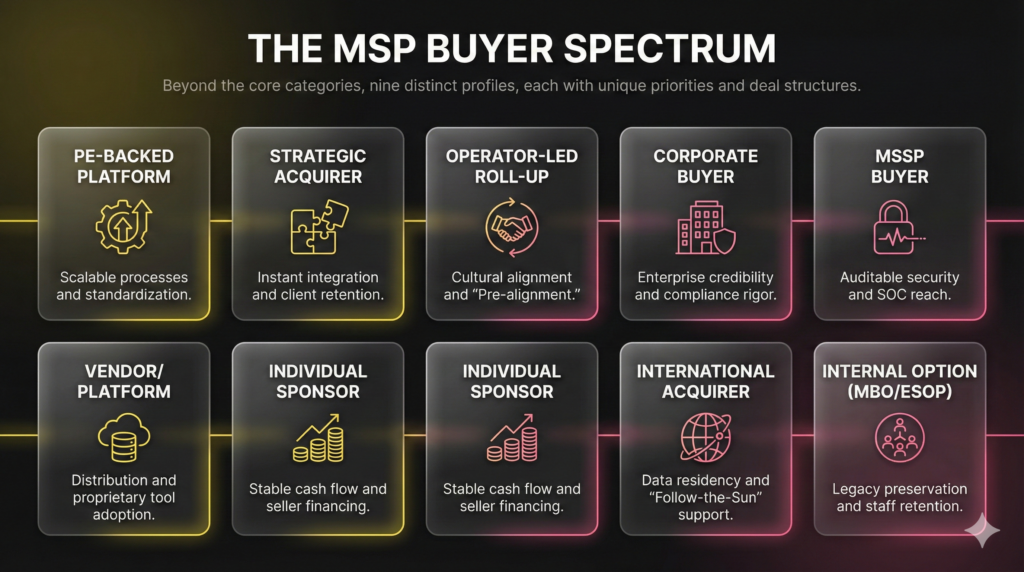

The MSP market is consolidating, yet treating all acquirers the same guarantees a valuation ceiling. The critical factor determining your exit multiple and understanding PE valuation exit mechanics is the identity of the firm across the table. Strategic failure arises from pursuing financial buyers when structured for strategic growth, or vice versa. To maximize your organic equity, founders must understand precisely who is buying msps and what they optimize for. This analysis defines nine distinct profiles, starting with the two core categories: financial buyers and strategic buyers.

1. The PE-Backed Platform: Optimizing for Integratable Scale

The PE-backed platform is the dominant force tracking who is buying MSPs. These financial buyers seek certainty, not potential. They establish a “platform” MSP designed to rapidly scale through repeatable, “bolt-on” acquisitions, optimizing targets specifically for de-risked, risk-adjusted EBITDA.

PE deal success is entirely predicated on Quality of Recurring Revenue (QRR). Buyers demand evidence of scalable processes, stack standardization, and demonstrably low customer churn. A typical structure is a majority buyout requiring the founder to retain significant “rollover equity,” aligning incentives for the growth phase. Earn-outs bridge valuation gaps based on future financial milestones.

The owner takeaway is direct: if you seek PE interest, prioritize M&A readiness. Your MSP must look integratable through clean, verifiable financials, process standardization (SOPs), and immediate mitigation of customer concentration risk. Your operation must be a predictable revenue machine capable of dropping seamlessly into a larger corporate structure.

2. The Strategic Acquirer: Leveraging Operational Fit for Immediate Gains

Where PE optimizes for financial engineering and risk-adjusted EBITDA, the Strategic Acquirer optimizes for immediate operational results. These are typically larger, established MSPs executing bolt-on acquisitions to achieve rapid geographical expansion, secure a new vertical foothold, or onboard specialized talent and capability.

Unlike a platform build, strategic buyers demand instant integration capability. Who is buying msps in this category focuses relentlessly on service quality, client retention rates, and cultural alignment. They are not interested in scaling abstract QRR; they need to know if your clients are happy and if your tech stack complements theirs for immediate cross-sell and upsell opportunities.

The deal structure is often simpler than PE (cash plus a retention-driven earn-out), but the required due diligence moves fast. To appeal to strategic buyers, an owner must articulate precisely how their client base, specialized compliance expertise, or RMM stack plugs seamlessly into the buyer’s existing structure, accelerating their time-to-market. Be prepared for accelerated integration timelines.

3. The Operator-Led Roll-up: Prioritizing Cultural Alignment

The operator-led roll-up offers a sophisticated middle path to answer who is buying MSPs, directly mitigating the culture-killing integration fears of founders. These groups, often led by successful MSP operators, prioritize cultural alignment as the fundamental factor reducing integration risk and limiting attrition.

The model optimizes for standardization through repeatable onboarding and shared best practices, avoiding immediate assimilation shock. Advanced platforms use pre-alignment: the acquired entity standardizes operations and the tech stack before further platform acquisitions are initiated. This structure minimizes disruptive impact on both employees and client relationships.

Owners must diligence the post-close environment. Determine which specific elements remain autonomous (leadership, branding, tool stack). Crucially, clarify if promises regarding cultural fit and employee retention are contractual or merely “best effort” guidance. This distinction defines the true enterprise value retained post-exit. (159 words)

4. The Corporate Buyer: Acquiring Enterprise Credibility and Compliance

Founders often assume their specialized, compliance-heavy MSP is too niche for M&A. In reality, that specialization makes you profoundly valuable to the largest tier of acquirers: the Corporate Buyer. These are major IT services firms, System Integrators (SIs), or Value Added Resellers (VARs) seeking to rapidly onboard Managed Services capabilities and enterprise credibility.

Unlike financial buyers focused purely on EBITDA, Corporate Buyers optimize for verifiable delivery capacity, compliance rigor, and high attach rates to existing enterprise accounts. Your operation integrates not as a standalone P&L, but as a tightly governed managed services division. This model demands increased internal reporting rigor and governance standards.

The owner takeaway is critical: if your MSP has deep regulated vertical exposure (like healthcare or financial services) or complex enterprise accounts, your value calculation shifts dramatically. Your specialization is an immediate, high-value asset to these strategic buyers, who pay a premium for established compliance rigor over general small-market consolidators. (152 words)

5. The MSSP Buyer: Valuing Auditable Security and Compliance Delivery

You position your firm as security-forward, but are you ready for true security diligence? This buyer profile is the specialized MSSP or security-centric platform acquiring MSPs to ingest critical security service lines, deepen SOC reach, or rapidly onboard specific compliance certifications. They are not optimizing for generalized EBITDA; they focus intensely on your security revenue mix, incident response maturity, and the defensibility of your delivery. Diligence goes far deeper on risk than with any financial buyer. Who is buying msps in this lane will scrutinize your tooling, insurance posture, and operational processes. To maximize valuation, your technical authority must be packaged as auditable proof. Transition from simply selling a security story to demonstrating delivery underwritten by verifiable SOPs and mature compliance playbooks. This allows the buyer to underwrite the transfer of high-value, recurring security contracts, justifying a premium multiple for predictable compliance performance.

6. The Vendor/Platform Buyer: Mitigating Vendor Concentration Risk

Believing your RMM or PSA vendor is irrelevant to your exit strategy until they send an LOI is a costly oversight. Who is buying MSPs is only half the equation; M&A activity among platform vendors—like ConnectWise, Kaseya, or adjacent enablement ecosystems—directly dictates your future margin structure and valuation.

These platforms optimize primarily for distribution and service attach, leveraging acquisitions to drive proprietary tool adoption, not pure MSP operations. When a major vendor changes ownership, expect pricing terms to shift, support quality to fluctuate, and integrations to sunset, creating immediate vendor concentration risk in your due diligence package.

The owner takeaway is documenting resilience for exit readiness. If 80% of your stack relies on a consolidating vendor, prepare to demonstrate—via verifiable SOPs—how you manage pricing volatility and mitigate single-vendor dependency. Buyers, particularly PE firms, pay a premium for systems resistant to external market pressures.

7. The Individual Sponsor/Operator: Optimizing for Stable Cash Flow

If large Private Equity platforms feel out of reach, you will likely encounter the small sponsor or individual operator first. These experienced executives raise capital to acquire, run, and optimize a single MSP or initiate a micro-roll-up. Unlike PE, they optimize not for complex financial engineering, but for simple, stable cash flow and clear owner add-backs.

Their ideal target is a straightforward business with low customer complexity and a manageable size they can personally run. The deal structure reflects their capital limits, often requiring a higher percentage of seller financing and demanding longer transitions involving the founder’s continued operational involvement.

The crucial owner takeaway: diligence the operator, not just the capital. Service quality and team retention hinge on one person’s competence. Demand a verifiable operating plan that proves they understand technical delivery, not solely the financial spreadsheet, thus ensuring your company’s legacy remains secure post-exit. (165 words)

8. The International Expansion Acquirer: Leveraging Geo-Specific Credentials

True global coverage demands instant, in-territory credibility, often achieved through cross-border M&A. Overseas MSPs and IT services firms execute these deals to immediately access new compliance regimes, languages, or time zones, perfecting the “follow-the-sun” support model.

The core asset they optimize is data residency compliance and immediate leadership depth within a new market. Acquiring an MSP with deep vertical expertise—such as CMMC or HIPAA—bypasses years of expensive legal and operational setup for the buyer. Friction points include integrating disparate service cultures, navigating complex legal/tax regimes, and merging payrolls across national borders.

The owner takeaway: If your MSP has differentiated vertical expertise, multilingual delivery capability, or a scalable remote model, your services are more “exportable” than you realize. You represent a competitive moat against their domestic rivals. Understand that who is buying msps internationally will subject you to exponentially heavier diligence focused on legal structure, data governance, and transfer pricing. (143 words)

9. The Internal Option: Prioritizing Continuity via MBO or ESOP

The fear that a strategic or Private Equity exit requires sacrificing service quality and staff retention is legitimate. Who is buying MSPs doesn’t always have to be an outsider. When evaluating IT business sales transfers, the Internal Option—a Management Buyout (MBO) by the leadership team or an Employee Stock Ownership Plan (ESOP)—is the pure strategy for legacy preservation of the МСП.

This path optimizes entirely for continuity: rewarding key team members, protecting client relationships, and maintaining the service delivery model. Financing complexity is the immediate hurdle. Furthermore, the resulting lower multiple will realistically not compete with aggressive financial bidders offering maximal upfront cash.

The owner takeaway is clear: if protecting your people and preserving established brand integrity is your top priority, internal succession belongs on the shortlist. While slower and often more complex to structure than a fast sale, this option ensures your years of work transfer directly to those who understand and value your unique technical authority.

The 4-Step Decision Workflow for MSP Exit Maximization

Maximizing your MSP’s exit requires operational rigor and M&A readiness. Use this four-step decision workflow to align your firm’s operational reality with the financial benchmarks that strategic and financial acquirers use to determine valuation.

Step 1: Classify Your Operational Reality, Not Your Ego

Start with hard, verifiable data to define your feasible buyer pool. Verify Annual Recurring Revenue (ARR) and normalized EBITDA. Use these figures to define your buyer set (e.g., $10M+ ARR attracts PE Platforms; $2M to $8M attracts Individual Sponsors). Crucially, audit your Revenue Mix. Quantify the percentage of Quality of Recurring Revenue (QRR) versus project-heavy work. Higher QRR translates directly to higher valuation certainty, as it proves revenue predictability.

Step 2: Run the Buyer’s Risk Underwriting Audit

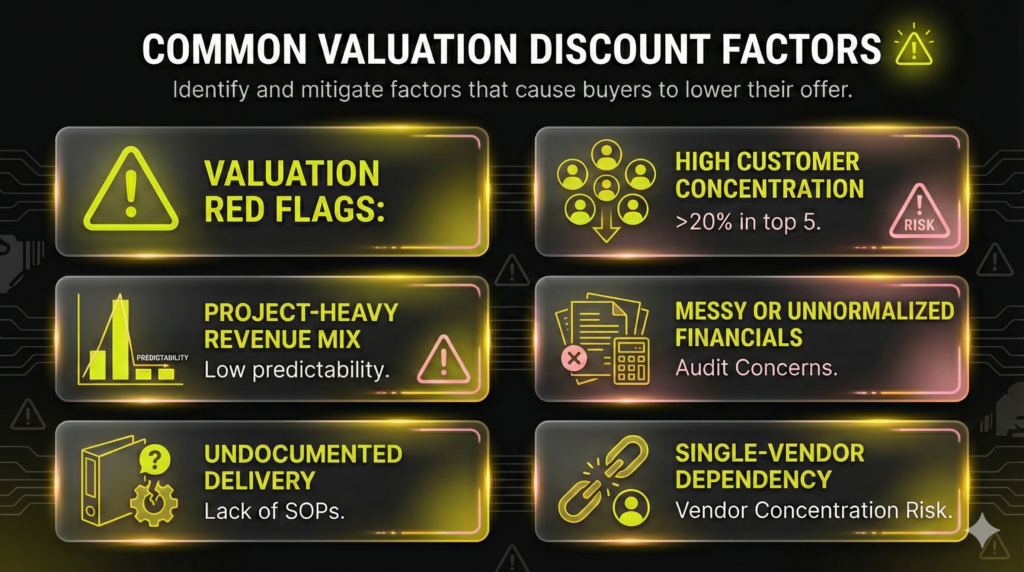

Run the Risk Underwriting Audit before a Letter of Intent (LOI) is signed. Calculate customer concentration; buyers scrutinize Top 1 and Top 5 revenue percentages intensely. Document Revenue Churn rates and confirm contract terms. Guaranteed auto-renewal terms are critical to Quality of Recurring Revenue (QRR). Finally, prove Integration Readiness using verifiable Standard Operating Procedures (SOPs) and stack standardization. This organized documentation mitigates Vendor Concentration Risk.

Step 3: Match Your Firm to the Optimal Buyer Profile

Reference the buyer profiles and match your exit goals. If maximum upfront liquidity is the priority, target the PE-Backed Platform or Strategic Acquirer optimized for immediate scale. If continuity and autonomy are paramount, seek an Operator-Led Roll-up or the Internal Option. If your firm holds deep compliance expertise (HIPAA, CMMC), focus exclusively on the Corporate Buyer or MSSP Buyer for premium vertical multiples.

Step 4: Prepare the Data Room and Narrative Checklist

Build a ready, high-quality Data Room. Prepare three years of audited financials, detailed customer churn metrics, and a clean CRM extract showing sales funnel metrics. Next, prepare your narrative: articulate the MSP’s competitive moat and forward growth thesis. If data quality or buyer-fit gaps are evident, utilize an M&A Readiness Audit to align your firm before vetting MSP M&A advisors or engaging investment banking counsel.

FAQ

Private Equity (PE) platforms currently dominate deal volume for platform acquisitions (seeking scale). However, Strategic Acquirers, typically larger MSPs, execute a higher frequency of smaller bolt-on transactions for geographical or technical expansion. Who is buying msps depends on size: PE seeks $10M+ ARR platforms, while strategics target firms with under $5M ARR for immediate integration. Align your M&A Readiness to the most suitable category.

Buyers prioritize verifiable financial predictability. Primary discount factors include high customer concentration (Top 5 clients exceeding 20% of revenue), low Quality of Recurring Revenue (QRR) due to short or month-to-month contracts, project-heavy revenue that lacks predictability, and messy, unnormalized financials. Undocumented technical delivery (lack of SOPs) also acts as a significant discount, signaling high integration risk.

QRR is the reliability and stability of your revenue stream. It is defined by long, auto-renewing contract terms, high gross margin stability, and robust pricing discipline that avoids heavy discounting. To optimize QRR, rigorously track monthly revenue churn and logo churn. Buyers pay a premium for systems that prove predictable revenue outcomes, making the business more investor-grade. (See Step 2: Run the Buyer’s Risk Underwriting Audit for detail.)

Earn-outs and rollover equity bridge the valuation gap and ensure seller retention. Expect earn-outs to be tied to clear, auditable performance metrics (e.g., achieving specific EBITDA or NRR targets) over 12 to 36 months. Diligence is critical: ensure the metrics are within your control post-close and that integration dependencies will not unfairly jeopardize your ability to hit the targets.

The primary risk is staff and service degradation churn. Immediately post-close, employees may fear cultural misalignment or loss of autonomy, leading to talent attrition. To mitigate this, negotiate clear retention commitments, use employee retention bonuses tied to the transition period, and establish explicit clarity on post-close authority and client transition plans to maintain predictable service quality.