

For an MSP in the $3M–$15M revenue band, small size is an advantage. These firms are the ideal tuck-ins for executing the core platform play: rapid, non-organic scale building. Add-on acquisitions generate MSP valuation multiples expansion far faster than organic growth.

Buyers driving the Ntiva roll-up use frequent tuck-ins to achieve critical scale and density without the integration burden of a larger target. They prioritize two strategic factors:

- Density: Expanding saturation in a specific geographic market (e.g., three small MSPs in Atlanta) or deepening penetration in a key vertical (e.g., adding specialized compliance expertise).

- Capability Bolt-Ons: Acquiring high-margin expertise—such as a managed security segment—to immediately cross-sell across the entire platform.

The objective of this roll-up math is low-cost integration combined with instant client expansion. To maximize M&A readiness and value, sellers must articulate what they add that the buyer cannot build quickly. Positioning your $3M–$15M firm as an engine for immediate density or margin expansion is essential to commanding a higher multiple.

8. The Integration Packet: How to Make Your MSP Easy to Buy

Most value leakage occurs post-close, not during due diligence. Buyers factor integration risk—the potential for staff churn, client loss, or tool failure—directly into the initial EBITDA multiple. To maximize valuation, provide a ready-to-copy integration narrative proving the business runs autonomously, without the founder.

The solution is the M&A readiness artifact: the Integration Packet. This blueprint translates operational stability into assurance, directly combatting four key buyer fears:

- Day 0 Communication: Templates for immediate staff and client messaging, ensuring continuity and calming transition anxieties.

- SOP Standardization: Searchable index of SOPs, proving repeatable service delivery (ticketing, QBRs, onboarding).

- Tooling Rationalization: Map of PSA/RMM systems and vendor relationships, justifying systems slated for cuts.

- Knowledge Transfer: Formal training/shadowing schedules for key personnel handoff, reducing founder dependency.

Smaller MSP multiples are discounted when integration hinges on the founder. Delivering playbooks via the Integration Packet transforms the business from a founder-dependent project into a process-driven asset. This signals low integration burden, justifying the highest achievable MSP valuation multiple. It makes you easy to buy.

9. The Triangulation Method: Creating Your Defensible Valuation Range

Achieving M&A readiness demands a four-step triangulation process. Stop chasing the mythical single number—like the rumored Ntiva purchase price 2026—and generate a defensible range supported by observable data, anticipating buyer skepticism. This methodology provides the narrative needed to justify your desired MSP valuation multiples.

- Establish the Baseline: Lock in foundational metrics: 12-month trailing (TTM) revenue, Recast EBITDA, Gross Margin percentage, and Net Revenue Retention (NRR). This determines the multiplier input.

- Define the Market Band: Determine your likely buyer archetype (PE platform, add-on, or strategic) and your size band’s typical multiple range. This sets the initial ceiling and floor.

- Create Actionable Comps: Research publicly available deals involving similar MSPs. Focus less on the disclosed price; track platform behavior: PE vs. strategic buyers, rapid add-on execution, and vertical focus.

- Apply Risk Adjustments: Convert qualitative differences into quantitative adjustments. High client concentration deducts basis points from the multiple; strong security productization adds them back.

The output is a low-end/high-end valuation range, supported by a formal narrative explaining why you deserve the upper end—grounded in de-risked cash flows and transferable systems.

FAQ

No. Like the majority of lower-middle market Private Equity transactions, the terms of the Ntiva acquisition were not disclosed publicly. While rumors circulate, relying on undisclosed financial details is not a viable M&A strategy. MSP owners should focus instead on reverse-engineering the buyer’s platform thesis: acquiring established, repeatable operations for rapid scale. Build your valuation model on verifiable, internal data like Recast EBITDA and client concentration metrics.

Searches referencing a “2026 price” reflect speculation regarding a typical PE hold period and potential exit date. There is currently no public information confirming a 2026 sale or divestiture for the Ntiva platform. Rather than chasing exit dates, focus on the operational signals that precede a successful exit: increased scale through add-ons, demonstrable margin expansion, and documented process maturity. These are the M&A readiness factors you can control.

No public process indicates that All Covered, acquired by strategic buyer Konica Minolta, is currently being sold. Strategic owners like Konica Minolta operate differently than Private Equity, often prioritizing vertical integration, capability expansion, or cross-sell opportunities over rapid financial flips. Positioning your MSP for an acquisition by a strategic buyer requires demonstrating high customer lifetime value and capacity to fill an internal technical or geographic gap, not necessarily the highest EBITDA multiple.

The achievable multiple spans a wide range—typically 4x to 8x Recast EBITDA—and is not determined by market forecasts. The multiple depends entirely on internal drivers and de-risked cash flows. To achieve the 7x-8x Platform Premium range, you must demonstrate low client concentration (under 5%), formal SOP documentation, an NRR exceeding 115%, and proven organizational maturity that minimizes integration risk for the buyer.

The revenue multiple (usually 1.5x to 3x ARR) is a shorthand for quickly assessing market size and revenue quality, but Recast EBITDA is the metric underwritten in a deal. Buyers purchase future profitability, and EBITDA measures that cash flow potential. A revenue multiple only becomes attractive when it implies an extremely high EBITDA margin compared to industry peers. Always start by normalizing and defending your Recast EBITDA, then use the implied revenue multiple as a final sanity check against market comps.