Stop chasing a vanity valuation multiple. The only number that matters is the one that survives deep diligence and prevents a painful re-trade. Before engaging a broker, you must stress-test your organization exactly as a Private Equity operating partner would. Use this buyer-style lens for a rigorous msp business evaluation. Deals crater when owners ignore the hidden financial, security, and operational weaknesses that become deal-killers. We analyze 10 core factors that drive enterprise value and expose P&L risks, starting with the metric buyers interrogate hardest: normalized earnings.

1. Anchor Your Valuation on Defensible, Normalized EBITDA

Valuation multiples apply only to normalized EBITDA—the figure reflecting sustainable cash flow, not the raw earnings on your P&L. Sloppy personal expenses, undocumented related-party transactions, and aggressive owner add-backs don’t just reduce the multiple; they invite a painful price re-trade during due diligence.

To anchor a defensible figure for your msp business evaluation, apply a Quality of Earnings (QoE) lens. Assemble 36 months of P&L/balance sheet, detailed owner comp, and a documented list of one-time expenses.

Self-test with QoE questions:

- What revenues or costs are genuinely non-recurring?

- Are run-rate adjustments necessary (e.g., delayed hiring)?

Buyers punish cash-basis distortions, margin swings, and undocumented add-backs. Remediation is non-negotiable: create a single, clear “normalized EBITDA bridge” spreadsheet you can defend line-by-line. This is the only figure that survives diligence.

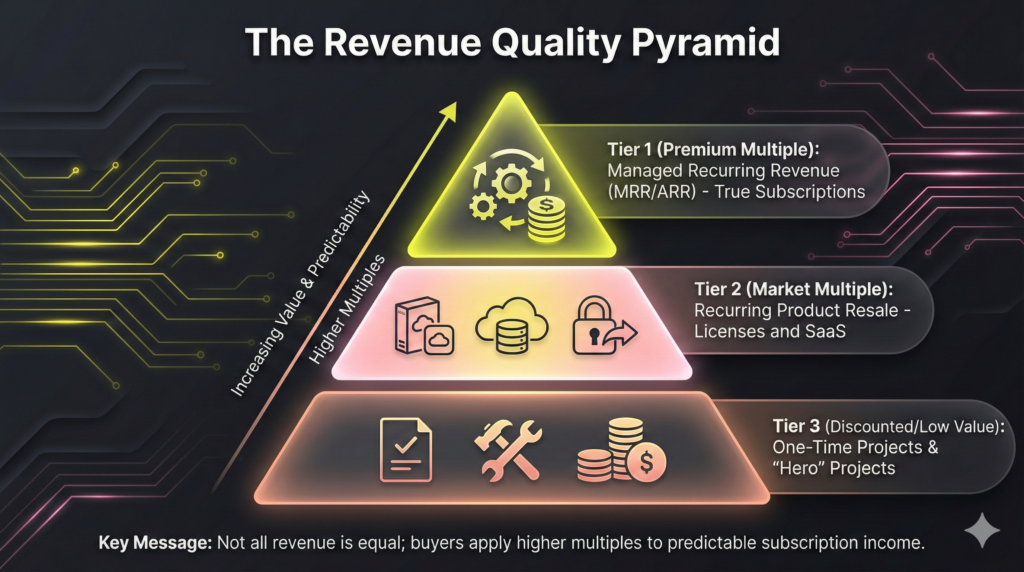

2. Protect Your Multiple with High-Quality Recurring Revenue

Buyers underwrite future stability, not past performance. Premium multiples are reserved for MSPs with defensible, recurring forward cash flows, as predictability fundamentally reduces perceived operational risk during due diligence.

For M&A readiness, you must segment revenue by quality and associated margin profile. Value depends not on volume, but on clean segmentation:

- Managed Recurring Revenue (MRR/ARR): True subscription, high margin. This earns the premium multiple.

- Recurring Product Resale: Lower margin, higher churn risk (e.g., software licenses).

- One-Time Projects: Highly lumpy, low predictability. Must be aggressively minimized.

Red flags invite painful price re-trades: reliance on “hero projects,” services sold below cost to win a logo, or month-to-month recurring contracts. Non-negotiable fixes include migrating repeatable project work into managed service add-ons and tightening renewal workflows. Clean MRR/ARR reporting is the investor’s language.

3. Validate Sustainability with Investor-Grade Retention Metrics

Retention is the third pillar of MSP valuation. Premium valuation multiples are reserved for firms that demonstrate revenue durability over time, proving stickiness and minimizing future revenue churn risk. Buyers analyze trajectory, not just the current run rate.

An M&A-ready MSP must present time-series proof by tracking:

- Logo Churn and Revenue Churn: Tracking both exposes silent contraction or single-client dependency risk.

- Net Revenue Retention (NRR): This definitive metric shows expansion revenue (upsells) offsetting contraction/churn. High NRR validates your service roadmap and allows buyers to model exponential growth.

Red flags are fatal: New sales masking high underlying logo churn signals a failure in client success. Achieve M&A readiness by implementing rigorous client success discipline: mandatory Quarterly Business Reviews (QBRs) and proactive remediation for “at-risk” accounts. Predictability—the core of a successful msp business evaluation—demands this discipline. (149 words)

4. Stress-Test Your Contracts for Diligence and Concentration Risk

Weak contract quality and high concentration are non-negotiable deal-killers, forcing painful discounts or onerous earn-outs. Buyer operational diligence exposes these vulnerabilities, undermining the valuation premium of high-quality MRR.

To achieve diligence-grade recurring revenue, stress-test these core elements:

- Contract Mechanics: Document term lengths, auto-renewal logic, termination for convenience, and price change clauses. Crucially, verify SLA commitments and liability language.

- Assignment Language: M&A readiness requires explicit change-of-control/assignability rights. Red flags include handshake arrangements and undisclosed closing-day discounts.

- Client Concentration: For a rigorous msp business evaluation, calculate top 1 and top 5 clients as a percentage of both total revenue and gross margin. Reliance on a handful of clients for over 20% of profits signals unsustainable concentration risk.

Immediate remediation includes migrating critical month-to-month accounts to standardized, multi-year MSAs. You must document relationship owners beyond the founder to prove the client relationship belongs to the enterprise, not an individual.

5. Operational Metrics: Prove Scalability with MSP Unit Economics

Your premium valuation multiple depends on scalable delivery; buyers pay for engineered repeatability, and they heavily discount chaos. For a rigorous msp business evaluation, diligence scrutinizes service metrics to ensure revenue is not dependent on tribal knowledge or founder-level intervention (“hero tech” syndrome). Margins relying on undocumented overtime will trigger a normalized EBITDA adjustment down.

These critical unit economics must be computed and reported quarterly:

- Technician Utilization: Billable vs. available hours, broken down by support tier.

- Effective Hourly Rate (EHR): The realized rate on labor delivered.

- Service Desk Performance: Mean Time To Resolution (MTTR), First Contact Resolution (FCR), and ticket backlog aging.

Investor-grade performance requires stable or improving KPIs quarter-over-quarter (Q/Q). Key red flags include high utilization on senior staff or margin sustained by uncompensated overtime. Remediation requires implementing standardized dispatch rules, clear tiering, and capacity planning tied directly to client or user count. Predictable service delivery validates the entire forward cash flow model. (146 words)

6. Analyze Client Profitability Per Account to Defend Margins

Unprofitable accounts create lethal churn risk, undermining margin sustainability. Financial diligence demands a client profitability analysis to validate valuation multiples. High-volume, low-margin clients that drain service capacity invite steep price re-trades.

To perform a rigorous msp business evaluation, build a client profitability heatmap using:

- Revenue Metrics: Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR).

- Cost Metrics: Time-to-serve (service desk hours, project time) and direct allocated costs (labor and specialized tools).

Identify investigative patterns: high-touch compliance industries, legacy pricing, or “strategic” accounts suffering permanent scope creep. Margin-dilutive top-line clients are critical red flags, signaling fundamental flaws in your service catalog or pricing model.

Before market entry, address these accounts: reprice, re-scope the service stack, standardize the technology stack, or intentionally prune the relationship. Document the rationale for every retained unprofitable account to defend future margin projections.

7. Mandatory Security Posture: Transferring Risk and Proving Compliance

Security posture is an existential liability, not an operational detail. Buyers pay a premium for reduced risk and heavily discount MSPs that force them to inherit security debt. A rigorous msp business evaluation demands defensible, engineered controls.

For M&A readiness, present this evidence checklist proving institutional control:

- Security Program Alignment: Document adherence to a recognized control framework (e.g., CIS Controls or NIST CSF).

- Incident Response Plan (IRP): Document and test the plan via tabletop exercises; include clear roles, escalation procedures, and client communication templates.

- Cyber Insurance: Provide proof of coverage and, crucially, understand any contractual exclusions that might invalidate the policy during a breach.

Investor-grade security often requires SOC 2 Type II or a funded 12-month roadmap. Critical red flags during diligence include inconsistent MFA policies, informal administration access, and the lack of a documented IRP. Remediation is non-negotiable: centralize security documentation, harden client baseline controls, and run documented tabletop exercises.

8. Standardize Your Stack to Unlock Scalability and M&A Readiness

Every exception to your operational workflow is a direct tax on scalability, eroding the margin profile required for a high valuation multiple. In diligence, buyers view customization as future integration cost. Your operational maturity is instantly judged by the consistency of your delivery platform. Supporting disparate RMMs, variable patch cycles, or relying on tribal knowledge for configs signals engineered chaos. This inconsistency inflates your cost-to-serve and risks massive Normalized EBITDA adjustments, undercutting your msp business evaluation.

M&A readiness requires demonstrable standardization across your core tools:

- Tool Sprawl: Do all clients run on a single RMM/PSA suite?

- Configuration Hygiene: Are backup and patch standards uniform, not bespoke per client?

- Process Playbook: Is onboarding/offboarding executed via a rigorous, repeatable (ITIL or CIS aligned) playbook?

Red flags like bespoke stacks and inconsistent monitoring standards signal instability. The fix: Define a non-negotiable “supported stack.” Create proactive migration offers to standardize outliers, and measure remaining client exceptions as a managed KPI. This predictable repetition validates your entire forward cash flow model.

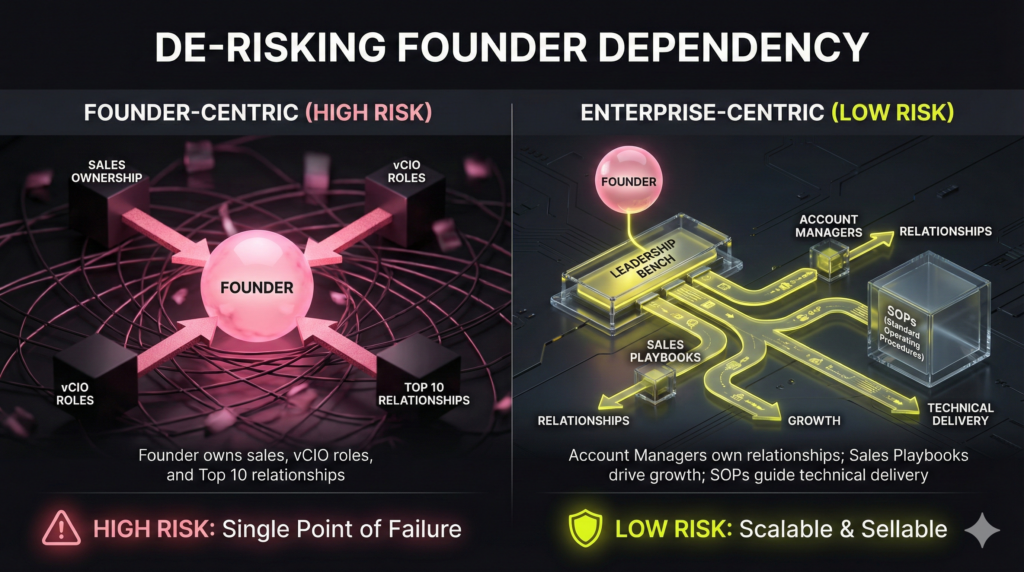

9. De-Risking Founder Dependency to Maximize Valuation

If your business stops when you take a vacation, you have a key-man risk that immediately jeopardizes your valuation multiple. Buyer underwriting assumes continuity. When delivery, sales, or top-10 client relationships are founder-anchored, expect painful earn-outs or holdbacks. Operational continuity must be owned by the enterprise, not the individual.

Evaluate dependency hotspots:

- Who owns the top 10 client relationships (beyond the founder)?

- Who can quote, close, and onboard deals autonomously?

- Are environment exceptions documented, or only known by a senior tech?

The critical red flag is the founder acting as dispatcher, vCIO, and senior salesperson. M&A readiness demands role separation, documented playbooks (SOPs for renewals, security incidents), and developing a leadership bench. Transfer relationship capital to the organization before diligence to mitigate this un-sellable founder dependency. (149 words)

10. Prove Scalability with Investor-Grade Revenue Operations

Stable maintenance revenue is essential, but it doesn’t earn a premium valuation multiple. Acquirers pay more for predictable growth—the proven, repeatable capacity to convert leads. Referral-only sales signal structural risk, warranting a steep discount during your msp business evaluation. You must prove growth is engineered, not accidental.

To establish diligence-grade repeatability, diagnose your growth engine:

- Lead Mix: Document the ratio of referrals versus scalable inbound/outbound channels. Over-reliance on founder networks signals key-man risk.

- CRM Hygiene: Buyers audit clean stage definitions, consistent attribution, and pipeline reconciliation to booked revenue.

- Proof Assets: Documented case studies, defined Ideal Customer Profiles (ICPs), and a formal sales playbook someone else can run.

Founder-only selling and irreconcilable pipeline value are key red flags. Demonstrate investor-grade RevOps by implementing simple reporting, defining CRM lifecycle stages, and documenting a transferable sales playbook.

FAQ

While not mandatory, a seller-side QoE is critical for MSPs generating over $5 million in Normalized EBITDA, as it preemptively validates financial sustainability and prevents price re-trades during buyer diligence. If commissioning a full QoE is overkill, you must “QoE-proof” your financials by creating a detailed EBITDA bridge spreadsheet and an evidence folder documenting all owner add-backs and one-time expenses. This preparation is essential for a credible msp business evaluation.

Valuation multiples are highly variable, determined primarily by the quality and predictability of revenue. Key drivers that push the multiple higher include demonstrated growth trajectory, high recurring revenue percentage (75%+), strong Net Revenue Retention (NRR), and minimized client concentration risk. Size band also matters; smaller MSPs often use public-company multiples only as context, while deal structure (like earn-outs) can heavily influence the final headline figure.

Buyers scrutinize operational maturity to prove scalability. Critical KPIs include service desk performance metrics such as Mean Time To Resolution (MTTR) and First Contact Resolution (FCR), which demonstrate service efficiency. Additionally, buyers demand evidence of strong delivery economics—specifically, high Technician Utilization and a defensible Effective Hourly Rate (EHR). Finally, client health (low revenue churn and high profitability per account) validates the margin model.

A fast baseline assessment—compiling necessary financial data, defining Normalized EBITDA, and identifying top security/operational risks—takes roughly 2 to 4 weeks. However, implementing real, diligence-ready improvements requires a dedicated improvement cycle of 90 to 180 days. This period is necessary for actions like standardizing your technology stack, cleaning up legacy pricing, stabilizing KPIs, and documenting the investor-grade processes required for M&A readiness.

The fastest path to mitigating key-man risk is proving operational continuity through documentation and role transfer. First, document 5-7 repeatable processes (e.g., client onboarding, security incident response, or quoting/renewals) into standard operating procedures (SOPs). Second, formally transition the primary relationship ownership for your top 10 clients away from the founder to named account managers. This institutionalizes critical relationships and validates the business’s independence.