Stop debating the “multiple.” For founders considering a sale or recapitalization, the true value of your MSP is hidden in the Letter of Intent, not the headline valuation. The real discussion starts with adjusted EBITDA, deal structure, and timing. I approach this guide not as a broker, but as an investor and operator who has executed roll-ups and understands the diligence reality. We will cut the noise and detail the specific mechanics that determine valuations for private equity msps, integrating investor-grade succession planning to anchor your exit expectations exactly where every successful deal negotiation begins.

1. Deconstructing the Valuation: The Three Numbers That Define Your Exit

The “7x EBITDA” figure heard in market chatter is rarely the price realized. For sophisticated private equity msps, valuation is defined by three distinct numbers, not a single headline multiple. Public or general middle-market multiples serve only as directional anchor points, not promises.

The primary anchor is the EV/EBITDA Multiple, Enterprise Value divided by trailing twelve months (TTM) adjusted EBITDA. Second, high-growth firms with low profitability may use the Revenue/ARR Multiple, weighting valuation toward future recurring revenue.

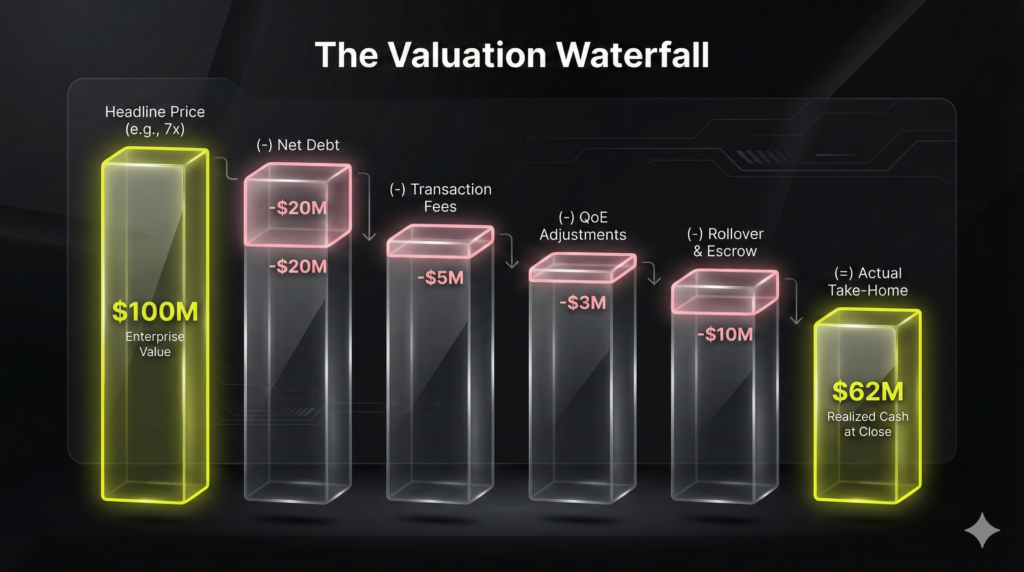

The third, most critical number is the Implied Take-Home at closing. This is the realized multiple, calculated after net debt, transaction fees, and crucial Quality-of-Earnings (QoE) adjustments. The headline multiple is dispersed by diligence findings and deal structure (e.g., earn-outs and rollover equity).

The Practical Interpretation Framework

Buyers translate risk into the final EV/EBITDA multiple using the following framework:

- Size and Role: Small tuck-ins absorbed into a larger platform command a lower multiple due to higher integration risk. Platform economics, by contrast, drive premium valuations.

- Revenue Quality: High client retention, multi-year contracts, and low customer concentration signal reliable cash flow, pushing the multiple higher.

- Capability Premium: Specialized offerings (e.g., advanced MSSP or vertical focus on regulated finance clients) justify a premium by reducing the buyer’s need to build capabilities internally.

Securing a realistic valuation range requires an investor-grade KPI pack backed by normalized EBITDA—a prerequisite addressed in the next section.

2. EBITDA Normalization: The Line Between Taxable Income and Enterprise Value

Misleading EBITDA, often exposed by a poor Quality-of-Earnings (QoE) report, is the single greatest driver of multiple erosion during due diligence. EBITDA normalization strips out owner-centric and non-recurring expenses that an institutional buyer would not incur, presenting true, sustainable cash flow. Buyers price predictability, not tax strategies or lifestyle costs.

The most defensible add-backs prove earning capacity is higher than the tax return shows. These typically include:

- Owner compensation exceeding market rate.

- Truly one-time legal settlements or non-recurring recruiting costs for specific projects.

- Unusual, non-repeating vendor transition fees.

Buyers aggressively push back on anything resembling chronic underinvestment. If you failed to hire crucial sales or technical headcount, that missing salary cost will be normalized down (subtracted). Recurring software costs or personal expenses without ironclad documentation will also be rejected.

To execute an investor-grade QoE, reconcile your monthly P&L/balance sheet and maintain a clean chart of accounts. Prepare an auditable add-back schedule with supporting evidence (invoices, contracts, rationale). Strong QoE readiness protects valuation from retrades and directly influences favorable deal terms and higher cash-at-close.

3. Translating MRR into Contract Durability: How Buyers Underwrite Risk

Most founders view Recurring Revenue (MRR) as a simple total, but private equity msps treat it as an underwritten risk portfolio, prioritizing durability over volume. Buyers focus on guaranteed contract life, stable gross margins, and the proven ability to scale service delivery without ballooning headcount.

Maximizing valuation requires improving five operational levers that reduce a buyer’s perceived risk:

- Retention: Prioritize dollar retention. High dollar churn (losing a top-tier client) is a massive red flag that decimates valuation, far outweighing logo churn.

- Contract Mechanics: PE scrutinizes termination rights. Migrate clients from evergreen monthly agreements to multi-year contracts (36 months preferred) to increase asset durability.

- Customer Concentration: Scrutiny applies if the top client exceeds 10% of MRR or the top five clients exceed 25%. Secure long-term extensions or diversify before diligence begins.

- Gross Margin by Service Line: Buyers segment profitability. Low-margin legacy services (break-fix, non-standard helpdesk) drag multiples down; showcase standardized security and cloud services achieving 65%+ gross margin.

- EBITDA Confidence: Demonstrate cash flow predictability through standardized stacks, automation, and low ticket volume per technician. This proves the business scales efficiently post-acquisition.

Establish an auditable KPI dashboard tracking MRR bridge, gross margin, and churn metrics. Fix concentration risk immediately to ensure deal stability and M&A readiness.

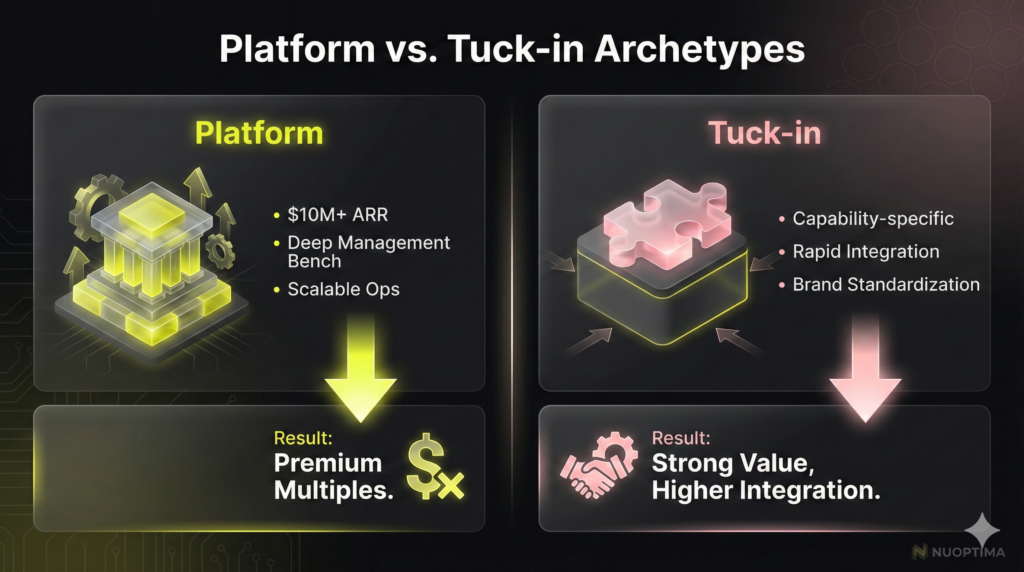

4. Platform or Tuck-In? How PE Defines Your Role and Exit Value

For any founder preparing an MSP sale, the critical variable is your role in the consolidation strategy. This distinction—Platform or Tuck-in—directly determines your valuation multiple, integration pressure, and retained autonomy.

The Two Archetypes of Private Equity MSP Deals

Platform Deals establish the foundation for the roll-up. These targets possess substantial recurring revenue ($10M+ ARR), deep management benches, and scalable operational procedures. Private equity msps underwrite these deals based on leadership quality, standardized reporting, and the proven ability to execute future acquisitions. Platform founders receive premium valuations and substantial rollover equity, but commit to a longer stay-on requirement.

Tuck-in or Bolt-on Deals are smaller, capability-specific add-ons that integrate fully into an existing platform. Buyers underwrite tuck-ins based on immediate client book quality, tech stack compatibility, and cross-sell potential. While still commanding strong valuations, tuck-ins face rapid brand standardization, a short integration timeline, and higher earn-out risk tied to client retention performance.

Understanding your lane is paramount for M&A readiness. If you lack leadership depth, position yourself as a best-in-class tuck-in; attempting to sell as a Platform will only expose operational gaps that suppress your multiple.

| Self-Diagnosis Checklist | Your Position (Yes/No) |

|---|---|

| Do you have a leadership team (COO/CFO) independent of the founder? | |

| Is your ARR above $10 million? | |

| Are your EBITDA margins consistently above 20%? | |

| Is your service stack and pricing model standardized across all clients? | |

| Can the firm function effectively for 90 days without the founder? |

If you answered “Yes” to four or more, you are strongly positioned as a Platform target. If you answered “No” to three or more, you are a valuable Tuck-in. Negotiate the deal structure appropriate for your role. (187 words)

5. Decoding the Consideration Stack and Structuring the Exit

Maximizing value requires focusing on deal structure, not just the multiple. For private equity msps, the total consideration is distributed across the stack: cash-at-close (immediate liquidity), seller note (deferred, secured by the buyer), rollover equity (re-investment in the platform), and the performance-based earn-out.

The three most common MSP M&A traps erode the headline multiple post-signature:

- Earn-out Control: Metrics are tied to buyer-controlled levers (e.g., service model changes, integration delays), rendering targets unachievable.

- Working Capital True-Ups: Aggressively high net working capital targets lead to a post-close “true-up” that significantly reduces immediate cash proceeds.

- Role Mismatch: Founders expecting a strategic exit often find the buyer demands a critical 2- to 4-year operating tenure under a stringent non-compete.

The Deal Term Scorecard: Negotiating Realized Value

| Status | Term Detail | Negotiation Strategy |

|---|---|---|

| Good | Earn-out tied to gross profit of existing client cohort. | Define governance and decision rights over performance metrics. |

| Watch | Vague “normalized” working capital target. | Require clear calculation methodology and strict KPI definitions. |

| Red Flag | Earn-out tied to buyer-controlled actions (platform-wide pricing changes). | Demand metrics tied solely to client retention/service efficiency. |

Negotiating a clean deal structure is fundamental to maximizing true M&A readiness and ensuring the multiple translates into realized wealth. (206 words)

6. The M&A Timing Decision: When to Prepare vs. When to Launch

The strategic decision for founders is whether to launch now and risk poor financing conditions, or wait for ideal market liquidity. Since external factors like market liquidity and buyer appetite fluctuate beyond your control, the strategic imperative is maximizing internal M&A readiness. This ensures you can execute a deal at maximum deal velocity the moment the market reopens.

Readiness work (data room, KPI pack, financial cleanup) must precede market launch. If targeting a close with a cohort of private equity msps in 2026, preparation and normalized data generation must begin 6–12 months prior to launch.

While external factors like the cost of debt and platform bolt-on appetite drive deal velocity, the internal factors you control dictate deal certainty. If you are receiving inbound interest now, use it only to benchmark valuation; never rush a deal before meeting key internal readiness triggers.

| Internal Timing Triggers | Readiness Signal |

|---|---|

| Leadership Bench | COO/CTO can run the business without the founder. |

| Security Posture | Fully documented and compliant MSSP offerings. |

| Churn Stability | Dollar retention consistent above 100% (tracked TTM). |

| Pipeline Predictability | Sales pipeline metrics (win rate, ACV) are stable and reliable. |

7. Protecting the Multiple: The Due Diligence War Room and Checklist

The Letter of Intent (LOI) marks the start of due diligence: an intense, compressed 45-to-90-day sprint where buyers validate all valuation assumptions. This critical phase determines whether the headline multiple holds or suffers significant erosion. Achieving complete M&A readiness means turning every workstream into a controlled checklist.

Diligence streams are divided into seven key areas, all of which must be prepped concurrently:

- Financial: Validation of QoE, normalized EBITDA, and revenue recognition (managed vs. project work).

- Commercial: Client interviews, churn risk analysis, and customer concentration stability.

- Operational: Service delivery KPIs, ticketing efficiency, and documentation quality.

- Technology Stack: Standardization of PSA/RMM tooling; confirming technology sprawl is not introducing uncontrolled CapEx.

- Security & Compliance: Incident history, MDR process documentation, and current cyber insurance policies.

- Legal: Scrutiny of MSAs/SOWs, SLAs, termination rights, and assignability clauses.

- HR: Review of compensation bands, retention risks, and assessment of keyman dependency (e.g., owner-as-only-salesperson).

Buyers aggressively hunt for deal-killers: messy contracts, undisclosed security incidents, or uncontrolled tool costs that spike post-close. Successful closings require anticipating and mitigating these risks before the data room opens. Your ability to produce clean, accessible data instantly is the definitive signal of professionalism and institutional readiness.

The Integrated MSP Exit Roadmap: A 4-Phase Execution Schedule

MSP deals fail or retrade when the owner mismanages the sequence (prep, process, integration). Optimize deal velocity by moving from strategic insight to controlled execution. This roadmap provides the blueprint for achieving institutional-grade M&A readiness.

Phase 1: Strategic Prep (6–12 Months Out)

This phase is the Valuation Defense.

- Normalize EBITDA using the framework from Section 2.

- Build a KPI pack (client retention, gross margin by service line) per Section 3 standards.

- De-risk customer concentration immediately.

- Document security and operational procedures to eliminate keyman dependency.

Phase 2: Market Launch (0–8 Weeks)

Manage the go-to-market process rapidly to maintain focus.

- Choose your advisor lane (broker or investment banker).

- Finalize the Confidential Information Memorandum (CIM).

- Execute NDAs and begin targeted buyer outreach.

- Conduct initial management presentations, applying the timing triggers discussed in Section 6.

Phase 3: Diligence Sprint (LOI → Close, 8–12 Weeks)

Prove your diligence integrity (Reference Section 7).

- Open the data room with a clean, pre-populated checklist.

- Complete the Quality-of-Earnings (QoE) report and proactively manage commercial workstreams.

- Validate the customer cohort.

- Negotiate complex deal terms (earn-out targets, net working capital definitions) per the guidance in Section 5.

Phase 4: Post-Close Integration (First 100 Days)

Focus on value retention.

- Standardize the combined tech stack rapidly.

- Ensure a consistent reporting cadence.

- Implement the employee retention plan.

- Manage proactive client communications to minimize churn and protect earn-out potential.

If you need to translate operational chaos into an investor-grade asset, consider an M&A Readiness Audit focused on KPI hygiene and concentration risk.

FAQ

The realistic range is typically 5x to 9x adjusted EBITDA. Smaller tuck-ins (below $3M EBITDA) are at the lower end, while established platforms ($10M+ ARR) with high recurring revenue quality and specialized security capabilities command the premium multiples.

Once M&A readiness is achieved, the process from signed Letter of Intent (LOI) to closing usually spans 8 to 12 weeks. The entire process, including 6–12 months of financial cleanup and preparation, can take 12 to 18 months in total.

Rollover equity is valuable if the platform has a proven, aggressive growth strategy and a clear path to a larger second exit (a “second bite of the apple”). It carries risk, however, if you lose governance control or if the platform’s integration execution is poor.

If you seek a full exit focused on strategic synergies, explore strategics (corporate buyers). If you want capital to scale and retain equity for a second liquidity event, explore private equity msps. Run a competitive process regardless of buyer type.