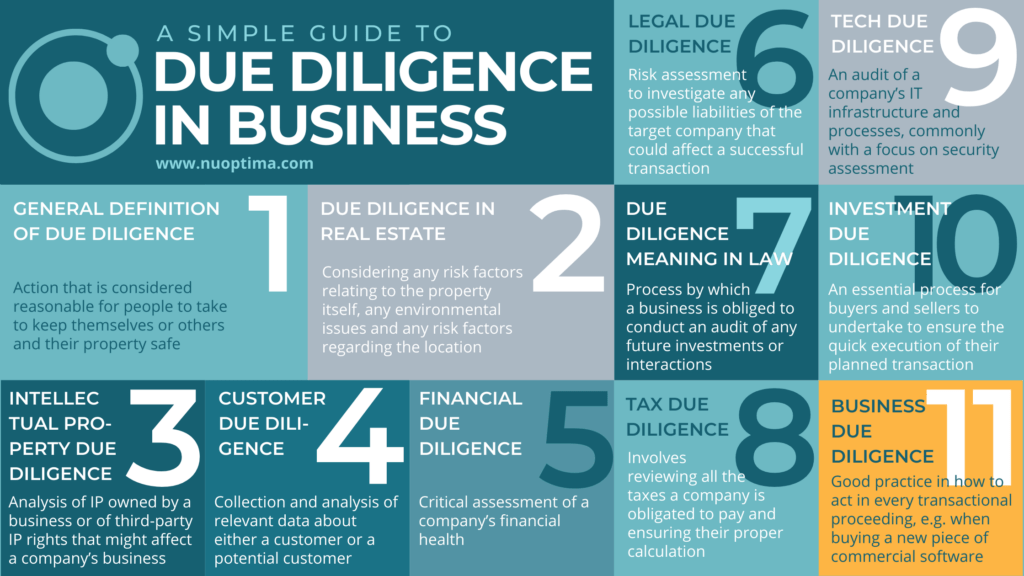

Key Points

- Due diligence has numerous meanings in the English language, and it is important to understand the differences between them.

- The general definition of due diligence is action considered reasonable for people to take to keep themselves or others and their property secure.

- Other types of due diligence include IP, tax, investment, environmental, legal, tech, customer, and operational.

The term ‘due diligence’ has many different meanings in the English language, and it can be hard to get your head around. In this article, we go through the numerous definitions of this term to give a clearer understanding.

What is the General Definition of Due Diligence?

According to the Cambridge English Dictionary, due diligence is defined as ‘action that is considered reasonable for people to take to keep themselves or others and their property safe’. In other words, it is an exercise of care that a person is expected to take before entering an agreement with another party or an act with a particular standard of care.

What is Due Diligence in Real Estate?

Due diligence in real estate is something that occurs often. Indeed, if you have ever bought or sold a property, you will have been a part of a due diligence process. In this context, due diligence is a process where you uncover if there are any issues with the property in question that the buyer should be aware of before the final purchase. Some of these issues may affect a person’s ability to get funding from a bank regarding a loan or mortgage to buy the property. Below are some of the standard features that due diligence in real estate considers:

- Any risk factors relating to the property itself

- Any environmental issues

- Any risk factors when looking at the location

An example of this due diligence process in real estate is a survey of a property for sale conducted by a registered and professional agent. The findings from this survey are then passed on to the buyer to make an informed decision about whether they wish to pursue buying the property.

What is Intellectual Property (IP) Due Diligence?

The IP owned by a business is commonly one of its most significant assets. On the other hand, if a company lacks the freedom to run due to third-party IP rights, this may have a considerable impact on its ability to operate effectively and, therefore, negatively impact its value. IP due diligence is consequently the analysis or assessment of the IP owned or used by a business or of third-party IP rights that might affect a company’s business. Consequently, IP due diligence can be hugely important when deciding whether to invest or buy into a company (or enter into some other agreement with the business where IP is a component).

To explain further, below are some examples of what IP due diligence typically involves:

- Assessing the chain of title (or ownership) of the IP in question and any potential encumbrances.

- Assessing if the scope, term of the IP rights, and geographical extent are appropriate to both protect and complement the company’s business.

- Examining whether a business has an IP policy and if their IP appears well-managed.

- Performing freedom to operate analysis on critical commercial processes, products or trademarks the company uses.

- Analysing the existence, enforceability, and validity of the IP rights licensed or owned by a company. This includes whether required formalities have been observed and if appropriate fees have been paid to keep the IP in force.

- Assessing the relevance, existence, and potential for company know-how and non-registered rights e.g. copyright.

- Considering contracts or contractual obligations relating to IP rights to which the business is a party and their effect on the company’s business.

- Evaluating the likelihood or existence of IP-related litigation and understanding the risk where it is present.

There are several scenarios where the need for IP due diligence arises. Below are a few examples:

- Trade-sale, inward-investment, licensing, or M&A (mergers and acquisitions)

- Initial Public Offering (IPO)

- IP reports or services for licensees, investors, or buyers

What is Customer Due Diligence?

Customer due diligence is a process used by financial institutions to collect and analyse relevant data about either a customer or a potential customer. This aims to explore any potential risk to the institution of doing business with a particular organisation or individual by analysing information from various sources. These sources include:

- Private data sources from third parties

- Public data sources, for instance, company listings

- Sanctions lists from governments or territories

- The customer, who needs to present certain information to do business with the financial organisation.

Customer due diligence is important as it is a central part of meeting Know Your Customer (KYC) standards. When conducting this type of due diligence on a target company’s customer base, there is an examination and analysis of the following:

- A list, with a corresponding explanation, of any major customers lost within the last three to five years.

- The company’s top customers (those who make the biggest total purchases from the company and those who are the largest concerning their total assets). Essentially, the customers that are important regardless of how much their current spend with the company.

- Customer Satisfaction Score (and related reports) for the last three years.

- Current credit policies. This involves running and reviewing the days sales outstanding metric (DSO) to examine the efficiency of accounts receivable.

What is Financial Due Diligence?

Financial due diligence is a critical assessment of a company’s financial health. The company’s historical and current financial performance is studied. This aims to determine future forecasts with any (and all) potential risks considered. A primary aspect of this is to review financial statements, debts, assets, projections, and cash flow to determine whether they are accurate and true. This assists the buyer by giving them a more transparent comprehension of the company’s core performance metrics. Conducting financial due diligence usually involves reviewing:

- Current financial position

- Historical financial results

- Forecast financial results

- Employee entitlements provisions

- Working capital requirements

- Valuation implications

- Risks and opportunities

- Taxation implications

What is Legal Due Diligence?

Legal due diligence is a vital aspect of any transaction and a compulsory consideration before entering into a merger or acquisition. It is essentially a risk assessment to investigate any possible liabilities of the target company that could affect a successful transaction. It is an analysis of a company’s legal health. Legal due diligence generally involves analysing all material contracts, such as licensing agreements, guarantees, partnership agreements, and loan and bank financing agreements.

What is Due Diligence Meaning in Law?

This is not to be confused with our previous definition, legal due diligence. Due diligence concerning law is the process by which a business is obliged to conduct an audit of any future investments or interactions they wish to make. The companies with which they want to do business are legally obliged to present them with all the information required to comprehend all risk factors involved in the transaction. An example of due diligence in law is an M&A department of a bank undertaking a thorough investigation of a company that another company wishes to buy. In this scenario, the bank investigates both entities and must be fully transparent in all findings.

What is Tax Due Diligence?

Regarding tax liability, due diligence involves reviewing all the taxes a company is obligated to pay and ensuring their proper calculation (with no intention of under-reporting of taxes). Furthermore, it also involves verifying the status of any tax-related case that is pending with the tax authorities. Documentation of tax compliance and possible issues generally includes verifying and reviewing the following:

- Documentation related to net operating loss (NOL) or any unused credit carry-forwards of tax credits or deductions.

- Information regarding any pending or past tax audits of the business.

- Copies of all tax returns for the past three years (including sales tax, income tax, and withholding).

- Any essential, peculiar correspondence with tax agencies.

The aim of tax due diligence is to ensure all the company’s taxes are paid and reported.

What is Tech Due Diligence?

Tech due diligence is also commonly referred to as technology, technical, or IT due diligence. Tech due diligence is an audit of a company’s IT infrastructure and processes, commonly with a focus on security assessment. It also considers technological-related aspects of a business, such as its products, software, product differentiators, product roadmap, systems, and practices. This due diligence type allows the acquiring company to assess existing IT structures and discover possible security risks. Among other things, it includes how sensitive data is both protected and managed.

What is Investment Due Diligence?

Investment due diligence is an essential process for buyers and sellers to undertake to ensure the quick execution of their planned transaction. It begins after an investment has been tabled through a term sheet or letter of intent. Then a team is assembled to conduct the exercise with relevant rules of engagement that both parties have agreed to. Investment due diligence involves a remote assessment of electronic assets and live site visits. In the end, a report is made and given to the investor, including recommendations of potential extra terms and conditions needed in the transaction.

What is Business Due Diligence?

Business due diligence is seen as good practice in how to act in every transactional proceeding. This can include buying whole entities, but it also refers to other purchases such as hardware, software, or anything else that requires business funds. The hope is to make sure that only good purchases occur that meet the requirements and needs of the wider firm.

An excellent example of business due diligence is buying a new piece of commercial software for a company. To undertake proper due diligence, there will need to be an investigation or analysis of:

- The pricing of the product

- Past customer reviews

- Determining if the security software will work in tandem with current systems

- Whether any more purchases are needed for the software package

- SaaS buyer due diligence to assess long-term viability and support

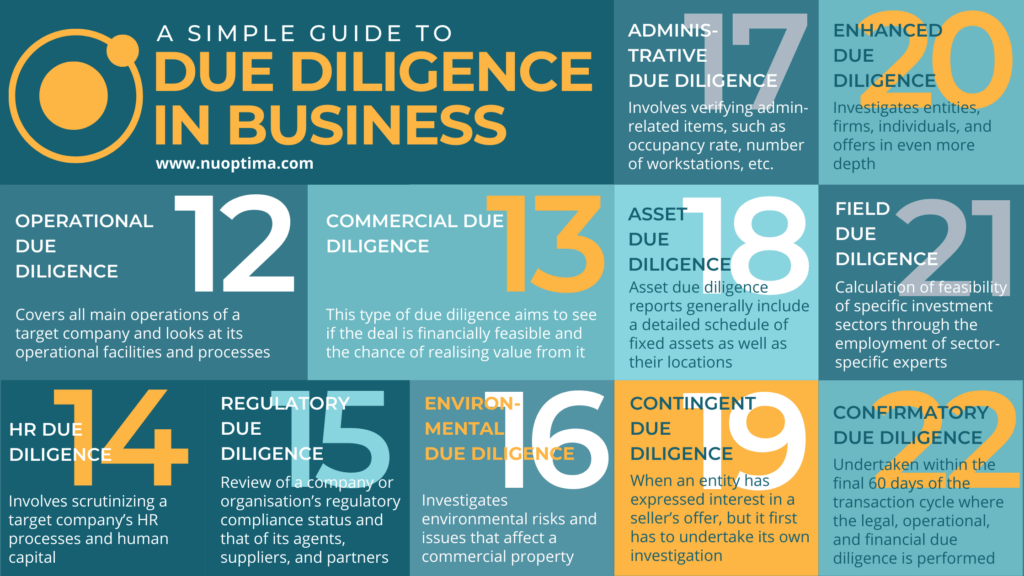

What is Operational Due Diligence?

This covers all main operations of a target company and looks at its operational facilities and processes. It investigates the business model too to ensure it is a good fit for the buyer in question. In M&A transactions, operational due diligence determines whether operational improvements could make additional value in the transaction. It also assesses if there are operational risks that could and should be addressed. Operational due diligence can include reviews of:

- Cost optimisation and risk management

- Human resourcing, employee retention, and workforce strategy

- In-house and department efficiencies

- Supply chain, procurement efficiencies and logistics

- Digitalisation Strengths, Weaknesses, Opportunities, and Threats (SWOT) analysis

- All operating processes

An operating partner plays a crucial role in leveraging operational due diligence to identify and implement these improvements, driving value creation for the investment. It is not just performed in M&A transactions. It is also a valuable part of real estate and private equity investment due diligence. Hedge fund administrators and investment managers have to review all possible operational risks as an aspect of their recommendation process.

What is Commercial Due Diligence?

Commercial (or market) due diligence is vital in strategically validating the opportunity. It considers market share, market size, customer base, potential future returns, and competitors. This type of due diligence aims to see if the deal is financially feasible and the chance of realising value from it. Commercial due diligence is key in giving the prospective buyer a detailed understanding of a target’s current positioning and long-term viability. It lets parties make informed decisions and enter negotiations with an accurate picture of the company. It ensures both parties know the relative positions of the business, if there are any threats to the model, and how to successfully navigate the post-deal industry landscape. This process is crucial for private equity value creation, as it typically involves:

- Looking at market trends

- Analysing the target’s competitive position and relative performance

- Assessing pricing and margins

- Examining whether projected revenues will be reached

- Assessing the customer base

- Reviewing the business plan

- Examining how realistic the goals of the business are

- Analysing the market and the company’s position in it

- Predicting the market’s future and the target’s place in it

What is Human Resources (HR) Due Diligence?

HR due diligence is when a target company’s HR processes and human capital are scrutinised. The company’s culture, roles, attitudes, and capabilities are also assessed. This helps find any differences in decision-making, discover any points of friction, and reduce any loss of talent post-deal. There are numerous operational risks that are investigated, including:

- Organisational culture (such as company values and leadership structures)

- Workplace relations (such as employee turnover, performance culture, current or historic employee disputes or issues)

- Employment agreements

- Remuneration and benefits (such as vacation and leave policies, compensations, and bonus plans)

- HR policies and procedures

- Training and development processes

The intention of HR due diligence is to prevent some common pitfalls of M&A, for instance:

- Decrease in productivity

- Talent loss before and during a deal

- Internal conflict because of different decision-making styles

- Misalignment of culture, communication, and processes

What is Regulatory Due Diligence?

Regulatory due diligence is a review of a company or organisation’s regulatory compliance status and that of its agents, suppliers, and partners. The information that needs to be reviewed includes:

- Audit processes

- Written standards of conduct

- Compliance policies for fraud prevention

- Compliance programme and/or the appointment of a compliance officer

- Current or previous regulatory investigations, reviews, or audits

- Inclusion of any regulatory or compliance training for employees

- Contracts and agreements with partners and suppliers

Given that some industries are more regulated than others, it becomes particularly crucial to ensure compliance in specific areas such as education compliance and healthcare compliance. The goal of regulatory due diligence is to uncover previously unknown problems, mitigate regulatory risk, confirm the company partners are legitimate, understand regulatory obligations, evaluate possible business impact and fix any issues.

What is Environmental Due Diligence?

Environmental due diligence investigates environmental risks and issues that affect a commercial property. This can include looking at:

- How close it is to sensitive environments, such as natural habitats

- Building materials and structure

- Possible groundwater and soil contamination

- Risk assessments and operational procedures

- Standard practices for the safe disposal of materials that are hazardous

Environmental due diligence is vital for examining the potential environmental responsibilities of a target company. If not undertaken, the acquirer might find themselves with a costly business with no liability protection whatsoever after the deal. A large number of deals collapse due to issues that surface during this due diligence process. This can be avoided if the sell-side undertakes due diligence on their own company before the involvement of the buy-side. Therefore, environmental factors can be examined, risks can be assessed, issues can be fixed, and preventative measures put in place to make sure the business is more valuable when the deal time approaches.

What is Administrative Due Diligence?

Administrative due diligence involves verifying admin-related items such as occupancy rate, facilities, number of workstations, etc. The aim of this is to verify the various facilities occupied or owned by the seller and work out if all operational costs are listed in the financials. Admin due diligence also presents a clearer picture of the sort of operational cost that the buyer is likely to incur if they intend to pursue expansion of the target business.

What is Asset Due Diligence?

Asset due diligence reports generally include a detailed schedule of fixed assets as well as their locations (physical verification should be done if possible), a schedule of sales and purchases of major capital equipment during the past three to five years, all lease agreements for equipment, real estate deeds, title policies, mortgages, and use permits.

What is Contingent Due Diligence?

Contingent due diligence is when an entity has expressed interest in a seller’s offer, but it first has to undertake its own investigation into the offer and the seller. The transaction will then continue as long as the contingent due diligence does not present any cause for concern. In other words, the deal is contingent upon the results of the due diligence.

What is Enhanced Due Diligence?

Enhanced due diligence is the same as due diligence, but it investigates entities, firms, individuals, and offers in even more depth. The aim is to gain more extensive knowledge to determine all risks involved and if they can be mitigated in a satisfactory way.

What is Field Due Diligence?

Field due diligence is a process used to calculate the feasibility of specific investment sectors, such as agriculture or renewable energy, through the employment of sector-specific experts.

What is Confirmatory Due Diligence?

Confirmatory due diligence is the process undertaken by the buyer within the final 60 days of the transaction cycle where the legal, operational, and financial due diligence is performed.