The search for “msp buyer demographics” is fundamentally misunderstood. You are not asking about end-customers; you are asking about strategic acquirers—the Private Equity (PE) groups and large MSPs—who define your MSP valuation for a peak exit. We engineered this framework based on years in PE to shift your lens from lead generation to M&A readiness. We reveal six primary buyer profiles, the specific metrics each acquirer screens for, and how they define “quality” during due diligence. Each profile requires a different investment thesis and appetite for integration risk.

1. Defining the Platform Buyer: What Private Equity Underwrites

The most common profile driving M&A is the platform buyer: a fund-backed entity executing a roll-up strategy. They buy standardized, risk-reduced cash flow, not technology. When assessing MSP buyer demographics, recognize that 60% of current deals involve institutional capital and a formal MSP appraisal process answering to a deal partner, operating partner, and finance lead.

The investment thesis centers on scalability through repeatable tuck-ins, underwriting three core elements to secure a high exit valuation: compounding recurring revenue, margin expansion via integration, and operational maturity. Due diligence screens aggressively for risk.

Valuation depends not on gross revenue, but on the demonstrable ability to deliver predictable margins under investor-grade scrutiny. Buyers look for:

- Revenue Quality: High MRR mix, low customer concentration (no single client over 10% of revenue), and best-in-class retention.

- Operational Maturity: Documented standard operating procedures (SOPs), clean financial books, and proven middle management depth.

To align your firm with this profile and maximize valuation, define these essential “buyer-facing proofs” now:

- Monthly KPI Pack: Standardized reporting detailing retention, churn, and service delivery metrics.

- Documented Ops: A visible library of standardized onboarding, troubleshooting, and delivery SOPs.

- Services Margin by Line: Detailed profitability reporting across different service segments (e.g., managed security versus cloud migration).

Failure to provide these proofs means longer diligence cycles, heavier documentation requests, and potentially complex deal structures like restrictive earnouts.

2. The Strategic Buyer: Targeting Synergy and Market Density

While the Private Equity firm (the Platform Buyer) focuses purely on financial engineering, the strategic buyer maximizes market capability and efficiency. This profile involves larger, established MSPs or MSP platforms executing “tuck-in” acquisitions designed to expand footprint and density, not merely increase EBITDA. Their central buying calculus is built entirely on synergy: they pay a premium only if your firm accelerates their market entry into a specific niche or demonstrably reduces existing operational costs.

Their primary anxiety is integration friction. A strategic buyer purchases your revenue stream and capabilities, but fears the hidden cost of integrating a messy operation. Understanding these msp buyer demographics requires knowing they screen for three immediate growth vectors:

- Geographic Density: Does your client base expand their territory or significantly reduce client response times in a key region?

- Vertical Specialization: Do you own compliance-heavy niches (e.g., finance, healthcare, or government expertise) they can cross-sell to their existing client base?

- Capability Bolt-Ons: Do you possess high-demand expertise (advanced managed security, automation, cloud development) that elevates their entire service offering?

To position your MSP as a low-friction bolt-on, due diligence must prove stack alignment. Ensure your PSA and RMM tools fit their infrastructure. Your ticketing hygiene must be stellar, and your service catalog clearly documented with standard operating procedures (SOPs). Presenting a seamless transition plan, alongside clean financials, guarantees you pass the integration friction check and maximize the final offer. (221 words)

3. The Tuck-In MSP Target: Proving Standardization Readiness

We have reviewed the primary buyer profiles. The ideal tuck-in or bolt-on target, typically acquired by a PE-backed platform, is judged strictly on its ability to increase revenue and EBITDA efficiently and with minimal complexity. For this group of msp buyer demographics, the decision group—often the integration lead, finance, and service delivery leadership—views your firm not as a strategic asset, but as raw, digestible cash flow that must be absorbed into shared services rapidly.

Their screening process focuses on eliminating operational risk, which translates to two non-negotiable checks:

Standardization Readiness

Integration teams need proof of readiness. They assess your willingness and ability to migrate PSA, RMM, and critical processes onto their platform’s stack immediately. They require that internal SOPs are robust enough to survive the transition, as a lack of documented procedure is flagged immediately as an integration cost risk.

KPI Transparency

The finance team requires clean, investor-grade data. They screen for high-risk flags: owner-dependent sales processes, undocumented service contracts, and the inability to produce immediate KPI production. If key metrics—MRR/ARR, margin by service line, and detailed churn—require two weeks of manual spreadsheet work, the deal is flagged as high-risk.

To align, anticipate this scrutiny. Prepare a “data room lite” showcasing operational health and a detailed 90-day integration story (people, tools, client comms, SLAs). This proactive transparency guarantees you pass the integration lead’s assessment.

4. The Operator Platform: Where Cultural Alignment Meets Operational Discipline

For MSP owners focused on service continuity and team stability—not just margin adjustment—the Operator Platform offers a critical alternative in msp buyer demographics. This archetype is often an MSP founder, backed by capital, executing a disciplined roll-up focused on shared services and standardization, where cultural alignment is central to the thesis.

They buy to build a better MSP, not just a bigger P&L. Screening is rigorous, focusing on three essential non-financial elements:

- Owner Intent: They seek owners willing to stay involved post-close to ensure client and staff trust transfers smoothly. This involves transitioning key client relationships responsibly.

- Staff Stability: Retention risk is paramount. They assess role clarity and continuity plans for client-facing employees; high churn is a non-starter.

- Operational Discipline: While culture matters, they demand professionalized standards. This includes clean SOPs, low churn rates, and processes that integrate cleanly into their centralized infrastructure.

To align with this buyer, prepare for cultural diligence as seriously as financial diligence. Document your service delivery norms, customer communication cadence, and employee structure. Proving strong operational discipline alongside high owner intent guarantees a streamlined deal and better terms, often resulting in fewer complex earnouts and a greater focus on integration success.

5. The Corporate IT Buyer: Navigating Compliance and Procurement Diligence

The highest level of scrutiny often originates not from PE or consolidation roll-ups, but from corporate IT groups—large VARs, System Integrators (SIs), or enterprises acquiring managed service capability for internal or external expansion. These buyers approach due diligence through a non-M&A-native lens: the decision group is procurement, legal, IT leadership, and compliance.

Their central buying thesis is risk mitigation: they acquire capacity, geographic coverage, or a compliance-ready offering to de-risk their existing vendor ecosystem. They are purchasing a standardized function that must withstand the rigor of their internal governance structure.

When assessing these msp buyer demographics, expect the screen to pivot immediately from financial metrics to legal exposure and reputation risk. They screen intensely for:

- Compliance and Governance: Mandatory documentation proving mature incident response, security policies, and continuous monitoring practices.

- Contracting Rigor: Scrutiny of client SLAs, liability clauses, indemnification caps, and detailed procedures for data handling and subcontractor dependencies.

- Reputation Risk: Deep dives into customer references, security track record, and stability of key staff to ensure brand damage is unlikely post-acquisition.

To successfully align with this profile, professionalize your artifacts. Focus on tightening governance documents, compliance mapping, and vendor management procedures. Prepare to face procurement-grade scrutiny; anything less than institutional-level readiness will stall the transaction. (227 words)

How to Build an Investor-Grade MSP: The 5-Step M&A Readiness Action Plan

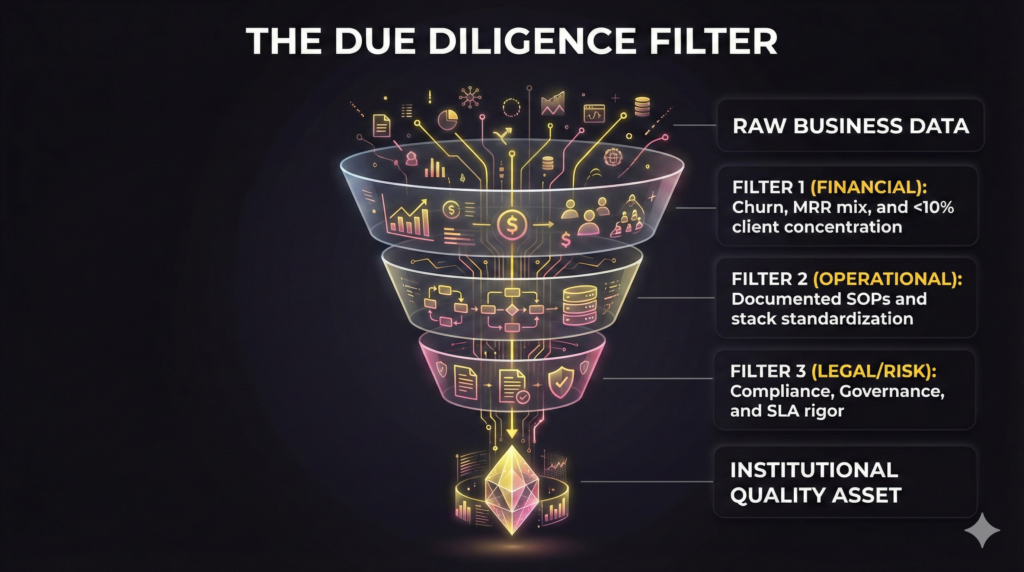

Knowing MSP buyer demographics becomes actionable only when it drives operational changes that maximize your multiple and de-risk the business. Use this execution schedule to transform your technical operation into an investor-grade asset ready for diligence.

Step 1: Commit to the Target Buyer Thesis

Before adjusting any SOP or KPI, commit to the buyer type you are optimizing for. Choose between the margin-focused Platform Buyer, the synergy-driven Strategic Buyer, or the stability-focused Operator Platform. Define your “win condition” (high multiple, quick exit, continued role). This thesis dictates which metrics you elevate and which risks you mitigate first.

Step 2: Build and Automate the Investor-Grade KPI Pack

Eliminate messy data, the top diligence delay. Implement the investor-grade KPI pack required by every finance team:

- Monthly Financials: Track MRR/ARR by service line, Gross Margin by Line, detailed churn and retention, and Top-10 customer concentration (keep below 10%).

- Operational Health: Report quarterly on SLA attainment, ticket volume trends, and onboarding cycle time.

Directive: Ensure data exports easily from your PSA/CRM stack on demand. Demonstrate KPI transparency.

Step 3: De-Risk the Three Biggest Buyer Fears

Acquirers pay a premium to eliminate perceived risk. Address these core diligence flags immediately:

- Keyman Dependency: Systematically transition key client relationships and sales processes from the owner to middle management.

- Messy Delivery: Document all core technical and operational SOPs. Create the internal playbook proving Operational Discipline.

- Unclear Unit Economics: Clearly separate labor costs and margins between project-based revenue and recurring managed services.

Step 4: Rewrite Your Positioning for Acquirers

Stop listing services; start delivering an investment narrative. Ensure your website, case studies, and pitch decks highlight: Quality of Revenue (recurring, high margin), Operational Maturity (standardized delivery), and Scalable Differentiation (niche vertical expertise). Transform your firm’s story from a tactical service provider into a robust, repeatable asset ready for absorption.

Next Step: M&A Readiness Assessment

For MSP founders ready to move beyond theoretical readiness and prepare for institutional scrutiny, secure a structured assessment. An M&A Readiness Audit provides the external, Private Equity-native perspective necessary to structure your firm’s financials and operations for maximum valuation and minimal diligence friction.

FAQ

The highest multiples often come from strategic buyers who see immediate, definable synergy—such as expanding into a high-margin vertical or filling a critical geographic gap. PE-backed platforms (Platform Buyers) optimize for standardized EBITDA and predictability, offering consistently strong multiples based on risk mitigation. When evaluating offers, look beyond the headline multiple; prioritize the total deal structure, including cash at close, terms, and the viability of any earnouts.

Buyer range depends heavily on recurring revenue quality and EBITDA margin, not just top-line revenue. Generally, PE tuck-ins target firms with $1.5M to $5M in annual recurring revenue (ARR) and $300k to $1.5M+ in adjusted EBITDA. Strategic buyers may look for smaller bolt-ons ($500k ARR) if the vertical specialization or geographic density is irreplaceable. Larger Platform Buyers target businesses well above $5M EBITDA for platform-level acquisitions.

Due diligence teams require immediate transparency on three key fronts. Financially, they need 24–36 months of clean financial statements, detailed churn/retention reports, and margin analysis by service line. Operationally, they screen for documented Standard Operating Procedures (SOPs) for service delivery and ticketing hygiene. Contractually, they scrutinize client concentration (aim for no single client above 10%) and all active service contracts/SLAs.

Strict adherence to a staged disclosure plan is essential. Initially, only key financial data is shared under a robust Non-Disclosure Agreement (NDA). Staff and clients should not be informed until the deal structure is firm and diligence is well advanced. When the time comes, screen the buyer aggressively on integration approach, retention plans for key staff, and their communications strategy to ensure service continuity.

Next Step: M&A Readiness Assessment

The fastest path to maximizing valuation is anticipating buyer scrutiny. An M&A Readiness Audit provides the institutional perspective needed to organize your financials and operations, transforming your MSP into a highly defensible, investor-grade asset ready for exit.