Capital doesn’t belong only to VC investors and private equity firms. In recent years, family offices have proven to be worthy contributors to the global economy.

Once perceived as merely a tool for preserving family wealth across generations, these entities are now managing an estimated $6 trillion in assets worldwide, rivaling even the largest institutional investors.

And guess what? They are becoming increasingly interested in investing in private capital.

As they continue to grow in number and influence, family offices don’t just sit and wait for money to come their way; they are decision-makers who drive trends in investment diversification, direct investments, and private equity.

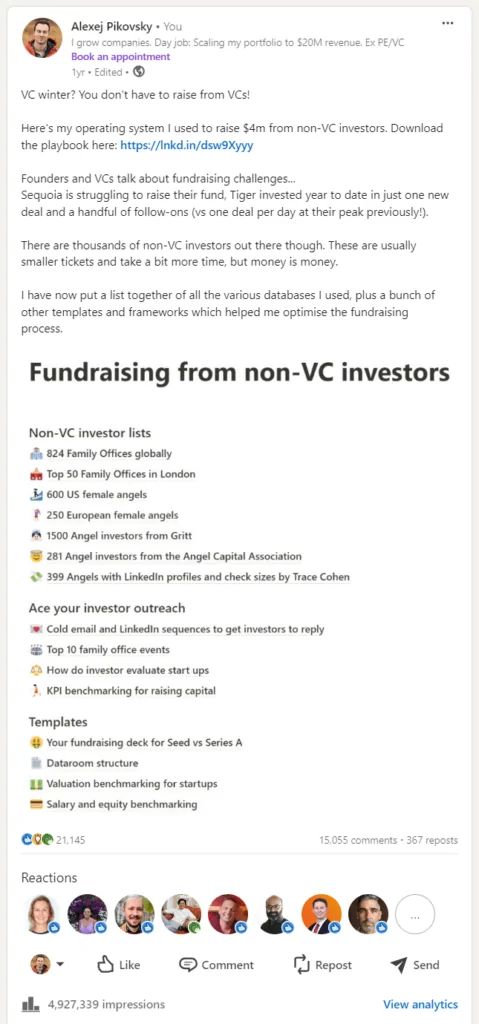

Back in March 2023, I posted my first version of the family office database with a title “Fundraising from non-VC investors”. That post got 5m views on Linkedin. Since then we continued to build our database which you can see at the bottom section of this article.

What Are Family Offices?

At their core, family offices are private wealth management firms established by wealthy families to manage their financial and personal affairs.

They provide investment management, estate planning, philanthropy, tax services, and succession planning. The primary goal of a family office is to preserve and grow the family’s wealth across generations while maintaining confidentiality and control over their financial affairs.

Family offices differ significantly from other financial organizations, such as traditional banks, investment firms, or hedge funds, primarily due to their highly personalized approach to wealth management.

Unlike these institutions, which typically serve a broad client base with standardized products and services, family offices are dedicated to the needs of a single family (in the case of single-family offices) or a small group of families (in the case of multi-family offices).

Family offices often have a long-term investment horizon, guided by the family’s legacy and values, rather than short-term profit motives.

This results in highly tailored, flexible investment strategies aligned with the family’s broader goals. Family offices are uniquely positioned to manage and grow intergenerational wealth with a level of discretion and control that other financial institutions simply cannot match.

However, as the younger generations take the steering wheel, they also invest in more modern opportunities, such as venture capital for startups. So don’t think about family offices as organizations stuck in their own and old ways of doing things.

Key Strategies of Family Offices

Over the generations, family offices have developed a range of strategies to effectively manage and grow their wealth. One of the most prominent strategies is investment diversification.

Investment Diversification

By spreading investments across various asset classes—including stocks, bonds, real estate, and alternative assets like hedge funds and private equity—family offices mitigate risk and enhance the potential for returns.

Family offices spread investments across a broad range of asset classes, including:

- Stocks

- Bonds

- Real Estate

- Alternative Assets: Hedge funds, private equity, and venture capital.

Diversification reduces risk and increases the potential for returns by not placing all wealth in a single asset class.

This strategy protects the family’s wealth from market volatility and economic downturns. For example, family offices may choose to invest in niche industries like equipment hire in Sydney, leveraging local expertise to tap into high-demand, asset-backed business opportunities.

Direct Investments and Private Equity

Another key strategy is direct investments, particularly in private equity.

Family offices increasingly prefer direct involvement in the companies they invest in, rather than relying solely on third-party funds. This hands-on approach allows them to leverage their expertise and align investments with their long-term goals.

It also provides opportunities for greater control and higher returns, as family offices can directly influence the strategic direction of their investments.

This strategy is especially popular among those working with middle market private equity firms, where they can take an active role in the growth and management of their portfolio companies.

What are the key aspects of it?

- Hands-On Approach: Many family offices now prefer direct investments over traditional third-party managed funds.

- Control and Influence: Direct investments allow family offices to actively participate in the management and strategic direction of their investments, ensuring alignment with long-term goals.

- Higher Returns: By cutting out intermediaries, family offices often achieve higher returns on their investments.

This strategy family offices employ is a great opportunity for anyone seeking investments for their business, whether it’s SaaS, marketplace, or any other industry relying on external investments.

Having secured capital from family offices for multiple business, I’ve experienced first-hand how it can help businesses in different industries.

But are investments always a good idea for founders and CEOs?

Learn what Matteo, 5x founder, had to say about the dangers of VC funding in SaaS and why he had to shut down one of his businesses in Nuoptima’s high-value podcast.

Global and European Family Offices

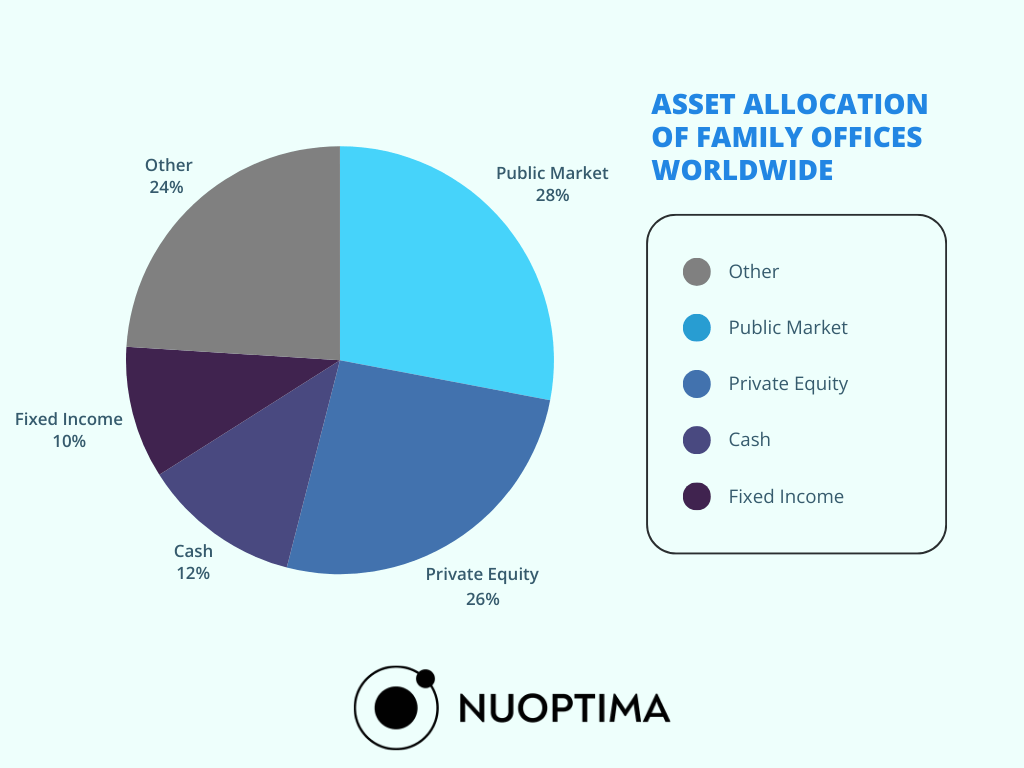

The asset allocation of family offices worldwide, expressed as a percentage of their total investment portfolios, is distributed as follows:

|

This distribution shows a strong preference for public markets and private equity, which together constitute over half (54%) of the typical family office portfolio.

The allocation also reflects a conservative approach, with 22% of assets in cash, fixed income, and private real estate, providing liquidity and stability.

Hedge funds, private credit, and commodities represent smaller portions of the portfolio, indicating a selective approach to these higher-risk or alternative investments.

Global Family Offices

Family offices have made their mark worldwide, with some of the most notable ones based in the United States. At the end of the day, the US has some of the best cities to raise capital in.

For example, Cascade Investment, one of the top family offices, owned by Bill Gates, manages billions of dollars across various sectors, including technology, real estate, and energy.

Another example is Bezos Expeditions, the family office of Jeff Bezos, which invests in early-stage companies and has a diversified portfolio ranging from space exploration to e-commerce.

Cascade Investment

| Founder | Established by Bill Gates, Cascade Investment is one of the most well-known family offices in the world. |

| Assets Under Management (AUM) | The most recent estimated portfolio value is $148,207,888 USD. The actual Assets Under Management (AUM) includes this value plus additional undisclosed cash holdings. |

| Investment Sectors | Cascade Investment is diversified across multiple sectors, with significant stakes in technology companies like Microsoft, real estate ventures, hospitality, and energy. The family office also emphasizes sustainable investing, with a notable commitment to renewable energy projects. |

| Influence | The family office often aligns with Bill Gates’ philanthropic efforts, such as the focus on clean energy, reflecting a blend of profit and purpose. |

Bezos Expeditions

| Founder | Established by Jeff Bezzos, Bezos Expeditions is another extremely popular family office. |

| Assets Under Management (AUM) | 107.8 billion USD |

| Investment Sectors | Bezos Expeditions has a unique approach, focusing heavily on early-stage startups and disruptive technologies. This includes investments in space exploration through Blue Origin, as well as e-commerce, healthcare, and media. The family office has been instrumental in the growth of companies like Airbnb, Uber, and Twitter, showcasing a keen eye for innovation and market potential. |

| Influence | The portfolio of Bezos Expeditions is incredibly diverse, ranging from commercial spaceflight to cloud computing, illustrating a strategy that embraces high-risk, high-reward ventures. |

European Focus

In Europe, for example, in the UK, family offices frequently collaborate with private equity firms in London, leveraging their local expertise to identify promising investment opportunities in the region.

The Edmond de Rothschild family office in Switzerland is a prime example as it manages assets of CHF 158 billion while focusing on sustainable investments.

Another notable mention is the Reimann family office in Germany, which has substantial holdings in the consumer goods sector through their investment in JAB Holding Company with more than $50bn of assets.

Edmond de Rothschild Family Office

| Founder | Based in Switzerland, this family office is part of the renowned Rothschild banking dynasty, which has been a pillar of European finance for centuries. |

| Assets Under Management (AUM) | CHF 158 billion |

| Investment Sectors | The Edmond de Rothschild family office manages a wide-ranging portfolio that includes banking, real estate, and a growing focus on sustainable investments. This includes significant investments in renewable energy, sustainable agriculture, and impact investing—areas that align with the family’s long-standing values of responsible stewardship and legacy building. |

| Influence | The Rothschild family’s influence extends beyond finance into philanthropy and cultural initiatives, further cementing their role as both financial and societal leaders in Europe. |

Reimann Family Office

| Founder | Based in Germany, the Reimann family office manages the wealth of one of the country’s most affluent families. |

| Assets Under Management (AUM) | More than $50bn in assets. |

| Investment Sectors | AB Holding Company, a private investment firm, is the primary vehicle through which the Reimann family office operates. JAB has a substantial portfolio in the consumer goods sector, with major investments in brands like Keurig Dr Pepper, Panera Bread, and Pret A Manger. |

| Influence | The Reimann family office’s strategy revolves around acquiring and scaling leading consumer brands, with a focus on long-term growth and market leadership. Their approach is methodical and driven by deep industry expertise, allowing them to dominate sectors like food and beverage on a global scale. |

Challenges and Opportunities

While family offices continue to grow in prominence, they are not without challenges. The market presents both hurdles and opportunities for them:

| Challenges | Opportunities |

| As family offices increase in size and influence, they are attracting more attention from regulators. Governments around the world are tightening regulations, particularly around transparency and compliance, which can complicate the operations of family offices that value privacy and discretion. | However, this scrutiny also presents an opportunity for family offices to set industry standards in governance and ethical investing, positioning themselves as leaders in responsible wealth management. |

| Managing a global portfolio is inherently complex, with family offices needing to navigate diverse markets, currencies, and geopolitical risks. This complexity is further heightened by the need to align investments with the family’s values and long-term goals, often across multiple generations. | The complexity of global markets also opens up new avenues for diversification and growth. Family offices that can adeptly manage these challenges are well-positioned to capitalize on emerging market opportunities and innovative sectors like technology and renewable energy. |

| Ensuring a smooth transition of wealth and leadership across generations is a challenge for every family office. The risk of wealth dilution or mismanagement increases with each generational shift, making effective succession planning essential. | The rise of next-gen family members, who often bring fresh perspectives and a greater emphasis on sustainability and technology, presents an opportunity to modernize family office operations and align investments with contemporary values. |

Detailed Family Office Database

As the influence of family offices continues to grow, having access to reliable data on these entities is invaluable for CEOs, founders, investors, researchers, and basically everyone looking for investors.

The Global and European family offices databases are a comprehensive resource that offers you a unique way to browse through detailed information and find a list of family offices for your needs.

The database provides comprehensive insights into the investment behaviors of family offices, including their partnerships with top growth equity funds, which are essential for scaling emerging businesses and ensuring long-term value creation.

[wpdatatable id=3]Conclusion

Over the past decade, the number of family offices has increased by more than 3x, driven by the rising wealth of global billionaires and a growing desire for personalized, long-term investment strategies.

This rise is particularly evident in regions like Europe and North America, where family offices shape markets through direct investments in private equity, real estate, and innovative sectors like technology and sustainable energy.

In Europe alone, family offices with a significant portion dedicated to sustainable and impact investments. This focus aligns with the broader European trend towards responsible investing, further positioning family offices as key players in driving the future of finance.

The good news is – as family offices continue to expand their influence, they increasingly collaborate with a private equity operating partner to optimize their investment strategies and drive growth in their portfolio companies.

This presents a unique opportunity for you and anyone who is looking for significant investments into their business, to take a piece of that capital.

And if you’re not sure how to manage investment relationships and get capital, don’t let the information overwhelm you. Watch the video on 10 Strategies to Raise Capital and Manage Investor Relations – Beginner’s Guide to Negotiations and get ready to raise the money you need!

Having personally raised $4m+ from family offices and angels, I know the ins and outs of scaling businesses with the help of investments. If you’re ready to take the leap, contact us, and you’ll get expert advice on how to raise capital without significant risks.