The era of simple scale arbitrage in managed services is finished. The reality of MSP Consolidation in 2026 demands a new calculus: enterprise value pivots entirely on operational transformation, tech stack standardization, and robust client retention strategies. For sellers preparing an exit, choosing the right buyer is critical. It is not about the largest check; it is about aligning your goals (cash-out, second bite, or technology arbitrage) with the buyer’s integration playbook to maximize valuation when selling your MSP. This analysis, written strictly to protect your maximum value, begins with the newest disruptive entrants.

1. Titan and the AI Arbitrage: The Strategy Driving Software-Like Services

The traditional consolidation model—buying scale at 5x EBITDA and selling at 7x—is dissolving. The core constraint in any high-touch services business, whether veterinary or managed IT, is the unbreakable link between revenue growth and headcount expansion.

This is the thesis leveraged by buyers like Titan. Titan is a VC-backed buyer acquiring services firms to immediately deploy a proprietary AI and automation stack. Their core bet is to break the revenue-to-headcount relationship, pushing software-like margins (40%+) out of a business sector historically limited to 15–20% EBITDA.

The Ideal Seller Profile for Automation

Understanding what this buyer wants is crucial. Titan is not interested in fixing broken operations. They seek operationally mature firms with clean, standardized data flows and repeatable delivery processes, often targeting those with highly regulated customers. Clean, structured data is the prerequisite fuel for their AI injection strategy.

Value creation post-close is ruthless and immediate. Automation targets are lower-level support functions: L1/L2 ticket triage, basic service desk tasks, and back-office workflows. To feed these centralized automation engines, the acquired firm must undergo immediate rigorous process standardization and asset inventory mapping.

The Deal Reality: High Risk, High Reward

For the selling partner, this strategy promises significant upside. If the automation successfully breaks headcount dependency, the entity’s valuation shifts from a services multiple (5–7x EBITDA) toward a technology multiple (potentially 10–15x EBITDA) for the second liquidity event.

Sellers must recognize the corresponding high-stakes risk. If the AI thesis fails—failing to yield promised labor savings or integration creating chaos—you are left with a highly integrated services entity carrying massive integration debt and devalued goodwill. Key watch-outs include governance, maintaining client trust (“Am I being supported by bots?”), and the operational shock of rapid, software-grade transformation in a people-first business. Only engage this buyer if your internal processes are demonstrably robust.

2. Shield and the Decentralized Edge: Retaining Culture, Centralizing Intelligence

Shield offers the decentralized counterpoint to Titan’s top-down, standardization-first model. It appeals to founders who require frontier AI enhancement but reject the cultural poison of a centralized corporate monolith.

Shield is a venture-backed hybrid holding company acquiring majority equity stakes. Its core promise is the separation of brand from technology: retaining the existing brand, local leadership, and crucial customer relationships while capitalizing and enhancing the firm.

The Thesis: Where AI Advantage is Defensible

Shield targets regulated, high-touch verticals where compliance and proprietary workflow data are inherently defensible. In sectors like veterinary services or regulated IT, nuanced AI models create a technological moat by leveraging this proprietary data, compounding value faster than generalized automation.

The model relies on operating duality:

- Local Focus: Brand equity, leadership, cultural identity, customer engagement, and strategic relationship management.

- Centralized Focus: Shared AI capabilities, security infrastructure upgrades, shared back-office delivery standards, and technology stacks.

This structure attracts founders who want to retain leadership while injecting a new, future-proof “delivery engine” to secure future service quality and margins.

Managing the Integration Paradox

Decentralized organizations risk tool sprawl, creating an integration paradox. Shield addresses this by centrally enforcing technology standards to ensure clean data feeds for new AI capabilities, while allowing local teams the freedom to manage client relationships.

Shield explicitly manages two key technological risks inherent to human-centric service businesses:

- AI “Black Box” Risk: Local leadership manages AI deployment to enhance, not replace, teams. This ensures the transparency regulated clients require for data governance.

- Client Perception Risk: Since the client-facing brand remains unchanged, the service upgrade is framed as an investment in resilience, mitigating the risk of de-personalization.

Deal Alignment: The structure involves a majority equity sale coupled with meaningful rollover expectations for the founder and management team. This performance alignment ensures the seller remains actively invested in the success of the new, AI-enhanced entity. Shield offers maximum financial value without sacrificing the legacy you spent decades building.

3. Thrive and the Integration Tax: The Security-First Super-Platform

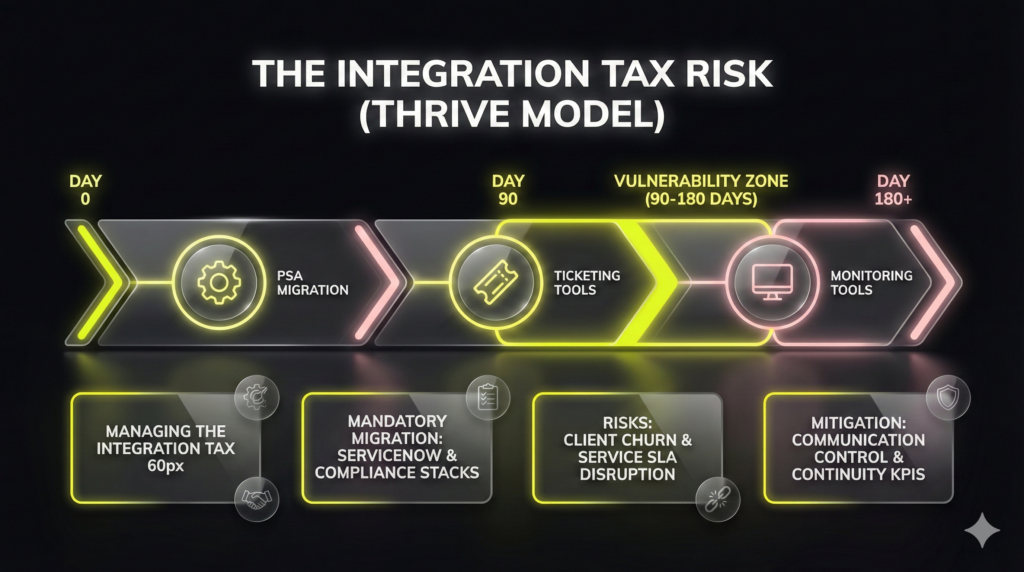

The financial benefit of selling to a massive platform often masks a significant operational consequence: the mandatory “integration tax”—the forced migration of your entire operational environment. This transition presents immediate, quantifiable risk to client retention and must be managed proactively to preserve your negotiated enterprise value.

Thrive is the definitive example of the scaled platform buyer. Their strategy is not about experimental AI or cultural decentralization; it is about density, scale, and enterprise-grade delivery capabilities built on a unified operating system. Thrive invests heavily in standardizing delivery—often mandating migration onto a comprehensive ITSM platform like ServiceNow—coupled with a rigorous, shared security and compliance stack. They buy for footprint expansion, but the core value is extracting efficiencies and cross-selling deep security services into the newly acquired client base.

The Standardization Imperative

For platforms like Thrive, integration is programmatic and swift. Your existing PSA, ticketing workflows, and monitoring tools are sunsetted immediately. This standardization is non-negotiable because it is the only way the buyer can guarantee their high-security SLAs and generate the clean data required for enterprise reporting.

This model strongly suits MSPs whose client bases already demand highly structured ITSM and who have already achieved a high degree of operational maturity. However, the migration itself is a critical period of vulnerability. When clients face new portals, new contact procedures, and changes to established service SLAs, churn risk spikes. Competitor MSPs, who are often independent, actively target clients during this integration disruption, framing the platform’s efficiency as a loss of personalized service.

Negotiating Your Operational Exit

To avoid common corporate ownership pitfalls like client churn and cultural compression, the seller must aggressively negotiate the transition plan. Maximum value retention requires control over three areas:

- Client Communication Control: Determine who announces the change, when, and how the continuity of service is framed to key accounts.

- Service Continuity KPIs: Establish measurable metrics for response times and ticket resolution during the critical 90 to 180 days post-close.

- Transition Duration: Lock in a reasonable timeline for founder and key leadership involvement to shepherd crucial relationships through the standardization process.

Selling to a super-platform like Thrive offers incredible scale and exit cleanliness, but success depends entirely on managing the operational shockwave that follows the deal.

4. Ntiva and the Family Office Horizon: The Platform-on-Platform Strategy

The primary anxiety for selling founders is the tyranny of the Private Equity clock. Traditional funds demand a 5-to-7-year exit, forcing aggressive cost-cutting and revenue growth that frequently degrades service quality. The emergence of Family Office-backed platforms, such as the Ntiva archetype, offers a different calculus for MSP Consolidation and value creation.

Ntiva’s thesis is the creation of a dominant national managed services brand, built not on dozens of micro-deals, but through strategic, platform-on-platform mergers. The goal is scale, consistent delivery, and deep market penetration, which mandates a model of full integration where brand, processes, and culture must converge.

The Long Game of Family Office Backing

When capital comes from a Family Office, the pressure shifts from a fixed-date IPO or sale to a longer-term, generational view of asset quality. This often translates into more resources dedicated to infrastructure and talent retention, and less urgency for immediate, ruthless margin expansion.

For the founder, this means joining a scaled entity with deeper resources in sales, security, and complex operations. You are plugging into a machine designed for enterprise delivery, rather than navigating the market alone.

Diligence: Identifying the Integration Road Map

While the time horizon is longer, the commitment to integration is absolute. Sellers must scrutinize two key areas during diligence to determine the risk to their legacy and client base:

- Local Leadership Retention: Since Ntiva relies on major platform mergers, the retention strategy for local leadership is critical. Ask for specifics: Are contracts simply tied to performance, or is there a genuine role defined for scaling the national brand?

- Client Segmentation: Large platforms are built for specific client profiles (often mid-market and enterprise). You must understand which of your current clients are “ideal” for the new platform and which are likely to be shed or transferred to a less profitable service tier post-close.

Integration across already large entities remains complex, even with robust playbooks. Buyer financial success requires significant operating leverage—growing revenue faster than cost. As a seller, your key question must be: How does the buyer plan to achieve superior EBITDA growth (via pricing, security attach rates, or co-managed expansion) without degrading the client experience? Commit only if the answer focuses on value acceleration, not just cost deceleration.

5. Integris and the Premium Posture: Trading Scale for Governance

When selling a high-touch MSP in risk-sensitive verticals—finance, legal, or healthcare—where compliance and data security are core differentiators, founders need a buyer who views operational excellence as an asset, not a cost center. Platforms like Integris embody this profile.

Integris is a scaled national MSP emphasizing premium security, deep compliance, and long-term reputation. Their capital structure, often derived from patient institutional sources (akin to large pension funds), prioritizes generational growth and client retention over the quick flip dictated by typical Private Equity clocks. This patient approach fundamentally changes the calculus of MSP Consolidation, providing assurance that service quality will not be immediately sacrificed for short-term gains.

The Institutional Buy: Compliance and Reputation

Integris targets MSPs serving highly regulated markets, acquiring capabilities that strengthen their premium security and governance posture. While standardization is critical, the integration approach emphasizes platform convergence—shared security tools, standardized runbooks, and unified compliance artifacts—specifically to mitigate centralized risk. This structure preserves a strong local presence and offers a “white glove” exit for founders prioritizing service quality and brand reputation post-sale.

Assessing the Specific Risks

Even premium platforms carry specific diligence risks. Overpaying for quality can cap returns without real, accretive growth. Furthermore, compliance-heavy clients present a unique retention vulnerability: new decision-makers (CIOs/CSOs) in regulated industries frequently re-shop MSPs to stamp their authority on vendor choice. Logo churn can be rapid. To protect your negotiated enterprise value and ensure a smooth earn-out, sellers must provide demonstrable evidence of client retention and operational governance.

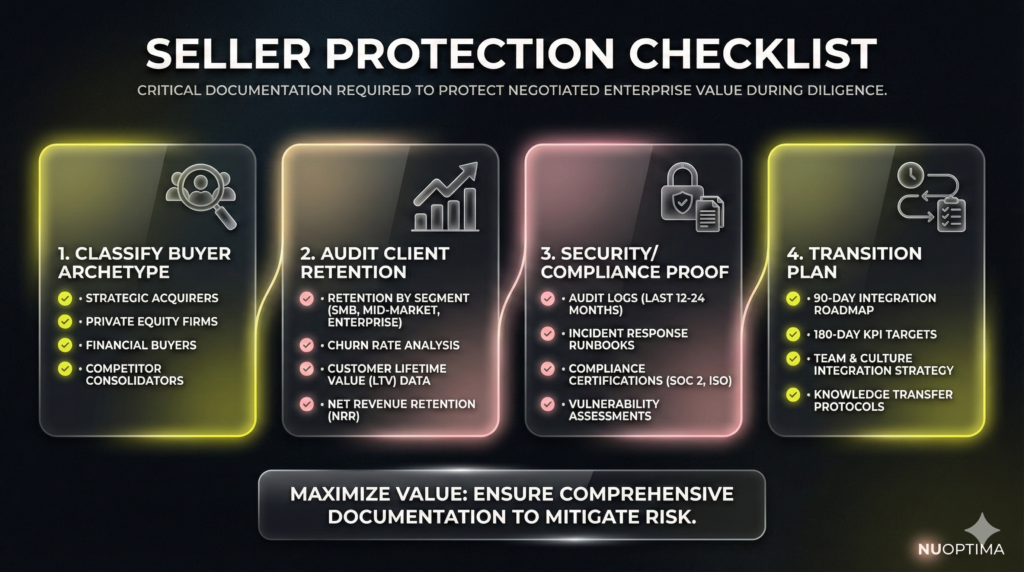

Seller Protection Checklist:

- Client Retention Reporting: Present detailed logo churn data segmented by client cohort and regulated vertical (e.g., finance vs. legal). This proves the stickiness of your service model.

- Security/Compliance Proof Artifacts: Organize and present clean, verifiable evidence of security operations, including established runbooks, audit logs, and a categorized history of incident response. This reduces the buyer’s post-close compliance debt and mitigates earn-out pressure.

6. The Vertical Moat: Why Compliance Complexity Drives the Highest Multiples

Value in the fragmented MSP market is found in owning an inaccessible sliver, not conquering the whole. This is the core thesis of vertical MSP Consolidation. These platforms target sectors where government mandates create insurmountable barriers to entry—like municipal, public-sector, and adjacent regulated organizations. The VC3 archetype exemplifies this focus, aiming to dominate local and state government IT services.

The Value of the Inaccessible Market

For generalist MSPs, regulatory overhead and complex public-sector procurement are deterrents. For the vertical specialist, these factors create a powerful moat. Procurement is slow, rigorous, and demands specialized audit documentation. Once secured, the contract yields intensely sticky revenue—provided service metrics remain impeccable and client trust is absolute.

This stickiness allows the acquirer to standardize post-acquisition clients onto shared, government-grade security and compliance playbooks. Value is generated by imposing repeatable delivery processes tailored specifically to that niche client type, ensuring audit readiness and predictable outcomes.

The Operational Demands of Vertical Consolidation

Public-sector focused acquirers demand a high degree of operational discipline from sellers already serving municipalities, counties, or adjacent organizations. Seller fit relies heavily on:

- Documentation Discipline: Clean policies, established incident response plans, and documented audit readiness are essential fuel for this model.

- Talent Scarcity: A core challenge is the scarcity of personnel with genuine, deep government governance and compliance expertise. The vertical consolidator is buying that scarce knowledge base.

- Integration Risk: Integration disruption can be swiftly punished in public-sector relationships, demanding flawless transition execution.

Sellers must also recognize vendor disintermediation risk: if regulatory tooling or contracts shift, the MSP must demonstrate defensible value beyond simple software resale. To maximize your financial outcome, clearly document all key contract renewal cycles, public-sector procurement dependencies, and any single-client concentration risks before going to market. (Word Count: 320)

7. New Charter and the Operating Partner Exit: Rolling Equity, Retaining Leadership

Highly ambitious founders navigating MSP Consolidation often reject the requirement to surrender operational control and retire after a brief service period. If the goal is to exchange administrative burden for scalable infrastructure while retaining significant influence and equity upside, the New Charter archetype offers a distinct partnership model.

New Charter is not a cultural absorption play; it is an equity partnership platform built for the active founder. The seller’s immediate hook is the equity rollover: exchanging local practice equity for shares in the larger holding company (TopCo). You monetize immediately, remain the active local unit leader, and align incentives for organic growth and long-term platform appreciation.

The operating model is “autonomy with accountability.” Local leadership manages client relationships and service delivery. Centralized support functions—Centers of Excellence (CoE) for finance, HR, and advanced marketing—act as leverage points, not merely cost-cutting targets. This division allows the founder to shed non-core administration and focus strictly on scaling high-margin client relationships.

For this specific archetype, co-managed IT is a critical growth wedge. Since the platform requires repeatable engagement models to justify its premium valuation, the ability to convert co-managed accounts into fuller managed revenue streams becomes highly valued by the buyer.

However, the partnership structure carries a unique risk: the value of your second liquidity event depends entirely on platform economics. If platform growth or margin expansion stalls, your rolled equity is devalued, and the “second bite” shrinks. Governance complexity is also a major concern; autonomy can drift into inconsistency if centralized operational standards are not strictly enforced.

Due diligence for this long-term partnership must be sharp. Demand clarity on two essential points: What specific KPIs determine your management incentives and earn-outs post-close? And critically, what is the platform’s actual, verifiable plan for multiple expansion, distinct from acquisition volume? Commit only when you understand how your continued sweat equity translates directly into platform financial success.

8. Lyra and the Evergreen Thesis: The Permanent Home for Your Legacy

The defining pain point for many legacy-minded MSP founders is the lack of a true permanent home. Traditional Private Equity mandates a forced exit, and platform deals require cultural absorption. This anxiety fuels the demand for the Lyra archetype: a buy-and-hold acquirer structured as a diversified conglomerate, not a flip-to-exit platform.

Lyra’s evergreen thesis offers a distinct approach to MSP Consolidation, promising a permanent exit. Absent a predetermined 5-year hold period, the acquired brand remains autonomous, retaining local culture, leadership, and operational standards indefinitely. This strategy is ideal for founders prioritizing staff and client continuity.

Value Creation Through Financial Discipline

In this model, value is generated through financial discipline and long-term portfolio diversification, not aggressive, near-term synergy capture requiring deep integration. Lyra provides centralized capital and shared learning—a peer network of MSPs—without imposing hard integration mandates on technology stacks or marketing.

This structure is the best fit for MSPs possessing strong local differentiation that would be damaged by forced integration, or for those whose EBITDA growth is robust and organic without central overhead.

The Autonomy Tradeoff and Necessary Diligence

While Lyra offers maximum brand autonomy, it requires intense diligence. Less synergy capture means growth must remain demonstrably real; the buyer is not there to fix operational deficits. Furthermore, absent central enforcement, severe technology and tool sprawl can limit operational leverage unless organic standardization emerges.

To protect negotiated value, clarify the governance structure in writing. Ask how the buyer handles underperforming portfolio companies—specifically, how oversight or capital is injected without harming adjacent, high-performing brands. Even “light-touch” buyers can change expectations, making clearly defined governance boundaries non-negotiable for securing your long-term legacy.

9. The 20 and Pre-Nuptial Standardization: Eliminating the Integration Tax

The central threat to realized enterprise value in any consolidation play is the post-close integration tax: the inevitable churn, downtime, and operational fatigue that occurs when two disparate entities are forced into systemic alignment. Buyers like The 20 bypass this risk, reframing MSP Consolidation as a financial event, not a chaotic operational overhaul.

The Standardized Acquisition Pipeline

The 20 operates less as a traditional roll-up and more as an acquirer leveraging a standardized membership community. The model mandates an operational “pre-nup”: prospective sellers must first join the network as members. This initial phase requires the firm to adopt the organization’s proprietary tools, standardized service delivery processes, and security stack.

When acquisition is triggered, the seller’s technology and back-office functions already operate on the buyer’s system. This attacks integration failure directly, reducing the post-close disruption risk that bleeds value and clients. For the seller, the proposition is clear: reduced disruption, defined operational guidelines, and a clear exit path.

The Trade-Off: Constraint Versus Value

While this model solves the immediate integration pain, it introduces significant long-term constraints that high-growth founders must recognize. The cost of pre-standardization is entrepreneurial flexibility. Sellers trade local autonomy for global efficiency.

The critical risks demanding diligence are:

- Technical Debt: If the standardized stack becomes outdated, the entire network carries collective technical debt, constraining long-term EBITDA growth.

- Sector Pivot Risk: If the buyer shifts its strategic focus (e.g., heavily into healthcare IT), non-aligned MSPs may be deprioritized, limiting access to shared resources and capital.

Sellers must evaluate precisely what autonomy remains during the membership phase and confirm their client base aligns with the standardized service parameters. Buyers, conversely, must model potential churn risk during any forced process changes, ensuring the reduction in integration tax justifies the operational constraints.

10. Sourcepass and the CX Arbitrage: The Platform as a Differentiator

The foundational failure of generalist MSPs is the inability to differentiate beyond a generic ticketing portal. The traditional “we answer tickets faster” pitch is commoditized, eroding the defensible moat. This reality fuels the rise of the ‘software-first’ archetype, exemplified by platforms like Sourcepass.

The Client Experience Thesis

This buyer’s thesis asserts that MSP Consolidation value shifts from operational efficiency to owning the complete client experience (CX). Acquired firms migrate onto a proprietary technology layer emphasizing automation, standardization, and a unique client-facing portal. Differentiation moves beyond endpoint management to providing a perceived premium, digitally-driven IT experience. Automation becomes a growth lever, freeing technical talent for high-value strategic conversations, not merely a cost-cutting measure. For challenger MSPs already focused on specialized CX, this model validates their strategy and offers growth capital to scale the platform.

High-Stakes Platform Migration

While the promise of superior Customer Experience is compelling, migration onto the buyer’s platform (e.g., Quest) presents significant diligence risk. Standardization is non-negotiable, and transitioning every client workflow, monitoring tool, and service portal creates enormous friction.

- Integration Risk: If the client base perceives a dip in service quality or response times during migration, competitor MSPs will actively target the ensuing churn, eroding the negotiated enterprise value.

- The Moat Problem: If the proprietary CX automation is merely a well-branded skin over generic tools, the strategic moat is thin. Sellers risk a tech-narrative valuation without defensible technology margins.

To protect your valuation and ensure earn-out success, demand specific diligence metrics:

- Automation Baseline: Require proof of what percentage of common L1/L2 tickets and routine workflows are genuinely automated post-close.

- Transition Governance: Lock in a detailed transition plan that strictly protects response times and executive communication channels with your top five accounts to prevent critical logo loss during integration.

11. CompassMSP and the Geographic Density Play: Securing Value Through Regional Hubs

A national platform acquisition often converts your hard-won local market into a distant line item, prioritizing geographic scale over service density. For the high-touch MSP owner, this generates a critical anxiety: how do you secure maximum enterprise value without sacrificing the local integrity clients rely on?

The CompassMSP archetype offers the geographic-density counterpoint to the dispersed national roll-up. This strategy builds strength through deep regional hubs, achieving critical mass within specific, high-compliance markets. This MSP Consolidation approach is rooted in regulated-industry positioning (e.g., healthcare or financial services) where local, verifiable on-site coverage is a competitive necessity.

Why Density is the 2026 Strategy

While many buyers prioritize centralization and digital transformation, the density play remains strategically crucial for operational resilience:

- Delivery Economics: Concentrated client bases reduce drive times and allow for more efficient scheduling of technicians, maximizing margin capture for managed labor.

- Service Quality: Regional density facilitates swift on-site coverage and strengthens local relationships, which is crucial for retaining sticky, high-touch clients.

- Recruiting Advantages: The platform becomes a dominant local employer, attracting and retaining specialized regional talent better than a scattered national footprint can.

The operating model involves integrating these regional hubs—standardizing back-office tools and mandating moderate-to-high process conformity. Crucially, the acquired region remains a core growth priority, not a distant outpost. This focus attracts sellers whose enterprise value is tied directly to deep client concentration in a specific metro area.

Risks and Retention Vulnerabilities

Density strategies are vulnerable. Integration remains the primary destroyer of value, particularly if standardization is rushed. Moreover, recurring revenue is conditionally sticky: client CIO turnover and price pressure can quickly erode the perceived governance and reliability of the platform. Independent competitors strategically exploit this, using the wedge: “Your old team is gone; we’re still local.”

To protect your valuation and EBITDA growth during the transition, sellers must rigorously assess their client profile. Model retention rates by segment, pre- and post-re-platforming, to expose structural vulnerabilities. Your final focus must be determining how much enterprise value hinges on founder relationships versus the measurable operational resilience of the service delivery.

12. Airiam and the Cyber Multiple: Standardizing Security for Valuation Uplift

Consolidation archetypes typically prioritize scale or geographic density. The key to trading a low services multiple for a higher technology multiple—the M&A holy grail—is productization. Today, the highest-margin product is proactive cybersecurity. This is the thesis leveraged by the Airiam archetype: a cyber-focused roll-up built on the premise that standardization unlocks premium valuation. It mandates a strictly standardized security stack across all acquired firms to establish product-like repeatability.

The Financial Thesis of Productized Security

The demand signal is clear: SMBs and mid-market companies in high-risk sectors (e.g., healthcare, legal) face escalating cyber-threats and regulatory pressure. This fuels intense demand for Managed Detection and Response (MDR) and Incident Response (IR). Packaging these solutions as repeatable, fixed-price products drastically improves margins and client retention—the twin pillars required for maximizing enterprise value.

Execution: Standardizing the Moat

Transitioning from a high-touch consulting model to a repeatable product delivery system requires aggressive operational constraints and standardization. This strategy demands:

- Tooling Standardization: Non-negotiable migration onto a defined, limited security stack to create unified data streams and repeatable runbooks.

- Centralization: Centralizing specialized capabilities, like the Security Operations Center (SOC) and advanced remediation teams, to gain operating leverage and consistency.

For the founder seeking to “graduate” into this security-first pricing power, the path is simple: prove your delivery is predictable.

The Diligence Trap: Earning the Multiple

Positioning for the high cyber multiple creates an intense burden of proof. Security promises increase liability; operational maturity must demonstrably match marketing claims. If security tools are commoditized, the only defensible moat is delivery excellence.

Sellers must document hard metrics, moving beyond general claims: average incident response times, Mean Time to Resolution (MTTR) for core security events, and renewal cohorts tied specifically to security services. Buyers, conversely, must verify the financial reality: is cybersecurity revenue truly recurring, or does it consist of project-driven, non-scalable consulting fees? Proof of repeatable, measurable outcomes is non-negotiable.

The Sell-Side Execution Schedule: Four Steps to Maximize Your Enterprise Value

Convert the high-level buyer selection strategy into a concrete execution plan. Before any transaction, define your desired exit outcome. Do you seek the pure cash-out? The rolling equity “second bite” enabled by AI arbitrage archetypes like Titan? The long-term stability of a “forever home” acquisition such as Lyra? Or the operating partner status required by a New Charter partnership? This foundational decision is the cornerstone of effective retirement and exit planning, dictating which buyer archetype will maximize your goals.

Step 1: Classify the Buyer Archetype (Strategic Alignment)

Do not engage diligence until you explicitly map the prospective buyer to a relevant consolidation model. The buyer’s financial structure dictates the operational pressure placed on your business post-close, directly impacting your earn-out success.

- Determine Integration Depth: Identify whether the buyer requires full integration (e.g., Thrive, Ntiva, The 20) or prioritizes brand autonomy (e.g., Shield, Lyra, Integris). Full integration means immediate, high Integration Tax risk to your client base.

- Identify Capital Horizon: Know the source of the capital. Traditional Private Equity mandates aggressive, short-term EBITDA growth (a 5-to-7 year flip). Family Office (Ntiva) or institutional funds (Integris) signal a longer-term, stability-focused view, which reduces immediate operational pressure.

Step 2: Implement the Six-Factor Diligence Scorecard

Use this scorecard during buyer conversations to quantify risk and align expectations. Demand specific, measurable answers for each factor.

-

Retention Risk:

- Identify Change-of-Control Churn: Quantify which clients are most vulnerable to churn resulting from new service contracts, leadership changes, or new portals (focus on regulated industries).

- Propose a Shield Strategy: Lock in a transition period for key founder involvement specifically to manage the top 10% of high-value logos.

-

Integration Tax:

- Map Tool Migration Costs: Get firm confirmation on which tools (RMM, PSA, ticketing system) will be sunsetted and the precise timeline. Model the client churn risk during this operational shockwave.

-

Operating Leverage Plan:

- Demand Margin Transparency: Require the buyer to demonstrate how they achieve future margin expansion. Determine if expansion relies on genuine AI injection (e.g., Titan) or aggressive headcount reduction and price inflation.

-

Deal Structure Alignment:

- Verify Rollover Protection: If rolling equity (e.g., New Charter), ensure your earn-out triggers are operational (e.g., net new customer wins). Avoid reliance on the platform’s aggregated, hard-to-control exit multiple.

-

Growth Engine:

- Validate Cross-Sell Capabilities: Confirm the buyer’s security or co-managed IT expansion plans are viable for your client profile. Ensure their strategy is accretive to your existing book of business.

-

Capital/Time Horizon:

- Define Your Exit Gate: If the buyer is PE-backed, understand the required EBITDA growth rate necessary to achieve the target exit multiple within the allotted time. This metric defines your operational pace post-close.

Step 3: Prepare the Diligence-Ready Proof Pack

Reduce buyer uncertainty to secure a premium. The cleaner your internal data, the less opportunity a buyer has to discount the offer during diligence.

- Security & Compliance Artifacts: Consolidate and categorize your security runbooks, incident response histories, and audit logs. Proactively mitigate buyer compliance debt and prove operational excellence (the Integris model).

- Contract Hygiene and Churn Cohorts: Present detailed churn data segmented by client type (SMB versus Mid-Market) and contract renewal cycle. Demonstrate the stickiness of your recurring revenue.

- Data-Flow Map: Inventory all client assets, data security policies, and internal data flows. Eliminate the uncertainty that often triggers last-minute valuation adjustments based on technical debt.

Step 4: The Final Warning Label (Capped Multiples)

For any founder or investor entering MSP Consolidation, the financial calculus is unforgiving:

- The Overpay Penalty: If the initial acquisition valuation exceeds the current market multiple, and the buyer fails to achieve substantial, measurable margin expansion through transformation (not just cost-cutting), the resulting exit multiple caps returns and erodes the realized Enterprise Value.

- Recurring Revenue is Conditional: Recurring revenue streams are not risk-free assets. As platforms like Thrive enforce the Integration Tax, change-of-control churn is a quantifiable, mandatory underwriting variable. Proactively manage this risk to protect your earn-out.

FAQ

Realistic valuations range widely, typically 5x to 7x Adjusted EBITDA for generalist MSPs, rising to 8x to 12x or higher for firms demonstrating superior EBITDA growth and operational maturity. Premium multiples are reserved for firms with high security attach rates, specialized vertical expertise (e.g., healthcare compliance), and clean, standardized data that fuels AI/automation deployment. The ceiling is set by demonstrated capacity for margin expansion beyond headcount additions.

No, but reliance on them can be drastically reduced. Earn-outs are common tools buyers use to mitigate perceived risk, especially related to client concentration, flawed contract hygiene, or integration dependency. To reduce earn-out percentage, sellers must present a diligence-ready “Proof Pack” of clean financial statements, measurable client retention data, and rigorous operational governance that demonstrates business predictability post-close.

An equity rollover involves exchanging a portion of your practice equity for shares in the buyer’s larger holding company (TopCo). Buyers mandate this to ensure retention and align your future performance incentives. It is worth it only if the platform has a clear, verifiable plan for multiple expansion (e.g., successful AI injection or massive scale). Rollovers are dangerous if the platform’s EBITDA growth stalls or if your governance rights in the TopCo are unclear.

Buyers view co-managed IT favorably if the engagement is structured, documented, and repeatable. It serves as an excellent growth wedge, allowing the platform to cross-sell deeper managed services post-close. However, it raises red flags during diligence if the division of responsibilities with the client’s internal IT is fragile, undocumented, or relies heavily on personalized founder relationships, which increases churn risk.

Client churn, or the Integration Tax, is primarily triggered by four factors: mandated new pricing structures, changes in key client-facing personnel, disruptive tool migration (e.g., new ticketing portals), and abrupt changes in support quality. Prevention requires aggressive negotiation during Step 2 of the Sell-Side Schedule, including locking in founder involvement, strictly controlling client communications, and establishing measurable service continuity KPIs for the 90-to-180-day transition window.