Key Points

- For SaaS businesses, raising capital is a vital business step to success.

- There are numerous requirements and benchmarks for raising capital for the various stages of funding. This article explains pre-seed, seed, Series A, and Series B funding requirements.

- Growing a SaaS brand can be highly challenging, which is why it is an excellent idea to consider hiring a growth agency to get you the metrics you need to be ready for the raise. If you want to learn more about how NUOPTIMA, a full-stack growth agency that scales SaaS businesses, book a call with our experts today.

Before we dive in, check out the YouTube video below from our CEO and Founder, Alexej Pikovsky. Here he discusses what percentage of your business to give away at different funding stages, with a focus on seed and pre-seed rounds.

Raising Capital in 2025

For SaaS companies, raising capital is a challenging but imperative business step. Regardless of how innovative or exciting your business idea may be, it simply cannot be successful unless it receives financial support. However, determining the requirements and benchmarks for raising capital can be a battle in itself, and this has never been more true than today in 2025.

Early in the year, the funding environment abruptly shifted with inflation soaring and the possibility of a recession hitting numerous countries worldwide. Furthermore, over recent months the market itself has changed a great deal, making it hard to gauge the state of the market accurately.

Fortunately, Point Nine, one of Europe’s leading venture capital firms, has conducted thorough research and recently presented its results regarding the requirements needed to raise capital in SaaS companies in 2025. P9 is a seed stage VC that targets B2B SaaS and B2B marketplaces. The results of P9’s study have been collated from 95 funding rounds that occurred between January and July 2025, and the information for the majority of the businesses derives from their investors. Of course, 95 rounds are by no means a complete representation of the market, but the information collected no doubt gives us a good idea of the current market at a minimum.

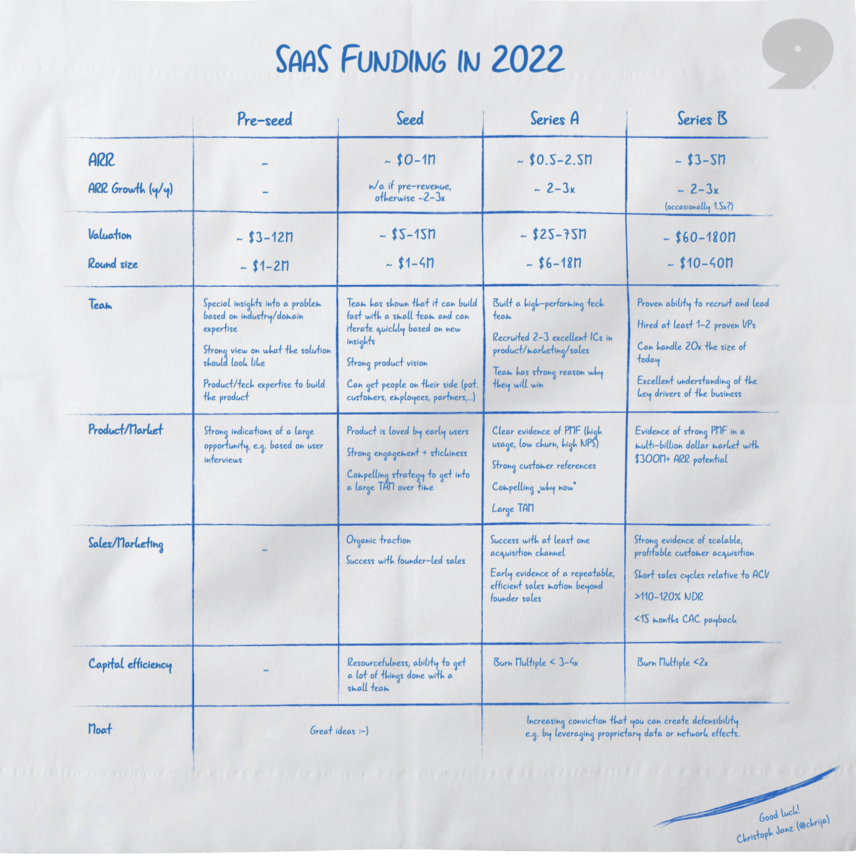

Below you can see the results of this research in P9’s SaaS Funding Napkin for 2025:

To help elucidate P9’s findings, we have divided the results into sections by the different funding stages. Let’s begin by considering the benchmarks for pre-seed funding.

Before that, explore the video below, where Alexej reveals further professional insights into the fundraising process, including the importance of creating urgency when fundraising and positioning your company as a scarce asset to draw the attention of investors.

Pre-Seed Funding Requirements and Benchmarks

Pre-seed funding is the earliest possible funding round. It is when a startup seeks to raise funds to validate its business idea and propositions. Pre-seed capital is needed in order to help start business operations and to confirm that a business is feasible. Generally speaking, pre-seed funding is not big enough to be seen as an official funding round. But, it is vital for many companies that need an influx of capital to build their foundation. Pre-seed funding usually comes from the founders themselves, their families, or perhaps an angel investor or incubator.

Because this is such an early stage of a SaaS business, P9 couldn’t gauge pre-seed data about the requirements of Annual Recurring Revenue (ARR) or its growth, sales and marketing, and capital efficiency because it is simply too soon in a company’s history to have such information. However, there are still key takeaways for pre-seed funding in P9’s results.

P9’s research found that the pre-money valuation for pre-seed funding is, on average, between $3-$12 million, while the round size is between $1-2 million. When it comes to team qualities in pre-seed businesses, it is important to understand that investors know that it is more than likely that their early-stage bet will not get them any return. Therefore, at this stage, investors actually consider whether a business has what it takes to survive (and thrive) and get them a return. Therefore, key qualities that they look for include intelligence, charisma, determination, and empathy for customers. According to the feedback from P9’s survey, investors also find it important for the team to have industry or domain expertise that gives them unique insights into a problem as well as a robust standpoint on what the solution looks like. Another critical team quality is relevant expertise in order to create the product in question.

In regards to the product or market, a pre-seed funding business generally has not yet produced a tangible product (though it should be in the process of finishing a blueprint). Still, it has identified a clear gap in the market with strong indications of a substantial opportunity. This conclusion is often drawn from user interviews. And finally, a pre-seed company’s moat — a company’s capacity to keep competitive advantages that are thought to assist it in keeping competition at bay and consistently maintaining profitability — is simply its excellent ideas.

Seed Funding Requirements and Benchmarks

Next, we turn to seed funding, the first official equity funding step. Normally, it represents the first official finances raised by an enterprise or business venture. Seed funding assists a business in financing its first stages, such as product development or market research. At this funding stage, angel investors are arguably the most common type of investor, often connecting with startups via a VC platform.

In the video below, Alexej shares the differences between raising funds from angel investors versus venture capitalists.

According to P9’s results, the ARR for seed funding is between $0-1 million. Meanwhile, ARR growth (year-on-year) is generally not applicable if it is pre-revenue but otherwise has two or three times growth. Moving on to the pre-money valuation, the data for seed funding shows that it is $5-15 million, while the round size is between $1 and $4 million. Concerning pre-money valuation, this is simply the amount that a business and an investor agree to consider the business to be worth imminently before investment. This is done so that the investor can determine how much to pay per share for the stock being bought.

In terms of team qualities for seed funding, it is important that the founder and their team can display specific characteristics. Evolving from a pre-seed team, P9’s results demonstrate that a seed stage funding team should be able to illustrate that it can grow fast with a close-knit group that can work fast depending on new insights. It is also critical to have a strong vision for the product. Furthermore, it is important to prove that the business can get people on-side (this includes customers, partners, and employees). This displays that other people and professionals have faith in the product.

When it comes to the product of the business, at this stage, it is crucial to demonstrate that it is well-liked by early users as this shows viability in the business. Adding on from this, it should also have fantastic engagement, and there should also be a powerful strategy present on how to break into a large Total Addressable Market (TAM) over some time. Remember, at this funding stage, it is important to prove to the investors that your business is the future and worth investing in. As P9’s table demonstrates, at the seed funding stage, there should already be natural traction for the business and evidence of success with founder-led sales. Founder-led sales are when the company’s founder connects with leads they have found and helps them trial the product. The founder then transforms these leads and signs them up for paid plans.

A further requirement for seed funding is that the founder can demonstrate capital efficiency through true resourcefulness and that they can still get many things completed with just a small team. This helps reassure an investor that the founder is capable and frugal. As with pre-seed funding, the moat for a seed stage company is its fantastic ideas, which can attract value added investors looking for innovative opportunities..

Learn how to supercharge your communication with VC’s below. Alexej highlights common mistakes founders make when emailing VCs as well as tips on how to produce an effective outreach email.

Series A Funding Requirements and Benchmarks

Series A funding is the first round post-seed stage. By this point, founders must have a plan for expanding the business model to create long-term profit. Unlike seed startups with interesting ideas, Series A funding requires some knowledge on how to monetise the company. Therefore, the founder must have a robust strategy along with great ideas to turn the business into a money-generating company. The Series A round generally comes from VC firms.

According to P9, the ARR for Seed A funding is between $0.5-2.5 million, while the ARR growth year-on-year is two to three times. For SaaS businesses, many Series A investors look to the ARR to determine whether the business is ready to raise. Typically (but not always), when a company surpasses $1 million in ARR, they are considered ready for Series A funding.

The pre-money valuation for Series A seed funding from P9’s research is $25-75 million (a stark increase from the previous round), while the round size is between $6-18 million. At the point of a Series A funding round, businesses have not usually got a proven track record, and so they may be an added risk factor. Investors can generally purchase between 10% to 30% of the business. These investments are usually used to grow the business and commonly in preparation for entering the market.

As we can once again see from the table, requirements for the team have increased further from the previous two rounds. Indeed, a SaaS company should be able to show it has a tech team that performs exceptionally well as well as provide a convincing argument as to why they think the company will succeed. Moreover, another benchmark is evidence that the company has recruited several outstanding individual contributors (IC). ICs are highly valuable because they provide unique expertise to support your decisions in a certain functional area. Therefore, the ICs recruited should have fantastic knowledge in either the product, marketing, sales, or all three combined.

At this stage, the company must provide evidence of product-market fit (PMF) through data that presents high usage, a low churn, and a high net promoter score (NPS). In layman’s terms, an NPS is a measurement of customer loyalty and satisfaction, collected by asking customers how likely they are to recommend the product to other people (on a scale from 0-10). In addition to this information, other benchmarks include providing excellent customer references, explaining convincing reasons as to why this is the right time for your business to receive Series A funding, and, last but not least, a substantial TAM.

Looking to increase your chances of getting connected with possible investors? Check out Alexej’s advice below on how you can successfully reach out to other founders for investor introductions.

Regarding the sales and marketing aspects of the business, it is essential to show that the business has enjoyed success with a minimum of one acquisition channel outside the founder-led sales. Scalable channels could include social media, a paid ad, or even an organic search. There should also be emerging evidence of a solid and repeatable sales motion (a particular sales method used to deliver a product to customers) that goes beyond founder-led sales.

At the Series A funding point, it is crucial to have a Burn Multiple of less than three to four times. The Burn Multiple measures the amount a startup spends to generate every incremental dollar of ARR. The moat for a Series A funding stage is that there is increasing evidence that the founder has protection for their company, such as through network effects or by leveraging proprietary data. Bear in mind that Series A is where many startups end up failing, often becoming VC orphans if they are unable to secure additional funding. According to CB Insights, less than 50% of seed-funded companies raise another round, making this the finishing point for most early-stage startup companies.

Series B Funding Requirements and Benchmarks

A business ready to raise a Series B round of funding will have already found its product and market fit and need help to expand. This expansion will lead to more customers and a bigger team to cater to that increasing customer base. Series B funding generally originates from VC firms and commonly involves the same investors as the previous round. However, the difference with this round is the addition of a fresh wave of VC firms specialising in later-stage investing.

P9’s data illustrates that the ARR requirement for Series B is between $3-5million, and the ARR growth year-on-year is two to three times (although it can occasionally be 1.5 times). Plus, because businesses going through Series B funding are well-established, consequently their valuations reflect this. This can be seen in P9’s collated data which puts the pre-money valuation between $60-180 million, while the round size is between $10-40 million.

For the company’s team at this stage, reputable people must be hired in numerous roles as it is no longer an option at all for the founder to try and handle everything. Indeed, there should be proof of recruitment and leadership in the team, and by this point, there should be a minimum of one or two hired and upstanding vice presidents (VPs). And, there should be evidence that the SaaS business can deal with a team 20 times the size it currently is. There should also be a clear understanding of the company’s main drivers so its success can be continued.

Unlike the Series A stage, where evidence of PMF is needed, by Series B, the founder needs to have proof of a solid PMF in a multi-billion dollar market with at least $300 million ARR potential. These stringent requirements carry over into the sales and marketing facets of the business. Indeed, as Series B companies should be generating stable revenues, it is important to demonstrate that your business meets this benchmark.

The company should therefore be able to provide strong evidence of both a scalable and profitable customer acquisition with short sales cycles relative to annual contract value (ACV). ACV is a vital metric that displays how much an ongoing customer contract is actually worth by averaging and normalising the value of the contract over a one-year period. Other requirements include having more than 110-120% net dollar retention (NDR) and a less than 15-month customer acquisition cost (CAC) payback. P9’s research shows that a Series B stage company should possess a Burn Multiple of less than two times for capital efficiency. And, like Series A, the moat should be transparent and the increasing conviction that the business can be protected.

Discover even more fundraising insights below where Alexej delves into automating your investor outreach before you start fundraising as well as other efficient strategies.

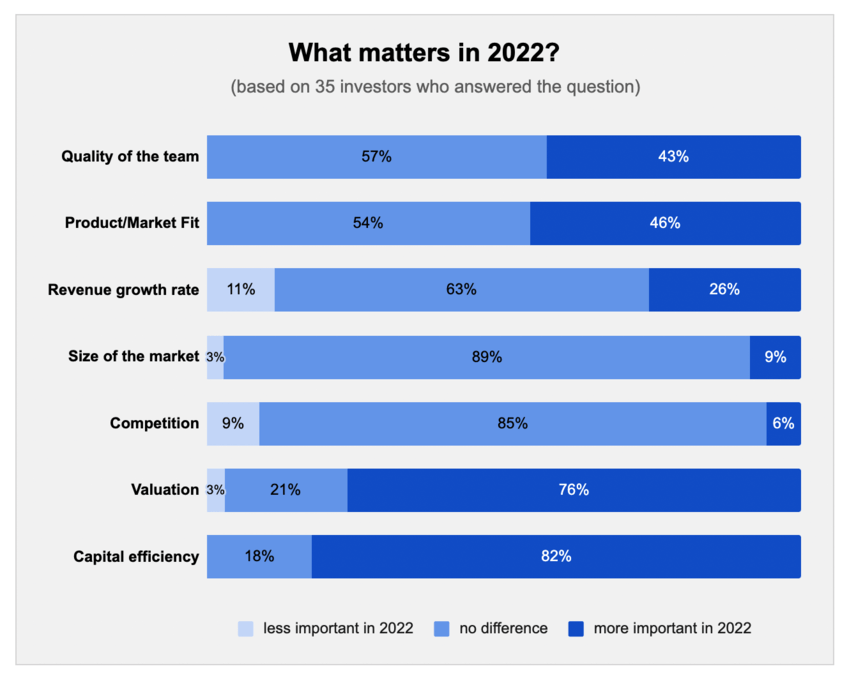

What Factors Matter in 2025?

In addition to P9’s highly useful table, they also have a graph illustrating the results of a question asked to investors about what factors matter more or less when considering investment compared to 2021. Below, you can view the results in P9’s image to see what investors say are the most imperative factors in 2025.

Final Thoughts

Fulfilling the requirements and benchmarks of each stage of funding is challenging and often impossible for many SaaS companies. For this reason, this article is a great way to gauge how your company is doing, whether it is ready for that next funding stage, and if not, what needs to be done. NUOPTIMA is a full-stack growth agency specialising in growing brands, including SaaS businesses. If you would like assistance accelerating your SaaS brand, or some expert advice regarding funding stages or growing a business, please book a free discovery call to learn more about how NUOPTIMA can assist your company today.