Introduction

With nearly 2 million active sellers operating on its website, Amazon is the biggest e-commerce company in the world. Today, the platform has a varied mix of small businesses that generate just a few hundred dollars per month in sales revenue, well-known brands that use Amazon as one of their numerous sales channels, and successful companies that were initially created with the goal of selling products primarily on Amazon. Many independent Amazon sellers who have managed to build a successful operation on the platform are now looking to cash out and sell their business to one of numerous Amazon aggregators that have popped up on the market in the last few years.

But while there’s a lot of interest from business owners looking to sell their operations to an aggregator, there’s very little publicly available information about what businesses aggregators are willing to consider for acquisition and the general structure and terms of deals that are usually agreed upon by parties. At the same time, there are many popular notions that sellers widely believe to be true without sufficient evidence to back them up.

In light of these circumstances, Nuoptima has talked to over 20 Amazon aggregators, collecting information about aggregator preferences, valuations, profit margins, deal structures, and numerous other factors. We will present the data we’ve gathered and discuss the conclusions that can be drawn from it over a series of articles on the matter. Our first article will discuss different factors aggregators look at when selecting targets for acquisition.

Amazon categories preferred and excluded by aggregators

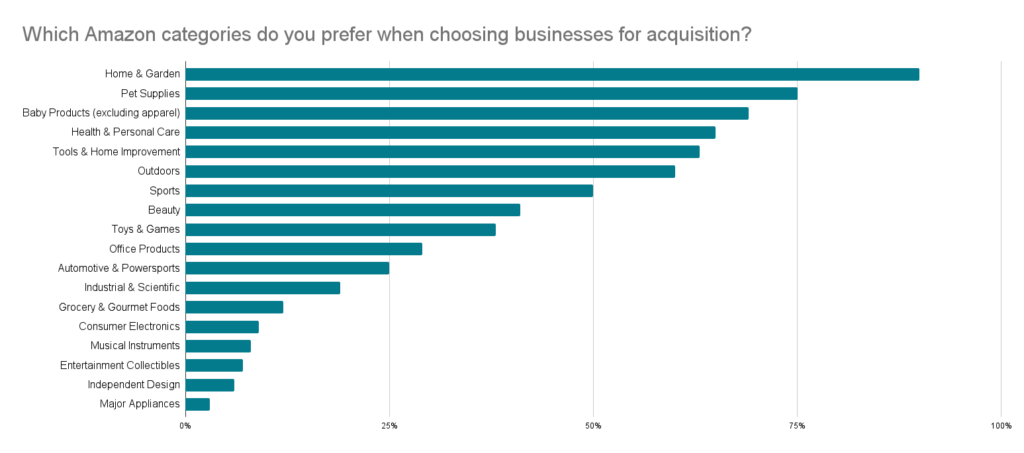

According to our study, the majority of aggregators are looking to acquire businesses in the Home and Garden, Pet Supplies, Baby Products, Health and Personal Care, Tools and Home Improvement, Outdoors, Sports, Beauty, and Toys and Games categories. This is not surprising, as these are some of the most popular categories on the platform overall. Most of the products sold in these categories are evergreen and don’t need to be frequently redesigned to adjust to changing consumer trends. Plus, these goods don’t have short expiration dates or complicated storage requirements and they don’t come with strict quality standards imposed by Amazon or governmental regulators.

It’s worth mentioning that Amazon aggregators are interested in purchasing brands that manufacture high-demand products that will potentially remain profitable and continue bringing in sales for many years. This means that sellers who offer products in categories that have experienced a boost in popularity since the start of the COVID-19 pandemic are especially well-positioned to negotiate favorable acquisition terms.

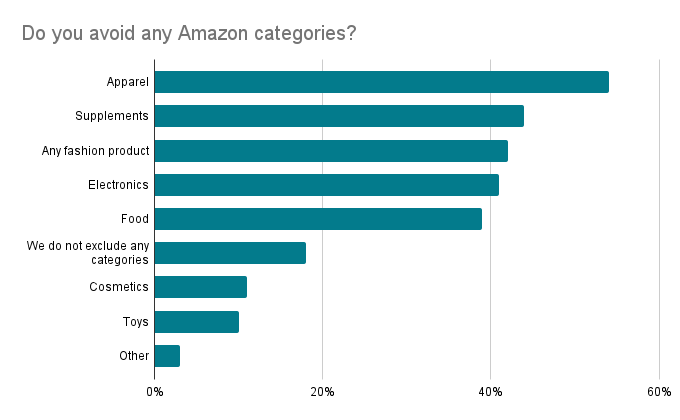

At the same time, there are several product categories aggregators choose to avoid, at least for the time being. According to our study, many companies have stated that they will not consider purchasing brands that sell apparel, supplements, fashion items, electronics, food, toys, and cosmetics. These groups of products require constant innovation and changes to the items, need to adhere to strict regulatory guidelines, or have short shelf lives. UK’s health agency, MHRA, might ban a supplement in the UK which is completely fine in say Germany, thus making it more difficult for an aggregator to just expand with the same product globally. Electronics have the disadvantage of sockets and plugs being different in certain countries. In addition, apparel and cosmetics categories are dominated mainly by well-known national and even worldwide brands, making it more difficult for sellers to attract customers to their listings.

Interestingly, nearly 20% of interviewees stated that they do not exclude any categories from consideration, which suggests that many other factors influence the decision to acquire a company.

Types of businesses usually acquired by aggregators

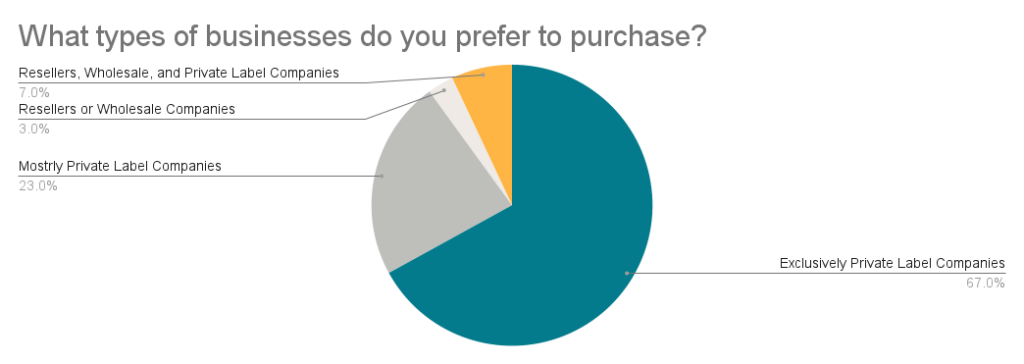

The majority of interviewees indicated that they only consider acquisitions of private label companies. On the other hand, only 3% of responders stated that they are open to buying reseller or wholesale businesses. Another 7% of responders said that they would consider buying all three types of companies.

There is a significant reason for this trend, as private label companies have many business advantages over resellers and wholesale sellers. Unlike wholesale sellers and resellers, private label businesses have their own unique products. And since they sell exclusive products, these companies can apply for an enforceable trademark, join Amazon’s Brand Registry Program, create their own product listings, amass reviews, and generate other valuable assets.

At the same time, resellers and wholesale sellers are completely dependent on the suppliers of their products, who may stop providing inventory at any time. Plus, unauthorized resellers and wholesale companies often face IP complaints from brands, which can result in significant legal expenses. On the other hand, aggregators may be willing to consider purchasing exclusive resellers with robust long-term contracts with brand owners.

Geographic criteria that influence decision-making during Amazon brand acquisitions

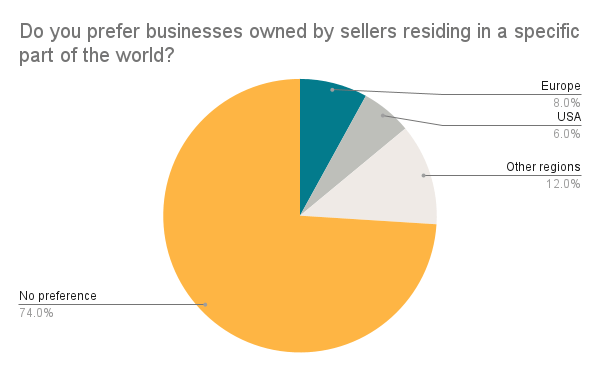

Many Amazon sellers, consultants, and industry experts believe that aggregators only purchase companies located in the USA. However, our conversations disprove this notion, showing that over 70% of aggregators do not have a preference for the location of the business they are planning to buy. This phenomenon has a simple explanation, as most buyers don’t purchase the business entity. Instead, they acquire the assets of the company, which often includes Amazon accounts, product listings, patents, trademarks, brands, inventory, contracts with suppliers, logistics operators, etc.

At the same time, most buyers who do have a preference regarding the geographic location of the seller’s company state that this is due to their geographic proximity to the seller. Being located in the same region or country as the seller helps simplify negotiations and allows aggregators to approach business owners directly without involving third parties.

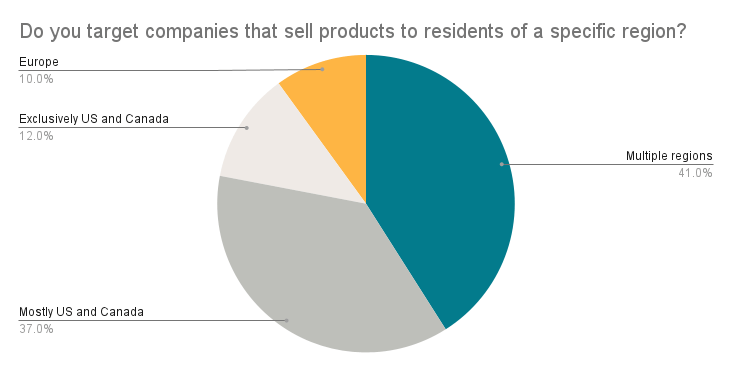

According to the results of our study, most companies looking to acquire Amazon brands prefer to purchase businesses operating in multiple regions around the world or in the US and Canada. Only 12% of responders stated that they only consider businesses based in the US or Canada and 10% of participants said that they prefer to acquire companies that serve only European customers.

These results may be surprising for some sellers who believe that operating a business in only one region puts them at a disadvantage with potential buyers. However, many aggregators see this as a chance to quickly expand the business into new markets, leveraging the brand’s success in the original market to win over customers and beat the competition. Plus, many buyers prefer to purchase brands operating in the US and Canada because of the sheer size and strength of the e-commerce sector in these countries.

Other factors considered when evaluating acquisition targets

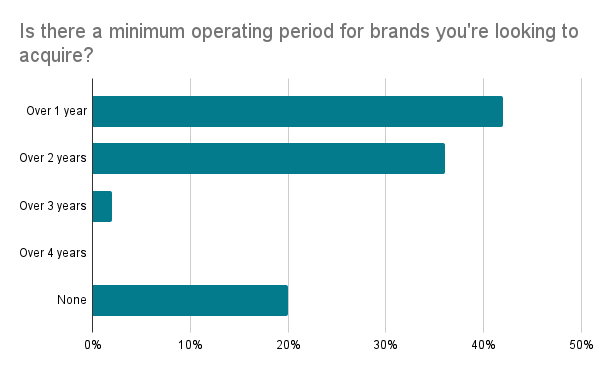

While some Amazon sellers assume that aggregators view a long historic operation period as an advantage, this is far from the truth. According to our conversations, over 40% of buyers prefer to purchase companies that have been in business for at least one year. Just over 35% of buyers select companies that have been operating for a minimum of 2 years, and 20% of aggregators do not have a set minimum operating period.

This data can be easily explained by the fact that aggregators want to acquire businesses that can grow relatively quickly. And if a company has been in business for several years, it could already be past its growth period. At the same time, even a short minimum operating period can help buyers ensure that they only consider businesses that have enough assets to make their acquisition worthwhile. These assets usually include products, listings, reviews, trademarks, etc.

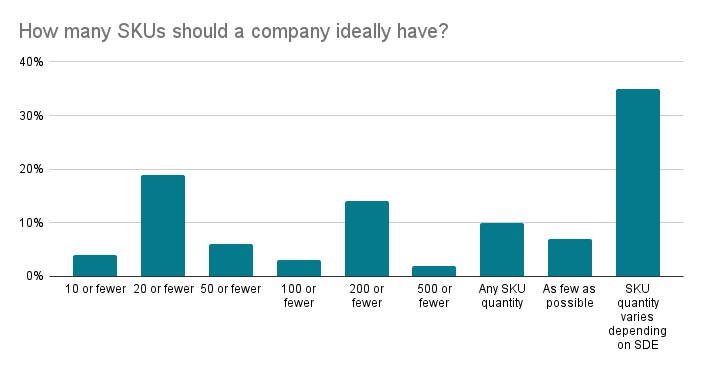

The data in the graph above shows that when it comes to the number of SKUs an Amazon seller has, the preferences of different aggregators range widely. This could depend on the buyer’s resources, the number of people that could be dedicated to managing the newly acquired store, the amount of experience the aggregator has in the industry, etc. However, a large proportion of all interviewees stated that the number of SKUs is not inherently important. Instead, what matters more is the ratio of SDE per SKU.

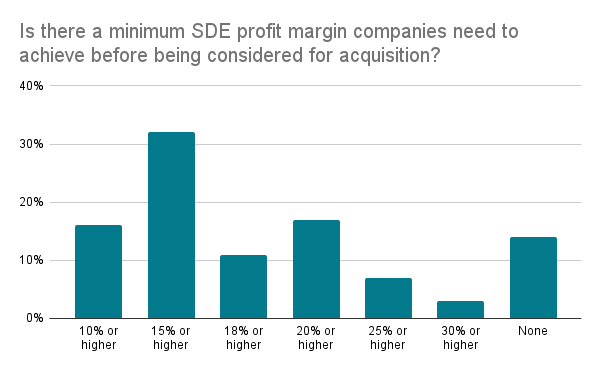

According to the results of our conversation-based study, over 30% of Amazon aggregators are willing to consider acquiring a company that has an SDE profit margin of at least 15%. While this number is relatively low, it could be justified by the fact that buyers expect that they will be able to optimize the business and increase the profit margin. It’s also important to note that companies with lower profit margins are usually cheaper to acquire, making them more attractive to buyers.

Conclusions

Today, most Amazon aggregators are actively searching for businesses to acquire and add to their network. Companies that sell popular evergreen products without regulatory restrictions tend to be the most popular choices. In addition, most aggregators are searching for companies that sell products in the US and Canada or multiple diversified regions. At the same time, the business’s location doesn’t matter much, as buyers usually acquire the company’s assets and not the legal entity itself. Private label companies are the preferred choice of buyers, as they have the most significant potential for long-term stability and success. Overall, aggregators are highly interested in acquiring businesses they can optimize and grow exponentially.