Selling your MSP is the highest-stakes transaction of your career. The wrong M&A advisor costs you the earn-out, client continuity, and control. Because MSP valuation is highly tiered, institutional buyers are pickier than ever regarding A-tier versus B-tier ARR quality. We provide a curated shortlist of top-rated msp m&a advisors and the rigorous framework required to vet them, focusing only on firms with explicit MSP practices.

1. Leveraging Specialty Brokers for Platform Investment Outcomes

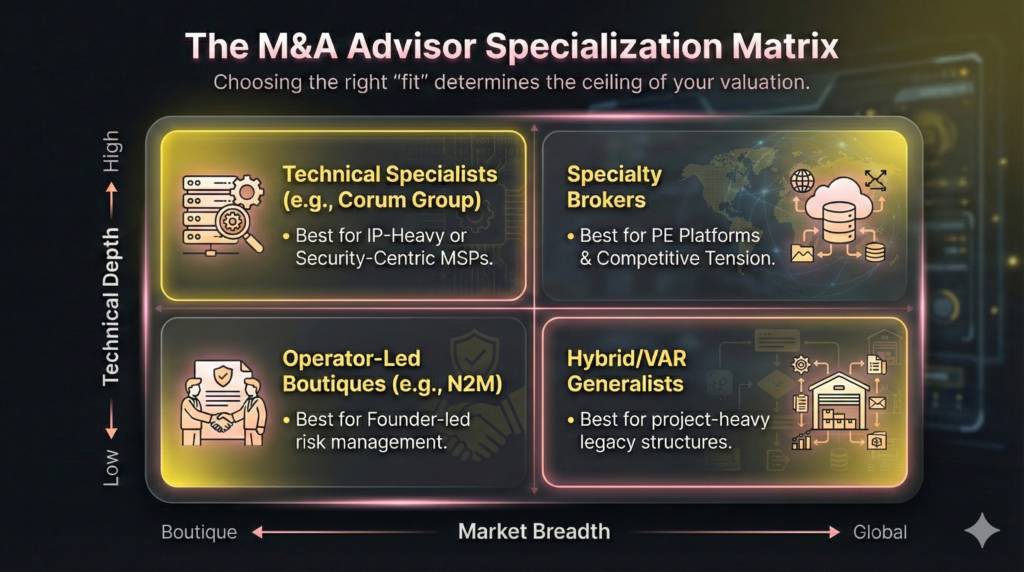

Selecting an advisor with verifiable MSP specialization is non-negotiable for PE platform investments or strategic sales requiring competitive tension. We focus on MSP M&A advisors who explicitly launch PE roll-ups, verifying their deep expertise through public metrics like transaction volume or platform launches.

These specialty firms maximize your enterprise valuation by developing investor-grade positioning, executing comprehensive outreach to PE groups and strategic buyers, and running a competitive M&A process designed for multiple bids.

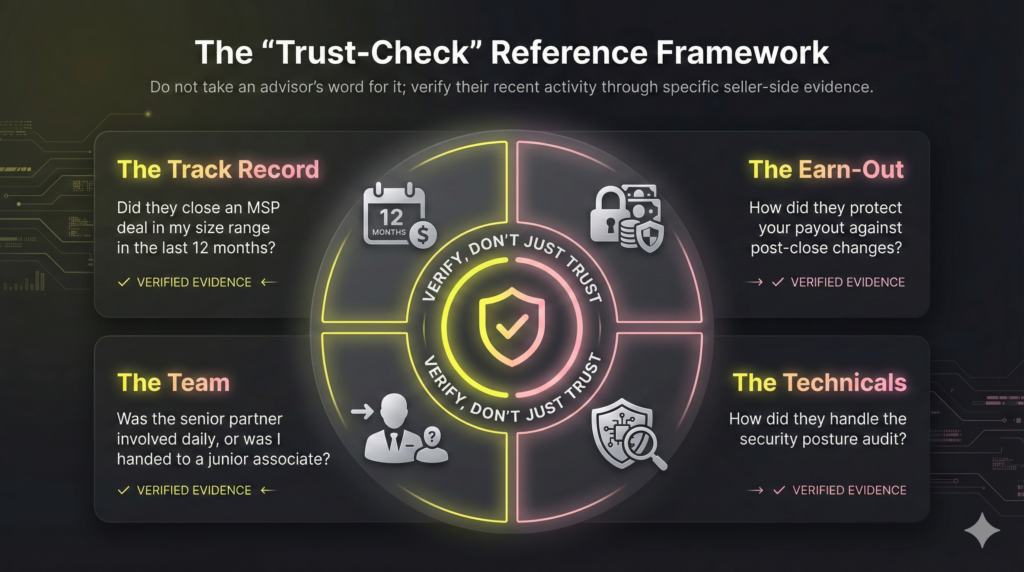

Before engaging, request these essential trust checks:

- Anonymized deal list by year, filtered for MSP/MSSP transactions.

- Two to three seller references in your specific EBITDA range ($3M-$10M).

- Their precise fee calculation on earn-outs or roll equity.

This fit is best suited for MSPs requiring wide buyer coverage and competitive tension to maximize their exit multiple.

2. Corum Group: The Technical Diligence Imperative

Failing technical diligence is the fastest way to trigger a retrade and lose valuation. If your MSP holds meaningful IP, security services, or a complex tooling footprint, you need a process built to withstand technical scrutiny.

Corum Group specializes in technology M&A, utilizing a rigorous five-step process: Assessment/Valuation, Positioning, Buyer Outreach, Technical Diligence, and Structuring/Closing. This defined approach is critical for technology-first MSPs because institutional buyers aggressively audit security posture, RMM/PSA metrics, and client concentration—areas where sloppy diligence preparation guarantees price erosion.

To lock down valuation, request these trust checks from any advisor:

- A sample technical diligence checklist (security, RMM efficiency, PSA utilization data).

- Clear examples of how they handled founder retention or earn-out clauses in previous MSP deals.

3. N2M: Prioritizing Operator-Led Guidance and Risk Management

Founder-led MSPs need high-touch, sector-specific guidance that generic middle-market finance advice cannot provide. The operator-led boutique model, exemplified by firms like N2M, explicitly targets technology services, grounding advice in deep industry-veteran experience.

Expect full-stack M&A support focused on valuation, sophisticated deal structuring, and rigorous risk management tailored precisely to the MSP model. This specialized rigor is critical for maximizing your enterprise valuation.

To ensure alignment with the operator-led ethos, demand these trust checks:

- Specifics on their defined buyer network: Do they prioritize PE funds active in MSP roll-ups or only strategic buyers?

- A clear narrative on how they handle customer concentration risk during valuation—a constant threat to MSP multiples.

- Validation of any “award-winning” claims (which years, which organizations).

4. Benchmarking Data: Sanity-Checking Adjusted EBITDA and Valuation Multiples

Aggressive EBITDA adjustments or inflated valuation multiples from an advisor demand validation. Benchmark data is the objective third-party tool required to sanity-check sell-side projections, preventing owners from anchoring on fantasy numbers.

Benchmarking defines “best-in-class” operational maturity, growth rates, and margins for your specific vertical and size. Understanding the future managed services 8 shifts for MSP profit can help you align your current margins with the high-performance benchmarks buyers use to justify premium multiples. This data ensures alignment on defensible adjusted EBITDA and credible “add-backs,” mitigating the risk of a retrade during technical diligence. Use it to frame whether your company truly warrants A-tier or B-tier status.

Demand these critical trust checks before proceeding:

- Which specific, non-proprietary benchmark sources do they rely on (e.g., Service Leadership, ChannelE2E)?

- How do they rationalize comps to match your exact size and vertical mix?

- A clear breakdown of acceptable versus aggressive EBITDA adjustments in the current market.

5. Focusing on Buy-Side Integration Diligence for the ‘Buy-and-Build’ Strategy

If your path involves recapitalization or continuing as the platform leader in a buy-and-build roll-up, the primary risk to future valuation is poor post-close integration—a factor often overlooked during initial sell-side preparation.

MSPs engaging in acquisition must demand that MSP M&A advisors demonstrate verifiable buy-side integration expertise. This integration-savvy approach pressure-tests buyer plans, ensuring the acquired revenue is durable and staff retention strategies are sound. Proactive planning helps avoid common corporate MSP ownership problems pitfalls that often lead to client churn and employee burnout post-acquisition. This diligence protects client continuity, staff retention, and your earn-out safety.

To verify an advisor’s integration capability, insist on these trust checks:

- Review their integration playbook, including staff and client communication templates.

- Require data on post-close KPI tracking and how they monitor margin improvement in merged entities.

- Demand concrete examples where their oversight improved retention and revenue synergy capture.

6. Verifying Current Activity in Boutique MSP Advisory

Boutique MSP advisors offer crucial advantages: deep channel relationships and reputation signaling that influence buyer introductions. For smaller MSPs seeking hands-on guidance, this specialized fit is critical. However, channel connection is worthless if the advisory is not currently closing deals. To maximize enterprise valuation, ensure the advisory is active by confirming these non-negotiable trust checks:

- Current-Year MSP Transactions: Require a verifiable list of completed MSP transactions in the last 12 months.

- Core Vertical Confirmation: Confirm that MSP/MSSP constitutes their core vertical (80%+ of deal volume), not an occasional client.

- Deal Team Activity: Identify your specific deal team and verify their individual, recent experience in MSP sales.

This targeted due diligence protects owners from relying solely on past reputation while providing the structure needed for optimal buyer outreach.

7. Ensuring Fee Structure Transparency and Process Discipline

Hidden fees or ambiguous success metrics erode final payouts. For MSP owners demanding rigorous process discipline and upfront fee clarity, this transparency is as critical as the advisor’s buyer sourcing capability. The firm’s incentives must align perfectly with maximizing your ultimate, realized cash-out, not just the announced enterprise value.

Before signing the engagement letter, demand these essential checks for transparency and alignment:

- Written Fee Schedule: Require a detailed, written breakdown of all potential fees.

- Retainer Credit Confirmation: Confirm whether the retainer fee credits against the final success fee.

- Success Fee Calculation: Confirm precisely how the success fee is calculated when considering cash versus earn-out versus rollover equity components. This level of detail is vital when comparing an evergreen acquisition multiples deal structure against a traditional private equity exit, as the long-term payouts vary significantly.

This diligence ensures alignment, mitigating the risk of post-close financial surprises.

8. Vetting Advisors Fluent in the Strategic Acquirer Narrative

High-value exits are not limited to the Private Equity channel. If your MSP possesses a unique vertical footprint, deep security specialization, or proprietary cloud knowledge, your best buyer may be a strategic acquirer: a major distributor, telco, or SaaS/IT services corporation seeking immediate, monetizable synergy.

You need MSP M&A advisors fluent in this strategic value narrative. A financial-only focus often fails to translate core operational advantages—like recurring revenue durability or immediate cross-sell potential—into a premium valuation multiple. This specialized fit is crucial for maximizing enterprise value.

To verify their capacity for securing a strategic exit, demand specific evidence:

- Specific examples of past strategic buyer outreach campaigns.

- The positioning narrative used to quantify cross-sell synergies and recurring revenue value for a non-PE buyer.

9. Focus on Hybrid Models: The Project Revenue/VAR Advisor Fit

The decision to include general IT solution or VAR-focused M&A firms is for hybrid providers with heavy project revenue or a legacy VAR structure who do not fit the pure-play MSP mold. Using a generalist requires maximum diligence; without proven expertise in subscription finance, they risk mispricing your business and failing to position it for strategic MSP M&A advisors who demand MRR quality scrutiny.

Demand these mandatory trust checks:

- Confirmation of recent MSP transactions, not just VAR deals.

- Verification that they understand MSP-specific diligence, including churn cohorts and client concentration analysis.

- A sample KPI pack for PSA/RMM data analysis (e.g., utilization, effective labor rate).

10. Specialized Guidance for Small-Deal MSP Transactions

Most institutional MSP M&A advisors gravitate toward enterprise-level EBITDA, often leaving smaller, high-growth boutiques without professional representation. For these smaller deal economics, securing expert guidance—not a casual intro broker—is essential. You must still run a rigorous multi-buyer process to generate competitive tension and maximize valuation, avoiding the trap of settling for the first offer.

Before engaging, ensure advisor incentives align perfectly with your exit strategy:

- Minimum Fee Clarity: Demand transparent base fee structures and minimum engagement costs upfront.

- Competitive Tension Plan: Require a documented strategy outlining how they will execute a multi-buyer process.

- Red-Flag Checklist: Watch for vague answers on fees (especially earn-outs), lack of verifiable seller references, or pressure to accept the initial Letter of Intent (LOI).

A 6-Step Execution Plan for Vetting and Engaging MSP M&A Advisors

This execution schedule provides the focused due diligence process required to vet top-rated MSP M&A advisors. Use this framework to efficiently narrow your shortlist and ensure the advisor’s incentives align with maximizing your realized cash-out, mitigating the risk of a retrade.

Step 1: Define Your Non-Negotiables and Exit Architecture

Solidify the deal architecture you intend to sell before engaging any advisor. This prevents advisors from steering you toward their easiest deal type.

- Define the Exit Architecture: Commit clearly to a full exit, a recapitalization with roll equity, or a strategic merger.

- Establish Continuity Mandates: Define non-negotiable terms for staff retention, client continuity, and post-close involvement duration.

-

Determine Timeline: Set a realistic, internal 9-to-12-month preparation and transaction schedule.

- Outcome: Create a single-page Exit Mandate Document defining scope and non-negotiables.

Step 2: Demand MSP-Specific Proof and References

Advisors must prove they operate in your specific MSP vertical and size range. Generic middle-market claims lack relevance in specialized MSP M&A.

- Request the Transaction List: Demand an anonymized deal list showing MSP or MSSP transactions closed in the last 18-to-24 months. Focus on deals within your size range.

- Contact Seller References: Execute calls with two or three previous MSP seller clients recently sold through their firm. Specifically ask about the earn-out structure and technical diligence preparation.

- Validate Valuation Metrics: Ask how they rationalize your adjusted EBITDA and valuation multiples using non-proprietary benchmark data.

Step 3: Pressure-Test Their Buyer Network

A competitive sale process requires a deep, pre-existing network of qualified buyers, including Private Equity platforms and strategic acquirers.

- Map the Top 20 Buyers: Require a list of the 20 specific PE platforms and strategic acquirers they would contact first for your MSP profile. Verify that this list is customized to your niche, not generic.

Step 4: Get Fee Clarity in Writing

Lock down the fee calculation structure to ensure alignment with your actual cash received at closing.

- Clarify Success Fee Calculation: Demand a written fee schedule confirming precisely how the success fee is calculated against cash at close versus the earn-out versus rollover equity.

- Confirm Retainer Credit: Confirm in writing if the retainer fee or work fee is credited against the final success fee amount.

Step 5: Validate Diligence and Narrative Discipline

Minimize the risk of a retrade by vetting the advisor’s ability to manage technical diligence and the quality of your Monthly Recurring Revenue (MRR).

- Review the Data Room Index: Request their standard data room index template. Look for detailed sections dedicated to PSA/RMM data, churn cohorts, client concentration reports, and the security posture review.

Step 6: Earn-Out and Key Retention Safeguards

Earn-outs and staff retention clauses are critical risk areas where MSP sellers often lose value. Demand proactive control measures.

- Require Negotiation Examples: Ask for concrete examples of how they negotiated control rights, reporting metrics, and protections for key staff and benefits within past earn-out structures.

Ergebnis

Apply this structured diligence schedule to shortlist 2–3 top-rated MSP M&A advisors. Select professionals who possess verifiable expertise, transparent fee structures, and the process discipline required to maximize your enterprise valuation.

FAQ

Most MSP M&A advisors use a tiered fee structure: a non-refundable retainer or work fee (creditable against the final success fee) plus a success fee, typically calculated as a percentage of the total enterprise value. Smaller deals often face a higher success percentage. Before signing, demand a written fee schedule confirming how the fee is calculated against the realized cash-out, earn-outs, and rollover equity components. See Section 7 for full transparency checks.

Prepare a comprehensive data room centered on M&A readiness. Critical items include clean, adjusted financials, detailed recurring revenue metrics (MRR/ARR), client concentration analysis, and verifiable churn cohorts. Operational maturity proofs—such as RMM/PSA utilization KPIs, SOPs, and a summary of your security posture—are mandatory. Organizing this early enforces process discipline and mitigates the risk of a retrade.

MSP valuation multiples vary significantly based on the quality of the recurring revenue, not just total revenue. Best-in-class firms (high margin, specialized vertical focus, low client concentration, high operational maturity) often command materially higher multiples than the median samples. The most critical factors are adjusted EBITDA, growth rate, and the durability of your MRR. Use benchmark data to sanity-check all projections before anchoring on a figure.

Advisors must prove their recent activity within the channel. Demand a verifiable list of completed MSP transactions in the last 18 months, not vague “tech deal” claims. Request two or three recent seller references in your EBITDA range, and insist on reviewing their MSP-specific technical diligence checklist. A true specialist will demonstrate deep familiarity with MRR quality, PSA/RMM data analysis, and current Private Equity buyer theses.

Earn-out protection hinges on control and metric clarity. Ensure the definitions for all financial or operational metrics are unambiguous and that you retain sufficient influence over them post-close. Insist on clear clauses covering control rights, mandatory reporting frequency, staffing commitments, and dispute resolution processes. If you cannot influence the metric, push for a higher cash amount at close or tighter contractual controls to safeguard your final payout.