When it comes to business acquisitions, things are never as easy as parties wish they could be. Whether it’s an acquisition of a company that brings in hundreds of millions of pounds every year or a small Amazon FBA business, extensive negotiations are necessary to ensure that both the seller and the buyer get the best possible deal. Amazon FBA businesses are usually sold through Asset Purchase Agreements (APAs) or Share Purchase Agreements (SPAs). The main difference between the SPA and the APA is that when acquiring the legal entity (i.e. the Company), it is done via a SPA. When acquiring only the Amazon account with all the reviews, history and trademarks, it is usually done via an asset purchase agreement. In this article, we will explain what a purchase agreement is, why it’s necessary, and discuss all the things you need to pay attention to when negotiating an APA or SPA.

What is a purchase agreement (SPA or APA) and how is it used in a business acquisition

A Share Purchase Agreement (same applies to APA) is a binding legal document that outlines the terms of a transaction between two parties, namely, a buyer and a seller, and obligates them to carry out said transaction. This document is used in many areas, including company acquisitions. Usually, an SPA / APA is drawn up once the initial negotiations have concluded and the parties have signed a letter of intent or heads of terms document. SPAs / APAs are usually prepared by the buyer’s legal counsel. Here are some of the things a typical SPA / APA contains:

- Acquisition terms;

- Conditions that may influence the acquisition;

- Information about the risk the buyer and the seller take on in the transaction;

- Clauses that prevent the seller from competing with the buyer in the same market after the acquisition.

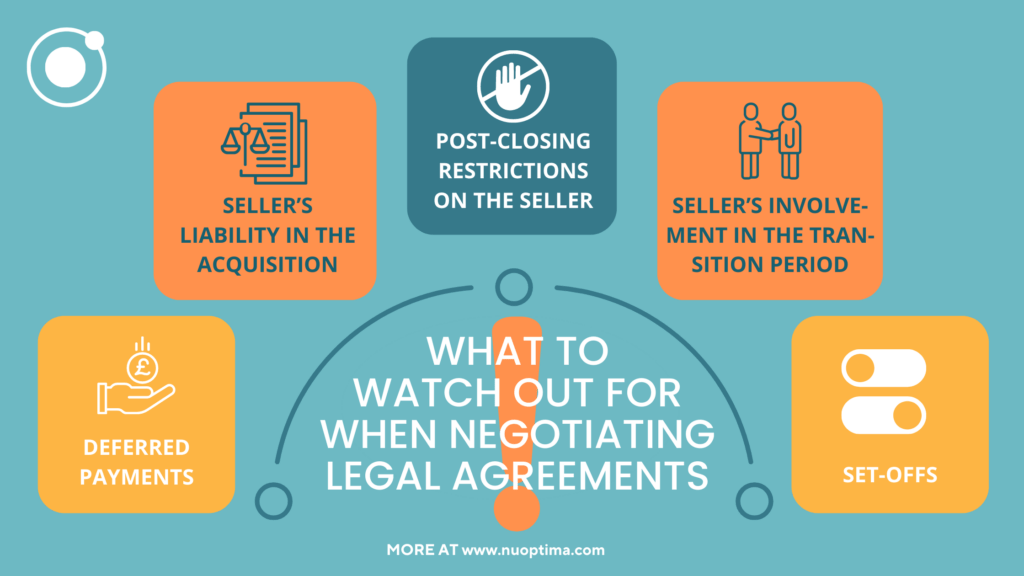

There’s a lot at stake in any business acquisition, which is why it’s crucial to carefully evaluate every part of the purchase agreement and negotiate the clauses that you are not satisfied with. Below, you will find some of the most important things you should pay attention to when negotiating legal agreements regarding the purchase of your Amazon FBA business.

Deferred Payments

Most Amazon FBA acquisition deals are structured to combine an upfront cash payment, deferred payments (usually in the form of an earnout), and profit-sharing components. The earnout sum is usually based on the profit the acquired company generates in a certain amount of time, also known as the earnout period. Thus, both sellers and buyers are motivated to negotiate the best possible earnout conditions. This often includes restrictions placed on the buyer after the deal is signed and the method used to calculate the Seller’s Discretionary Earnings.

Seller’s Liability in the Acquisition

Most SPAs / APAs outline risk distribution between the seller and the buyer. The seller’s liability is usually defined by a list of warranties, representations, indemnities, and limitations in legal documents. Warranties outline the assurances the seller gives the buyer regarding the business being sold. Indemnities specify the buyer’s promise to reimburse the seller in certain situations. In the scenario where the legal entity is being acquired i.e. a Shares Purchase Agreement, the amount of warranties and representations is usually much larger. These can include matters concerning the organisation itself, authority, no conflicts, ownership, subsidiaries, title of assets, employee benefits and contracts, environmental, and IP. Given there might be claims from customers or competitors, the buyer needs to put more protection in place compared to the scenario where only assets are being transferred.

Since the buyer is legally entitled to file a claim against the seller if warranties or indemnities are breached, most SPAs / APAs also put limitations on the seller’s liability. Thus, negotiating indemnities, warranties, and limitations that both parties find reasonable is crucial.

Post-Closing Restrictions on the Seller

Traditionally, virtually every merger and acquisition contract includes a set of post-closing restrictions placed on the seller. These often prevent the seller from starting new companies in the same market and developing competing products. Most aggregators understand that many sellers have other Amazon FBA businesses, or they may be interested in selling new products on Amazon once the deal closes. That means there can be a carve-out in the non-compete for certain other products which are not competing directly with the category the buyer is interested in. As a seller, you should always consider what you’re planning to do after selling your current company and negotiate restrictive covenants outlined in the acquisition deal accordingly.

Seller’s Involvement in the Transition Period

Most Amazon FBA businesses acquired by aggregators are operated by the seller alone and sometimes members of their family or virtual assistants offshore. And even though aggregators generally have extensive experience running and growing Amazon businesses, they usually require assistance from the seller during the transition period. This allows the buyer’s team to successfully take over all the day-to-day tasks associated with running the FBA business. And while support from the seller in the post-closing period is generally considered customary, the duration and extent of that support should be discussed in detail and outlined in the acquisition agreement. Common examples include helping the buyer with first orders and support in getting up to speed with specifications of the product, design and specific issues which were not covered in as much detail during the SaaS buyer due diligence period.

Set-Offs

Traditionally, most acquisition contracts specify a set-off amount, which is a sum that is withheld from payments to the seller because the buyer has a claim for that sum against the seller. While set-offs are expected to be present in most contracts, the exact restrictions, conditions, and amounts are determined through negotiations between the buyer and the seller. In some cases, the set-off sum can be placed in escrow. However, this practice is more widespread in the United States than in the United Kingdom due to its complexity.

Guarantees Provided to the Seller

Even though the seller will usually conduct negotiations with the aggregator’s representatives, when it comes the time to review and sign the SPA agreement, the aggregator’s name will likely be replaced with another unfamiliar company. Putting the name of a special-purpose acquisition entity in the contract is a common practice. However, it can still make the seller feel uneasy about the buying company’s ability to fulfil its financial obligations. Thus, the parent company of the acquisition entity usually provides certain guarantees to the seller. Still, these guarantees need to be thoroughly reviewed by the seller’s counsel.

Price Adjustments

While sellers usually receive a significant sum of money as a payment for their business itself, they are also often entitled to the funds accumulated on the balance sheet of the company they are selling. This usually includes the net cash the business has at its disposal, receivables owed by Amazon to the seller’s company, inventory cost, etc. The amount of money the seller receives on top of the cost of their business is usually discussed in the beginning stages of negotiations.

Final Thoughts

Selling a business is never easy, and you often need to spend many weeks negotiating the conditions of the share transfer agreement until both parties are happy with the results. However, it’s possible to conduct negotiations quickly and efficiently if both the buyer and the seller are motivated to achieve a mutually desirable result. Many software aggregators SaaS claim that they can make a purchase within 30 or 45 days. While it is correct that a quick decision can be made within 1-2 days by looking at the unit economics and quality of the business, most likely it is the legal agreement which will take up to 30+ days. That is partly because of negotiations, but partly because other parties such as lawyers and accountants are also involved and therefore the process can usually take much longer than initially expected.

If you believe that you’re ready to take the next step towards the sale of your business, especially if you’re considering a SaaS exit deal, read our article that explains the entire exit process step-by-step. And if you’re looking for help growing your Amazon FBA company, sign up for a discovery call with one of NUOPTIMA’s experts today.