Introduction

B2B SaaS companies need to understand some key financial metrics to help with cost amortization. One such metric that often takes center stage is the B2B SaaS customer acquisition cost (CAC). This figure represents the average expense a company incurs to win subscribers, from initial outreach to final conversion.

According to a recent study, nearly 70% of SaaS businesses either underestimate or miscalculate their user acquisition cost, potentially leading to misinformed decisions and missed opportunities. As the SaaS industry becomes increasingly competitive, having a clear grasp of your acquisition costs and their implications can be the difference between thriving and merely surviving.

This article delves into the intricacies of just how much revenue SaaS businesses spend to acquire customers, shedding light on its significance and offering insights on how to optimize it for long-term profitability.

Why Is Customer Acquisition Costs Important for SaaS?

For software companies, the financial underpinnings of a venture often have other key metrics to determine its viability. Among these, the CAC stands as a pivotal metric. Understanding this metric is crucial because it directly impacts the company’s SaaS growth and profitability.

If the cost to acquire a new user surpasses the lifetime value (LTV) that the user brings, the business model may not be sustainable in the long run. Conversely, a lower figure indicates that a company can recoup its investment in acquiring a new user more quickly, allowing for reinvestment in other areas or increased profitability. For B2B SaaS entities, where long-term contracts and high lifetime values are common, ensuring a favorable balance between LTV and CAC becomes even more vital.

Benefits of a Lower CAC

While CAC is just one of many metrics B2B SaaS companies should monitor, its significance cannot be understated. A lower CAC offers businesses a clear path to profitability, sustainable growth, and a competitive advantage in the market. The table below explains the main benefits so you can better understand and optimize this metric.

| Benefit | Explanation |

| Increased Profit Margins | Spending less to attract each new client boosts overall profitability. |

| Competitive Edge | Lower initial costs can provide an advantage over rivals who may be investing more in this area. |

| Quicker Return on Investment | Reduced initial expenditure allows for a faster recovery of any investment put into the business. |

| Easier Scaling | With less money required upfront, it’s simpler to expand operations. |

| Budget Flexibility | Savings can be reallocated to other aspects like enhancing customer service or product development. |

| Improved Cash Flow | Reduced upfront spending leads to better liquidity. |

| Reduced Financial Risk | Lower initial expenses reduce the financial risks tied to marketing and promotional campaigns. |

| Investor Appeal | Efficiency in initial spending is often seen as a favorable metric by potential investors. |

| Higher Lifetime Client Value | A lower initial cost increases the long-term value of each customer in relation to what was spent to acquire them. |

| Efficient Resource Use | Fewer resources are needed to attract new clients, allowing for a focus on other strategic areas. |

How to Calculate Customer Acquisition Costs

As discussed above, understanding the CAC is essential for B2B SaaS companies, as it provides a clear picture of the resources expended to gain a new customer. To ensure clarity and accuracy, it’s vital to know both how to calculate CAC and what elements are typically excluded from this calculation.

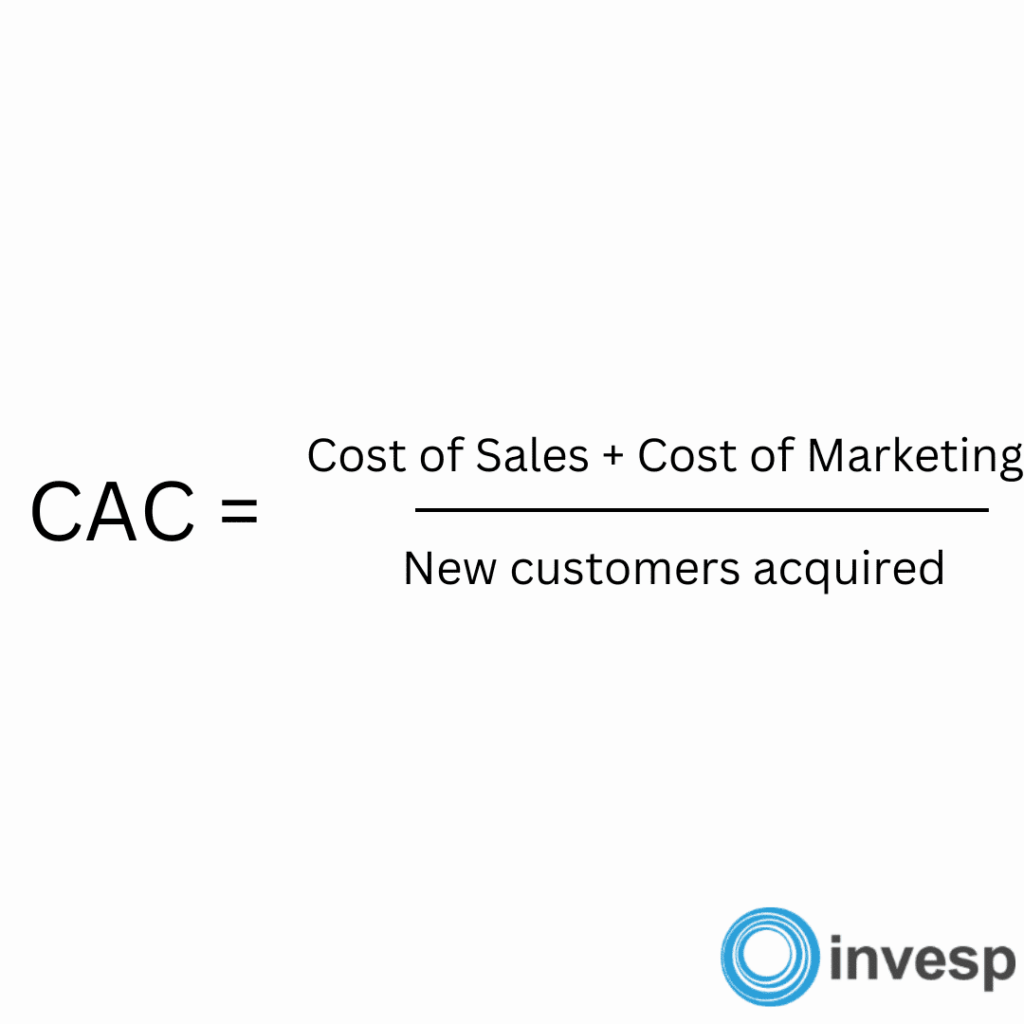

The CAC Formula

CAC is calculated by dividing the total costs associated with acquiring new subscribers by the number of users acquired during a specific period. In mathematical terms:

For instance, if a company spent $10,000 on acquisition and marketing efforts in a month and gained 50 new subscribers, the CAC would be $200.

The total costs of acquisition may include:

- Advertising and promotional expenses

- Employee salaries and benefits for sales and marketing teams

- Costs of tools and platforms used for acquisition (e.g., CRM software, advertising platforms)

- Any external consultancy or services related to the acquisition

What Is NOT Included in a CAC Calculation

While the above components are needed to calculate customer acquisition, certain costs are typically excluded to ensure the metric remains focused on marketing and sales expenses for acquisition efforts:

- Overhead Costs: General administrative expenses, rent, utilities, and other indirect costs are not part of the CAC. These are costs the company would incur regardless of its sales expenses or user acquisition activities.

- Post-Acquisition Costs: Expenses related to customer support, account management, or product delivery are not included. These are considered costs of retention rather than acquisition.

- Research and Development (R&D): While R&D can indirectly influence user acquisition by enhancing the product or service offering, its costs are not directly tied to sales efficiency or the process of gaining new subscribers.

- Capital Expenditures: Purchases of long-term assets, such as equipment or property, are not included in the CAC calculation.

How to Improve Customer Acquisition Costs

Enhancing CAC is a continuous process that requires vigilance, adaptability, and a commitment to understanding the ever-changing needs and behaviors of the target market and audience. By employing the following methods, your B2B SaaS company can position itself for sustained growth and success.

Refine Targeting

Understanding and narrowing down the target audience can lead to more cost-efficient marketing campaigns. By focusing sales and marketing spend on segments that are more likely to convert, companies can reduce wasted budgets on less relevant audiences.

Optimize Conversion Funnels

Review the user journey from initial touchpoint to conversion. Identify bottlenecks or drop-off points and streamline the process. This might involve simplifying sign-up forms, enhancing the user interface, or providing clearer calls to action.

Leverage Content Marketing

Offering valuable content, such as whitepapers, webinars, or case studies, can attract potential users and position the company as a thought leader. This organic pull can often lead to conversions at a fraction of the cost of paid campaigns.

Test and Iterate

Continuously test different acquisition channels and campaigns. A/B testing, for instance, can help determine which messaging resonates most with the target audience. By focusing on what works and discarding what doesn’t, companies can achieve a more favorable CAC.

Train Sales and Marketing Teams

Equip teams with the tools and knowledge they need to be efficient. Regular training sessions, workshops, and feedback loops can ensure that they’re always operating at peak performance.

Monitor Competitors

Keep an eye on what competitors are doing. If they’re employing a tactic or pricing model that seems to be working, consider if it’s applicable and how it might be adapted for your own company’s context.

Negotiate With Vendors

For companies that rely on paid platforms or services for acquisition, negotiating rates or seeking bulk discounts can lead to direct savings, thus positively impacting CAC.

Embrace Feedback

Actively seek feedback from both converted and non-converted leads. Understanding their pain points or reasons for hesitation can offer insights into refining the acquisition process.

Learn about maintaining brand integrity and managing online communities by tuning into the Nuoptima SaaS Podcast featuring Jenny Wolfram from BrandBastion.

Other Key SaaS Metrics to Consider

Average Revenue Per User (ARPU)

The ARPU is a metric that provides insights into the revenue generated from existing subscribers, offering a snapshot of the company’s earning potential and efficiency. It is calculated by dividing the total revenue over a specific period by the number of users or accounts during that same period. For example, if a SaaS company earns $100,000 in a month from 500 users, the ARPU would be $200.

SaaS marketers understand that knowing the ARPU can offer a business a competitive edge. Here are some of the ways this metric influences decision-making and strategy formulation:

- Revenue Streams: ARPU helps businesses identify which revenue streams are most lucrative. For subscription-based models, it can shed light on which plans or tiers are most popular and profitable.

- Product Value: A rising value can indicate that users perceive growing worth in the product, possibly due to feature additions or enhancements.

- Pricing Strategy: If the metric remains stagnant or declines, it might signal a need to revisit the pricing strategy or assess the competitive landscape.

- Forecasting: With this calculation in hand, businesses can make informed projections about future revenue, especially when combined with user growth rates.

While ARPU offers a snapshot of revenue patterns, various factors can sway its trajectory. For example:

- Churn Rate: A high churn rate can negatively impact ARPU, as losing higher-paying customers can bring down the average.

- Upsells and Cross-sells: Successfully upselling or cross-selling to existing users can boost ARPU.

- Discounts and Promotions: Offering discounts can attract more users but might result in a temporary dip in ARPU.

- Market Position: Companies positioned as premium solutions in their niche often have a higher value compared to budget-friendly alternatives.

If you are finding the ARPU calculation not where it needs to be for your SaaS business, here are three actionable strategies to fine-tune this metric, ensuring it aligns with your business objectives:

- Segmentation: Segment users based on behavior, usage, or company size. Tailored offerings or pricing for different segments can enhance ARPU.

- Feedback Loops: Regularly gather feedback to understand user needs and adjust offerings accordingly.

- Periodic Review: Regularly review and adjust pricing strategies based on market demand, competitor actions, and product enhancements.

Customer Lifetime Value (LTV)

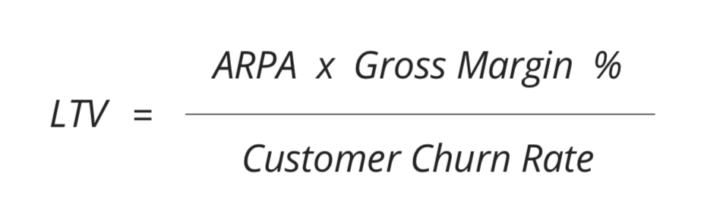

As also highlighted earlier, the Customer Lifetime Value (LTV) is a figure that represents the total revenue your SaaS business can expect from a single paying subscriber during their subscription period. It’s a cornerstone metric that offers insights into the profitability and sustainability of your particular business or model.

LTV is calculated by multiplying the average earnings from a subscriber by the average duration of the relationship minus the costs of serving the customer.

For instance, if a company’s ARPU is $200 per month and the average user stays for 36 months, with service costs amounting to $1,000 over that period, the LTV would be $7,200 ($200 x 36) – $1,000 = $6,200.

Understanding the LTV offers SaaS companies a lens through which they can view the long-term revenue potential of their current subscribers. Here are some of the main benefits it provides:

- Profitability Gauge: A high LTV indicates that customers find sustained value in the product, leading to prolonged relationships and increased revenue.

- Acquisition Budgeting: Knowing this calculation helps businesses determine how much they can afford to spend on user acquisition while remaining profitable.

- Business Health: Monitoring this metric trends can signal the overall health of the business. A declining LTV might indicate rising competition or diminishing product value.

- Resource Allocation: LTV insights can guide where to allocate resources, be it in product development, customer support, or sales and marketing.

Various elements can sway this crucial metric, meaning the calculation of LTV isn’t static. Here are some of the factors that determine the overall LTV of a user:

- Churn Rate: A lower churn rate typically leads to a longer client relationship duration, thereby increasing LTV.

- Product Enhancements: Regular updates or feature additions can increase the perceived value, encouraging users to continue their subscriptions.

- Pricing Models: Tiered pricing models or upselling opportunities can boost the CAC payback from each subscriber.

- Customer Support: Effective and responsive support can enhance user satisfaction, leading to longer relationships.

While understanding LTV is essential, the real advantage lies in optimizing it. By implementing the following specific strategies and practices, you can enhance the lifetime value of your customers, ensuring SaaS growth:

- Feedback Mechanisms: Implement systems to gather regular feedback, ensuring the product aligns with subscriber needs.

- Loyalty Programs: Incentives for long-term commitments or referrals can enhance the duration of client relationships.

- Educational Resources: Offering tutorials, webinars, or training sessions ensures users derive maximum value from the product.

- Proactive Support: Anticipating common issues and proactively addressing them can reduce churn and enhance LTV.

Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

In the B2B SaaS sector, understanding revenue patterns is essential for gauging business health and forecasting growth. Two pivotal metrics that offer insights into these patterns are Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR). These figures provide a snapshot of the predictable revenue a company can expect, making them indispensable for strategic planning and decision-making.

MRR represents the total predictable revenue that a software company can expect to receive every month. It’s calculated by multiplying the number of paying users by the average subscription fee they pay.

For instance, if a company has 100 users, each paying $50 per month, the MRR would be $5,000.

ARR, on the other hand, provides an annual perspective. It’s either the sum of MRR over 12 months or the total yearly contracts’ value. Using the previous example, if the MRR is $5,000, the ARR would be $60,000.

Knowing your MRR and ARR will give you clarity on your SaaS company’s health and growth trajectory. Here are the three main reasons you should be paying close attention:

- Predictability: Both offer businesses a clear view of their predictable revenue, allowing for better financial planning and resource allocation.

- Performance Indicator: Seeing a steady increase in these values indicates positive growth and can be a testament to the product’s value proposition and market fit.

- Investor Relations: For companies seeking external funding, showcasing a healthy MRR or ARR can be persuasive, as investors often look for predictable revenue streams.

While the two metrics provide a foundational understanding of revenue, various external and internal factors can influence these financial metrics. These are some of the elements that play a role in shaping the final MRR and ARR figures:

- Churn Rate: The rate at which customers cancel their subscriptions can directly impact both MRR and ARR. A high churn rate can erode these metrics over time.

- Pricing Changes: Any adjustments to subscription pricing will influence MRR and ARR. This includes both price hikes and reductions.

- Sales Efficiencies: The effectiveness of the SaaS sales process, including the onboarding of new subscribers and upselling to existing ones, can sway MRR and ARR.

Comprehending MRR and ARR is just the first step; the real challenge lies in optimizing these figures. Through the following strategic initiatives and responsive measures, your B2B SaaS company can enhance its MRR and ARR.

- Customer Retention: Focusing on keeping existing customers can stabilize and increase MRR and ARR. This involves offering continuous value and addressing user concerns promptly.

- Flexible Pricing: Offering tiered pricing models or periodic promotions can attract a broader range of subscribers, positively impacting MRR and ARR.

- Regular Reviews: Periodically reviewing and adjusting strategies based on MRR and ARR trends can ensure sustained growth.

10 Ways to Increase Customer Retention

Customer acquisition often takes priority for growing businesses, but for long-term success, you also need to retain existing users. After calculating CAC, it will be obvious that keeping a subscriber is more cost-effective than acquiring a new one. Studies have shown that it can cost four to five times more to acquire new clients versus retaining current ones.

With this in mind, let’s delve into strategies to bolster retention:

- Understand and Anticipate Needs: Engage with your users regularly to grasp their evolving requirements. This proactive approach can lead to timely product or service adjustments, ensuring continued relevance.

- Deliver Continuous Value: Regular feature updates, performance enhancements, and integrations with popular tools can ensure that users consistently derive value, fostering loyalty.

- Prioritize Customer Support: A responsive and effective support system can significantly impact retention. Ensure users can easily reach out through various marketing channels and find answers to common queries in a comprehensive knowledge base.

- Build a Sense of Community: Encourage user interaction through forums, webinars, and workshops. A strong community fosters engagement and can provide invaluable feedback.

- Implement Loyalty Programs: Consider incentives for long-term commitments, such as discounts on extended plans or rewards for referrals.

- Monitor and Act On Usage Patterns: Regularly review how users engage with your product. Addressing potential issues proactively, identified through decreased activity or feature neglect, can prevent churn.

- Educate and Inform: Keep users updated about new features and best practices through newsletters, tutorials, and training sessions.

- Value Feedback: Actively seek and act upon user feedback. Demonstrating that their opinions are valued can enhance loyalty.

- Maintain Transparent Communication: In the event of issues, such as downtimes or bugs, proactively inform your user base. Transparency in challenging times can foster trust.

- Analyze and Learn From Churn: When subscribers leave, understand why. This feedback can be invaluable in refining offerings and preventing future churn.

Closing Thoughts

Running and growing a successful SaaS business requires a deep understanding of various metrics, with CAC being at the top of the list. Calculating CAC not only offers insights into the financial efficiency of SaaS subscriber acquisition but also sets the stage for sustainable growth. By comprehensively analyzing CAC in conjunction with other key metrics like LTV, MRR, and ARR, businesses can make informed decisions, optimize their marketing efforts, and ensure a positive return on investment.

NUOPTIMA has the experience and industry-specific knowledge to be an invaluable partner in this journey. We have worked with many SaaS companies and have proven results from our expertise in analyzing, interpreting, and optimizing these metrics, ensuring that our SaaS clients remain competitive and profitable.

By leveraging the right tools, methodologies, and strategies, we can provide you with actionable insights and recommendations tailored to your unique needs. If you want to explore how NUOPTIMA can elevate your SaaS business, book your free discovery call today. We’ll do your CAC calculation and find ways to help you keep your marketing expenses and sales spend under control.