Owner dependency is the single greatest risk to your MSP’s valuation. It breaks service continuity, client retention, and M&A readiness. Successful MSP succession planning requires reducing this liability across a 3-to-5 year window. We approach this as founders: engineering predictable revenue and protecting enterprise value from an investor-grade readiness perspective. Here are the seven practical moves required to secure cash flow and maximize your exit optionality.

1. Define Your Success Scorecard and Non-Negotiable Outcomes

If you wait for an unsolicited inbound offer to define your exit strategy, you have already lost leverage. Succession planning is a financial engineering exercise designed to preserve enterprise value by moving decisions from forced reactions to calculated strategy.

The first step in MSP succession planning is quantifying success. This requires internal alignment on three non-negotiable outcomes:

- The Liquidity Goal: Define the target: Are you seeking a 100% full exit, or a strategic partial sale that allows you to roll equity into the new entity? This distinction determines the type of buyer (PE vs. strategic) and the corresponding valuation expectations.

- Role and Legacy: Clearly establish your desired role post-close and any strictly non-negotiable cultural elements or client relationships that constitute legacy constraints.

- The Timeline Reality: An ideal M&A timeline is 3–5 years. This window is critical for executing contract renewals, fully de-risking major client concentration, and building the internal leadership bench. A buyer pays a premium for de-risked assets with predictable revenue that does not rely on the founder’s daily presence.

To ground this strategy, implement a one-page Succession Scorecard today. This essential deliverable defines the “must-be-true” metrics for a clean transition, tracking key continuity constraints like SLA performance, key client retention, and key technician retention. The Scorecard must also list the top five risks (e.g., PSA lock-in, compliance gaps) and the top five value drivers to improve (e.g., increasing gross margin). This establishes clear, measurable M&A readiness thresholds from Day One.

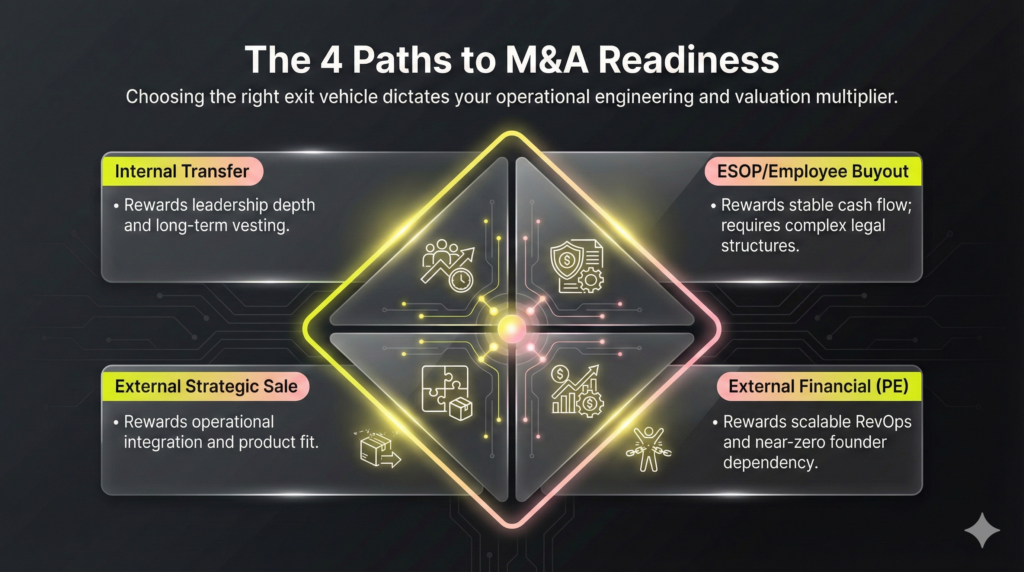

2. Map Your Exit Vehicle: The Four Paths to M&A Readiness

Choosing the right exit vehicle for your MSP is not a handshake; it is the fundamental decision that dictates the required operational engineering and the ultimate valuation multiplier. Relying solely on market timing leads to sub-optimal outcomes.

There are four primary routes for MSP succession planning, each requiring specific M&A readiness adjustments:

- Internal Transfer: Family transfer or promote-from-within. This requires deep leadership depth and a multi-year vesting schedule.

- ESOP/Employee Buyout: Rewards stable cash flow capacity but demands willingness to invest in complex administrative and legal structures.

- External Strategic Sale: Purchase by a competitor or larger platform MSP. This rewards operational integration ease, product fit, and cross-sell opportunity.

- External Financial Sale (PE-backed roll-up): When selling to an MSP aggregator, the highest-value path often requires predictable cash flow, scalable RevOps, clean financials, and, critically, near-zero founder dependency.

For PE and strategic buyers, minimizing continuity risk is paramount: concentrated client relationships and staff retention liability instantly erode enterprise value.

To move past confusion, use a simple 3-Column Filter to guide your decision: (1) Your personal goals and legacy; (2) Your tolerance for continuity risk (client and staff churn); and (3) The highest-probability value outcome based on your current operational maturity. Aligning these columns makes the correct exit path evident. (194 words)

3. Engineer Leadership Redundancy: Building the Successor Bench

Keyman risk is the biggest liability for financial buyers. When your entire revenue engine relies on the founder as the sole decision-maker or primary client closer, the valuation multiplier instantly contracts. Effective MSP succession planning requires engineering leadership redundancy, viewing internal talent as an essential de-risking mechanism for maximized enterprise value.

Identify high-potential internal candidates first. They must possess the non-negotiable traits for MSP leadership: sound operational judgment, financial literacy, deep client-facing credibility, and a strategic, security-first mindset.

The transition must be a phased process lasting 12 to 24 months. Do not simply hand over the keys; begin by delegating low-stakes decisions (staffing, vendor selection). Gradually increase the stakes to major commitments: QBR ownership, budget control, and strategic vendor alignment. The core goal is the systematic transfer of client trust.

Implement retention packages for key engineers and account managers tied to transition milestones to protect the new structure. Address your founder identity risk by explicitly planning your post-transition role to prevent shadow-management. Finally, run at least one full quarter where the successor owns the executive cadence (top-client comms, leadership meetings) while you observe. This provides critical, measurable proof of continuity for M&A readiness. (194 words)

4. Operationalize Continuity: Build the Investor-Grade MSP Manual

A prospective buyer is purchasing predictable cash flow, not merely technology. Operational maturity must translate into verifiable, documented processes that survive due diligence and minimize continuity risk. If workflows exist only in the heads of your best engineers, you have instantly eroded enterprise value.

To mitigate this founder-dependency, create the “MSP Operating Manual”: People → Process → Tools → Metrics → Risk Controls. This manual serves as your M&A prospectus, demonstrating systematic service reliability.

Document the critical workflows buyers stress-test: client onboarding/offboarding, incident response runbooks and escalation paths, backup/DR routines, and vulnerability management cadences. These systems prove client lifecycle management is repeatable.

Further strengthen this narrative with investor-grade KPIs. Metrics must include gross margin by service line, client concentration, Net Revenue Retention (NRR)/churn rates, and hard SLA performance data tied to ticket volume.

Provide absolute clarity on vendor and toolstack dependencies, listing critical contracts, renewal dates, and single points of failure (including licensing). Finally, establish robust continuity controls—such as access management, credential vaulting, and compliance evidence—to prove your MSP is a scalable asset, not a sophisticated break-fix shop.

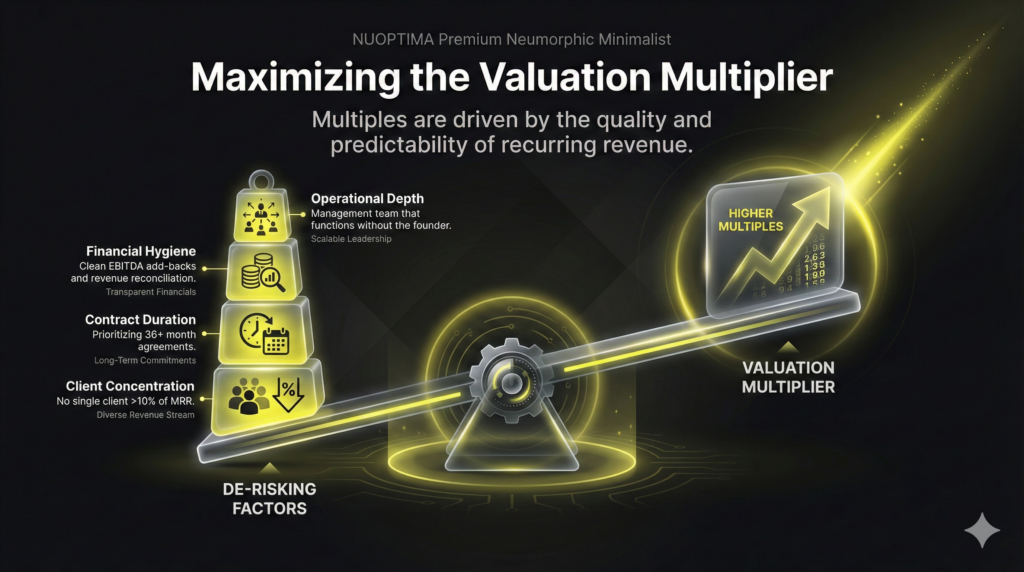

5. Secure Your Valuation Multiplier: Financial Hygiene and De-Risking

MSP valuation is defined by the perceived quality and predictability of revenue, not just the raw numbers. Buyers pay a premium to eliminate risk and diligence friction.

First, establish ruthless financial hygiene to signal M&A readiness: Separate owner perks, document consistent add-backs logic, and ensure monthly revenue reconciliation. This reduces diligence friction instantly.

Most valuations utilize an EBITDA multiple, heavily weighted toward high-margin recurring revenue (ARR/MRR). To maximize this multiple over the next 12–36 months, prioritize de-risking the asset:

- Client Concentration: Ensure no single client exceeds 10% of MRR.

- Contract Duration: Longer contracts (36+ months) are premium assets.

- Gross Margin: Elevate efficiency through automation and optimized service delivery.

- Churn: Reliable customer retention justifies higher multiples.

While small MSPs often trade on MRR (1.5–2.5x), mature firms with investor-grade operations and management depth command higher EBITDA multiples. Treat exit readiness as a system: implement a mandatory quarterly “Value Driver Review” alongside operational KPIs.

6. Structure the Transaction: Protecting Your Cash-at-Close

The headline purchase price is meaningless if the legal structure subjects you to massive tax leakage or uncontrollable post-close risk. Effective MSP succession planning shifts focus from the top-line valuation to the net cash retained, demanding ruthless attention to transaction mechanics.

The initial step is defining the legal vehicle. Sellers favor a stock sale for capital gains treatment; financial buyers prefer an asset sale to cherry-pick liabilities and reset tax bases. Structuring the deal requires M&A counsel to negotiate indemnities, satisfying buyer risk without collapsing the seller’s tax basis.

Next, address the primary founder traps: earn-out negotiation strategy and holdbacks. Earn-outs tie payment to post-close metrics, often including factors (like retention post-integration) the founder cannot control. If unavoidable, restrict metrics to realistic levers (e.g., gross margin on specific legacy contracts) and demand tight covenants limiting buyer interference.

Finally, clarify ongoing commitments. The Transition Services Agreement (TSA) and non-compete/non-solicit clauses act as essential continuity insurance for the buyer, directly impacting enterprise value. Define your role (a consulting period) with clear boundaries to ensure a clean transition. Invest in expert M&A legal and tax advisors early; this cost is dwarfed by the value leakage from a bad structure. (179 words)

7. Orchestrate the Client & Staff Retention Rollout: The M&A Communication Sequence

During an exit, vague communication triggers client churn and talent attrition, instantly eroding enterprise value. Effective MSP succession planning requires an operationalized, sequenced communication plan to guarantee client continuity and stabilize the team.

The rollout must be staged and rigid to prevent rumors:

- Internal Core: Inform the Leadership Team, Key Managers, and Internal Successors first. Define new org charts and clear post-close career paths before any public announcement.

- External Core: Sequence notifications to Top-Tier Clients, followed by the Broader Client Base, and finally, Key Vendors/Partners.

For staff retention, immediately deploy targeted mechanics. Offer transition bonuses or conduct stay interviews with key engineers and client-facing Account Managers. Provide absolute clarity on the new organizational structure, defining exactly how roles are protected or elevated to secure critical talent.

Client messaging must focus exclusively on continuity. Reassure them on SLA guarantees and security posture, formally introduce the successor, and confirm new points of contact. Schedule Quarterly Business Reviews (QBRs) immediately for all top accounts to prove the operational transfer is seamless.

Execute a tight 90/180-day operational cadence involving weekly transition standups, monthly executive reviews, and an explicit client health dashboard. This structure provides measurable proof of continuity for the buyer and mitigates the primary failure mode: attrition driven by uncertainty. (193 words)

The Succession Planning Checklist: Your Pre-Diligence Audit and M&A Roadmap

Use this checklist as your internal dry-run diligence and continuity audit. Initiate this process 6 to 12 months before seeking formal offers. Completing this roadmap verifies M&A readiness and protects enterprise value by minimizing friction during discovery.

Step 1: Data Room Index: Gather Investor-Grade Documentation

Populate a secure digital repository with all documentation a financial buyer (PE) demands. Structure the files using this index:

- Corporate: Full cap table, entity formation documents, all operating agreements.

- Financial Integrity: Last 3–5 years of audited financials; 12 months of monthly P&L; detailed add-backs list supporting EBITDA; revenue reconciliation reports.

- Commercial Reliability: Full client list (by MRR); contract terms, renewal dates, and termination clauses; current churn/NRR rates; client concentration data.

- Operations & HR: Up-to-date SOPs and runbooks; complete organizational chart; key vendor contracts and licensing; key employee retention agreements.

- Security & Compliance: Formal security policies, incident response plan, and proof of compliance (e.g., HIPAA, SOC 2 evidence).

Step 2: Continuity Audit: Mitigate Keyman Risk

Use this template to operationalize leadership redundancy and mitigate keyman risk: If the owner is unavailable tomorrow, ensure the business continues.

- Interim Decision-Maker: Designate the executive leader and define their authority scope for the next 90 days.

- Credential Vaulting: Store all critical credentials (PSA, RMM, financial accounts) in a secured, accessible vault. Confirm the interim manager knows the access keys.

- Client Communication Script: Pre-draft the immediate communication script for top accounts to guarantee continuity reassurance.

- Escalation Tree: Define the operational and client escalation path that bypasses the founder entirely.

Step 3: Leveraging External Advisors

Engage specialized M&A or succession planning consulting for structure, benchmarking, and objective gap assessment. External advisors are critical for validating financial hygiene, accurately assessing valuation potential, and negotiating clean transaction structures for maximized cash-at-close.

FAQ

Begin formalized planning 3 to 5 years before your desired exit date. This timeframe allows you to execute client contract renewals, fully de-risk key-person dependency, and establish three years of clean financial history. Late planning (under 12 months) creates extreme M&A readiness friction, as buyers cannot verify continuity or predictable revenue under founder absence.

Valuations vary significantly by size and maturity. Smaller MSPs (under $5M ARR) often trade on an MRR multiple (typically 1.5x to 2.5x MRR). Mid-market MSPs with predictable recurring revenue and strong management depth often command an EBITDA multiple (ranging from 5x to 10x+). Focus on increasing gross margin, reducing client concentration risk, and extending contract length to elevate your enterprise value.

Sellers overwhelmingly prefer a stock sale because proceeds are taxed at the typically lower capital gains rate. Buyers, however, prefer an asset sale as it allows them to select specific assets and avoid assuming historical liabilities. The final structure is highly negotiated and depends heavily on the entity type and tax liability. Always consult M&A tax and legal counsel before agreeing to a structure.

An Employee Stock Ownership Plan (ESOP) is realistic only if the MSP has stable cash flow capacity and a well-defined internal leadership bench capable of managing the company post-owner exit. The primary constraints are the significant setup and ongoing administrative costs, complex governance requirements, and the multi-year timeline necessary to structure the internal financing. It is rarely the highest-value exit path.

Focus on the core drivers of M&A readiness: (1) Drastically reduce key-person dependency by transferring core client relationships to successors. (2) Document all critical SOPs (onboarding, security, DR) into an operating manual. (3) Clean up financial reporting, separating all owner perks for accurate EBITDA add-backs. (4) Implement a measurable staff retention plan for all client-facing employees.