If your MSP is hitting $5M+ ARR, your phone is ringing. The 2026 buyers are not purchasing simple revenue; they demand repeatable delivery, stellar security posture, and scalable economics. The initial price is the least important variable. True M&A diligence requires analyzing the control and integration model, as you are choosing a 3–7 year outcome path. This founder-to-founder framework translates opaque deal terms into practical consequences for your culture and equity upside. We start by identifying the type of msp consolidators sitting across the table.

1. Categorize MSP Consolidators by Integration Philosophy

The headline multiple is irrelevant if the integration structure destroys your operating autonomy post-close. Diligence must categorize the consolidator’s philosophy, which dictates the speed and depth of operational assimilation.

Buyers fall into three core archetypes:

- HoldCo/Decentralized: Preserves brand and leadership; centralizes selective shared services (advanced finance, vendor leverage, reporting). Autonomy is highest.

- Integrated Platform: Goal is standardization. Requires immediate re-platforming of delivery, security, and PSA tools to achieve massive scale. Autonomy is moderate; support (NOC/SOC) is robust.

- Fast Tuck-in / Roll-up Machine: Aggressive model built on repeatable acquisition cadence and brand retirement within 12 months. The hidden term is the loss of decision rights over hiring, pricing, and client acceptance.

For a $5M+ MSP founder, this philosophy is the 2026 differentiator. It predicts your post-close reality: managing an investment or executing a centralized mandate. The core trade-off is control over stack and pricing versus shared services speed and vendor leverage.

Founder Diligence: Ask what systems get centralized in the first 90, 180, and 365 days. Crucially, demand to speak with an acquisition 12 months post-close to verify autonomy retention and culture reality.

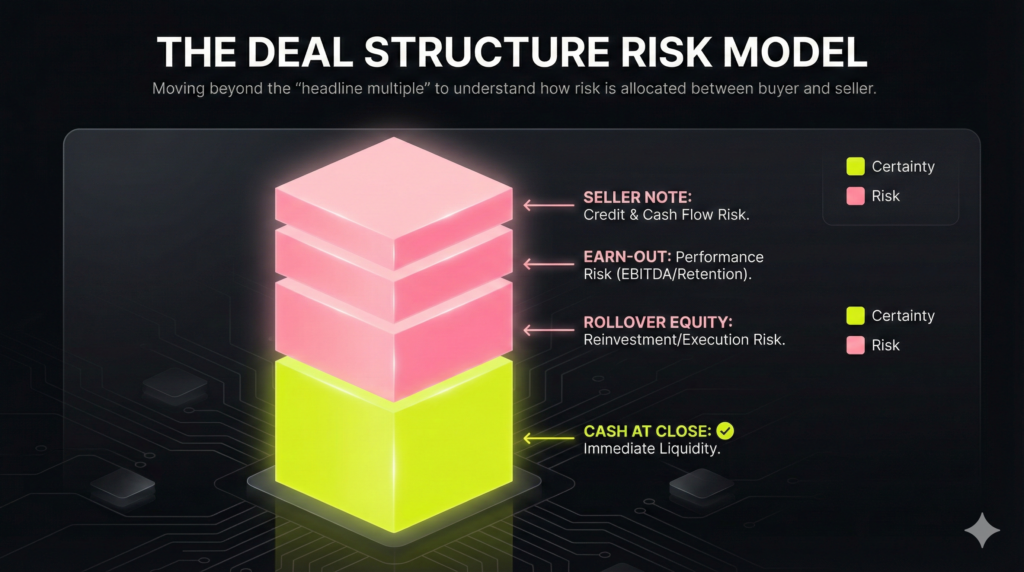

2. Structure is the Risk Model: Decoding Rollover, Earn-Outs, and Seller Notes

Negotiating only the headline multiple misses the point. Deal structure is the risk allocation model: it defines who finances whom and what performance you are paid to deliver post-close.

The payment structure breaks down into four components, each carrying specific risk:

- Cash at Close: Immediate, certain liquidity.

- Rollover Equity: Reinvestment into the platform, subject to future execution risk and platform upside.

- Earn-out: Performance-contingent payment tied to hitting EBITDA/revenue targets. This is operational risk retained by the seller.

- Seller Note: A post-close loan from seller to buyer; carries credit risk and cash flow dependency on the combined entity.

As competition increases, msp consolidators use complex structures to manage underwriting uncertainty. A high contingent payment (earn-out) mandates increased governance: expect oversight on budgets, required stack mandates, and strict KPI tracking that erodes operating autonomy.

Owners must model the complete financial outcome:

- Best, base, and worst-case liquidity proceeds.

- Time-to-cash for every component.

- Identification of who controls the levers (pricing changes, forced migrations, client offboarding) determining earn-out success.

Critical Insight: While headline multiples track size and quality, the deal structure—the precise mix of cash, rollover, and contingent payments—often matters more to your ultimate net worth.

3. Rollover Equity: Diligence on the Platform, Not Just the Price

Rollover Equity is not a payment; it is a forced reinvestment into the buyer’s platform, transforming the seller from an owner to a minority equity holder. This commitment immediately exposes you to the buyer’s operational leverage, integration execution risk, and five-year exit timing—the very risks you sought to shed. Treat rollover capital as a measured bet strictly dependent on the strength of the buyer’s future platform strategy.

Rollover is rational only when the buyer provides hard evidence, not promises. Look for a clear integration track record, a repeatable acquisition playbook, and a transparent capital structure (waterfall) that explicitly defines your investment seniority. When you roll capital, you accept short-term integration friction for long-term value. This requires securing robust governance rights and detailed reporting access to protect the base business.

The bet becomes an unpriced risk when the sponsor is untested, the exit plan is vague, or the underlying dilution assumptions (e.g., future option pools) are opaque. Before committing your capital to the combined entity, demand concrete answers related to control and execution.

Owner Diligence Questions:

- How is post-close management incentivized, and where do my interests align with the General Partner?

- What happens to my equity if growth stalls or the platform misses its debt covenants?

- What are the platform’s current debt covenants that could force immediate cost cuts or divestitures? (180 words)

4. Earn-Outs: Protecting Your Upside from Buyer-Mandated Sabotage

The nature of the earn-out has fundamentally changed. They no longer target simple revenue or EBITDA maintenance. Today, MSP consolidators underwrite the integration value, tying payments to granular metrics: client retention, gross margin improvements, security bundle attach rates, or successful migration to the buyer’s mandated tech stack.

This shifts integration risk entirely onto the seller. The core control problem is explicit: if the buyer mandates stack migrations or new pricing structures, they can inadvertently sabotage the KPIs required for payment (e.g., increased costs impacting margin, client churn impacting retention). Your upside depends entirely on the buyer’s execution speed.

Protection requires control mechanisms, not just target numbers. Ensure the definitive purchase agreement (DPA) includes these protective terms:

- Clear KPI Definitions: Precisely define metrics, accounting policies, and calculation methodology before closing.

- Churn Carve-Outs: Stipulate how churn caused directly by buyer-mandated actions (e.g., pricing changes or required client off-boarding) is treated against retention goals.

- Budget Governance: If delivery execution relies on key staff, secure governance rights related to minimum headcount or budget maintenance for the acquired entity.

Finally, conduct practical diligence: ask the buyer for a sanitized sample earn-out schedule, and crucially, ask how many of their prior acquisitions have hit their full earn-out and, if not, why they missed.

5. Security & Compliance: The Mandated Stack Trade-Off in Diligence

If revenue dictates the baseline multiple, the security posture you deliver dictates the premium and integration risk. Cybersecurity and regulatory compliance are now productized, measurable assets necessary for platform scalability and the buyer’s future EBITDA projections. This shift mandates stack standardization, a key diligence friction point.

Buyers are underwriting repeatable security delivery and transparent auditability. Expect granular scrutiny on:

- Security Tooling Baseline: EDR/MDR, full MFA penetration, and granular backup posture across the client base. Non-standard tools are priced for elimination.

- Compliance Workflows: Repeatable, documented compliance procedures (SOC2, HIPAA, CMMC). Manual management results in a valuation discount.

- Incident Response Readiness: Audited, tested incident response plans and clear communication paths meeting insurer and regulatory standards.

The trade-off is strong control mandates and mandatory stack migration. This causes short-term client friction and churn risk if poorly executed. Position these changes to clients as essential long-term risk reduction, proactively planning client communications.

Before signing, ask the buyer three non-negotiables: What minimum security baseline is required? Who pays for the uplift required for non-compliant clients? How are clients who actively resist new standards handled? Your answer dictates future revenue quality.

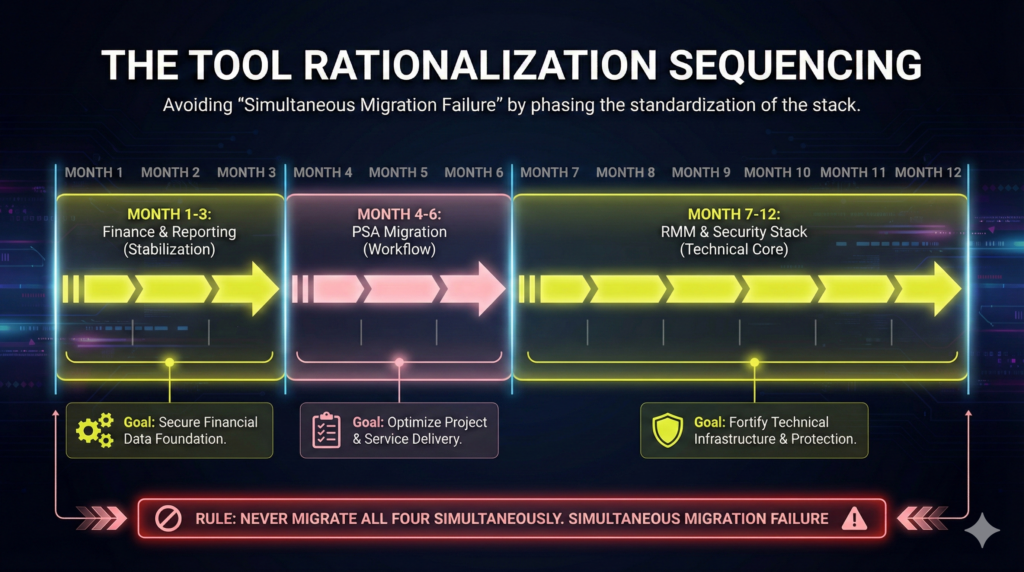

6. Automating Scale: Navigating the Tool Rationalization Mandate

The fastest post-acquisition lever for margin expansion is tool rationalization, but this creates profound tension. While consolidators promise vendor leverage, standardizing the RMM, PSA, and reporting stack collides directly with team identity. A $5M+ MSP sells technical talent and reliable workflows built on muscle memory, not just technology.

By 2026, buyers underwrite the platform’s automation capacity (triage, service desk, reporting). This forces standardization onto a smaller, approved stack. The critical trade-off is simple: you may keep your brand name, but you surrender “stack sovereignty.”

This transition impacts technician experience (morale/productivity), vendor costs, and SLA delivery during migration. To manage risk, define sequencing aggressively. Never migrate PSA, RMM, core security, and billing platforms simultaneously—that combination guarantees client friction and service failure.

Diligence Prompts for Stack Standardization:

- What specific tools are absolutely non-negotiable for integration?

- What is the buyer’s track record for internal migration resources (people/budget)?

- What is the 90-day plan versus the 12-month plan for full assimilation, and what guardrails protect gross margin during migration?

7. Vertical Focus: Protecting the Niche That Justified Your Valuation

Your competitive moat is built on deep vertical focus—specialization in high-compliance industries (e.g., healthcare, finance, legal). This alignment creates the three core drivers MSP consolidators underwrite: higher Average Contract Value (ACV), clear differentiation from generalists, and superior client stickiness driven by specific compliance and tooling.

The major post-close risk is dilution. Standardization is the enemy of specialization. The buyer risks destroying the premium if they mandate generic rebranding, force bundling of non-vertical services, or eliminate your specialized compliance team for centralized efficiency.

To protect this asset, the definitive agreement must preserve operational autonomy over vertical go-to-market and client acceptance policies. Guarantee the buyer invests in your niche, securing stronger growth resources, rather than merely absorbing it into generalist machinery.

Diligence Prompts:

- What is the buyer’s track record with vertical plays: do they maintain or retire acquired specialized brands?

- Will vertical-specific sales teams and compliance officers retain their roles, or be rationalized into the centralized structure?

- How will the platform market niche offerings at scale without diluting the specialized language that drives high ACV?

8. Leveraging Shared Service Layers: Scaling Capability Without Killing Culture

The talent scarcity crisis mandates post-close integration for investor-grade scale. MSP consolidators cannot afford localized hiring bottlenecks for specialized roles (e.g., 24/7 SOC/NOC). The immediate solution is utilizing shared service layers: centralized functions covering helpdesk escalation, advanced security, procurement, and finance operations.

Consolidators push this to standardize delivery, accelerate M&A integration, and scale 24/7 coverage. Sellers gain immediate access to security depth their localized team could not afford. However, the primary risk is a direct hit to morale. Centralization removes local autonomy over hiring and compensation, driving key staff departures and jeopardizing the seller’s earn-out.

While service coverage and security depth improve for clients, they may feel a loss of the personalized, local relationship quality. Set expectations early. Protecting the asset requires aggressive negotiation of these control points before closing:

- Retention Plans: Confirm packages for key staff essential for client continuity.

- Compensation Alignment: Get explicit confirmation on how existing salaries map to the platform’s standardized bands.

- Local Decision Rights: Define which local hiring decisions remain (e.g., vCIOs, relationship managers) versus centralized HR oversight.

- Accountability Model: Secure a transparent escalation path, ensuring shared services accountability reports to local leadership.

To secure your full financial outcome (earn-outs and rollover upside), manage the operational sequence post-close. This timeline translates strategic deal terms into concrete action items, defining the first year under new ownership as you transition from seller to integrated platform partner.

Phase 1: Pre-Close Diligence (Weeks 0–10)

Phase 1 defines the deal structure and locks in valuation.

- Approach & Qualification (Weeks 0–2): Screen the consolidator archetype (HoldCo vs. Fast Tuck-in). Buyers qualify your business based on recurring revenue quality, EBITDA consistency, client concentration, and owner dependency.

- LOI & Structure (Weeks 2–6): Model the deal structure. Focus ruthlessly on contingent payment conditions (Earn-Outs) and the inherent value of your Rollover Equity.

- Diligence (Weeks 6–10): Execute technical review. Audit contracts, security posture, QoE-lite reports, service delivery KPIs, and PSA/RMM data hygiene. This mitigates potential valuation discounts and accelerates the integration schedule.

Phase 2: Close and Stabilization (Day 1 – Day 90)

The closure is the governance reset, requiring immediate operational alignment.

- Close & Governance Reset (Day 1): Formalize the new reporting cadence, decision rights, and leadership roles. Immediately activate retention packages for essential staff to protect client continuity.

- Standardization (Day 1–90): Prioritize must-have systems: Financial Reporting Standardization and Security Baseline Uplift. Integrate the shared service layer and capture immediate vendor leverage. Strictly avoid simultaneous migration of RMM, PSA, and billing platforms during this stabilization window.

Phase 3: Platform Integration & Endgame (Day 90 – 365+)

After 90 days, the priority shifts to deep integration and scale.

- Tool Rationalization: Phase the migration of RMM/PSA platforms. Communicate stack changes to clients explicitly as long-term risk reduction, not just efficiency moves. Assess optional standardization of pricing models and service catalogs.

- Achieve Scale: By Day 365, the platform must achieve the operational scale necessary for multiple expansion. Founder upside is realized only if integration succeeds; client churn or stalled standardization destroys the value of invested rollover capital.

FAQ

While quality and specialization dictate the range, a $5M+ ARR MSP with high recurring revenue, low client concentration, and strong security posture typically achieves an EBITDA multiple between 7x and 12x. The true proceeds depend heavily on the deal structure (cash vs. contingent payments). High multiples require institutional-grade delivery and compliance, often compelling the founder to accept greater rollover equity and performance risk.

The decision is governed by your liquidity needs and risk tolerance. Cash at close offers certainty, while rollover equity is a strategic reinvestment in the platform’s future growth. Only take rollover if the buyer demonstrates a transparent exit plan, a strong integration track record, and explicit alignment of your interests with the General Partner’s. Analyze the platform’s debt covenants and governance clarity before committing.

Service quality depends directly on the buyer’s integration model. Minimal change occurs with decentralized models, but platforms enforcing stack mandates create short-term friction during migration (up to 12 months). Long-term standardization should lead to superior service via centralized 24/7 SOC/NOC support. Demand a clear client transition plan and contractually stipulated service guardrails during due diligence.

Founders are often surprised by the immediate loss of operational autonomy. This typically manifests as mandated changes to the technology stack (RMM/PSA), new centralized pricing policies, and a shift to complex, aggressive reporting and governance cadences required by Private Equity ownership. Cultural shifts and the exposure of key-person dependencies, especially in specialized roles, are also common shocks.

Ask for two references: one high-performing acquisition and one that has experienced average results. This provides a realistic view. Additionally, inquire specifically about which tools and systems they mandate standardizing in the first 90 days. Crucially, ask for a sanitized sample of their earn-out definition and quarterly performance reporting pack to understand the execution hurdles.