Introduction

In the booming world of e-commerce, Amazon sells goods estimated to be worth $600 billion in Gross Merchandise Volume (GMV) on its platform and is powered by over 2M Amazon sellers worldwide, creating a complete ecosystem. Ali Hamed from CoVenture, a venture fund that backed several aggregators with debt and equity, mentioned on a podcast that he could see more than a dozen unicorns being created just on the back of the Amazon platform.

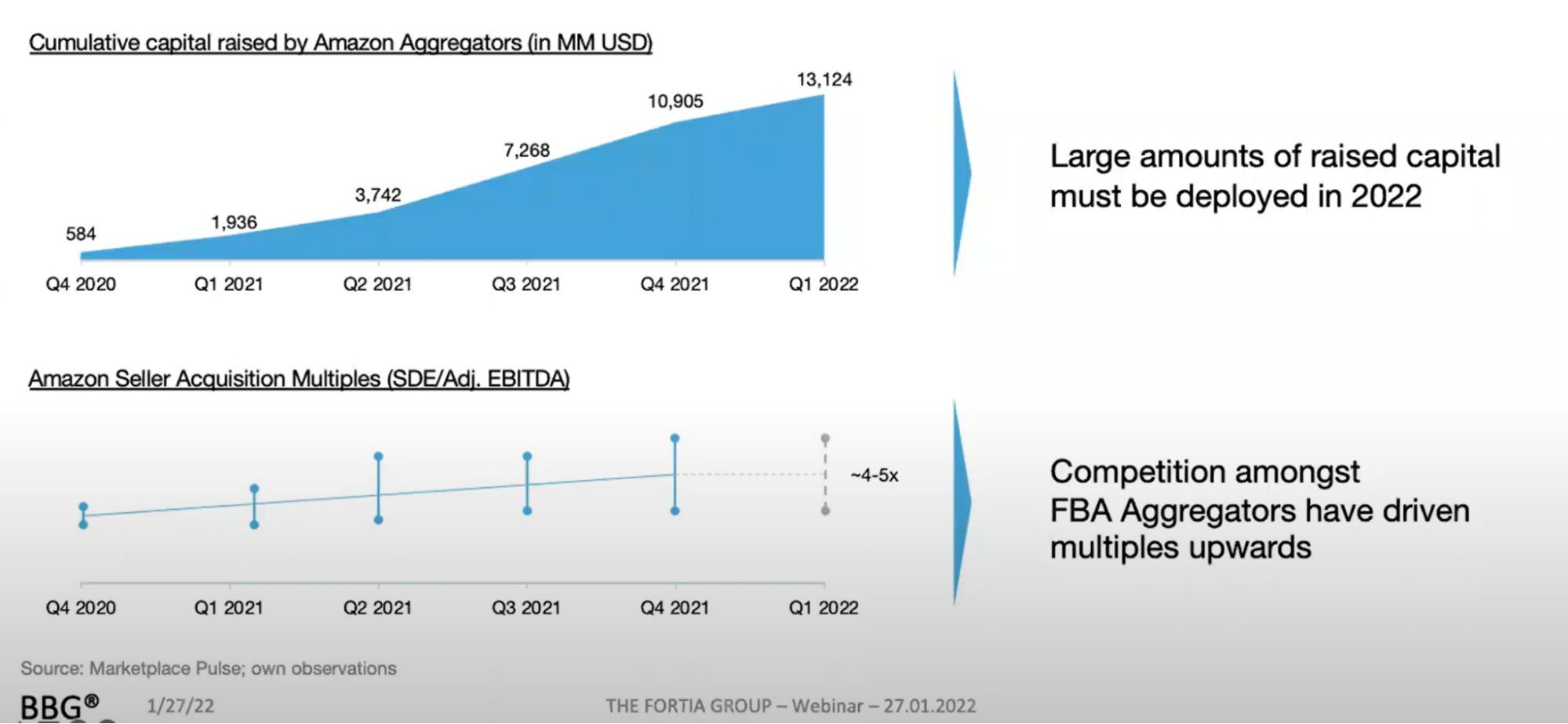

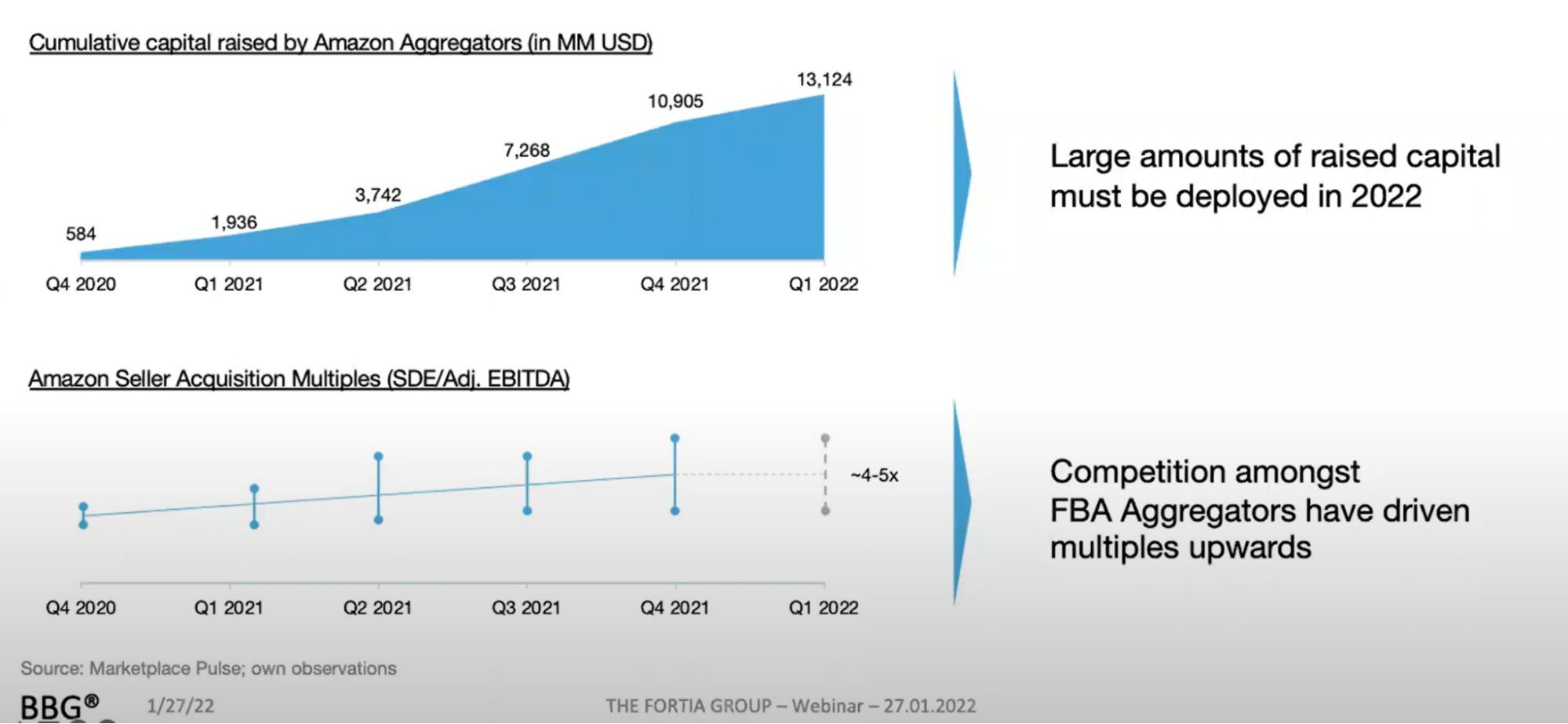

With $15 billion raised in the last three years (albeit mostly debt) and with over 90 participants worldwide, the Amazon aggregator space has been a very popular field in the startup world, with many of the players claiming to be highly profitable from the first year of operations.

With more competition, overreliance on Amazon rankings and external factors, increased interest rates, inflation and increased logistics costs, the game is becoming more complex though, and numerous players with high debt burdens are experiencing a challenging 2022.

The standard playbook of buying as quickly as possible as long as the brand has high ratings and is profitable is no longer the norm. The aggregation sector is becoming more specialised, requiring more value creation to stay ahead of the competition and be successful.

Top ten predictions for 2022:

1. Valuations for FBA brands peaked with price expectations coming down

During a webinar hosted by Emmett Kilduff from Fortia Group, Berlin Brands Group showed that multiples have been steadily increasing due to competition between aggregators but have reached a peak. Two years ago average multiples were at 2x EBITDA while by the end of 2021 the average multiple was 4-5x.

In a recent piece on Amazon aggregators pausing acquisitions, Juozas Kaziukenas explains that average multiples are no longer a representative metric Multiples are now being distributed into two clumps which are increasingly drifting apart, lower valuations for lower quality businesses and higher valuations for higher quality businesses.

According to Jeko Kolev, CEO and Co-Founder of Nextoria, an e-commerce focused M&A advisory, buyers’/aggregators’ acquisition preferences are beginning to shift towards larger assets. Lower demand is resulting in multiples for deals below $1.5m in revenue to decrease, and so it will become increasingly more challenging to find suitable buyers for smaller business exits.

The year started with a lot of capital markets turbulence on the back of central banks announcing to increase rates. A war and increasing energy prices have put even more pressure on the public markets with many of the publicly listed e-commerce businesses trading at 50-70% discount to what they traded at in Q4 2021 (e.g. THG, Wayfair, Made.com, Farfetch). It might be too early to say how this will impact the valuations of privately funded aggregators. Still, it speaks for lower valuations rather than higher valuations when negotiating a price with an Amazon seller. We expect acquisition pace to come down even more, and the culture of “acquisitions at any costs” will no longer be the norm, further driving down valuations.

Finally, debt is becoming increasingly more expensive. Gone are the days of 80% leverage to purchase assets, and with equity capital being more limited, we expect purchase prices to fall.

2. Margins are being compressed

Supply chain disruptions since March 2020 have been on the rise, with big queues in ports resulting in significant delays for Amazon brands. Unsurprisingly, many optimistic players (who raised monster rounds) thought it would be resolved by now and are beginning to feel the crunch of stockouts. 70% of Amazon’s seller’s supply chain is rooted in China. Switching suppliers or air freight is not an option without accepting an even more significant cost increase, ultimately compressing thin margins. With China starting to implement new lock downs this year again on the back of the zero-Covid policy, it feels like a deja-vu.

Amazon’s bid style PPC auction is the real winner, intensifying competition. More players spending more money on advertising to squeeze out revenue growth has resulted in Amazon advertising costs rising by 50% on average only in the first half of the year 2021 alone. Several categories have even seen CPC (Cost Per Click) increases of more than 100%. The introduction of storage limits by Amazon and an increase in their fulfilment costs results in additional expenses to brands and aggregators. Instead of just relying on Amazon, one needs an additional 3PL (Third Party Logistics provider) to receive the goods from the supplier before sending the products in batches to Amazon.

If an acquirer bought a business for 3x SDE and the margin dropped from 30% to 15%, the real multiple doubles quickly to 6.0x SDE. With all the debt assumptions and growth assumptions made with a 30% margin in mind, one can quickly see how decreasing margins can create a fragile state for both the business and the new owner. Remember, interest rates on the debt borrowed range from 8-15% on average, not accounting for the amortisation payments; thus, if the margin drops to 15%, there is very little room for error.

3. Specialisation in sectors and geographies

Short term focus on rapid growth will eventually underperform compared to more sustainable strategies highly focused on operations to unlock the highest value over time. An approach to create synergies and create sustainability is by becoming a specialist. That could be in a sector or geography.

Director of Growth, Europe, at Unybrands, Alexey Lankin, emphasises that the strategic buyer space is becoming more professional with more players shifting their focus to a particular niche or a set of products. It leads to higher yearly revenue growth expectations and thus gives the sellers a better chance to see their earnouts paid.

A handful of specialist aggregators have built an expert team that can move faster than agnostic players. For example:

Opontia is an aggregator focused on Africa and the Middle East. Nebula is China-focused. There are several Latin America focused aggregators such as Merama, Valoreo and Quinio. Finally, Una Brands raised a round from White Star to focus on the Asia Pacific space.

Alphagreen Group is a specialist health and wellness group with brands in the aromatherapy and sleep space, a modern wellness marketplace, and a focus on niche supplements, longevity, cannabis accessories, and the more expansive wellness space. Another specialised player is mDesign, a marketplace for home solutions that entered the Amazon aggregation game in summer 2021. Financial engineering by buying at low multiples, when raising at higher multiple valuations, is quickly becoming an over told story. Investors seeking differentiation and a true MOAT are forcing more prominent aggregators to consider the implications. As a result, these aggregators are likely to trim their acquisition criteria further as they eventually prune their portfolios to focus on their favourite verticals.

4. Internationalisation

“Internationalisation on Amazon via new geographies is critical to boosting sales”, says Michael Bassler, CEO and Co-Founder of Amazing Brands.. International expansion will also be a big topic for 2022.

Berlin Brands Group announced in summer 2021 to push the acquisition of Chinese sellers and use its distribution network in the US and Europe to grow them.

In early January 2022, Thrasio acquired an Indian D2C brand and is deploying a total of $500m to grow in India.

Growth and finding new distribution channels is key to growing the acquired brands. Apart from increasing ad spend and expanding on marketplaces such as eBay, Walmart, and Etsy in the US and Europe, international markets present a significant opportunity for aggregators.

5. Offline distribution

In a highly competitive environment, aggregators will also look to push brands into the offline market via brick & mortar. There are great synergies with online sales since it is easier to communicate a story to a physical outlet/ chain to show the demand online.

According to Alejandro Fresneda, Co-Founder and Co-CEO of Yaba, “International expansion and social media in online channels should be complemented by creating partnerships with brick and mortar stores to create a well-rounded brand and boost sales”.

For brands, this translates to pursuing an omnichannel strategy, maximising the touch-points with potential customers, and in turn benefiting from increased brand awareness, recognition, and ultimately sales.

6. Trough of Disillusionment

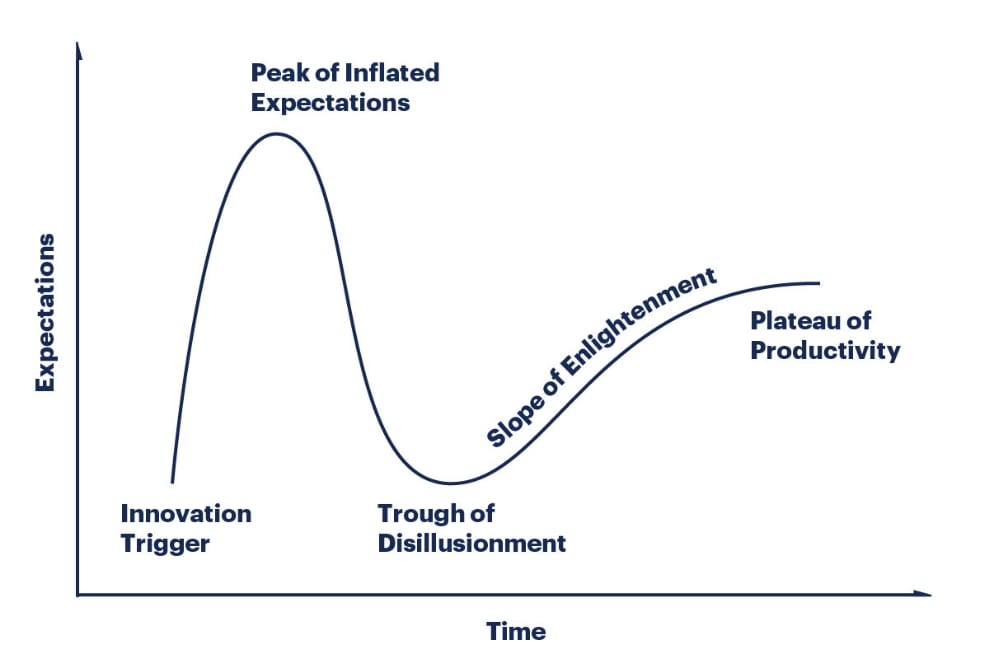

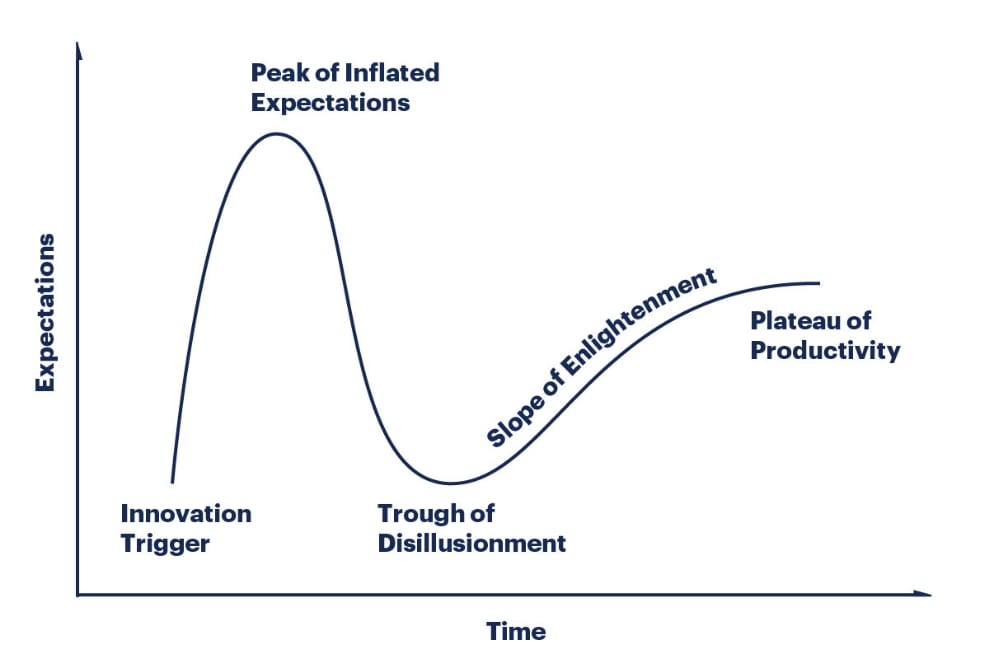

Gartners Hype Cycle for Emerging Technologies is an interesting model to draw comparisons to , considering the the space went from weekly funding and deal announcements from over 90+ aggregators to rumors of co-founders of Unicorns letting founders go and debt facilities being terminated.

The graph shows how an industry or a specific technology goes through its life cycle. Starting with huge expectations by the crowd, a period of disappointment and the realisation that things are harder than expected, followed by adoption and a period of slower but stable growth.

Looking at 2021, at the peak of inflated expectations, several aggregators looked at a public market debut. Israeli aggregator, TCM, appointed early 2021 Canaccord to lead its IPO. With the sentiment turning, in October 2021, Thrasio cancelled its public market exit plans via a SPAC, but still managed to raise a $1 billion equity round led by Silverlake and Advent.

With more difficulties coming to light in 2022, this year feels like it’s going to be the Trough of Disillusionment.

7. Consolidation between Aggregators

2021 finished with Olsam acquiring a smaller aggregator in the US. Before that, Berlin Brands Group acquired Orange Brands in Germany, and back in 2020, Thrasio acquired Thirstii and installed their founders to head up Germany’s operations for Thrasio.

All these acquisitions were undisclosed in value and on the smaller end of the spectrum. 2022 could see some of the established names in the industry merge or be acquired. Many more prominent brands are not keen to sell, and thus to continue their promised growth rate, some of the aggregators will have to make much bolder moves

8. First casualties

Bill D’Alessandro, the Founder and CEO behind ElementsBrands, tweeted how aggregators are getting wrecked by supply chain issues. Since the post, geopolitical tensions have layered on top and inflation, which increases raw material costs, further decreasing gross margins.

As illustrated above by BRANDED, a large Amazon aggregator, more sellers are joining the market in new and niche categories, existing sellers innovating, and aggregators pumping more money into the system is all culminating in one thing: Increased customer acquisition costs. The game is becoming more complex, and players will be heavily penalised for mistakes that were not as fatal in the past.

Director of Acquisitions at BRANDED, Alex Lardugin, explains that with increased interest rates and as a result more expensive debt, there might be more pressure on aggregators with relatively high debt to equity ratios. Many of the debt facilities raised are structured in a way where the first year repayments are interest rate only and the second year kicks in amortisation payments. Given that 2022, for many aggregators, is the second year of the debt facility, the negative cash impact of debt repayments is likely to show on the balance sheets.

The combination of inventory issues and compressed margins have already triggered a few bankruptcies in the USA, and we expect more names to suffer under the consequences of high leverage.

9. Aggregation outside Amazon

Open Store raised $75m at the end of 2021 to acquire Shopify based eCom brands. The Series B funding round, valued at $750 million, was led by General Catalyst, with support from previous investors Atomic, Founders Fund, and Khosla Ventures.

Launched in March 2021, OpenStore is now acquiring one Shopify-based business a day. CEO Rabois claims Amazon-based aggregators have an easier task than he does. He believes that since Amazon is great at what it does, it has already streamlined the sales and delivery processes, leaving the aggregators with fewer opportunities to drive value.

In contrast, OpenStore acquires Shopify brands that do not benefit from the Amazon advertising and delivery systems, meaning that Rabois believes his team can leverage their own expertise to optimise processes and generate higher returns.

Initially, a brand incubator, Pattern Brands pivoted to a brand aggregator focused on DTC brands. Pattern, led by a former team behind the branding agency Gin Lane, focuses on the home goods and kitchen accessories space and looks at brands predominantly on Shopify.

Many of the aggregators look at brands outside Amazon as well. Dwarfs in the Netherlands have acquired many brands listed on bol.com as opposed to Amazon.

We are predicting more aggregators looking outside Amazon to acquire brands and non-Amazon aggregators potentially entering the Amazon space.

10. Alternative debt and capital providers entering the Amazon aggregation industry

In many cases, 80-90% of the capital raised by an aggregator is made up of debt. As outlined in our spider web on the most active venture debt investors, players such as Victory Park Capital, Crayhill Capital Management, Claret Capital, Upper90, and NorthWall funded multiple aggregators.

Since the first wave of debt funding, several revenue-based financing providers such as Uncapped and Wayflyer also entered the Amazon aggregation game, with SellersFunding and Goja even announcing an exclusive partnership. The latest additions are e-commerce focused digital banks such as Juni, backed by Felix Capital and partners at DST. While interest rates tend to be higher with revenue-based financing structures, there are no warrants involved; thus, shareholders are diluted.

For 2022, we predict many alternative lenders to play an even more aggressive game in the debt provision, as well as family offices and other institutional credit providers entering the game. More flexibility and options on the debt side are great news for aggregators who continue to grow and have a solid portfolio of brands.

Summary

- More than $12.5 billion of equity and debt capital was raised by Amazon aggregators in 2021.

- But, 2022 started very differently. Public stock markets saw massive corrections, with e-commerce valuations hitting significantly and several giant aggregators raising equity rounds to cover recurring debt payments.

- Specialist aggregators, focusing on single sectors and geographies, are beginning to appear and compete in acquisitions and positioning. After the initial land grab, Aggregators are focusing on value creation, channel expansion beyond Amazon and internationalisation as key revenue drivers for growth beyond acquisition.

Author bio:

Alexej Pikovsky

CEO of Alphagreen Group

Alexej is the Co-Founder and CEO of Alphagreen Group, a global acquisition and incubation organisation specialised in the health and wellness industry. He began his career in investment banking at Nomura before moving on to become a founding member of Delin Ventures, a venture capital arm investing in leading technology companies and VC funds. Alexej acquired board-level experience as an investor for a large-cap private equity fund before founding Alphagreen in 2019. The firm initially focused on CBD markets and then expanded to focus on all products related to pain, sleep, and anxiety management.

The group leverages his interest and involvement in tech-enabled services and background in venture funding to deploy a ‘hybrid aggregator business model’ which helps brands to scale both locally and internationally. They achieve this through their own distribution channels, data science, growth agency and extensive external omni-channel network.