The biggest risk when selling a Managed Service Provider (MSP) is hiring a generic advisor. Generalist M&A firms and business brokers frequently fail to navigate the technical diligence, recurring revenue metrics, and compliance risks unique to the IT sector. This lack of specialized expertise causes discounted valuations or collapsed deals. You need advisors who speak the language of Private Equity. This framework provides an investor-grade vetting workflow, helping you shortlist specialized msp brokers to ensure maximum enterprise valuation from day one.

1. Boutique M&A Advisory: The Investor-Grade Specialists

Maximizing enterprise valuation and attracting sophisticated buyers (Private Equity or strategic add-ons) requires boutique MSP brokers who understand that recurring revenue must survive rigorous technical diligence.

These specialized M&A firms excel at process discipline: confidential CIM creation, staged diligence, and building brand authority to attract premium PE platforms. They are the ideal fit for MSPs demonstrating standardized delivery, strong recurring revenue concentration, and leadership depth beyond the founder. This operational maturity often starts with a clear strategy for in-house SEO vs outsourcing to drive growth.

These advisors are fluent in MSP-specific valuation drivers, scrutinizing PSA/RMM standardization, security posture, and contract assignability—all non-negotiable checks for PE-backed platforms.

Demand transparency before signing: ask for confirmed deal examples specifically in managed services, the expected timeline, and their minimum deal size to ensure you are a priority client. This level of specialization is critical to preventing the valuation haircut generic brokers often inflict.

2. Quality of Earnings (QoE) Experts: Normalizing EBITDA for Credibility

Owner-operated MSPs must professionalize their financials for private equity review. Maximizing enterprise valuation hinges on translating reported P&L into investor-grade numbers via adjusted EBITDA normalization.

A QoE expert validates revenue quality and reduces buyer objections. They must analyze critical MSP levers: churn/retention, stability of the service gross margin, and the ratio of recurring vs. project revenue. Crucially, addressing customer concentration risk is non-negotiable, as high reliance on one client immediately suppresses the valuation multiple.

Demand a transparency check: The advisor must walk you through a sample valuation bridge, clearly showing the shift from reported EBITDA to the implied adjusted range and specifying assumptions. Any advisor who avoids deep discussion of churn or concentration risk as primary multiple drivers is not fit for purpose.

3. Fee Structure and Incentive Alignment: The Contractual Vetting

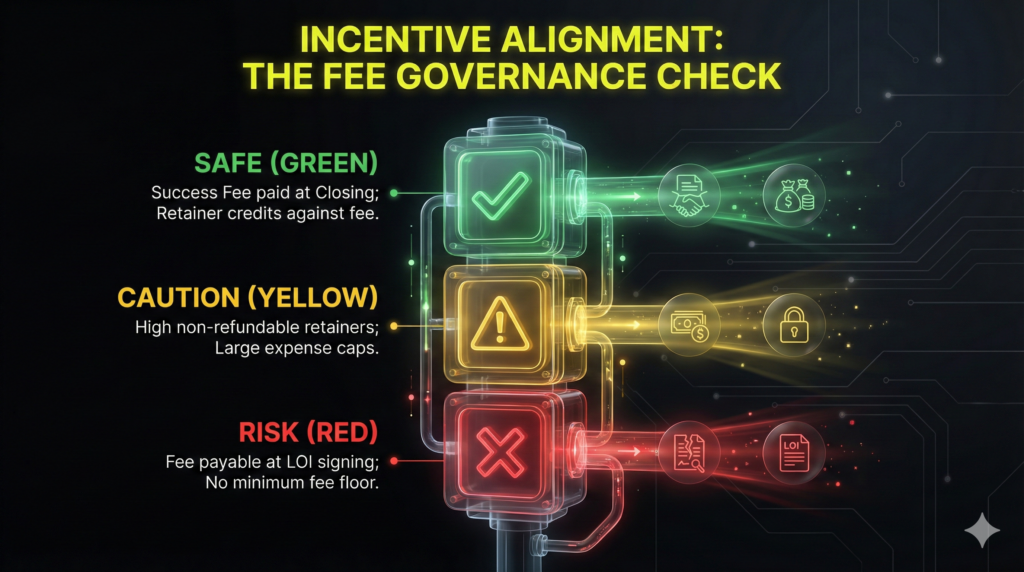

The fee structure is the third, most critical governance check. If your advisor is compensated solely on speed rather than price, their incentive alignment is fundamentally flawed, threatening maximum enterprise valuation.

Demand a written fee schedule detailing mechanics: how the retainer credits against the success fee, the minimum fee, and the expense policy. Crucially, confirm the payable event: Does the fee trigger at LOI signing, closing, or cash receipt? Insisting on the latter ensures your msp brokers remain actively engaged until the transaction successfully funds.

For full transparency, request a redacted engagement letter. Verify the precise scope of included services (CIM creation, buyer list building, negotiation support). Watch out for vague “expenses” or clauses that incentivize advisors to push a quick, low-price sale rather than maximizing your final valuation.

4. Digital Business Brokers: Vetting for Recurring Revenue Nuance

For downmarket MSPs focused on generating inbound buyer interest and establishing a quick baseline valuation, digital business brokers are an option. The trade-off remains: wide reach and buyer volume versus technical specialization.

The critical hurdle is screening their capacity to handle a recurring service business, not a generic e-commerce or SaaS firm. Do not proceed unless msp brokers confirm specific experience with contract assignment review, recurring revenue verification, and staged client confidentiality protocols.

Ask for their marketing plan: How are buyers screened, and where is the listing placed? A major red flag is any advisor who refers to your MSP as a “website business” or confuses service gross margins with SaaS economics. That generalized approach signals potential mispricing and guarantees friction during technical diligence. You risk a significant valuation haircut if the broker lacks fluency in compliance or stability metrics specific to IT services.

5. Generalist Business Brokers: When Local Reach Trumps Sector Expertise

Generalist business brokers provide access to local and regional strategic buyers, useful for quick tuck-in exits over a private equity focus. The inherent risk is their lack of fluency in recurring revenue metrics, often guaranteeing a valuation haircut during technical diligence.

To de-risk this path, require your msp brokers to demonstrate verified experience selling recurring IT service businesses. Demand a specific, documented confidentiality process, using client list placeholders until late-stage LOI.

Furthermore, demand transparency on buyer qualification: how do they screen for proof of funds and eliminate “tire-kickers”? The critical red flag is any broker who pushes a simplistic, generic revenue multiple without deep context into your service gross margins or client retention metrics. If they cannot speak to MSP-specific economics, walk away immediately.

6. Investment Banks: Driving Competitive Tension via Auction

If your MSP is positioned for a major exit and ready to support a full auction-style process, the highest-tier msp brokers are specialized investment banks. Their core value is driving maximum competitive tension among qualified PE and strategic buyers, ensuring you do not leave millions on the table by using a passive advisor.

Investment banks bring rigorous execution: a formal Confidential Information Memorandum (CIM), detailed buyer segmentation, and a managed process including Indications of Interest (IOIs) and Letters of Intent (LOIs). Their structural expertise is critical for negotiating complex financial leverage and deal structures. For transparency, demand a clear, weekly pipeline reporting cadence and clarity on senior partner vs. junior staffing.

The watch-out is scale: these firms enforce stringent minimum fees and deal sizes, meaning sub-scale MSPs will not be prioritized. This option is reserved for firms built with M&A Readiness in mind.

7. Valuation CPAs: The Financial Truth Layer for M&A Readiness

If you suspect your internal accounting will not withstand the institutional scrutiny of a Quality of Earnings (QoE) diligence, you need a specialized Valuation CPA before engaging MSP brokers. This advisor is the crucial financial truth layer, translating operational accounting into the investor-grade metrics required by Private Equity funds and strategic acquirers.

They perform rigorous QoE-style analysis to create defensible add-backs, normalize adjusted EBITDA, and develop crucial reports: recurring revenue schedules, cohort retention/churn views, and formalized customer concentration summaries. These deliverables strengthen the entire pricing narrative, drastically reducing the risk of costly post-LOI valuation retrades.

The CPA validates the financials while following a professional valuation checklist; the broker manages the competitive outreach and negotiation process.. Be explicit about this division of labor upfront: a CPA is an M&A readiness expert, not a sell-side process manager. Confusing these roles guarantees friction and delays.

8. Direct Buyer Outreach: Calibrating Valuation Without Representation

Direct conversation with known buyers (industry platforms, local add-on acquirers) offers the fastest market feedback and immediate valuation calibration. However, this path fundamentally sacrifices competitive tension and leverage.

To maintain control and protect your enterprise valuation, insist on a stringent, MSP-specific NDA. Implement staged disclosure, protecting your client list until the Letter of Intent (LOI) stage. Specialized buyers immediately focus on retention risk, security posture, and the assignability of core contracts.

Ask buyers directly how they model MSP risk—specifically their concentration thresholds and churn assumptions. This insight is vital for M&A readiness.

Watch-out: Without specialized msp brokers, you are likely to accept unfavorable post-closing structures, such as extended indemnities or unachievable earnouts. Ensure you have legal counsel experienced in IT service M&A before negotiating these terms.

9. Operator Communities: Sourcing Fit, Demanding Process Discipline

MSP operator communities serve as a valuable sourcing layer, connecting owners with high-fit buyers who understand the business model. While fostering operator-to-operator trust, this informal channel introduces immediate rumor and confidentiality risk.

Treat the community only as an introduction mechanism. Immediately transition viable interest to a formal process, requiring a stringent, MSP-specific NDA and a structured diligence plan before sharing sensitive data.

Validate buyer credibility: confirm funding, successful integration history, and request non-MSP references. To protect your enterprise valuation, maintain tight message control. Broadcasting an exit creates noise and invites low-ball offers.

Secure the introduction, then immediately move the conversation off-platform to protect M&A Readiness and prevent a valuation haircut. This enforces discipline upon an otherwise chaotic sourcing method.

The Technical Screening Checklist for Vetting MSP Brokers

Moving from M&A readiness to active execution requires a non-negotiable screening workflow for potential MSP brokers. Use this four-phase technical checklist to test their sector expertise and ensure their process maximizes your enterprise valuation.

Phase I: Confirm Deal-Fit and MSP M&A Experience

Your advisor must demonstrate institutional competence in the unique economics of recurring IT services.

- Request 3+ verified managed services sell-side examples. Detail the size range, buyer type (PE platform vs. strategic add-on), and specific technical issues encountered during diligence.

- Verify they are fluent in MSP-specific metrics: service gross margin stability, high churn tolerance, and customer concentration thresholds. Expected Outcome: Confirm they understand how your recurring revenue stream is priced differently than typical SaaS or e-commerce models.

Phase II: Fees, Incentive Alignment, and Governance

Ensure the broker’s financial incentives align strictly with maximizing your closing price.

- Request a detailed written explanation of all fees: retainer amount, success fee percentage, minimum fee floor, and the policy for crediting the retainer.

- Confirm the precise payable event for the success fee. Insist on payment at closing or cash receipt; walk away if payment is demanded upon Letter of Intent (LOI) signing. Expected Outcome: Obtain a clear document ensuring they are motivated to negotiate favorable final terms.

Phase III: Test Technical Diligence Competency

Operational technical diligence often collapses the MSP sale process. A high-quality broker anticipates these hurdles.

- Demand they outline their preliminary diligence checklist: security posture, documentation maturity, PSA/RMM standardization, and license portability.

- Ask for their strategy to prevent buyer-driven chaos, including the use of staged data rooms, client name redaction, and controlled access protocols. Expected Outcome: They must demonstrate a plan that protects confidentiality while accelerating the technical review.

Phase IV: Communication Cadence and Execution Control

Execution control requires predictable reporting and senior leadership involvement.

- Confirm the weekly execution cadence, including a standing meeting for pipeline updates, buyer feedback, and next steps.

- Identify the senior partner who will run negotiations. Ensure you are not handed off to a junior analyst.

Immediate Disqualification Red Flags

Disqualify candidates immediately if they show:

- Vague expense policies or success fees payable upon LOI signing.

- Promises of “top multiples” without deep underwriting of your adjusted EBITDA and churn data.

- No specific plan for client confidentiality or staged data disclosure.

- No fluency in technical diligence requirements unique to MSP/MSSP models (e.g., confusing service margin with product margin).

FAQ

Valuation multiples typically range from 4x to 8x adjusted EBITDA, but specialized MSSPs or mature platforms with high recurring revenue quality can achieve higher figures. The multiple heavily relies on strong service gross margins, low customer concentration, standardized delivery (RMM/PSA), and high leadership depth. Smaller, founder-led firms often receive conservative pricing.

The cost structure usually involves a small upfront retainer fee and a larger success fee, calculated as a percentage of the total transaction value. Ensure you clarify four contractual terms: how the retainer credits against the success fee, the minimum fee floor, coverage of expenses, and the specific payable event (ideally at closing, not LOI signing).

Confidentiality is protected through staged disclosure. Initially, buyers see anonymized client IDs and revenue segments under NDA. Full client names and contractual detail are only released in a controlled data room environment, typically after a Letter of Intent (LOI) is signed and proof of funds is verified. Rigorous technical diligence minimizes this risk.

You should engage advisors 6 to 12 months before you plan to exit. This runway allows you to implement their M&A readiness recommendations, such as reducing client concentration risk, cleaning your financial statements for QoE analysis, and standardizing your contract inventory. You need clean financials and process discipline ready before outreach begins.