مقدمة

على مدار ما يقرب من 30 عاماً من وجود أمازون، استخدم ملايين الأشخاص منصة التجارة الإلكترونية لبناء أعمالهم التجارية الخاصة بهم، وكثير منها يزدهر الآن ويحقق إيرادات بملايين الدولارات سنوياً. وفي الوقت نفسه، يتطلع العديد من أصحاب متاجر أمازون الناجحة إلى بيع شركاتهم والانتقال إلى مشاريع أخرى. ومع ذلك، سرعان ما يكتشف بائعو أمازون الذين يبدأون في البحث عن إمكانية بيع أعمالهم التجارية أن هناك القليل جداً من المعلومات الموثوقة المتعلقة بعمليات الاستحواذ على أمازون المتاحة للجمهور. بالنسبة للجزء الأكبر، يتعين على أصحاب الأعمال أن يشقوا طريقهم من خلال عدد لا يحصى من الخرافات والتخمينات المنتشرة في المدونات والمنتديات، في محاولة لتحديد ما هو صحيح وما هو غير صحيح.

وفي ضوء هذا الوضع، تواصل فريق Nuoptima مع أكثر من 20 مجمّعاً من أمازون وجمع معلومات قيّمة لمساعدة البائعين المحتملين على وضع أعمالهم في موضعها الصحيح للحصول على أفضل صفقة ممكنة. لقد وضعنا رؤيتنا القائمة على المحادثة في سلسلة من المقالات، والتي غطت بالفعل تفضيلات المجمّع ومتطلبات أهداف الاستحواذ والنموذجية هياكل صفقات الاستحواذ على أمازون. سوف نركز على المفاهيم الخاطئة الشائعة لدى أصحاب الأعمال التجارية في أمازون فيما يتعلق بالعوامل التي يمكن أن تزيد أو تخفض تقييم أعمالهم.

العوامل التي تؤثر على قيمة أعمال أمازون التجارية

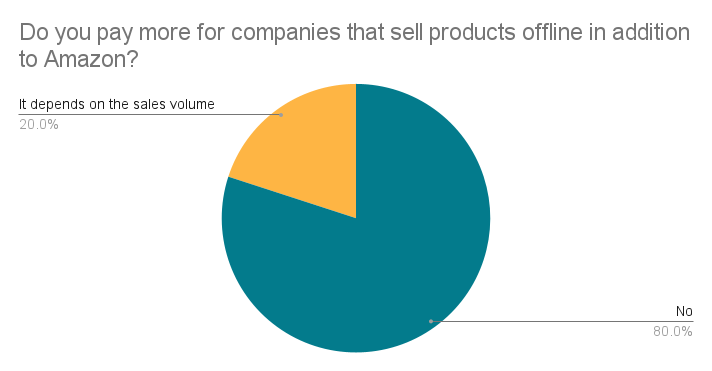

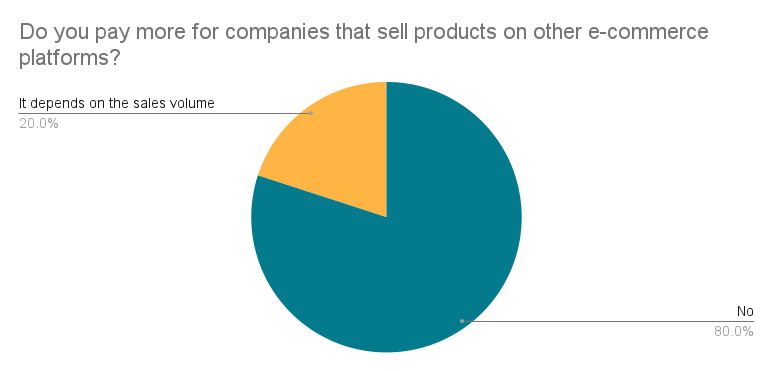

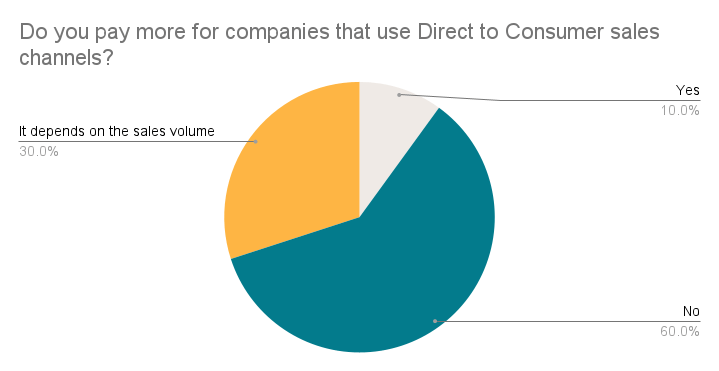

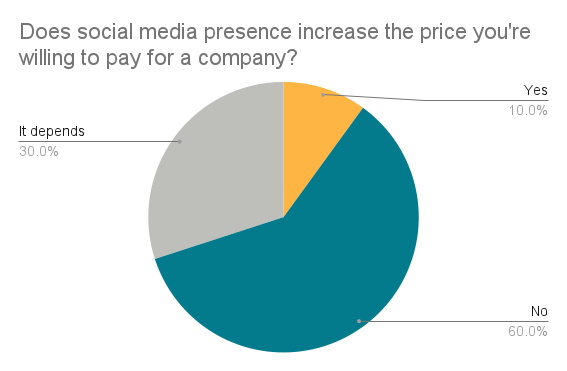

يعتقد العديد من أصحاب الأعمال التجارية في أمازون الذين يتطلعون إلى بيع أعمالهم أن وجود قنوات بيع أخرى بالإضافة إلى أمازون يمكن أن يساعد في تعزيز علامتهم التجارية، وتحسين فرص الاستحواذ على أعمالهم، وفي النهاية زيادة تقييم تلك الأعمال. ومع ذلك، أظهرت محادثاتنا مع ممثلين من أكثر من 20 مجمّعاً من أمازون أن هذه الفكرة لا تنطبق إلا في عدد قليل من الحالات. في الواقع، قال معظم الذين قابلناهم إن قنوات البيع الأخرى لا تزيد بالضرورة من تقييم الشركة. وذكر غالبية المستجيبين أن قنوات المبيعات الإضافية لها تأثير إيجابي على سعر الشركة فقط إذا كانت تجلب قدراً كبيراً من إيرادات المبيعات.

قد يكون لدى العديد من العلامات التجارية في أمازون وجود DTC على Shopify/ Woocommerce، ومع ذلك، فإن معظم حركة المرور يتم تحقيقها من خلال الإعلانات باهظة الثمن على Google أو Facebook. في كثير من الحالات، نرى في كثير من الحالات مواقع إلكترونية عمرها من عام إلى عامين بدون حركة مرور عضوية مع عائد سلبي على الإنفاق الإعلاني (ROAS). على الرغم من أنه من الجيد أن نرى أن العلامة التجارية حاولت بناء وجود لها خارج أمازون، إلا أنها لا تمثل نفس العائد على الإنفاق الإعلاني مثل القائمة الرائعة على أمازون، وبالتالي فإن القيمة الإضافية غير مبررة.

فماذا يعني ذلك بالنسبة لك كصاحب عمل؟ تعتمد الإجابة على ما إذا كانت خططك قصيرة الأجل أو طويلة الأجل. إذا كنت تخطط لبيع شركتك في المستقبل القريب، فعلى الأرجح أن الأمر لا يستحق الوقت والجهد لاستثمار الأموال في إنشاء قنوات مبيعات جديدة فقط من أجل التنويع. ومع ذلك، إذا كنت لا تتطلع إلى البيع بعد وترغب في تنمية أعمالك على المدى الطويل، فقد يكون ذلك فرصة نمو كبيرة لشركتك إذا تم القيام به بشكل صحيح. إن الاستثمار في تحسين محركات البحث (المحتوى والروابط الخلفية) سيمنحك موقعاً مماثلاً في بحث جوجل كما فعلت مع أمازون (على الرغم من أن الأمر قد يستغرق وقتاً أطول وسيكون أكثر تكلفة).

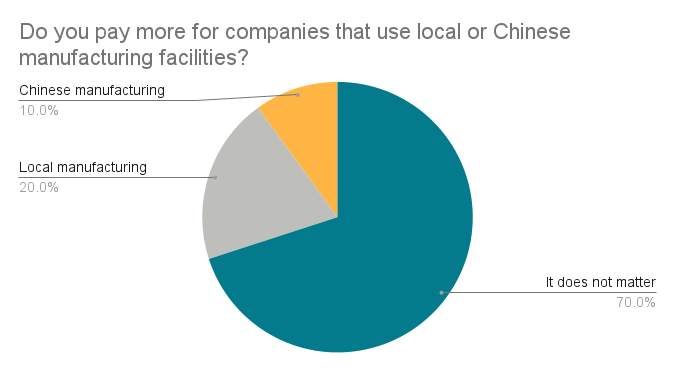

يشعر العديد من أصحاب الأعمال في أمازون الذين عملنا معهم بالقلق من أن تتأثر احتمالات استحواذهم سلباً بحقيقة أن منتجاتهم تُصنع في الصين. وهذا مثال مثير للاهتمام، حيث تمتلك بعض شركات التجميع الأكبر مثل ثراسيو ومجموعة برلين للعلامات التجارية فرقاً في الصين ويمكنها الاستفادة من سلسلة التوريد في الصين لصالحها والتعامل مع المشكلات على الفور. العديد من شركات التجميع الأصغر محايدة بشأن الصين. ومع المخاطر الأخيرة في سلسلة التوريد العالمية، نتوقع أن تزداد جاذبية التصنيع المحلي.

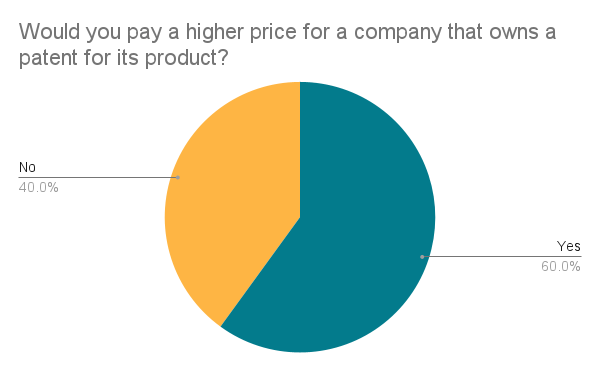

اليوم، هناك أكثر من مليوني بائع على أمازون يعرضون منتجات لا حصر لها. وبطبيعة الحال، في هذه البيئة، من الصعب الحصول على منتجات حصرية. فالعديد من البائعين يحصلون على مخزونهم من نفس الموردين الموجودين في الصين أو في أماكن أخرى، مما يجعل من الصعب الفوز بصناديق الشراء وجذب المشترين. وهذا ما يجعل الشركات التي تمتلك براءات اختراع أو حقوقاً لتصميمات منتجات محددة جذابة للغاية بالنسبة لشركات التجميع. ويدعم ذلك حقيقة أن 60% من الأشخاص الذين تحدثنا إليهم قالوا إن الشركات التي تمتلك براءات اختراع لمنتجاتها تكون قيمتها أعلى بشكل عام. ومع ذلك، فإن نسبة المجيبين الذين قالوا إن ملكية براءات الاختراع لا تؤدي بالضرورة إلى تقييم أعلى هي أيضاً كبيرة. ذكر بعض المجيبين أن العديد من براءات الاختراع يمكن التحايل عليها بسهولة نسبياً، مما يجعلها عديمة الفائدة. بالإضافة إلى ذلك، فإن العديد من المجمّعين قادرون على تنمية أعمالهم بنجاح حتى بدون براءات اختراع أو حقوق حصرية للمنتجات.

الاستنتاجات

تُظهر رؤانا التي جمعناها من المحادثات التي أجريناها مع العديد من المجمّعين وخبراء الصناعة أن العديد من المفاهيم التي يؤمن بها مجتمع بائعي أمازون لا تعكس بالضرورة الوضع الفعلي للأمور في الصناعة. يجب على أصحاب الأعمال الذين يتطلعون إلى بيع شركاتهم بأعلى سعر ممكن أن يفحصوا عملياتهم بشكل نقدي ويتخذوا خطوات للتخفيف من المخاطر وإجراء التحسينات التي يمكن أن تمنح الشركة ميزة تنافسية حقيقية وتمهد الطريق للنجاح على المدى الطويل بدلاً من إجراء تغييرات تحسن الأعمال على الورق فقط. هناك مجال كبير لمزيد من البحث وهو مقارنة المضاعفات المدفوعة حسب حجم الأعمال. وفي نوبتيما ومجموعة Alphagreen Group، نرى مضاعفات أعلى تُدفع لصفقات أكبر بكثير، بينما لم تعد الصفقات الأصغر حجماً تُقبل أو تضطر إلى خفض توقعات تقييمها بشكل كبير لتكون ذات

الفائدة للمشترين.