Executive trend reports often miss the point, cataloging technology shifts without connecting them to financial outcomes. The critical question for leadership is how the latest msp market trends impact enterprise valuation and M&A readiness. Multiples are won or lost based on predictability, margins, and defensibility, not just topline growth, a core principle detailed in our guide to MSP acquisitions and valuation. This guide maps 10 critical market shifts directly to the levers that matter most: recurring revenue mix, operating margin leverage (OML), and concentration risk. We focus strictly on the investor’s lens and the data buyers use during due diligence. Start here by dissecting the core valuation mechanics that drive every strategic decision.

1. The Valuation Reality: Why Multiples Are Earned, Not Given

Every MSP leader understands the relationship between EBITDA and enterprise valuation. If your $10 million ARR looks identical to a competitor’s but earns a 2.0x lower multiple, the difference is the aggressive underwriting of quality of revenue during due diligence. This core shift in msp market trends means PE buyers focus relentlessly on future cash flow predictability.

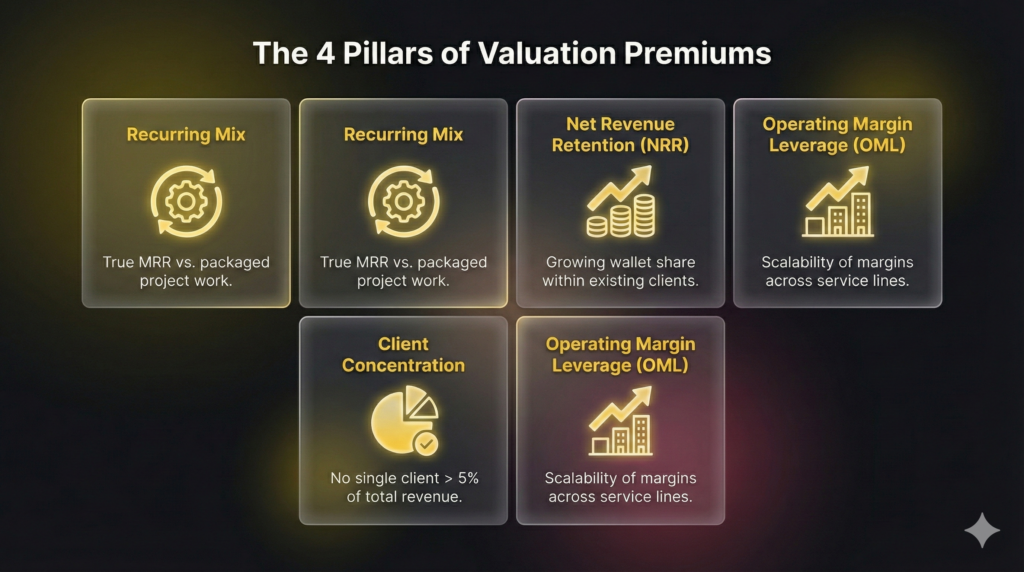

Valuation premiums hinge on four critical factors that directly move your EBITDA multiple:

- Recurring Mix: Is the revenue true MRR, or project work packaged as services?

- Net Revenue Retention (NRR): Proven ability to grow wallet share within existing clients.

- Client Concentration: No single client should represent more than 5% of total revenue.

- Operating Margin Leverage (OML): Scalability and durability of gross margins across all service lines.

To achieve M&A readiness, operationalize these metrics within 90 days. Track recurring % targets, NRR, gross margin by service line, and documented SOP coverage. This transforms good revenue into defensible, investor-grade asset value.

2. Productize Security for Margin and Multiples

The market has shifted: Security spend is no longer discretionary IT support, but a fundamental investment in quantifiable risk reduction and compliance outcomes. Delivering security via bespoke projects or relying on high-cost engineers actively erodes Operating Margin Leverage (OML) and depresses your EBITDA multiple.

Security-led MSPs capture premium pricing and higher gross margins only when delivery is standardized, reducing key-person risk. To maximize the valuation premium driven by these msp market trends, immediately define a security offer ladder:

- Baseline: Standardized compliance and hardening (high-volume, low-touch).

- Advanced: EDR/XDR bundled, requiring minimal specialized effort.

- MDR/SOC Partnership: Leveraged third-party services that retain a high margin split.

Reporting must prove quantifiable value, tying services to audit readiness, patch compliance rates, and incident response time. Shifting from time-and-materials to repeatable, measurable security packaging transforms revenue quality.

3. Leverage AIOps to Achieve Operational Margin Leverage (OML)

Linear cost-to-serve scaling erodes Operational Margin Leverage (OML). Manual fulfillment of high-volume, low-complexity tickets creates persistent friction, a major investor red flag in msp market trends.

The market shift is clear: clients pay for measurable outcomes (uptime, quick resolution), not ticket volume. AIOps decouples service quality from manual labor cost, turning ticket volume into margin expansion.

Higher EBITDA is insufficient; buyers demand proof of margin persistence post-scale and post-founder exit. Valuation relies on demonstrated scalability. Executive leadership must set strict, measurable goals now:

- Metric Selection: Choose 2–3 quantifiable targets: ticket deflection percentage, reduction in Mean Time to Resolution (MTTR), or after-hours coverage without human intervention.

- The Service Playbook: Document a repeatable delivery model around AIOps. This ensures high-margin service is standardized across accounts, guaranteeing scalability beyond hero engineers.

This transition from hero-based delivery to standardized automation elevates efficiency into demonstrable enterprise valuation quality, especially as AI reshapes the MSP market by driving higher margins through scale.

4. Productize Cloud Governance for Persistent NRR

For executives under investor scrutiny, chaotic cloud adoption risks margins and valuation. Hybrid cloud is the operational default; MSPs must sell governance, not migrations. Multi-cloud complexity breeds cost leakage, compliance drift, and security dilution, undermining predictability.

Productizing cloud governance is the key to persistent Net Revenue Retention (NRR). Services like landing zone standards, policy-as-code, and identity guardrails are sticky. They embed the MSP into the client’s DNA, resisting churn and driving expansion revenue.

To capitalize on these msp market trends and secure a valuation premium, MSPs must:

- Engineer Standardization: Package governance deliverables into defined, repeatable monthly services, moving past bespoke projects.

- Align to Business Outcomes: Connect metrics directly to client KPIs: compliance posture, uptime, change failure rates, and cost predictability.

Formalizing hybrid estates with auditable policy-as-code transforms unreliable project revenue into high-margin, sticky MRR, signaling enterprise value during due diligence.

5. Productize FinOps: Turning Cloud Cost Audits into High-Margin MRR

Cloud usage growth has created massive “sticker shock” for client finance teams, demanding cost transparency, forecasting, and accountability. This shifts the MSP from a reactive provider to a strategic financial partner, raising Average Revenue Per Account (ARPA) and bolstering retention. FinOps transforms a one-time cloud audit into a high-margin recurring advisory service, tying the MSP directly to the client’s annual budget cycle.

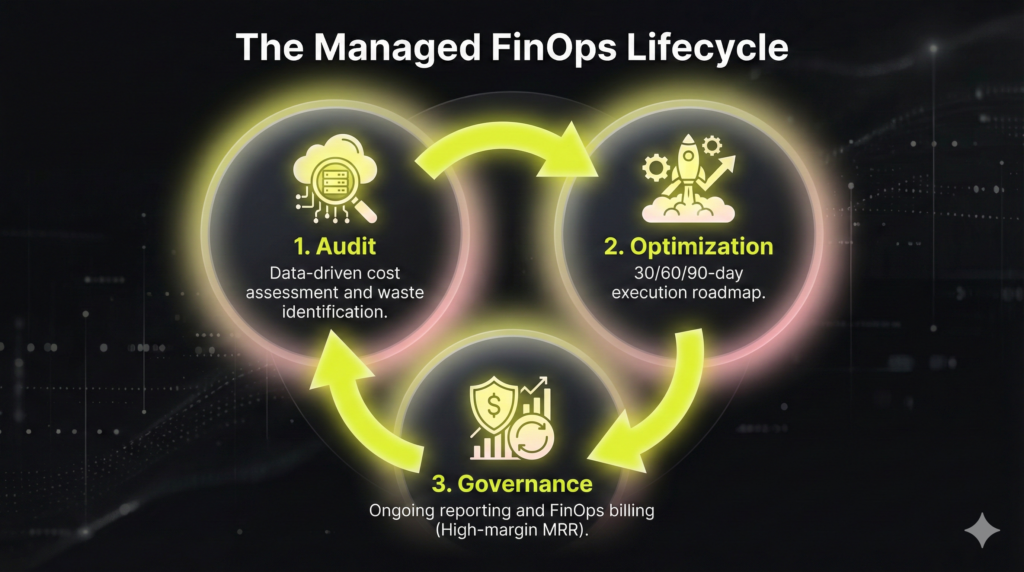

To monetize this FinOps trend and secure higher valuation multiples within msp market trends, execute this structured offer:

- Audit: Deliver a precise, data-driven cost assessment focused on immediate waste identification.

- Optimization Plan: A 30/60/90-day execution roadmap centered on quick, measurable wins.

- Managed FinOps Cadence: Ongoing reporting and governance billed as high-margin MRR.

Internally, M&A readiness demands proof of non-hypothetical savings. Implement strict tagging standards, integrate cloud dashboards into client reporting, and define a clear RACI matrix for client approval on optimization actions. This makes the service sticky and demonstrably critical to the client’s P&L.

6. Verticalize Your ICP to Maximize Valuation Multiples

Horizontal MSPs suffer the horizontal squeeze. Lack of differentiation increases sales friction, complicates MSP lead generation, and suppresses your valuation multiple due to undifferentiated, low-margin revenue.

Verticalization creates defensibility. Owning compliance and complex workflows for a single sector (e.g., finance, healthcare) enables standardized, repeatable playbooks. This reduces key-person risk and dramatically increases scalability, signaling an asset capable of predictable growth—a critical msp market trend for multiple expansion.

Executive leadership must act now:

- Select 1–2 Verticals: Focus only where you genuinely claim domain expertise in regulatory compliance and operations.

- Build Proof Assets: Document specific reference architectures, compliance mappings (e.g., HIPAA, SOC2 checklists), and benchmark reporting tailored to the vertical’s unique anxieties.

This approach transforms your service into an essential, non-negotiable layer of the client’s operation, raising Average Revenue Per Account (ARPA) and fortifying Net Revenue Retention (NRR). (145 words)

7. Embed Digital Trust and Governance to Maximize Contract LTV

Security tooling is now table stakes; the market is pivoting to holistic digital trust. For MSPs targeting high valuation, the client’s definition of trust has expanded beyond endpoints to include data sovereignty, vendor risk management, and auditability. The pain point is complexity: clients demand a single, accountable partner for complete trust outcomes (security + governance).

This shift fundamentally increases valuation quality. Contracts that embed ongoing governance and compliance are intrinsically harder to replace, driving longer Lifetime Value (LTV) and fortified Net Revenue Retention (NRR).

Executive action requires defining a comprehensive Trust Stack: policies, controls, evidence collection, and third-party risk protocols. Crucially, pivot to an “evidence-first” delivery model. This approach operationalizes compliance, ensuring continuous evidence collection makes both annual audits and renewals cheap to support. Embedding governance transforms your service from a discretionary expense into indispensable operational infrastructure. This defensibility maximizes M&A readiness within current msp market trends.

8. Standardize Outcome-Based QBRs for Strategic Embeddedness

A Quarterly Business Review (QBR) focused solely on ticket counts and uptime metrics confirms your MSP as a replaceable vendor, actively undermining the critical valuation metric: Net Revenue Retention (NRR).

Current MSP market trends demand a move beyond reactive support to quantified business outcomes. High-growth mid-market clients expect proactive planning that aligns IT expenditure with strategic goals. Outcome-driven relationships are intrinsically stickier, justifying higher ARPA and increasing NRR predictability—metrics that lower the buyer’s discount rate during due diligence.

Executive action mandates standardizing QBR delivery via a fixed, non-negotiable dashboard. This package must include a documented risk register, a future-facing modernization roadmap, and a budget forecast. These strategic deliverables embed your MSP into the client’s planning cycle, transforming the monthly fee from a cost center into a strategic investment. This practice is mandatory for maximizing contract LTV and enterprise valuation.

9. Refactor Pricing Architecture for Investor-Grade Multiples

If your pricing cannot be explained simply in a 10-slide due diligence deck, you are actively depressing your EBITDA multiple. With AIOps absorbing low-complexity tickets and rising cyber stakes, clients now demand pricing that maps directly to measurable outcomes and explicit risk reduction.

Valuation multiples penalize revenue ambiguity. Messy packaging—bundling project work or allowing core security services to dilute base plan margins—creates significant “earnout risk” for buyers. To achieve M&A Readiness, standardize pricing architecture to ensure clean margins and sales velocity.

Executive action requires building three clear, non-overlapping tiers:

- Baseline: Core Managed IT (standard monitoring/management).

- Secure IT: Baseline + full EDR/XDR, basic compliance evidence collection.

- Advanced/Regulated: Secure IT + v-CIO advisory, specialized compliance (e.g., CMMC, HIPAA).

Crucially, define security add-ons outside the base plan to prevent margin dilution, and separate one-time projects completely. This structured approach ensures every dollar of recurring revenue is predictable, defensible, and assigned its proper gross margin—the definition of high-quality asset value.

10. Decouple Growth from Hero Engineers to Kill Key-Person Risk

Specialized talent scarcity (cloud, automation, security) is a critical constraint among current msp market trends. Failing to hire fast enough eliminates Operational Margin Leverage (OML) and creates unacceptable key-person risk.

Investors apply a deep valuation discount during due diligence when service models rely on proprietary “hero engineers.” This reliance undermines the defensibility of recurring revenue by signaling an inability to scale delivery or guarantee predictable service quality.

Executive action requires fundamentally redesigning the delivery architecture. Shift delivery from bespoke effort to a repeatable machine by documenting and standardizing processes. Implement tiered support (L1/L2 + specialist pods) leveraging AIOps automation.

Utilize specialized partners (for SOC, compliance tooling, cloud marketplaces) selectively to capture demand. Crucially, maintain client ownership and keep standardized playbooks in-house. This strategic separation engineers the business model for scalability, maximizing enterprise valuation and eliminating key-person risk.

FAQ

Valuation ranges are highly variable, often defined by size and quality metrics, not just revenue. For premium, mid-market MSPs ($10M+ ARR) with high Operating Margin Leverage (OML) and Net Revenue Retention (NRR) above 100%, EV/EBITDA multiples typically range from 6x to 12x. EV/Revenue benchmarks for high-growth, recurring revenue MSPs range from 1.8x to 3.5x. Multiples are driven by stability, low client concentration, and standardized delivery—not just top-line growth.

Growth is primarily fueled by mandatory spending in two areas: advanced managed security services and hybrid cloud governance/cost optimization (FinOps). Strategic consolidation (M&A roll-ups) also drives segment growth. For individual MSPs, sustaining growth requires keeping core managed IT stable while aggressively scaling 1–2 high-margin premium lines—specializing in security or cloud governance to capture higher Average Revenue Per Account (ARPA).

Clients no longer primarily seek help with initial cloud migration, which is now table stakes. The focus has shifted to ongoing, high-complexity governance, identity management, policy enforcement, and cost controls. This transition moves budgets toward recurring cloud operations and FinOps cadence over one-off projects. MSPs must productize these governance functions to transform unpredictable project revenue into sticky, high-margin Managed Services Revenue (MRR).

Prioritize establishing clean, predictable financial operations first: maximize Operating Margin Leverage (OML) by standardizing packaging and implementing AIOps (as discussed in Section 3). This improves both growth economics and due diligence readiness simultaneously. Once OML is locked in, choose a high-growth “wedge”—either security, cloud governance, or FinOps—to drive Net Revenue Retention (NRR) expansion based on your Ideal Customer Profile (ICP).

Buyers focus on non-financial operational risk factors. Critical scrutiny areas include contract defensibility, Net Revenue Retention (NRR) and churn data integrity, customer concentration metrics, evidence of standardized playbooks/SOPs, tooling standardization across the client base, and the depth of the leadership team beyond the founder. Weakness in these areas maps directly to risk, resulting in lower valuations, earnouts, or price holdbacks.