The Structural Metamorphosis of the Managed Services Landscape

The managed services sector, historically defined by its fragmentation and high degree of localized competition, is currently navigating its most profound structural metamorphosis to date. As we progress through 2025 and into 2026, the era of simple financial arbitrage—where private equity firms acquired Managed Service Providers (MSPs) purely to exploit the spread between entry valuations and exit multiples—has largely concluded. In its place, a complex, multi-dimensional marketplace has emerged, characterized by distinct and often divergent strategic philosophies regarding value creation, integration, and the very nature of IT service delivery.

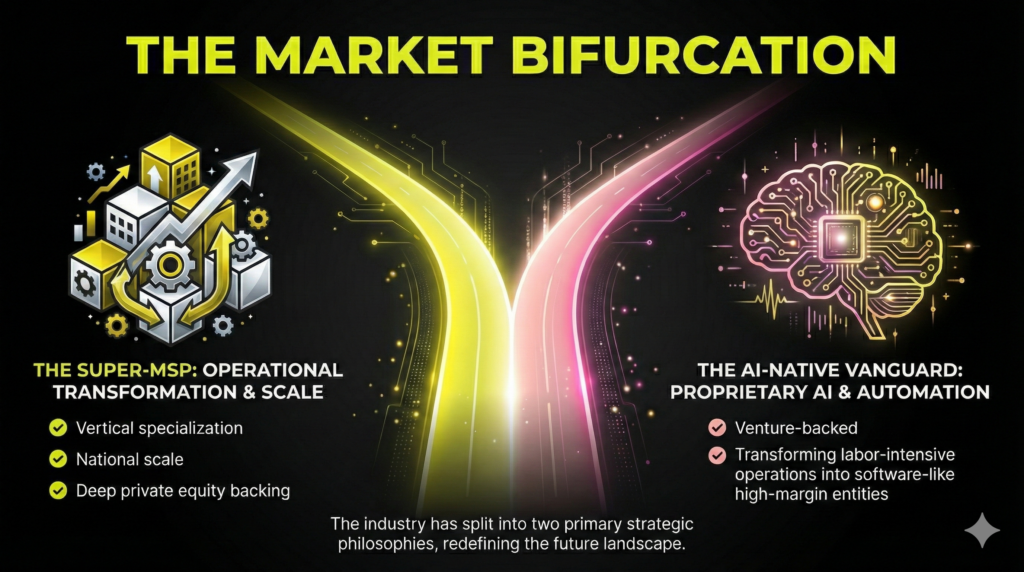

The prevailing narrative of the 2015–2022 cycle was one of aggregation. Investors sought to bundle sub-scale providers, typically generating between $1 million and $5 million in revenue, into regional platforms that could command higher multiples upon exit. While this “roll-up” strategy remains active, it has been superseded in strategic importance by the rise of “Operational Transformation” models.1 The current market is bifurcated. On one side, established private equity platforms are doubling down on vertical specialization and scale, exemplified by “Super-MSP” mergers like the combination of Ntiva and The Purple Guys.2 On the other, a new asset class has emerged: the AI-enabled holding company.

This new breed of acquirer, backed by venture capital firms such as General Catalyst and Thrive Capital rather than traditional private equity buyout funds, views the MSP not as a terminal service business but as a distribution channel for proprietary Artificial Intelligence (AI) and automation stacks. The investment thesis here is not merely to consolidate EBITDA but to fundamentally alter the unit economics of the service model—transforming labor-intensive, low-margin operations into software-enabled, high-margin entities.1

The macroeconomic environment of 2024 and 2025 has further catalyzed this divergence. With interest rates stabilizing at levels higher than the near-zero era, the cost of capital has disciplined the market. Acquirers can no longer rely on cheap debt to fuel growth; they must demonstrate tangible operational leverage. Consequently, we are witnessing the rise of “platform” models that prioritize organic growth and operational maturity over sheer headcount accumulation. The “Equity Partnership” model, championed by groups like New Charter Technologies, has matured into a dominant force, offering sellers a “second bite of the apple” that aligns long-term incentives and preserves the entrepreneurial spirit essential for local market success.4

This report provides an exhaustive analysis of the groups driving this consolidation, structured to highlight their unique operational models, financial structures, and strategic objectives.

The AI-Native Vanguard: The “Venture Buyout” Phenomenon

The most disruptive development in the current M&A cycle is the entry of top-tier venture capital into the MSP rollup space. Historically, VCs avoided services businesses due to their linear revenue-to-headcount scaling. However, the advent of Generative AI has inverted this logic. Investors now believe that the “services economy”—a $16 trillion global market—is the next frontier for AI disruption, provided one owns the underlying workflow data and customer relationships.5

Titan (General Catalyst)

- Founding Year: 2024 (Platform Launch) 7

- Country of Operation: United States 8

- Backing / Capital Source: General Catalyst (Venture Capital) 7

- Primary Acquisition Model: AI-Native “Venture Buyout” / Holding Company 8

- Strategic “Hook” for Sellers: Transforming legacy service models into high-valuation “tech-enabled” assets through proprietary AI injection.

- Investment Thesis: The “Services Economy” is the next frontier for AI. By acquiring MSPs and layering in an “Augmented AI” stack, Titan aims to break the linear relationship between revenue and headcount, achieving software-like margins in a service business. 9

- Operational Implications / Strategy: Heavy operational transformation. Titan implements its own AI platform to automate Level 1/2 support and back-office workflows immediately post-acquisition. 8

- Recent Landmark Deals / Acquisitions: RFA (Richard Fleischman & Associates) – a premier financial services MSP. 7

- Vertical Focus / Specialization: Financial Services and other high-complexity, data-rich regulated industries. 7

Market Position: The pioneer of the “AI Roll-up,” moving from pure financial arbitrage to technological arbitrage.

Shield Technology Partners

- Founding Year: 2024 10

- Country of Operation: United States 10

- Backing / Capital Source: Thrive Capital (Thrive Holdings), ZBS Partners, and OpenAI (Equity Stake) 10

- Primary Acquisition Model: Vertical AI Integration / Partnership Model (60–90% equity acquisition). 11

- Strategic “Hook” for Sellers: Direct access to OpenAI’s research, models, and talent before the broader market; retention of local culture and leadership. 10

- Investment Thesis: Vertical integration of AI software and IT services. Shield views MSPs not just as service providers but as distribution channels for advanced AI models that require deep context and customer data to function effectively. 10

- Operational Implications / Strategy: Decentralized brand strategy but centralized technology injection. Partners keep their name and autonomy while Shield upgrades their delivery engine with AI. 11

- Recent Landmark Deals / Acquisitions: Option One Technologies, ClearFuze, IronOrbit, OneNet Global. 10

- Vertical Focus / Specialization: Highly regulated sectors such as Biotech, Financial Services, and Oil & Gas. 10

- Market Position: A “Venture Capital Platform” bridging the gap between Silicon Valley AI labs and Main Street IT services.

The “Forever Hold” and Decentralized Aggregators

While AI-native groups seek radical transformation, another class of acquirers focuses on radical stability. These groups, modeled after conglomerates like Berkshire Hathaway or Constellation Software, prioritize long-term cash flow compounding and minimal operational disruption.

Lyra Technology Group (Evergreen Services Group)

- Founding Year: 2017 (Evergreen), 2022 (Lyra formed as operating group) 12

- Country of Operation: US, Canada, UK, Australia, New Zealand 12

- Backing / Capital Source: Alpine Investors (Private Equity)

- Primary Acquisition Model: “Forever Hold” / Decentralized Aggregation 12

- Strategic “Hook” for Sellers: A “permanent home” for the business with no intention to flip; 100% autonomy regarding brand, team, and culture.

- Investment Thesis: Creating a “Berkshire Hathaway” of MSPs. They buy profitable businesses and hold them indefinitely to compound cash flow, avoiding the disruption of integration. 4

- Operational Implications / Strategy: Extremely light touch. Acquired MSPs run independently. Lyra provides a peer community and financial discipline but does not force tool consolidation. 13

- Recent Landmark Deals / Acquisitions: REDD (Australia – 100th acquisition), The Final Step (UK), Blackbird IT. 12

- Vertical Focus / Specialization: Generalist (Portfolio contains specialists, but the group is sector-agnostic).

- Market Position: The global volume leader in MSP acquisitions; the safe harbor for owners who want to preserve their legacy.

The 20 MSP

- Founding Year: 2013 (Group), 2022 (Aggressive M&A launch) 15

- Country of Operation: United States 15

- Backing / Capital Source: Private / Debt-Funded (Sunflower Bank). No Private Equity backing. 15

- Primary Acquisition Model: Membership Conversion (Proprietary Funnel) 16

- Strategic “Hook” for Sellers: Zero integration friction. Targets are already members of “The 20 Group,” using the same tools and help desk processes before acquisition.

- Investment Thesis: Scale through absolute standardization. By acquiring MSPs that already operate identically, they eliminate the “integration tax” that kills most roll-ups. 16

- Operational Implications / Strategy: Pre-integrated. The acquisition is a financial event, not an operational one, as the target is already using The 20’s stack. 15

- Recent Landmark Deals / Acquisitions: Collabrance (Master MSP), iCoreIT (Healthcare division of iCoreConnect), Red Level Group. 17

- Vertical Focus / Specialization: Historically Generalist, now pivoting to Healthcare/Dental via iCoreIT. 18

- Market Position: The “McDonald’s of MSPs”—standardized, scalable, and rapidly expanding through a unique membership-to-equity model.

The “Equity Partnership” Model: Empowering the Owner-Operator

For many high-performing MSP founders, a full exit is undesirable. They still want to grow, lead, and participate in the upside. The “Equity Partnership” model has emerged to serve this demographic.

New Charter Technologies

- Founding Year: 2019 4

- Country of Operation: United States / Canada 4

- Backing / Capital Source: Oval Partners (Private Equity) 4

- Primary Acquisition Model: Equity Partnership (Platform Model)

- Strategic “Hook” for Sellers: The “Second Bite of the Apple.” Sellers roll significant equity into the TopCo, remaining as Presidents of their local units to share in the platform’s eventual exit. 19

- Investment Thesis: Building a high-performance platform by partnering with “best-in-class” MSPs (high operational maturity) rather than distressed assets. Focus on “Co-Managed IT” as a growth engine. 20

- Operational Implications / Strategy: “Autonomy with Accountability.” Centralized Centers of Excellence (Finance, HR, Marketing) support local growth without stifling the entrepreneur. 4

- Recent Landmark Deals / Acquisitions: Verus (Co-managed IT specialist), ProTech IT Solutions, Strategic Solutions. 21

- Vertical Focus / Specialization: Diversified, with emerging strength in Co-Managed IT and hybrid environments. 21

- Market Position: The premium “partner model” alternative to full buyouts, attracting high-performing founders not ready to retire.

The Integrated Platform Giants: The “Super-MSPs”

While decentralized models grow, the traditional “integrate and dominate” strategy remains a powerful force, driven by deep private equity pockets and a drive for national scale.

Thrive

- Founding Year: 2000 (Recapitalized 2016/2021) 2

- Country of Operation: United States, UK, Philippines, Canada

- Backing / Capital Source: Court Square Capital Partners, Berkshire Partners (Invested Jan 2025) 18

- Primary Acquisition Model: Integrated Platform / “NextGen” MSP

- Strategic “Hook” for Sellers: Exit to a sophisticated “Super-MSP” with enterprise-grade security and ServiceNow capabilities.

- Investment Thesis: Standardization on the ServiceNow platform creates automation and scalability that smaller MSPs cannot match. Heavy focus on cybersecurity (MSSP) capabilities.

- Operational Implications / Strategy: Full Integration. Acquired companies are migrated to Thrive’s tools and processes (ServiceNow) to ensure uniform service delivery.

- Recent Landmark Deals / Acquisitions:

- 2025 Expansion: Secured Network Services (New England), Abacode (Compliance/GRC specialist), Baroan Technologies (NJ/Tri-state), VitalCORE (Midwest), and Worksighted (Midwest).

- Prior Deals: Cusos, Storagepipe, 4IT.

- Vertical Focus / Specialization: Financial Services (Alternative Investment/Hedge Funds), Life Sciences, and increasingly Compliance/GRC via the Abacode acquisition.

- Market Position: A high-end “Super-MSP” competing for mid-market and enterprise clients, distinct from the SMB mass market.

Ntiva

- Founding Year: 2004 23

- Country of Operation: United States 2

- Backing / Capital Source: PSP Partners (Pritzker Family Office) 2

- Primary Acquisition Model: Integrated Platform / “Platform-on-Platform” Merger 2

- Strategic “Hook” for Sellers: Joining a top-tier national player with family office backing (longer horizon than traditional PE).

- Investment Thesis: Creating a dominant national MSP through the merger of large regional platforms. Focus on digital transformation and “pure-play” managed services.

- Operational Implications / Strategy: Full integration to build a single national brand and culture. 2

- Recent Landmark Deals / Acquisitions: The Purple Guys (Major merger of two large platforms), Navco. 2

- Vertical Focus / Specialization: Commercial, Non-Profit, Government Contractors. 2

- Market Position: A “Super-MSP” created by merging large regional powerhouses; one of the largest pure-play providers in the US.

Integris

- Founding Year: 2021 (formed via merger of 4 MSPs) 24

- Country of Operation: United States

- Backing / Capital Source: OMERS Private Equity (Pension Fund) / Frontenac (Previous majority) 24

- Primary Acquisition Model: National Platform / Premium Service

- Strategic “Hook” for Sellers: Stability of pension fund capital; focus on premium, regulation-heavy clients.

- Investment Thesis: Building a “premium” national network. The OMERS backing signals a shift toward very long-term value creation rather than a quick flip. 24

- Operational Implications / Strategy: Integrated platform with strong local offices. Focus on “Financial & Legal” grade security and compliance.

- Recent Landmark Deals / Acquisitions: TechMD (Largest to date), 1nteger Security, Blue Jean Networks. 25

- Vertical Focus / Specialization: Financial Institutions, Legal, Healthcare (Regulation-heavy sectors). 25

- Market Position: The “Premium/White Glove” national MSP, now backed by institutional pension capital.

VC3

- Founding Year: 1994 26

- Country of Operation: United States, Canada 26

- Backing / Capital Source: Nautic Partners (Private Equity) 26

- Primary Acquisition Model: Vertical Dominance / Integrated 26

- Strategic “Hook” for Sellers: Deep expertise in the municipal/government space; ability to handle complex public sector clients.

- Investment Thesis: “Serve those who serve.” Municipal IT is a sticky, recession-resistant vertical with high barriers to entry (procurement, compliance). 27

- Operational Implications / Strategy: Deep vertical integration. Standardizing government clients on specific security and compliance stacks (CJIS, etc.).

- Recent Landmark Deals / Acquisitions: Sophicity, DominionTech, Accent Computer Solutions, FPA Technology Services. 27

- Vertical Focus / Specialization: Municipal/Local Government (Primary), Commercial (Secondary). 26

- Market Position: The undisputed leader in Municipal/Government managed services in North America.

Emerging Models and Challengers

The boundaries of the MSP market are porous. Players from adjacent sectors—consulting, marketing, and telecom—are crossing over, creating new competitive dynamics.

Sourcepass

- Founding Year: 2020 29

- Country of Operation: United States 29

- Backing / Capital Source: Metropolitan Partners Group, Wedge Venture Partners 30

- Primary Acquisition Model: Tech-Enabled Integration

- Strategic “Hook” for Sellers: Access to the proprietary “Quest” platform (CX/Automation); aggressive capital deployment for growth. 31

- Investment Thesis: Disrupting the “stale” IT services market by leveraging SaaS, RPA (Robotic Process Automation), and AI to create a superior client experience. 31

- Operational Implications / Strategy: Migration to the “Quest” platform to digitize the client journey and automate support. 32

- Recent Landmark Deals / Acquisitions: CompuWorks, A.D.B. Services, Proxios, Infinity (Microsoft Dynamics practice). 29

- Vertical Focus / Specialization: Generalist SMB, expanding into Business Applications (Dynamics 365). 33

- Market Position: A rapidly growing “Digital Experience” MSP challenging legacy providers with a software-first mindset.

CompassMSP

- Founding Year: 2016 34

- Country of Operation: United States 34

- Backing / Capital Source: Agellus Capital (Acquired majority stake in 2024/2025)

- Primary Acquisition Model: Regional Platform / Geographic Density

- Strategic “Hook” for Sellers: Strong regional density in the Northeast and Florida; focus on “co-managed” and regulated industries.

- Investment Thesis: Building a leading multi-regional platform by uniting strong regional players (Compass + BlackPoint).

- Operational Implications / Strategy: Integration of regional hubs.

- Recent Landmark Deals / Acquisitions: BlackPoint IT Services (Merger), Simplegrid Technology. 34

- Vertical Focus / Specialization: Regulated Industries (Legal, Finance, Healthcare). 34

- Market Position: A strong multi-regional player solidifying its presence on the East and West Coasts.

Airiam

- Founding Year: 2021 (Formed via 5-way merger) 35

- Country of Operation: United States 35

- Backing / Capital Source: NewSpring Capital 36

- Primary Acquisition Model: Product-Led Roll-up (Cybersecurity)

- Strategic “Hook” for Sellers: Transitioning from a generalist MSP to a specialized MSSP/Cyber resilience provider.

- Investment Thesis: SMEs are under attack and need enterprise-grade cyber resilience (MDR, IR) at a flat fee. Standardizing on the “AirProducts” stack. 37

- Operational Implications / Strategy: Aggressive standardization on proprietary cyber stack (AirGuard, AirGapd). 37

- Recent Landmark Deals / Acquisitions: Syntervision, Transcendent, MePush, Indigo Beam. 35

- Vertical Focus / Specialization: Cybersecurity / Incident Response / SMEs.

- Market Position: A “Cyber-First” MSP focused on resilience and disaster recovery for the mid-market.

Conclusion: The Death of the Generalist

The 2024–2026 M&A wave signals the definitive end of the “generalist” MSP era. The market has rendered a verdict: to survive and thrive, an MSP must either achieve massive scale (Ntiva, The 20), dominate a specific vertical (VC3, Shield), or possess a unique technological differentiator (Titan, Airiam).

For the independent MSP owner, the landscape offers more choice than ever before, but also more complexity. The “Equity Partnership” model of New Charter offers a middle ground for those not ready to retire. The “Forever Hold” model of Evergreen offers a haven for legacy-minded founders. But the most intriguing development is the “Venture Buyout” offered by Titan and Shield. For the operationally mature MSP willing to bet on the AI revolution, these partners offer a path to transform their service business into a technology powerhouse.

Ultimately, the consolidation is driving the industry toward higher maturity. The “lifestyle” MSP is being squeezed out by platforms that can afford the multimillion-dollar investments in AI, cybersecurity, and compliance that modern clients demand. The future of the sector belongs to those who can successfully bridge the gap between human service and artificial intelligence.

FAQ

A Traditional Roll-up (e.g., Ntiva, VC3) focuses on financial arbitrage: buying smaller companies at a lower multiple and combining them to sell at a higher multiple based on scale. They often integrate tools and processes to achieve cost synergies. An AI-Native Roll-up (e.g., Titan, Shield Technology Partners) is a “Venture Buyout” strategy. These groups acquire MSPs not just to aggregate revenue, but to serve as a chassis for deploying proprietary AI automation stacks. Their goal is to fundamentally change the nature of the business—from labor-intensive services to high-margin, software-driven outcomes.

The Equity Partnership model, popularized by groups like New Charter Technologies, is an alternative to a 100% buyout. In this model, the MSP founder sells a majority stake (e.g., 60-70%) but retains a significant minority equity position (30-40%) in the parent platform (TopCo). The founder often remains as the President of their local operating unit. This structure allows the founder to take “chips off the table” immediately while participating in the future growth and eventual exit of the larger platform, often referred to as the “second bite of the apple.”4

Major private equity firms driving MSP consolidation in 2025 include: Alpine Investors (backing Evergreen Services Group / Lyra) Oval Partners (backing New Charter Technologies) PSP Partners (backing Ntiva) Court Square Capital & Berkshire Partners (backing Thrive) OMERS Private Equity (backing Integris) Nautic Partners (backing VC3)

Venture Capital firms like General Catalyst (backing Titan) and Thrive Capital (backing Shield) are investing in MSPs because they see the “Services Economy” as the next major sector for AI disruption. They believe that by owning the MSP, they own the workflow data required to train AI models that can automate complex tasks. This allows them to transform low-margin service revenue into high-margin “tech-enabled” revenue, a thesis known as “Service as Software.”5