You keep hearing that successful MSPs are selling for 8x or 10x EBITDA, but that number is useless without context. The reality is that determining what multiple of ebitda do msps sell for requires segmenting your firm by size, quality of earnings, and inherent risk profile. A realistic enterprise valuation demands investor-grade benchmarks, not vague market rumors. This article distills the complexity of lower mid-market M&A into a practical math workflow you can use to translate those rumors into a credible range. We start by defining your starting point: size-based benchmark tiers.

1. Size Matters: Defining the MSP Valuation Multiple Tiers

The valuation multiple an MSP commands is directly correlated with size, measured by Adjusted EBITDA. Benchmark against these tiers to establish a realistic enterprise valuation.

Here are the current lower middle-market M&A ranges for what multiple of EBITDA do MSPs sell for:

- Very Small/Owner-Led MSPs: ~3.0–4.0x (Often lower due to heavy Keyman Dependency risk).

- $250k–$1M Adjusted EBITDA: ~4.0–5.0x

- $1M–$2M Adjusted EBITDA: ~5.0–6.0x

- $2M–$5M Adjusted EBITDA: ~6.0–8.0x

- Mid-Market Deals ($5M+): Median disclosures trend toward ~8.0–9.0x

These multiples are applied to Adjusted EBITDA, not the standard figure reported on tax returns. Adjusted EBITDA reflects Quality of Earnings by normalizing expenses (owner benefits, one-time costs) to show true, maintainable profitability. The multiple increases with size because larger firms dilute risk, possess mature processes, and offer greater comfort for buyer financing.

2. The Micro Discount: Why Your Valuation Suffers Below $1M Adjusted EBITDA

If your MSP operates below $1M Adjusted EBITDA, you face the micro discount—a structural penalty that attracts the lowest multiples, often landing in the 3.0x to 4.0x range. This profile is defined by the owner-operator model, heavy reliance on short-term project revenue, and high client concentration.

Buyers—especially Private Equity firms—apply this discount due to unsustainable risk factors that erode Quality of Earnings (QoE). The core issue is keyman dependency: the founder is both the primary sales engine and the delivery manager, making revenue highly unstable if they step away. Weak internal SOPs, limited technical bench depth, and inadequate documentation further create operational fragility, directly impacting the buyer’s post-acquisition integration timeline.

To escape this valuation ceiling and accelerate M&A readiness, execute three immediate shifts:

- Stabilize Revenue: Prioritize contracted recurring revenue (MRR) over short-term project work.

- Document Assets: Implement robust internal documentation, standard operating procedures (SOPs), and service ticket metrics.

- Mitigate Keyman Risk: Install a second-in-command responsible for client success and service delivery, proving the business can operate without the founder’s daily intervention.

3. The 4.0–5.0x Valuation Band: Meeting the Buyer’s Quality Threshold

For MSPs generating $250k to $1M Adjusted EBITDA, the common valuation benchmark is 4.0x to 5.0x. This band applies to viable businesses demonstrating operational hygiene. Buyers require defensible evidence that the revenue base is stable and maintainable long-term.

To secure a base 5.0x valuation, you must prove:

- Stable Recurring Revenue (SRR): Minimum 70% of revenue derived from long-term, contracted MRR.

- Clean Financials: Investor-grade Quality of Earnings (QoE) with defensible, verifiable add-backs.

- Client Retention Proof: Documented service standards and annual client churn below 10%.

To push beyond this ceiling into the aspirational 6.0x trigger territory, focus on asset quality that guarantees future expansion:

- Contract Terms: Longer average contract terms (36+ months) with favorable renewal mechanics.

- Expansion Revenue: Demonstrable net negative churn, proving organic client spending expansion.

- Specialized Positioning: Deep vertical or compliance expertise (e.g., CMMC/HIPAA), backed by high attach rates and key client logos. These factors insulate future revenue from commoditization.

4. The Systemic Premium: Underwriting the 6.0x to 8.0x Valuation

The jump to the 6.0x to 8.0x valuation multiple requires institutional maturity and surviving rigorous due diligence, reserved for MSPs generating $2M–$5M Adjusted EBITDA. Buyers—often Private Equity firms or large strategic acquirers—are not underwriting historic profit; they are underwriting systems engineered for repeatable growth, demanding elimination of keyman risk and operational fragility.

The premium multiple is justified by systemic resilience, requiring rigorous due diligence focused on three core elements:

- Repeatable Sales Motion: Growth driven by internal teams and robust inbound engines (RevOps/SEO), often powered by HubSpot for MSPs, ensuring revenue is independent of founder-led networking.

- Mature Service Delivery: Standardized stacks, formal SLAs, and deep technical bench depth that mitigates reliance on high-cost senior staff.

- Predictable Cash Flows: True Quality of Earnings (QoE) achieved through high-quality, long-term recurring revenue and minimal client concentration (no single client exceeding 10% of revenue).

Two MSPs with identical EBITDA can trade at vastly different multiples if hidden risks are present. Weak contract enforceability, pending compliance issues, or chaotic financial books will slash a high-end multiple back into the 5.0x range. This confirms that systemic process is the highest-value asset an MSP can build.

5. Separating Market Medians from Your MSP’s Realistic Valuation

Reconciling market headlines with private reality is key for M&A readiness. Reports often cite median mid-market multiples around 8.9x Adjusted EBITDA, potentially reaching 11.4x during highly competitive cycles for public/hybrid technology firms. These high figures often create unrealistic expectations for MSPs operating in the $1M–$5M EBITDA range.

The underlying deal mix drives this inflation. Medians are skewed by including larger, highly de-risked assets—which strategic acquirers pay a premium to secure—and integrating public company comparables. Strategic buyers consistently underwrite institutional scale, not the volatility inherent in owner-operator revenue streams, pulling the benchmarks away from the lower middle-market reality.

Founders must not anchor personal valuation expectations on these outliers. Use the size-based tiers (Items 2–4) to establish your appropriate base multiple first. Only after setting that credible floor should you proceed to adjust for operational quality and risk mitigation, which are the true drivers of multiple expansion (Items 7 and 8).

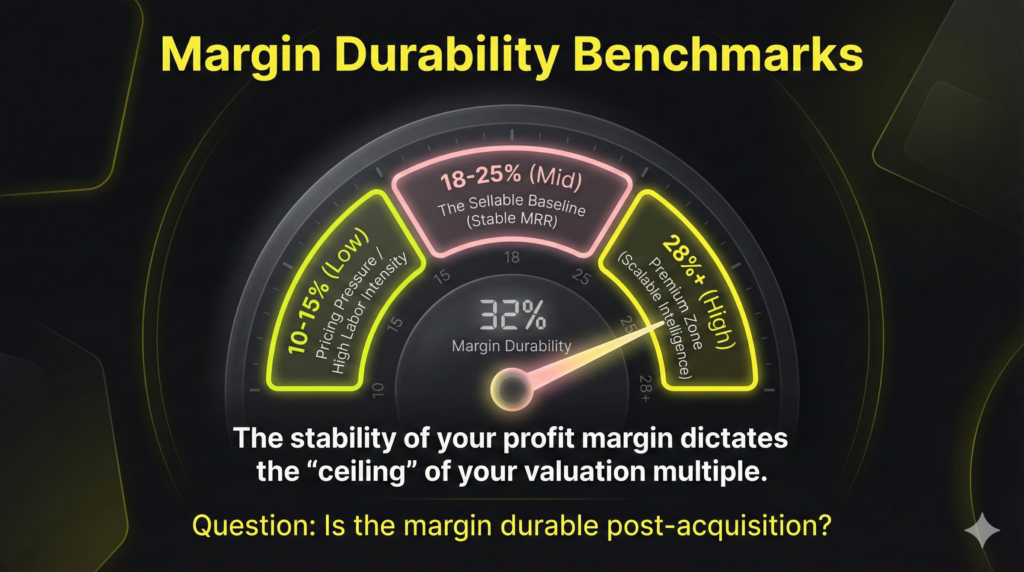

6. Margin Durability: Underwriting Quality of Earnings (QoE)

If size-based multiples set your floor, margin durability sets the ceiling. Buyers pay a premium for Adjusted EBITDA that is secure and replicable post-acquisition. Fragile profitability, regardless of revenue size, attracts lower multiples.

MSPs should segment margins into risk bands:

- Low Margin (10%–15%): Signals pricing pressure, high labor intensity, or weak service packaging, attracting maximum scrutiny.

- Mid Margin (18%–25%): The “sellable” baseline, indicating recurring revenue stability and fundamental operational hygiene.

- High Margin (28%+): Supports a premium, but only if profitability is not achieved through underinvestment in technology or staff.

Buyers stress-test this margin: Can the profit survive replacing the owner (Keyman risk)? Can the margin withstand 10% customer churn or vendor stack changes? For immediate M&A readiness, quantify your top three margin leaks: poor labor utilization, tool sprawl (unused licenses), and unchecked discounting. Only durable margins underpin true Quality of Earnings (QoE).

Valuation multiples are determined by risk assessment. Buyers quantify fragility during due diligence to mandate EBITDA haircuts.

7. The M&A Risk Checklist: Valuation Haircuts and Premium Factors

Common Valuation Haircuts:

- Customer Concentration: Any single client exceeding 10% of MRR risks a 0.5x–1.0x reduction due to revenue instability.

- Contract Risk: Month-to-month services or weak 30-day termination clauses erode the “R” (Recurring) in MRR.

- Keyman Dependency: If sales, compliance, or delivery is tied to one person (founder or sole technical cert holder), the multiple suffers.

- Revenue Quality: Heavy reliance on low-margin project work dilutes the overall multiple.

M&A readiness counters risk by documenting premium factors:

- High Retention/Expansion: Proven net negative churn (clients spending more year-over-year).

- Security Specialization: Vertical compliance expertise (e.g., CMMC), backed by audits and client wins in regulated industries.

- Documented Processes: Clear, repeatable Standard Operating Procedures (SOPs) for all service delivery.

If risk is too high or hard to price, buyers use deal structure to bridge the gap. Expect earn-outs or retention bonuses that vest only if high-risk factors stabilize post-close.

8. Multiple Expansion: Monetizing Technical Specialization

Valuation multiple expansion requires demonstrably defensible specialization—not just offering security or cloud. Buyers pay a premium, often 1.0x to 2.0x above the benchmark, because this defensibility creates stickier demand, raises client switching costs, and justifies a higher Average Contract Value (ACV).

Premium specialization must be measurable and tied to regulated outcomes:

- Compliance-Driven MSSP: Specializing in regulated verticals (e.g., CMMC, HIPAA) and packaged managed security services.

- Modern Cloud/DevOps: Focusing on measurable outcomes in cloud optimization, FinOps, and automated infrastructure management.

To justify the multiple expansion during due diligence, provide irrefutable proof points:

- Contract Language: Average contract terms exceeding 36 months and highly restrictive Termination for Convenience (TFC) clauses.

- Compliance Artifacts: Established policy libraries, SOC 2 alignment evidence, and formalized risk frameworks.

- Security Attach Rate: High adoption percentage of proprietary security packages across the entire client base.

The guardrail is crucial: The premium instantly evaporates if security revenue is primarily low-margin reseller margin or one-off projects. Specialization, supported by targeted compliance marketing, must translate directly to durable, high-margin recurring revenue.

The M&A Valuation Workflow: Converting Benchmarks to Equity Value

The critical bridge between knowing what multiple of EBITDA do MSPs sell for and calculating your actual cash-at-close requires a structured, six-step M&A math workflow. Use this schedule to translate size-based benchmarks into a specific, defendable enterprise valuation range prepared for investor scrutiny and due diligence.

Step 1: Compute Your Defendable Adjusted EBITDA (QoE)

The foundation of your valuation is a verifiable Quality of Earnings (QoE). Do not use the tax return figure.

- Start with TTM EBITDA: Begin with the Trailing Twelve Months (TTM) EBITDA figure.

- Identify and Document Add-Backs: Systematically document and justify every normalizing adjustment. Focus on three categories: non-recurring expenses (e.g., one-time legal fees, excess IT spend), owner/personal expenses, and normalization of owner compensation to a market rate.

- Output: Calculate the resulting Adjusted EBITDA figure, which reflects the true, maintainable profitability of the asset for a new owner.

Step 2: Establish the Base Multiple

Set an achievable valuation floor by using the closest peer benchmark based on your size tiers.

- Select the Band: Based on your Adjusted EBITDA from Step 1, identify the associated multiple tier (e.g., 5.0x to 6.0x).

- Action: Select the median of that range as your initial base multiple. Avoid anchoring your expectation on the highest median available in the market.

Step 3: Explicitly Apply Margin and Risk Adjustments

Asset quality dictates whether the multiple expands or contracts.

- Risk Haircut: Subtract 0.5x to 1.0x for factors like high Client Concentration (where a single client exceeds 10% of revenue) or heavy Keyman Dependency.

- Specialization Premium: Add 0.5x to 1.0x only if you possess measurable, documented specialization, such as CMMC compliance or proven net negative churn.

Step 4: Calculate Enterprise Value (EV)

Enterprise Value (EV) represents the total operating value of the business, independent of its financing structure.

- Formula: Adjusted EBITDA Multiplied by (Base Multiple Plus Adjustments) Equals Enterprise Value (EV).

- Output: The value of the core business operation.

Step 5: Bridge EV to Net Cash-at-Close

Buyers pay Enterprise Value, but sellers receive Equity Value (the final cash distribution).

- Adjust for Capital Structure: Subtract all debt, including loans and capital leases. Add all surplus cash that exceeds the normal working capital requirement.

- Account for NWC: Adjust for Normalized Net Working Capital (NWC). Buyers set an NWC target; if your NWC is below this target at closing, the Enterprise Value will be reduced via the true-up mechanism.

Step 6: Perform a Sanity Check

Stress test your valuation claim before presenting it to prospective buyers.

- Compare EV/Revenue: Divide your calculated EV by your total TTM Revenue. A result exceeding 3.0x EV/Revenue may indicate an aggressive Adjusted EBITDA multiple relative to industry norms.

- Stress Test the Downside: Model the impact of losing your single largest client or incurring a significant labor cost increase. If your valuation claim collapses under a simple downside scenario, the valuation lacks the systemic resilience institutional acquirers demand.

FAQ

Multiples are virtually always applied to Adjusted EBITDA, reflecting the true Quality of Earnings (QoE) available to a new owner. This figure is derived by normalizing expenses and applying “add-backs.” Common adjustments include removing non-recurring costs (e.g., one-time legal fees or excess IT purchases) and normalizing owner compensation to a fair market rate. Defensible documentation for every add-back is non-negotiable during due diligence.

Your MSP valuation multiple will likely fall within the 4.0x to 5.0x band, consistent with the lower middle-market tiers for this size. Where you land within that range depends on asset quality. Factors such as high contract quality (36+ month terms), low client concentration, and strong evidence of mitigating Keyman Dependency (having operational SOPs and a documented second-in-command) can push your valuation closer to the 5.0x ceiling.

The high-end figures (10x–12x) usually reflect median reports skewed by very large, strategic deals, including public company comparables and highly scaled, specialized mid-market firms ($5M+ Adjusted EBITDA). Smaller, private MSPs typically command multiples in the 4.0x–6.0x range due to the size effect and higher risk underwriting required. These assets are judged on operational maturity and systemic resilience, not just high growth rates.

Enterprise Value (EV) is the total operating value of the business before accounting for financing. What you take home—the Equity Value—is calculated by subtracting total assumed debt (e.g., equipment leases, term loans) and adding surplus cash (cash exceeding normalized working capital) from the EV. Due diligence also includes a mandatory Working Capital true-up adjustment that affects the final cash distribution.

They change both, serving as the primary drivers of multiple expansion. Predictable recurring revenue (70%+ MRR) and high retention rates (under 10% churn, or net negative churn) drastically reduce buyer risk and support better financing terms. Documented retention proves margin durability and customer satisfaction, justifying a premium up to 1.0x above your base valuation multiple and accelerating M&A readiness. (372 words)