Stop calling MSP consolidation “market noise.” It is a structural shift driven by Private Equity seeking multiple expansion. PE isn’t paying for raw revenue; they pay premium valuations for repeatable operating systems: security, automation, and AI, all built for scale. This dynamic dictates the winners, the losers, and who achieves a premium exit in 2026. This founder-to-founder framework details seven core msp consolidation trends 2026 defining M&A readiness for growth-stage MSP owners. We start with the trend driving everything else: PE-backed platform roll-ups.

1. Mastering the Add-On Acquisition Flywheel

If you are currently relying on organic growth alone, you are competing against a revenue machine built for mathematical optimization. That is the core frustration defining the MSP consolidation trends 2026. Consolidation has evolved from fragmented local mergers into disciplined platform formation, driven by the “add-on acquisition flywheel.”

Buyers are no longer just acquiring revenue; they are acquiring capabilities engineered for instant valuation arbitrage. The platform strategy centralizes high-cost functions—finance, RevOps, and standardized stacks—and then acquires smaller “add-ons” to gain geographic density or vertical specialization (e.g., CMMC or HIPAA expertise). This structure enables massive EBITDA growth by immediately standardizing operations and cross-selling premium security and compliance services across the unified client base.

For the owner, this dynamic presents a dual assessment: the opportunity to become a premium add-on or the risk of competing directly against capital-backed scale. Opportunity demands M&A readiness: clean financials, documented SOPs, and demonstrable vertical specialization. The risk is that these platforms can leverage standardized pricing and enterprise-grade packaging to undercut local competitors.

Crucially, watch for signals indicating a platform has entered your market: a local competitor suddenly rebrands, launches a sophisticated Managed Detection and Response (MDR) suite, or begins hiring integration and operations leaders. These are not signs of organic growth; they are the indicators that the acquisition flywheel is turning.

2. The Widening Valuation Gap: Quantifying Your Investor-Grade Multiple

The msp consolidation trends 2026 show the market bifurcating into two asset classes: sub-scale and platform-quality. Buyers no longer pay a median multiple; they pay a premium only for assets engineered for seamless diligence and integration.

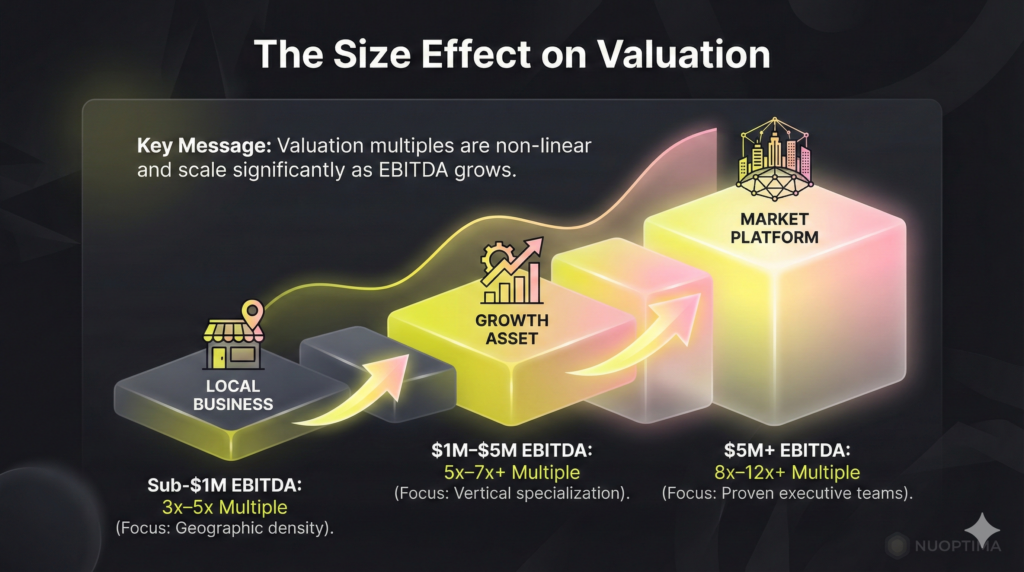

This bifurcation is defined by the size effect:

- Sub-$1M EBITDA: Often trading at 3x–5x Adjusted EBITDA. These deals are slow, risk-heavy, and typically acquired for geographic density or a book of business.

- $1M–$5M EBITDA: The sweet spot for add-on acquisitions, trading at 5x–7x+. Premium multiples here are driven by recurring revenue quality and vertical specialization.

- $5M+ EBITDA: True platform scale, commanding 8x–12x+ EV/EBITDA. These firms have proven executive teams and robust, investor-grade reporting.

To enter the premium bracket, maximize controllable factors that de-risk the asset. This M&A readiness pivot requires tightening contract hygiene, ruthlessly reducing keyman risk, and ensuring no client exceeds 10% of total revenue. Most crucially, professionalize your data. Buyers pay for quantifiable quality, meaning you must build investor-grade KPIs: gross margin by service line, utilization rates, and detailed churn/retention metrics.

Playing “Adjusted EBITDA games” will backfire. Aggressive salary valuation normalization attempts are exposed and penalized during diligence, creating friction that shaves points off the eventual multiple. Focus instead on tangible improvements that create provable, recurring revenue outcomes.

3. Security: The Primary Acquisition Thesis for 2026

Security is no longer an “add-on” service but the critical msp consolidation trends 2026 driving modern valuations. For the PE-backed consolidator, security is not a defensive cost center; it is the core revenue accelerator and acquisition thesis. This shift is driven by rigorous insurance requirements, intense buyer diligence on security posture, and non-negotiable demand for Managed Detection and Response (MDR).

Consolidators prioritize targets that reduce portfolio risk while accelerating security revenue through cross-selling. Specialized knowledge in vertical compliance—HIPAA, SOC 2, or CMMC—is now an asset class, not a footnote.

This trend presents a stark choice. The opportunity is to productize a scalable security offering. This requires packaging security outcomes (MDR, incident readiness, compliance reporting) to maximize MSSP acquisition offers with clear SLAs and predictable recurring revenue. That productized approach transforms your valuation, delivering the investor-grade recurring revenue outcome buyers crave. The risk is remaining positioned as “helpdesk plus patching” only—a commoditized model irrelevant to the modern platform strategy.

To pivot toward premium valuation, implement a security roadmap, formalize an incident response partner network, and develop compliance bundles tailored by industry vertical. Watch your local market for rivals launching SOC/MDR solutions or compliance landing pages; these are immediate signals that the security-led acquisition flywheel has landed in your backyard.

4. The Automation Thesis: AI as a Multiplier for EBITDA Margin

AI has shifted from futuristic toolkits to mandatory operational efficiency. Buyers are no longer impressed by ‘AI pilots.’ They demand a demonstrable, AI-enabled operating model that guarantees EBITDA margin expansion and standardizes integration.

AI/automation is the new foundation of M&A readiness, solving the scale problem. Platforms pay premium multiples for assets where service delivery is instantly streamlined. Credible automation playbooks radically reduce service costs through ticket deflection and faster Mean Time to Resolution (MTTR).

Your valuation depends on proving exactly where AI touches your operation: triage, knowledge base management, proactive patching, and reporting.

The action is documentation, not declaration. The risk is “AI theatre”—claims in due diligence that lack verifiable metrics. To secure an investor-grade multiple, you must quantify your impact. Buyers audit key metrics, directly tying them to gross margin:

- L1 deflection percentage

- Ticket volume per endpoint/user

- Average MTTR reduction

- Gross margin by service line

For MSP consolidation trends 2026, the way AI is reshaping MSPs is not a buzzword;. It is the evidence that your recurring revenue is stable, scalable, and maximally profitable. Make automation part of your outcome narrative, focusing on risk reduction and efficiency, not just new software.

5. Stack Standardization: Erasing Operational Debt Before Diligence

Tool sprawl is the operational debt that kills M&A speed and depresses multiples. A critical msp consolidation trend 2026 is the buyer preference for MSPs with a rationalized, supportable technology stack, easily standardized across a consolidated platform.

Integration friction is expensive. When a PE-backed platform acquires an asset, the mandate is rapid standardization, cross-selling, and immediate margin expansion. A target running disparate RMM/PSA systems, varied security vendors, and brittle API integrations signals a liability, not scale.

Tooling alignment dictates integration speed. A disciplined stack signals “scale-readiness,” ensuring operations are repeatable and margins predictable. Messy tool management—relying on single-vendor dependencies or poor documentation—is flagged as operational debt, increasing switching costs and costing multiple points.

Owner Action: The Standardization Audit

To secure a premium valuation, position your stack maturity as a story of efficiency:

- PSA/RMM Hygiene: Ensure configurations are clean and documentation is centralized.

- Vendor Contracts: Negotiate scale-like terms now, demonstrating contractual discipline.

- Integration Map: Document all primary tool integrations (e.g., PSA to billing) to prove ease of migration.

- Security Architecture: Rationalize security vendors (MDR, compliance, backup) to a core, easily supported set.

Buyers prioritize reliability, security, and the predictable margins a standardized platform delivers. Prove you have done the heavy lifting now.

6. Mitigating Integration Debt: How to Contractually Prove Continuity

The key msp consolidation trends 2026 risk is the customer perception gap. While consolidation offers potential upgrades (e.g., full SOC access, robust reporting), clients fear the degradation that often follows: templated QBRs, SLA creep, and high-touch support replaced by a centralized ticket mill.

This skepticism is a commercial liability. Customer trust is the primary retention lever, directly feeding enterprise valuation. Integration failure—or “integration debt”—manifests as silent churn, ticket backlogs, and reputational drag that kills M&A multiples.

Consolidators must implement an Integration Operating System (IOS) that contractually protects the client experience. This means deploying predefined SLA protection, rigorous communications plans, and a knowledge transfer protocol ensuring helpdesk reorgs do not impact resolution times.

For independent MSPs, the opportunity is differentiation. Prove “high-touch + niche expertise” with superior quality. The QBR agenda must focus on measurable outcomes (risk reduction, uptime), moving beyond simple quarterly spend review.

For M&A readiness, deliver tangible proof of continuity: standardize a Transition Plan template, utilize a client-visible SLA dashboard, and ensure leadership turnover is transparently managed. These signals convert integration risk into measurable value.

7. The Strategic Fork in the Road: Niche vs. Scale

The primary msp consolidation trend 2026 is the vanishing middle ground. Generalist MSPs lacking vertical depth or scale face severe margin compression and churn risk. The market is bifurcated: platforms win on standardization; specialists win on compliance and credibility.

Stop defending the middle. This decision framework dictates your next three years and eventual valuation:

- Path A: The Specialist Play. Choose one regulated vertical (e.g., healthcare, finance). Package compliance, security, and vCIO services as a single outcome. This builds a competitive moat, delivers higher pricing power, and maximizes your EBITDA multiple via vertical specialization.

- Path B: The Scale Play. If you possess $1M+ in EBITDA, build M&A readiness and pursue calculated tuck-in acquisitions. Integrate add-ons efficiently to accelerate geographic density or service line expansion.

- Path C: The Exit Play. Seeking an exit in the next 18–24 months requires an M&A readiness sprint now. Standardize contracts, clean financials, document SOPs, and build an investor-grade data room.

The risk is trying to be “everything to everyone.” In consolidation, ambiguity is punished, making you hard to buy and hard to integrate. Clarity yields opportunity: higher pricing power and multiple expansion.

FAQ

Yes, volume is highly likely to increase, driven by persistent Private Equity optimism and the structural necessity of the add-on acquisition flywheel. While high-end platform valuations may normalize slightly due to the interest rate environment, consolidation will accelerate. Deals may shift toward more structured terms, including earnouts and seller notes, as buyers seek to manage risk and lock in future EBITDA growth.

Realistic EBITDA multiples currently range from 5x to 7x Adjusted EBITDA for quality add-on targets ($1M–$5M EBITDA). To reach the premium end of this scale, focus on controllable drivers: Net Revenue Retention (NRR) above 100%, gross margins exceeding 55%, strong security maturity, minimal keyman risk, and customer concentration below 10%. Quality metrics dictate the multiple.

Buyers look for clean financials, high recurring revenue quality, security specialization, scalable technology stack hygiene, and documented operational maturity. Common deal killers include opaque financial reporting, high customer concentration that exposes revenue volatility, undocumented Standard Operating Procedures (SOPs), inconsistent pricing across the customer base, and unaddressed compliance liabilities.

Avoid the generalist middle ground. Compete by winning on specialized authority and high-touch service. This defensive playbook requires deep commitment to a niche vertical, productizing a robust MSSP capability, and using RevOps to provide outcome-based proof-of-value reporting. Focus your marketing on achieving authority through Generative Engine Optimization (GEO) before the sales call even begins.

The results are mixed. Customers often gain access to centralized, sophisticated capabilities like advanced SOC/MDR. However, service responsiveness can degrade if centralization replaces local account ownership. Customers should immediately demand contractual commitments regarding SLA maintenance, named account management continuity, defined escalation paths, and a transparent transition plan to mitigate “integration debt” risk.