If you were to analyze businesses with an Annual Recurring Revenue (ARR) of over $100 million, what insights would emerge? Are there distinct patterns separating the growth trajectory of B2B SaaS ventures from B2C ones? What strategies do SaaS aggregators use to achieve $100M ARR through strategic acquisitions?

In this article, we will explore six research-backed approaches to help your business achieve the coveted $100M ARR milestone. We will dive into five traditional growth strategies, unveiling the critical metrics and methodologies that lead to sustainable growth. We’ll also reveal one unconventional tactic that helps many businesses reach and exceed a $100M ARR.

5 Ways to Build a $100M+ ARR Business

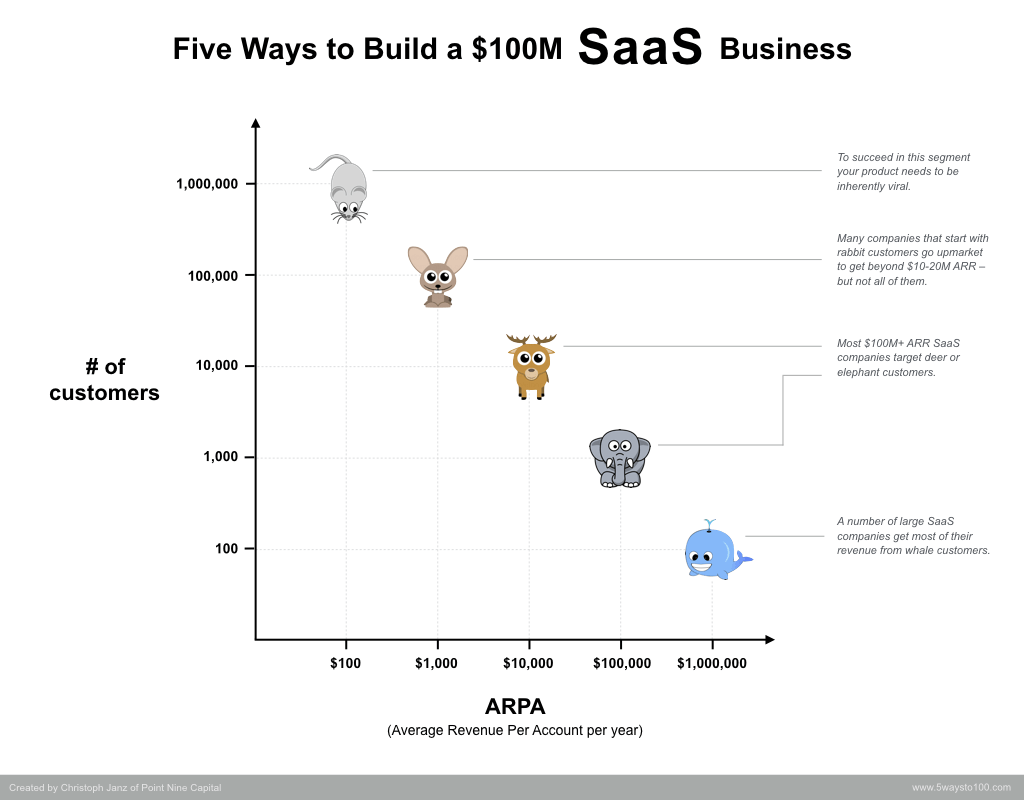

In the grand safari of SaaS, your customers are as diverse as the animal kingdom itself. Just as hunting each animal requires a distinct approach, each customer segment has its unique GTM strategy and growth strategies.

Christoph Janz, a partner at Point Nine Capital, created a classification system with five distinct animal types to categorize SaaS customers based on their Average Revenue per Account (ARPA)[1].

Let’s delve into these conventional methods of building a $100 million business by examining each of these animal segments.

1. “Mice” – Leverage Viral Growth Mechanisms

One potential strategy in the pursuit of building a $100m+ ARR business is targeting what we call “Mice” – customers with a relatively small average revenue per account (ARPA) but abundant in numbers. In an ideal scenario, a business hunting “mice” would have 1 million consumers paying $100 each year for their services ($100 ARPA).

The key here is to emphasize volume and efficiency – it’s about casting a wide net. Consider businesses like Calendly or Hubstaff, which thrive on this principle. Calendly simplifies calendar bookings, while Hubstaff streamlines time tracking. Both rely on capturing a large user base, each contributing modestly to the overall revenue.

A prime example of this approach is Everbee, a tool tailored for merchants on Etsy looking to gain insight into the best-selling items on the platform to discover potential product launches to grow their sales. During a recent discussion on our SaaS Minds podcast, the founder shared some valuable perspectives on his business experience. Within just two years, Everbee achieved an impressive $5m ARR, fueled by 50,000 individual users paying $20 per month – a quintessential Mice business model.

To learn more about his entry into the SaaS space and journey towards becoming a $100m ARR business, listen to the podcast episode.

Strategic Implementation: Viral growth mechanisms are designed to organically increase product visibility and adoption. By embedding features that naturally encourage users to share your product, you can capture a large volume of smaller customers.

In the case of Everbee, its success was largely attributed to the implementation of such mechanisms. By running Facebook ads directing people to sign up for a freemium version of the product and leveraging growth channels like YouTube, the company was able to achieve the virality needed to scale its low ARPA product effectively.

2. “Rabbits” – Focus on a Niche Market

A step up in the food chain, “rabbits” represent your small to medium businesses – ideally 100,000 businesses, each paying $1000 per year ($1000 ARPA). These businesses require a different approach but promise a higher return on investment compared to mice. The trick with targeting this segment lies in striking a balance between personalized attention and scalable growth strategies.

Take, for instance, Zenmaid, a vertical market tool tailored for cleaning businesses. By focusing on a niche market like this, the company was able to rapidly gain traction within the cleaning industry, establishing itself as the go-to solution for businesses in need of streamlined operations and enhanced productivity tools.

We featured the founder of Zenmaid on the SaaS Minds podcast, where he delved into his go-to-market strategy and pricing tactics for hunting these “rabbits” effectively. You can listen to the episode here.

Strategic Implementation: Zeroing in on a niche market, or “rabbits”, allows a SaaS company to ensure a deep product-market fit. This focus facilitates a strong initial user base and sets a solid foundation for scaling.

3. “Deer” – Expand Market Reach Gradually

Moving into the “Deer” segment represents a shift towards more substantial businesses, often mid-market companies that offer a significant increase in average revenue per account ($10,000 ARPA). Targeting this segment demands a strategic approach, typically involving tailored sales efforts and customized solutions.

For instance, Zendesk’s customer service software is tailored to meet the needs of medium-sized businesses, aligning its offerings and pricing strategy with the “deer” segment. Another notable SaaS example is ThinkChain, an AI platform catering to private equity, finance, real estate, and professional investors. Tony Lewis, the founder, shared insights into their client acquisition strategy in one of our podcast episodes.

One of the main reasons companies target “Deer” is because, in order to achieve significant growth, you need to get your churn rate close to zero (or better yet, achieve negative churn), which is typically unattainable if you’re only selling to Small and Medium-sized Businesses (SMBs). Another reason is that outbound sales strategies may not be effective if your ARPA is not large enough, which limits your potential customer base to businesses that are actively seeking a solution that aligns with your product or service.

Strategic Implementation: Offer personalized solutions and value-based pricing to mid-market businesses through a high-touch sales approach. Foster long-term customer relationships by proactively engaging in strategic partnerships to drive mutual growth and market expansion within the “Deer” segment.

4. “Elephants” – Build a Sales-Driven Approach for Larger Deals

“Elephants” are high-value clients with an annual recurring revenue of over $100,000 ($100,000 ARPA). These large enterprises hold the potential to significantly impact your ARR with just a few deals. Securing an elephant requires deploying your top sales professionals, exercising patience, and often crafting a tailored solution that deeply integrates into their operations.

A good example of a company that successfully caters to these organizations is Salesforce, renowned for its CRM solutions tailored to large enterprises. Its extensive platform and ability to command higher contract values firmly place it among the “elephants” in the industry.

Strategic Implementation: Transitioning to a sales-driven model is essential when targeting larger accounts or “elephants.” This shift typically involves developing a dedicated sales team capable of navigating the complex sales cycles and bespoke needs of larger clients. Additionally, organizing events and fostering more physical interaction are often necessary steps to succeed in the game of landing elephants.

5. “Whales” – Pursue Upmarket Customers

With an ARPA of $1,000,000 or more, “whales”, known as the titans of the SaaS ocean, are those once-in-a-lifetime clients that can transform your business ($1,000,000 ARPA). For instance, companies offering extensive enterprise software solutions like ERP, Oracle, or SAP often cater to large organizations, commanding high contract values characteristic of the “whales” segment.

One of the main points to bear in mind is that the higher your ARPA, the fewer users you need to reach that $100M ARR milestone. To illustrate, you would only need 100 whales to reach $100m, whereas you would need 1 million mice to achieve the same result.

But, of course, capturing a whale is much more difficult than a mouse. Take Palantir, for example, a prominent tech firm specializing in government contracts. Approximately 50% of their client activity stems from government contracts[2], representing whales in this context. Government contracts typically involve extensive administrative and procurement processes, lasting between 12 to 24 months. Despite the lengthy acquisition process, these contracts are less likely to churn, providing a stable revenue stream for Palantir.

Are there 100 government bodies that can buy Palantir services? Absolutely. However, in contrast, businesses targeting smaller clients, akin to mice in the market, face higher churn rates. For instance, while there may be over 7.5 million merchants on platforms like Etsy, many of them start the business but soon after go out of business, which means a high churn for companies like Everbee operating in the mice segments. With government bodies and other elephants or whale customers, the churn is much lower.

Hunting Mice vs Whales – Which Is Better?

According to the well-known author George Orwell, “All animals are equal, but some animals are more equal than others.” In a business context, this means that while all clients contribute to revenue, targeting “whales” or “elephants” offers greater stability and growth potential compared to serving a multitude of smaller clients. Let’s explore if this statement rings true.

The Argument for Targeting Larger Animal Segments

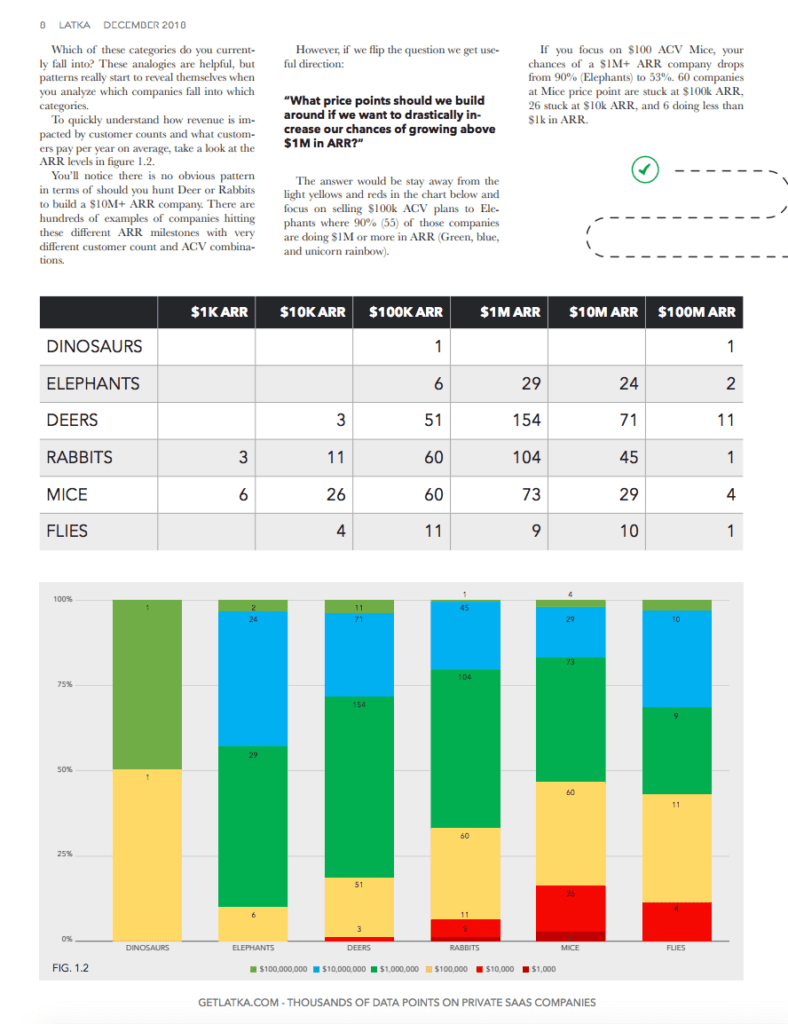

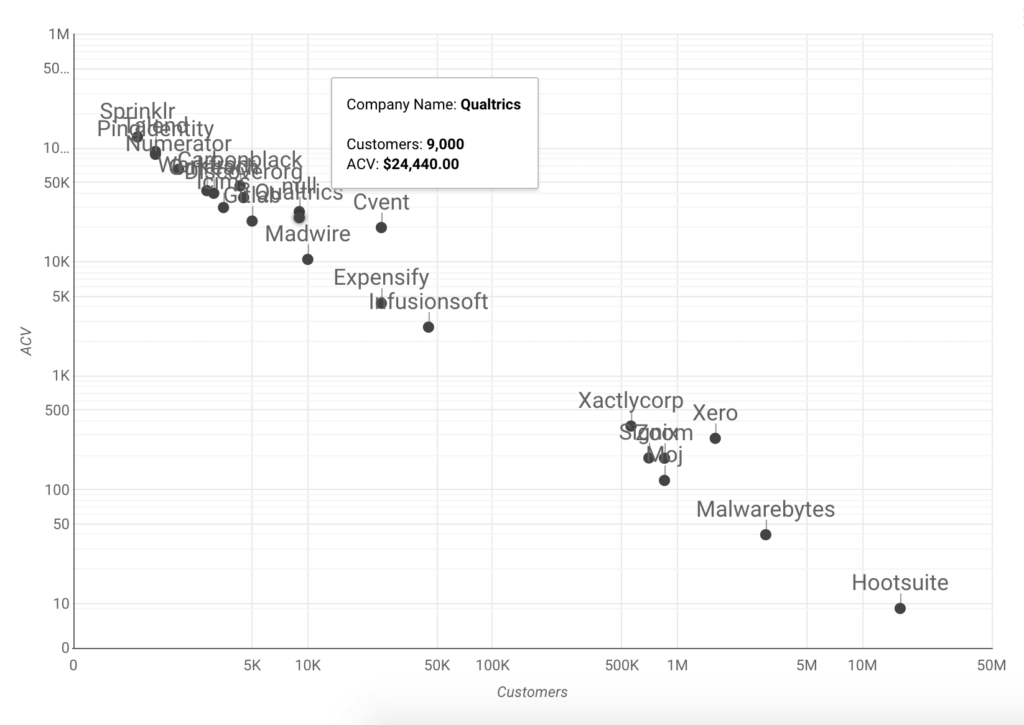

According to Nathan Latka’s study of 20 companies that have surpassed $100 million in annual recurring revenue (ARR), only 30% of them maintain their focus on customers with low average contract values (ACVs)[3].

The images below highlight this, with 70% of the 20 $100M ARR companies targeting larger animal segments.

This indicates a strategic shift towards targeting larger and more profitable contracts, which is a common trait among mid-market and enterprise-focused SaaS companies. As a result, these $100 million ARR companies tend to focus on acquiring high-value customers, such as “Deer,” “Elephants,” and “Whales,” rather than smaller animal segments.

The Argument for Targeting Smaller Animal Segments

However, In a different study conducted by Sammy Abdullah, the co-founder of Blossom Street Ventures, he analyzed a set of 61 publicly traded SaaS companies and their estimated ACVs at exit or when they went public and found that the world’s biggest and best software companies tend to have smaller ACVs[5].

He argues that Average Contract Value is a vanity metric that shouldn’t be put on a pedestal. It should instead be looked at as part of a group of ratios, which include the number of qualified leads, close ratio, sales cycle, and other critical sales metrics.

The Balance – Achieving $100M ARR

Examining our examples and the accompanying data, it becomes evident that there are multiple pathways to building a $100M ARR business. Hunting mice, whales, and other animal segments in between present viable strategies for achieving this ambitious goal. While targeting smaller clients, akin to mice, can yield significant revenue through volume, pursuing larger, high-value clients, or whales, offers the advantage of stability and scalability.

That said, amidst these strategies lies a pivotal metric that determines the success of your SaaS business.

In 2015, Neeraj Agrawal, a partner at Battery Ventures in Boston, introduced the T2D3 concept. According to T2D3, to reach unicorn status with a $1 billion valuation or achieve $100 million ARR (assuming a 10x revenue multiple), a company should triple its revenue in the first three years and then double it every subsequent three years[6].

This framework is validated by McKinsey & Company, as they emphasize that maintaining a high ARR growth rate, especially as a startup scales after the product-market fit, is a key factor in sustained revenue growth beyond unicorn status (more than $1Bn in corporate value)[7].

Analyzing data from 72 companies that achieved $100 million ARR, Kim Chihill found that 50% of these companies reached this milestone between years 5 and 10, with most founded between 2000 and 2010[8]. This aligns with both the T2D3 theory and McKinsey’s studies.

Notably, these companies achieved over 170% year-over-year (YoY) ARR growth to reach $100 million ARR. They maintained such a high growth rate even after surpassing this milestone to sustain their success and join the $1 billion ARR club. This highlights the importance of consistent, rapid growth in ARR as a fundamental driver of long-term success in the SaaS industry.

The “Easier Way” to Reach $100M ARR

In the pursuit of building a $100M+ ARR business, much emphasis is placed on businesses targeting different customer or “animal” segments. However, these traditional strategies tend to overlook institutions that do not follow conventional business practices, such as venture acquirers. But is it valid to exclude these institutions? Could there be an “easier” or alternative way to achieve $100M+ ARR without following the conventional methods?

The answer may lie in the aggregation method—acquiring SaaS companies to build a portfolio with a cumulative ARR of $100 million or more.

One prominent player in this strategy is Constellation Software, boasting over $8 billion in revenue. This group consistently acquires 50 to 100 SaaS companies annually, particularly focusing on the vertical market software segment.

Another exemplar is Visma, a private equity-owned firm that recently brought more investors at a $21 billion valuation. Based in Norway, Visma has a portfolio of 184 companies and a total annual recurring revenue of EUR 2.4 billion.

Although smaller in scale, SaaS.Group is yet another notable aggregator. With $50 million ARR from 18 companies, they are steadily advancing toward the coveted $100 million ARR milestone. In fact, at one of NUOPTIMA’s webinars, we hosted the head of origination at SaaS.Group, where we discussed how to acquire SaaS companies as well as strategies for preparing for a successful exit as a SaaS founder. To get more insight on this, watch the episode here.

Invest in the Services of Full-Stack Growth Agency NUOPTIMA

In the SaaS industry, scaling a company to $100M+ ARR requires expert guidance and strategic direction. This is where NUOPTIMA comes in as your indispensable partner in the process. We specialize in developing comprehensive growth strategies that go beyond conventional approaches to create customized solutions that help businesses achieve their ambitious goals.

Our approach begins with a thorough analysis of your product and market dynamics. We conduct meticulous research to identify customer segments that have the potential for exponential growth. By partnering with us, you will not only gain strategic insights but also a dedicated ally committed to your success at every step.

Our impressive track record speaks for itself. A great example of this is our collaboration with a company called Alphagreen. With our help, the business was able to build the largest CBD marketplace in Europe in just six months[9]. This momentous achievement not only cemented Alphagreen’s market dominance but also earned them a nomination for the prestigious ‘Best Scale Up’ award at the 37th Marketing Society Awards.

At NUOPTIMA, our expertise does not end there. We excel in guiding businesses through every stage of growth, from identifying acquisition opportunities to optimizing market presence. Whether you’re targeting small or large markets, our tailored strategies and innovative tactics are poised to unlock your full growth potential.

Ready to begin your journey to $100M+ ARR? Book a free discovery call today and take the first step toward realizing your business aspirations.

Conclusion

In the world of SaaS, businesses use various strategies to reach $100M+ ARR. Whether you’re targeting mice, rabbits, deer, elephants, or whales, there are plenty of great examples of $100M ARR companies thriving in each category.

Each approach has its own advantages and challenges, highlighting the fact that there is no one-size-fits-all solution for success and that the path to $100M ARR can be achieved through various means. That said, a rapid growth rate remains an undisputed factor in achieving this goal, so as you embark on this journey, ensure your business has a solid product-market fit, leverage your strengths, and relentlessly pursue growth.

Finally, if you have the capital, deal flow, and ability to execute, venture aggregation is also a good strategy for building a $100M ARR business.

References

- https://www.upekkha.io/blog/saas_million_dollar_company_christoph_jans[1]

- https://www.cbsnews.com/news/palantir-shares-jump-30-in-stock-market-debut-direct-listing/[2]

- https://christophjanz.blogspot.com/2019/04/[3]

- https://www.linkedin.com/posts/nathanlatka_saas-pricing-software-activity-6536259990234165248-4IOa/[4]

- https://blossomstreetventures.medium.com/dont-obsess-over-average-contract-value-9545a59537d5[5]

- https://techcrunch.com/2015/02/01/the-saas-travel-adventure/[6]

- https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/grow-fast-or-die-slow[7]

- https://kimchihill.com/2020/04/09/path-to-100m-arr/[8]

- https://www.businessleader.co.uk/europes-biggest-cbd-marketplace-alphagreen-set-to-raise-2m-funding/[9]