Exiting your Amazon FBA business can be daunting. There are numerous aspects to consider when exiting a business, such as the arduous task of finding the right buyer and ensuring your paperwork is all in order. You must have a firm structure in place, or you will be less likely to achieve financial freedom and may rue the day when you decided to sell your business without sufficient preparation. While it can be intimidating, if you take it one step at a time — with sound, detailed preparation — there is no reason why exiting your business should be daunting for you. This article presents you with key tips that will help you maximise your exit from your Amazon FBA business and ensure it all runs smoothly.

Consider Your Exit Objectives

Before you do anything else, it is prudent to consider what you would like to achieve from exiting your business. For example, how much do you want to sell? When do you want to sell? Do you still want to be involved to an extent within the business? Once you have decided what exactly you want to receive from your exit, you can take the steps toward achieving that goal.

Enhance and Diversify Your Sales Revenue

When you have decided to exit your business, the last thing on your mind will probably be making adjustments to improve its sales revenue. But, this is a sensible move because logic dictates that the more sales you make and the higher the consequential value of your business, the higher the payout is likely to be and the more tempting it looks for a potential buyer. Therefore it is highly recommended that you maximise your sales revenue, such as through increased advertising of your brand. For further help understanding what influences the value of a business, read our article about Amazon Seller Valuation.

Not only is it a good idea to maximise your sales revenue, but you should look to diversify it too. While having only one product to sell can appeal to many businesses (due to its simplicity), there is also substantial risk of relying on one product. What happens if the operating fees skyrocket overnight or customers are simply losing interest in the product? This is why potential buyers are attracted to businesses with fingers in several pies, whether it is a diverse product range or items that sell in more than one market; anything that eradicates a single product risk is a big tick in the box for a buyer.

Understand and Maximise Your Seller Discretionary Earnings (SDE)

The SDE is a crucial part of your business. Many businesses are sold based on SDE, defined as the full financial benefit that a single full-time owner-operator would expect to get from the business annually. Therefore, you must calculate this figure accurately and do what you can to maximise it so that you can sell your business for more money. Even if you have just started a business and are only interested in learning about exiting, you must do your accounting regularly to keep on top of the numbers and present a more accurate SDE. It might even be wise to seek expert advice to help guide you on how your business can work to maximise this figure. You should ensure that your sales revenue is producing an excellent net margin. This will help to improve the SDE and help your business stand out more to a buyer.

Understanding Your Plan for Brand Growth

Of course, when someone is considering a brand, one of the first things they will think about is its growth potential. Where is the appeal in buying a business with no possibility for a growth opportunity? Therefore they will be looking for ways to improve sales revenue, SDE, and net margins. If you have followed our earlier tips, you will have already answered these questions for them. But you must articulate to a buyer with better capital and resources what paths they could go down and where they could lead the brand after your departure.

Improve Your Brand Equity

Brand equity (the social value of a brand name) cannot be underestimated. After all, if customers are enthusiastic about the products, and your brand is becoming more recognised, it is hard for your business to go far wrong. Increased sales can occur from the simple fact of brand recognition. Therefore it is a great idea to improve your brand equity to further your business venture. While it can be challenging to stand out from the crowd when you are on a congested marketplace such as Amazon, there are some ways that you can develop your brand equity further.

Getting positive reviews and excellent star ratings is one way to push your brand ahead of the rest. You could also aim to improve your overall ranking on Amazon. A third suggestion is to offer a price for your product(s) that are fair and stable against the competition. Making efforts to improve these factors can make a real difference and maybe enough to get potential buyers turning their heads in your direction. Furthermore, achieving strong brand equity will give faith to buyers that consumers have a favourable view of your brand, and your business could promise much longevity.

Obtain Preliminary Feedback

When you are working toward maximising your exit, the early opinions of buyers are invaluable. There is nothing wrong with asking for general feedback from buyers you would be interested in working with. The worst scenario is that you are given a lot of negative points. However, this is ultimately a massive advantage at the end of the day, as you still have time to improve your business and make any necessary changes based on the feedback. If you receive negative feedback, take it as a springboard for your business to jump from and improve. If you do not seek out early feedback, then you could be left facing massive and previously unseen issues at the negotiation stage of selling your business, a time when it may be too late to act or entice a desired buyer back.

Legally Prepare Your Business

If you have not already done so, make sure your business is legally prepared. This means ensuring that all the legal requirements and documents are adequately implemented. Before speaking to a potential buyer about selling your business, this should be done. Conducting this preparation indicates a highly organised business and competent seller. It does not look good if a buyer realises that appropriate action has not yet been undertaken during negotiations. Furthermore, failure to legally prepare can delay negotiations and pause the selling of your business.

Get Your Accounts and Finances in Order

It cannot be stressed enough how vital your accounts and finances are in order and ready for a buyer. If there are even basic miscalculations, your valuation can be quickly and negatively affected. For this reason, you must ensure that your finances are accurate before starting the exit process. Some sellers prefer to do this through an accountant, which can help ease the burden. Concerning finances, some sellers also opt to seek out tax advice to ensure that they do not pay more tax than they should or need to. This can be a valuable idea if advice is sought out before the exit process, as you can determine which purchase agreement works best for your business and, consequently you. It is not essential to seek outside advice so long as you are confident with the numbers you present to a potential buyer.

Remember Your Key Performance Indicators (KPIs)

You must never forget that when you present your business and its assets to a potential buyer, it has to be enticing. You have to convince the buyer why they should invest their money in your business. A great way to do this is by using KPIs when selling your business in a pitch or discussion. Make sure you do your research on what your business can offer so that you can offer this information in a compelling and positive way. Whether you have KPIs in monthly sales growth or perhaps a tremendous lead-to-sale conversion rate, make sure you compile all your assets and present them with confidence to a buyer. Including KPIs in a pitch can make you stand out.

Other Tips

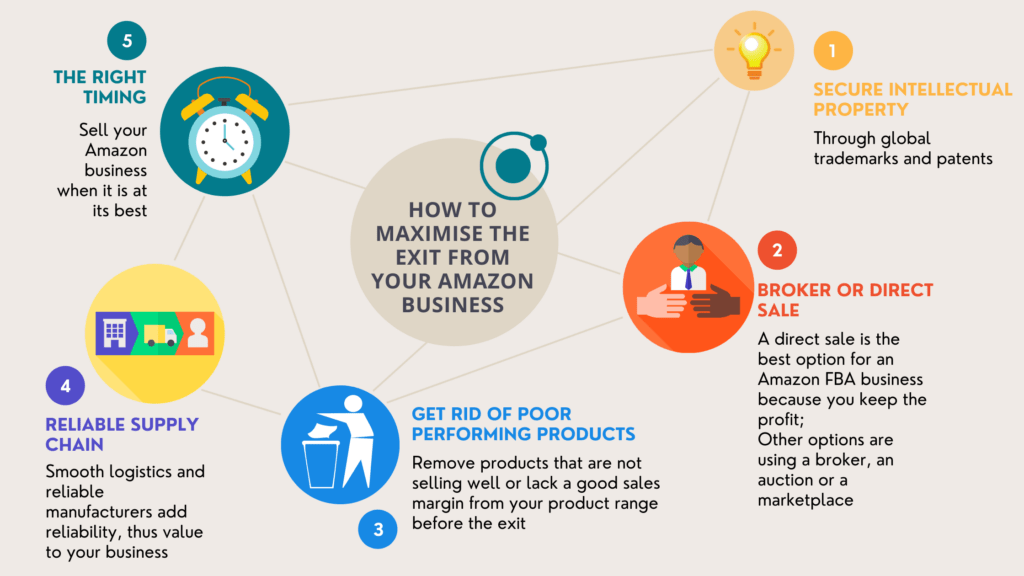

- Secure your Intellectual Property (IP). Ensure that you have global trademarks in operation before you sell, as well as design and utility patents if required for your products. This will help boost your exit price, and, luckily, Amazon is excellent at enforcing any breaches.

- Decide how you want to sell the business. You can choose to sell your business through a marketplace, an auction, a broker, or a direct sale. Generally, a direct sale is the best option for an Amazon FBA business because you keep the profit, and the transition can be smoother and quicker.

- Get rid of any poor performing products. If a product is not selling well or there is a lack of a good sales margin, it is in your interest to drop them as you are essentially haemorrhaging money into something that is not profiting you or your business

- Secure a reliable supply chain. Having a positive relationship with suppliers will help ensure your orders are fulfilled punctually and attract new customers while retaining the existing ones. All of these factors point toward a more successful business to sell.

- The timing of selling a business is crucial. Any good exit strategy requires excellent timing. It is best to sell your FBA business when things are going well for your business. Think through the timing of your exit with great care.

Final Thoughts

There are both pros and cons to running an Amazon FBA business, but you do not have to be on the brink of selling your business to consider how you will maximise your exit. Many people consider their exit plan while they are still creating a business. It is a great idea to prepare for this as early on in your business as possible, as the more time you put in, the more you can refine and benefit from your exit. It is wise to consider ideas such as increasing your sales revenue, maximising your SDE, and improving your brand equity, anything at all that will make a buyer turn their head twice. While preparing for an exit can seem laborious and stressful, following our top tips will help you to keep your head above water. And, if you are unsure of when is the best time to sell your brand, we have the answers here for you.