When the first venture capital firms started to break through, you could name only one prominent role in the company – investors.

Nowadays, there are more complex and interesting roles you can take on in a VC firm, and they all fall under the umbrella term “platform role(s).”

For more details, check out this article on how venture capital for startups drive growth and provide value via their platform teams,

If you have extensive experience working in a startup or a specific field such as marketing, operations or finance, VC platform roles may be your next best career choice.

As we go deeper into this topic, you will learn more about VC platform roles, how and where to apply for those jobs and how to pick your ideal VC firm.

The VC Platform Role: A Strategic Evolution

The venture capital landscape has undergone a significant transformation in recent years, evolving from a model focused primarily on financial backing to one that emphasizes strategic partnerships. This shift has given rise to an important new role within VC firms: the Head of Platform.

The introduction of this role has led to the creation of dedicated platform teams within VC firms. These teams, often led by a Head of Platform, serve as the connective tissue between the VC and its portfolio companies.

These platform VC teams provide a range of non-financial support services, from mentorship, GTM strategy development, and networking opportunities to operational advice and resource allocation.

“The platform vc team is essential in providing the right resources and connections that can help our founders navigate their journey and scale effectively.” Carolina Küng, Head of Platform at Frontline Ventures [1]

The importance of platform vc teams is reflected in industry trends. The proportion of VC firms with platform teams has risen significantly, from about 26% in 2000 to 52.8% in 2024. [2]

This growth highlights the strategic importance venture capital platform firms place on comprehensive support for their portfolio companies, viewing it as a key differentiator in attracting and nurturing promising startups.

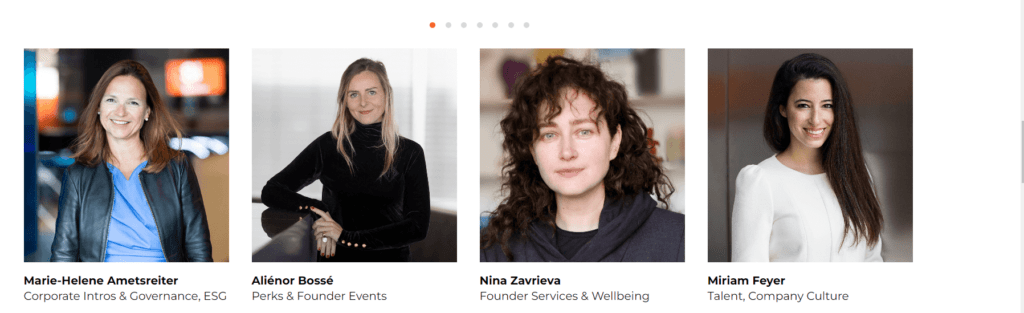

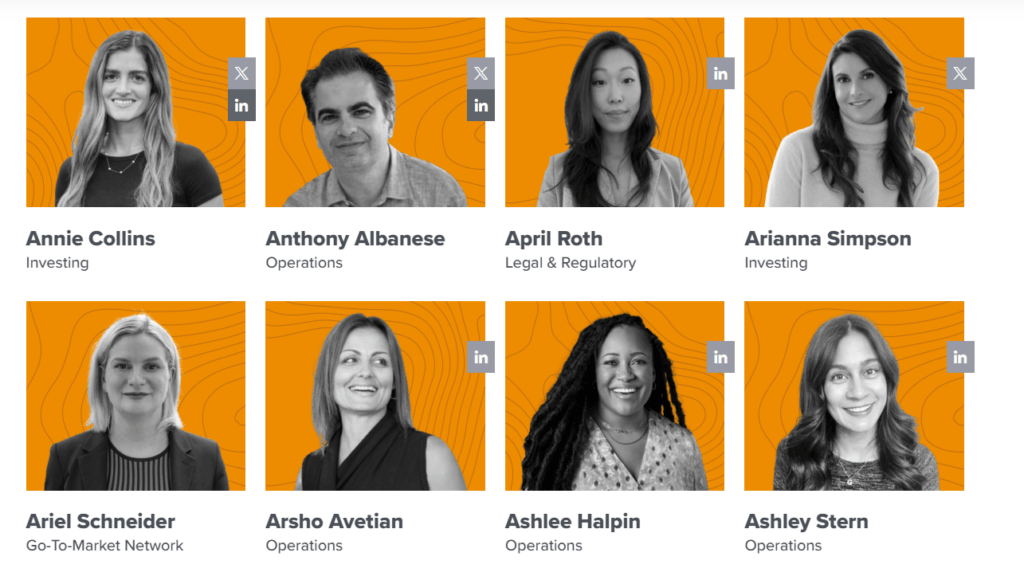

Now all VC companies’ websites have a dedicated section for their platform team, with different roles and responsibilities.

Key Functions of VC Platform Teams

Platform team members have specialized, hands-on roles. They execute specific support programs, provide direct assistance to portfolio companies in their areas of expertise, and gather data on company needs and program effectiveness.

Their tasks might include organizing workshops, conducting tech stack audits, managing online communities, and creating resource guides. Team members make tactical decisions within their specialties and often work behind the scenes to provide customized support to individual startups.

Usually, bigger platform teams are divided into:

| Team | Responsibilities | Example task |

| Board partners | Provide strategic guidance and governance support, helping portfolio companies establish and maintain effective boards of directors. | Facilitate a quarterly board strategy session for a Series B fintech startup, focusing on international expansion plans and regulatory compliance |

| Capital network | Focuses on facilitating additional funding opportunities for portfolio companies. | Organize a targeted pitch event connecting AI-focused portfolio companies with 20 pre-vetted growth-stage investors specializing in AI technologies. |

| Finance | Offer financial planning and analysis support, helping startups with budgeting, forecasting, and financial modeling. | Develop a detailed 18-month cash flow projection for a pre-revenue biotech company, incorporating multiple scenarios based on clinical trial outcomes. |

| Full stack talent | Specialize in recruitment and talent development. | Design and execute a recruitment campaign to hire a Chief Revenue Officer for a rapidly scaling e-commerce platform, resulting in a shortlist of five highly qualified candidates. |

| Go-to-market network | Assist startups in developing and executing their market entry and expansion strategies | Arrange a strategic partnership between a B2B SaaS portfolio company and a major cloud service provider, facilitating joint product development and co-marketing initiatives. |

| HR | HR teams support portfolio companies in developing robust human resources practices. | Help with policy development, compliance, and employee engagement initiatives. |

| Legal & regulatory | Provide guidance on legal matters, help with contract negotiations, and ensure compliance with relevant regulations. | Guide a health-tech startup through the process of obtaining HIPAA compliance certification, including policy development, staff training, and technical safeguards implementation. |

| Marketing | Offer support in brand development, marketing strategy, and execution | Help with a product launch campaign for a consumer IoT device, including influencer partnerships, social media strategy, and coordination with major tech review platforms |

| Security | Help startups implement robust cybersecurity measures, develop security policies, and manage risk in an increasingly digital business environment. | Provide guidance on security-related compliance requirements (e.g., GDPR, CCPA, HIPAA) and assist in implementing necessary measures to meet these standards. |

| Special advisors | Typically industry veterans or subject matter experts who provide specialized guidance in specific sectors or on particular challenges faced by portfolio companies. | Assist with expansion into new markets. An advisor with international business experience might help a U.S.-based startup plan its entry into European markets. |

| Strategy and operations | Work on high-level strategic planning and operational execution | Conduct a two-day workshop with the leadership team of a Series C cybersecurity company to refine their go-to-market strategy for enterprise clients and develop a detailed 24-month execution roadmap. |

Check out these private equity value creation strategies.

The Role of the Head of Platform

The Head of Platform at a venture capital and platform team members in a VC firm share the overall goal of supporting portfolio companies. Still, their roles and responsibilities differ significantly in scope and focus.

The Head of Platform takes on a strategic leadership role, setting the overall direction for the platform function. They manage resource allocation, lead the platform team, and act as the primary point of contact between the platform function, VC partners, and portfolio companies.

Their tasks include developing annual strategies, presenting performance metrics to partners, and representing the firm at industry events. The Head of Platform makes high-level decisions about program direction and focuses on creating scalable support systems that benefit the entire portfolio.

Based on the dozens of job descriptions we analyzed here are the main traits and responsibilities for the Head of Platform.

Common responsibilities

- Find answers to all inquiries posed by founders and their teams

- Work collaboratively with all members of the VC’s team to assist with providing appropriate resources to founders

- Lead and iterate the process of tracking portfolio performance

- Support efforts related to guiding founders through the end-to-end process of fundraising

- Build and maintain rapport with founders and fellow co-workers

- Manage tech stack of platforms and reporting tools

Common traits:

- An understanding of the startup ecosystem

- Intellectually curious by nature

- Demonstrated expertise in relationship management and vendor management from a platform partner perspective

- Team player with a proactive mindset, exceptional organizational skills and attention to detail

- Entrepreneurial empathy to support founders

- Experience with startup investing and venture capital fundraising process

Famous Heads of Platform in the VC world include

- Galina Ozgur, Vice President of Platform at H/L Ventures

- Olivia O’Sullivan, Head of Platform at Forum VC,

- Paul O’Brien of Mediatech Ventures

- Laura Clifford, US Platform Lead at Northzone

- Allie Mullen, Director of Platform at Wireframe Ventures

Many other heads of platforms you can find in our 1,000 VC VC Platform Professionals list here.

The VC Platform Role: How to Become a Member or Head of Platform

Expert in a specific field

If you want to have a specific role in a VC platform, you have to be an expert in some field. We mentioned marketing, security, and finance as one of the platform teams, so make sure you have a solid background and proven results in the field you are applying for.

The best candidates have proven experience in this field, and their CV highlights their achievements and the big company names they worked for previously.

Apart from expertise, for a VC platform role you need resourcefulness, adaptability, strategic thinking, and verbal reasoning skills.

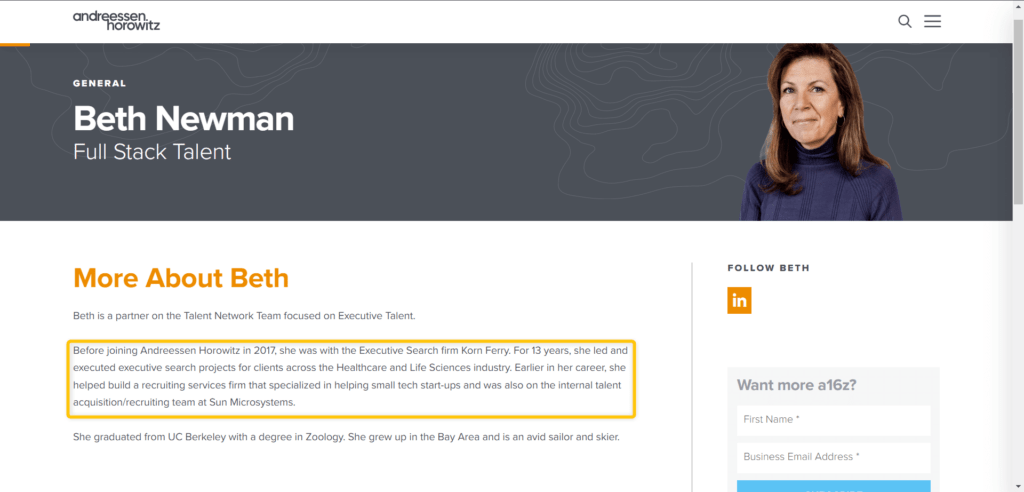

For example, Beth Newman is a partner on the Talent Network Team at Andreessen Horowitz who helps hire people inside portfolio companies, which high-growth companies really need help with.

Her experience with building a recruiting service firm and helping small tech-startup companies make her a valuable asset for this VC firm.

Another great example is Nick Keegan from Mayfair Equity, who helps portfolio companies with marketing, communications and digital media. He used to advise Coca-Cola, Telefonica O2, GlaxoSmithKline in that field as well, making him the perfect candidate for the job.

Ex Startup role

To become a member of the platform team or the head of the platform, you need to first and foremost understand the VC landscape and be eager to work with entrepreneurs.

The best candidates often were a part of startups that partnered with VCs. These candidates know the ins and outs of this partnership, and they know the struggles and the path of a startup.

People who have worked for startups know what it takes to build something from scratch and possibly have worn many hats during that journey – from marketing to talent acquisition.

For example, In Sik Rhee an Operations partner for Vertex Ventures US, founded his first startup, Kiva Software, at the age of 24, which eventually got acquired by Netscape.

No experience

If you aren’t an expert, you can look for volunteering, internships or training opportunities in popular VC companies. This opportunity can be your “foot in the door,” and you can learn, gain experience and get to know the VC world inside out.

Insiders have a better chance of staying in the company than people who haven’t worked for them before.

Another great tip is – to do outreach and networking. If VC companies don’t have opportunities for you right now, you can always connect with them on social media, reach out to them or get to know the employees at VC-related events.

Head of Platform

To become a head of the platform in a VC firm, you need to have extensive experience with managing larger teams, like a former VP of sales, product or talent or a senior-level startup executive.

To become a head of a VC platform, you either have to have experience in the same or similar role, or to be promoted within your VC company. The head of the VC platform needs to be knowledgeable about every platform team and have great communication and organizational skills.

Dom Perri is the Head of Platform at Vertex Ventures US, with a long career in business development and M&A strategy at companies such as Tesla and DropBox, as well as being a founder of a few acquired startups.

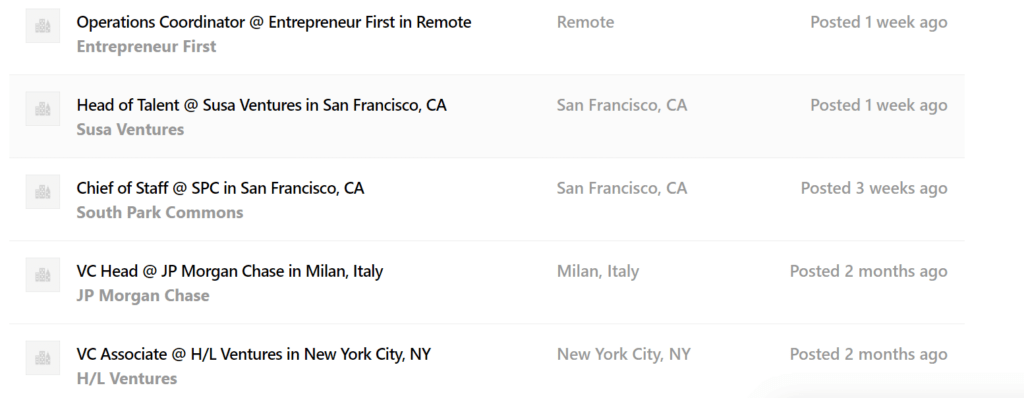

Where to Apply for the VC Platform Role

If you don’t have an ideal VC platform you’d like to target, it is best to take a look at designated VC platform role job boards. The most up to date job boards are:

We’ve analyzed dozens of VC platform role(s) job descriptions, and here are the common traits and responsibilities:

Common qualifications:

Experience:

- 2-5+ years of relevant experience

- Background in startups, venture capital, or related fields (e.g., management consulting, operations)

Skills:

- Exceptional communication skills (both written and verbal)

- Strong project management abilities

- Detail-oriented and highly organized

- Ability to work independently and drive outcomes

- Proficiency in managing multiple work streams simultaneously

Personal attributes:

- Entrepreneurial mindset and ability to work in fast-paced environments

- Self-starter with high initiative

- Ability to interface with senior leaders and manage up effectively

- Sound judgment and professionalism

- Adaptability and willingness to take on new challenges

Responsibilities varied depending on the roles, but here are key responsibilities for the most popular VC platform roles, according to job descriptions:

| Roles | Key responsibilities in job descriptions |

| Talent management | Leading recruiting efforts for portfolio companiesManaging talent relationships and building talent networksConducting surveys (e.g., NPS, CSAT) and synthesizing results |

| Content creation and marketing | Developing various types of content (presentations, articles, social media posts)Managing editorial calendars and social media platformsEnsuring brand consistency across communications |

| Event planning | Organizing and facilitating events (e.g., founder dinners, CEO roundtables)Building and maintaining founder resource librariesManaging communication channels (e.g., CEO listservs) |

| Operations | Assisting with firm-wide operations and strategic planningManaging special projects and supporting senior team membersMaintaining internal wikis and knowledge basesSupporting HR initiatives, including onboarding and employee engagement |

| Portfolio company support | Onboarding new portfolio companiesProviding resources and support to foundersAdvising on marketing and content strategies |

Conclusion

In this article, we’ve explained the VC platform role(s) in detail, with tips for applying and picking your ideal VC firm.

VC firms have become great career opportunities for experts of ex start-up founders who want to use their experience and skills to help other startups succeed. In a VC portfolio firm, there will hardly be a dull day, so look at the job boards we provided to find your next opportunity.

Need help with your brand marketing? Contact us today!

[wpdatatable id=9]