Many people believe that the sale of a business is always a complicated and drawn-out task. However, it doesn’t have to be that way. If you start preparing in advance, you can sell your business in as little as 3-10 weeks. Getting your company exit-ready early on doesn’t just speed up the acquisition deal. It can also allow you to get a lot more money for your business and attract better offers from aggregators. So if you’re interested in selling your Amazon FBA business but don’t know how the acquisition process works, keep reading this article, and we will guide you through each step of the exit process.

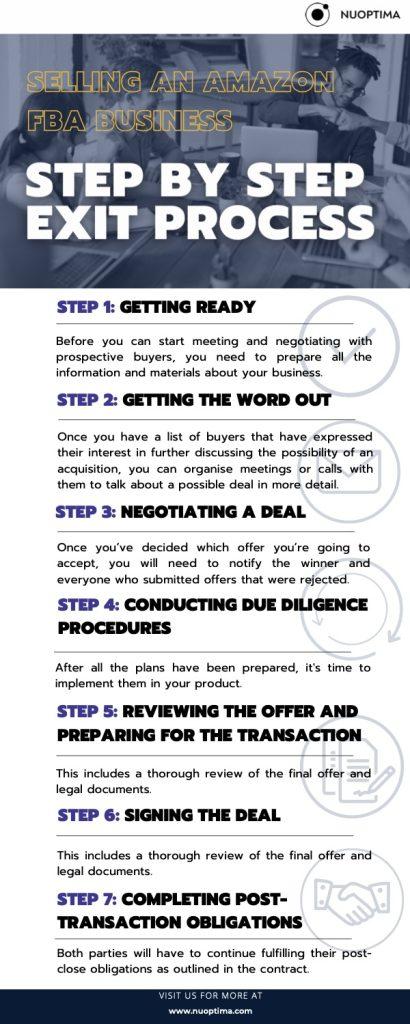

Amazon FBA Acquisitions Explained Step-By-Step

While all businesses are inherently different, the general process of an Amazon FBA exit is the same regardless of the size and age of your company, the products it sells, and other factors. Below, you will find the main steps you need to go through when preparing your company for an acquisition, negotiating the contract, and carrying out the transition. However, we need to note that it’s best to keep these steps in mind long before you’re ready to sell your business. If you start thinking about your plans and preparing for the acquisition months or even years in advance, it will help simplify and speed the entire process and increase the value of the Company.

Step 1: Getting ready

Before you can start meeting and negotiating with prospective buyers, you need to prepare all the information and materials about your business. This usually includes a confidential information memorandum or CIM, teaser, and a dataroom with all the relevant financial data about your company. It’s also a good idea to put together a growth plan for your company and documents regarding its legal structure and tax information. Finally, you will also need a list of aggregators, private equity firms, and other entities that may be interested in acquiring your business.

Step 2: Getting the word out

Once you have all the necessary paperwork ready for potential buyers, it’s time to get the word out. Usually, business owners do this by sending out the teaser to a pool of individuals and companies that may be interested in acquiring their brand. Next, you will need to have all interested parties sign non-disclosure agreements before they can be granted access to information about your company’s financials. Once you have a list of buyers that have expressed their interest in further discussing the possibility of an acquisition, you can organise meetings or calls with them to talk about a possible deal in more detail.

In 2020, there was a bit of a gold rush in this space with multiple aggregators usually bidding for targets and sellers having a big choice. By the end of 2021, the velocity of acquisitions in the Amazon space decreased significantly with much fewer deals being completed and several of the aggregators announcing difficulties. It makes a lot of sense before reaching out to everybody there is, to conduct research on who would be a suitable buyer for the business. If you are in the health & wellness space, there are dedicated brand groups such as Alphagreen Group. Talking to a potential buyer in the same vertical will allow you to usually extract the highest value given that there are also synergies most likely and the due diligence for the buyer is much easier given the knowledge of the space.

Step 3: Negotiating a deal

This is perhaps the most exciting part of the entire process, as you get to compare different offers and choose the option that works best for you. During this stage, you need to make sure that you understand each aspect of the proposed deals and clarify all the details with prospective buyers if necessary. You can read more about everything you need to account for during Amazon FBA acquisition negotiations here. Once you’ve decided which offer you’re going to accept, you will need to notify the winner and everyone who submitted offers that were rejected.

It is important to be transparent and honest. Sellers who are trying to create an auction around their business will be disappointed. A lot of the aggregators have groups where they exchange information on processes. Trying to get the best possible purchase price is important, however, dragging the process out and pretending there are multiple offers out there might end up causing an aggregator to lose interest and trust and consequently walk away.

Step 4: Conducting due diligence procedures

During this stage, the buyer will prepare for the acquisition by reviewing information relating to different aspects of the business, including data about the target company’s finances, product, legal set-up, and supply chain. The seller will need to provide the buyer with all the necessary information and answer all questions the buyer may have about the business. Finally, the two parties will set a deadline for the completion of the acquisition deal.

Step 5: Reviewing the offer and preparing for the transaction

During this stage, the buyer and the seller will conduct final preparations before completing the transaction. This includes a thorough review of the final offer and legal documents. If everything is in order, the buyer will proceed to transfer the payment into an escrow account.

Step 6: Signing the deal

This is the most important stage of the deal, during which both parties will sign all necessary documents. Once the seller and the buyer execute all documents, the seller will receive the money held in escrow.

Step 7: Completing post-transaction obligations

Upon the completion of the sale, the buyer and the seller have to fulfil their post-transaction obligations. This includes the seller’s obligations to train the buyer’s team and aid it during the transition period. During this stage, the seller will also receive their earnout payment if all conditions stated in the SPA are met. Both parties will also have to continue fulfilling their post-close obligations as outlined in the contract.

Final Thoughts

The sale of an Amazon business is not an easy process. However, you can successfully navigate it if you know what steps you need to take during each stage. But it’s even better to have a trusted Amazon consulting service like NUOPTIMA help you on your Amazon FBA journey. Our experts can aid you in optimizing and growing your company, developing a winning business strategy, and more. And if your brand sells health and wellness products and you’re looking for a potential buyer, don’t hesitate to reach out to us to discuss the possibility of an acquisition.