Introduction

Businesses capable of identifying their “moat” and capable of extracting value from that competitive advantage have historically thrived. This is no different today. However, what happens when you take the concept of a winning business model, and you couple it with another winning business model in an industry that is constantly growing really fast? What would happen if this industry was so fragmented and without clear leaders squeezing everyone else out?

You end up in the e-commerce world, specifically in the niche of Amazon FBA brand aggregators, businesses almost cherry picking the best parts of the marketplace and the Amazon FBA business models.

Amazon FBA business model

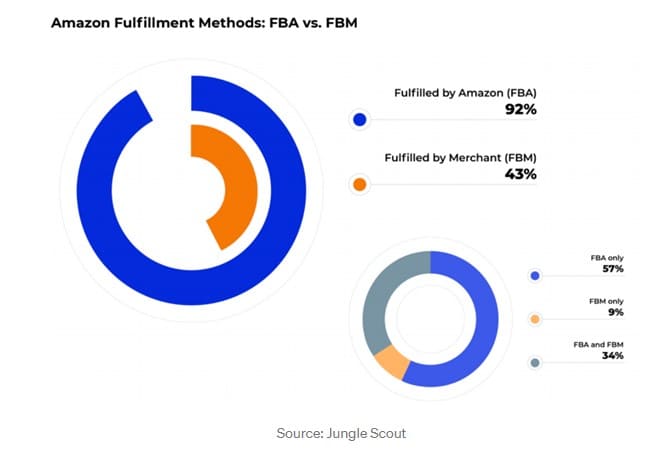

Whenever a business decides to sell on Amazon Marketplace, it can pick one of two options: Amazon FBM (Fulfilled by Merchant) or Amazon FBA. FBA stands for Fulfilled by Amazon: it’s the Amazon-branded 3rd party fulfillment model. In layman terms, the vendor identifies a product that has a very high likelihood of selling well and reaches out to the supplier to have their goods produced at the agreed terms. However, because our vendor does not want to deal with all of the struggles, costs and difficulties associated with the logistics, warehousing, delivery, customer service and potential returns of the products, he or she pays a 3rd party to do all that in their place. Without assuming any of the risks, and for a small fee, the vendor is able to deploy capital only on products, without having to manage and finance the operations of this endeavor. The vendor will only have to market the product, to make it as compelling as possible. Amazon FBA means that Amazon is the chosen partner to host the operations of this e-commerce business, and the storefront of our vendor’s products.

Validity and strengths of the model from a business perspective

Given the above, the reasons justifying the rise (and even predominance!) of FBA businesses are clear. The advantages are just staggering vs traditional business models. From a managerial perspective, more time can be dedicated to the actual sale of products.

Capital requirements are low, as the capital is spent on the actual order rather than costly overheads. The need for assets such as cars, machinery or IT infrastructure is essentially 0. Ease of scalability.

There is very limited risk these businesses face: among the most common potential pitfalls lack of diversified sales channels tends to be somewhat common, but it is also an easy fix. Lack of innovation or failure to maintain a relevant product SKU stock, can also be a challenge, and supply chain relationships are a critical factor for success.

Why do VCs back the business model

Capital raised

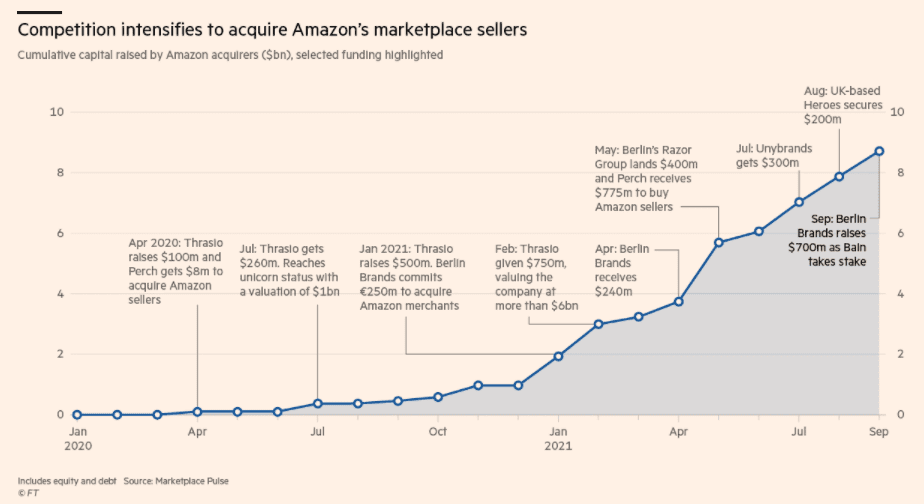

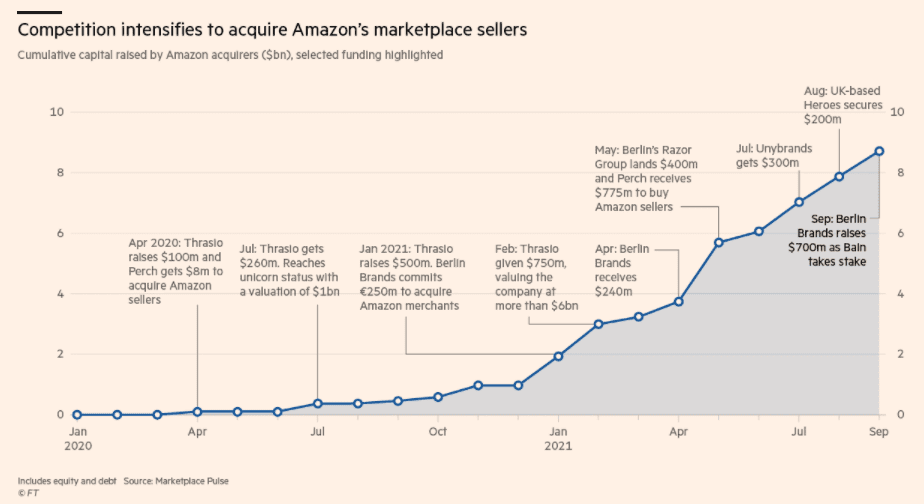

Consolidators are a solution to a succession and efficiency problem: they acquire businesses, consolidate and centralise their operations, improve them with a highly skilled and specialised workforce, maximise efficiencies and eliminate redundancies, and boost marketing spend. In today’s environment, with so much capital being raised by credit and equity funds, the Amazon FBA Aggregator space has been a huge beneficiary of that. In the last two years more than $12 billion has been raised in terms of capital. While it was mostly debt, a lot of equity investors backed this business model as well. The Financial Times provided an interesting timeline of the raises.

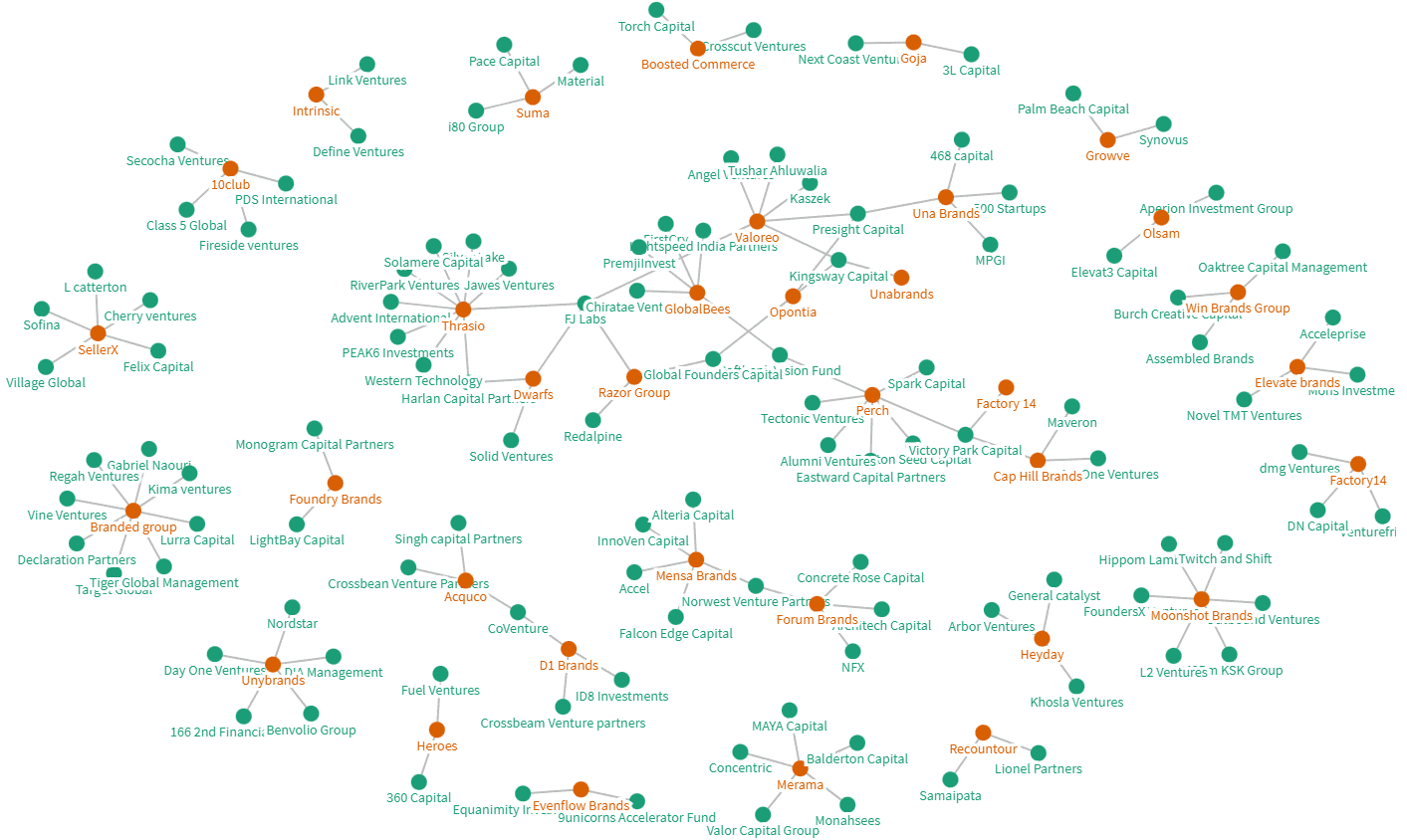

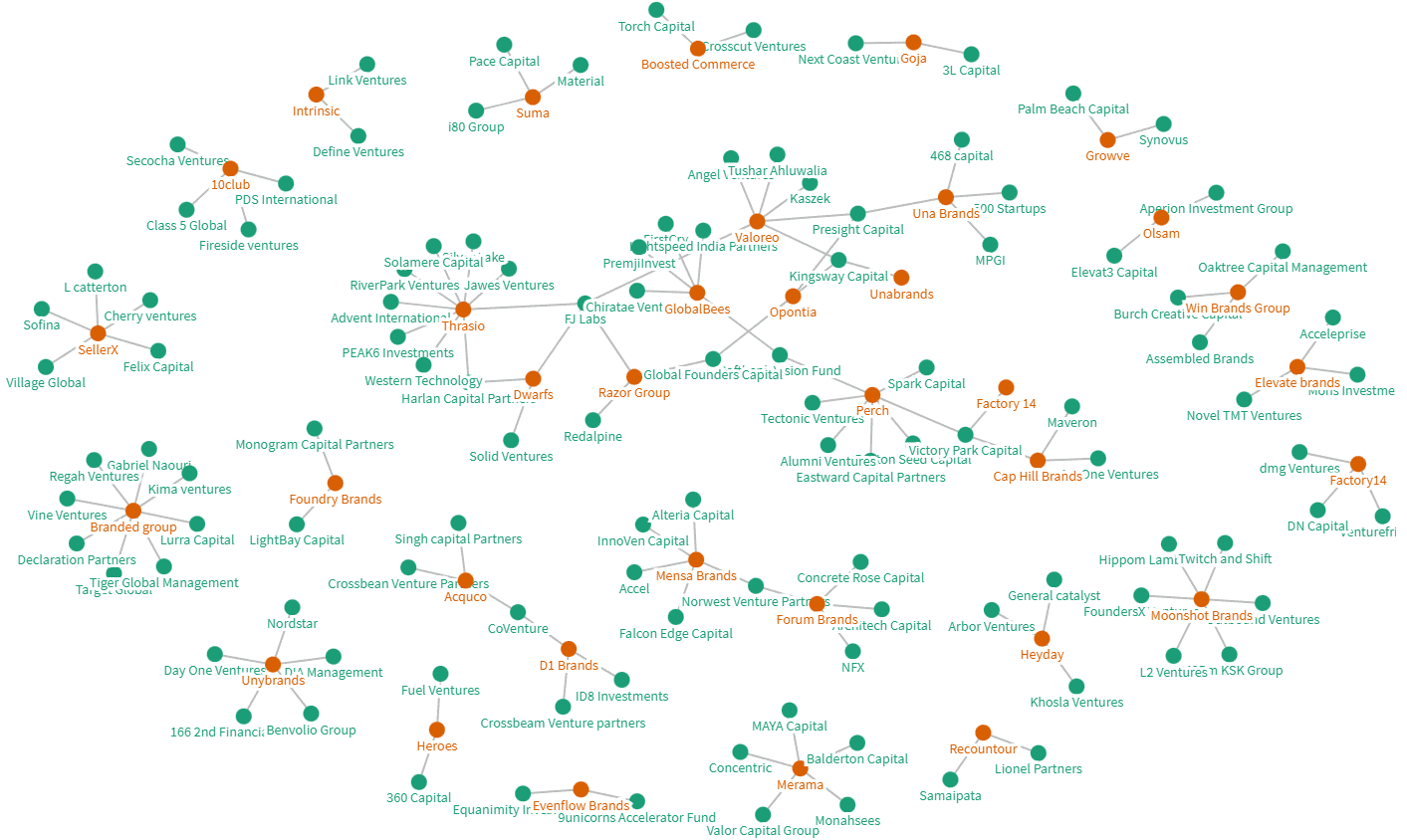

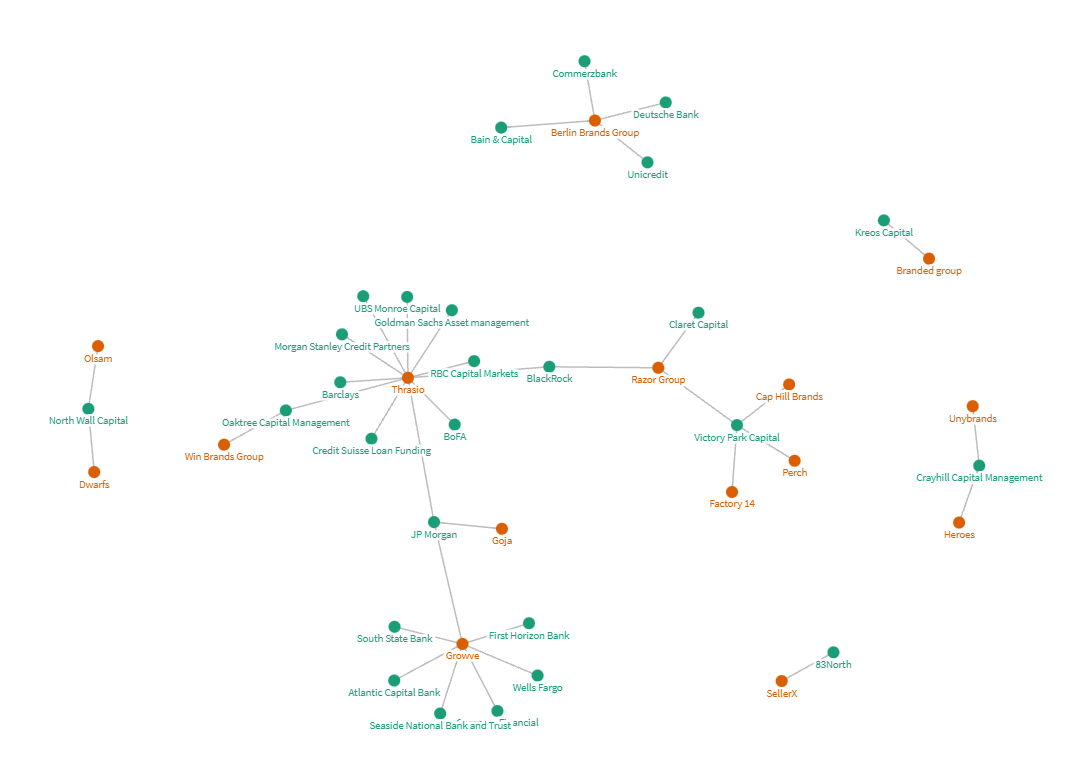

In an effort to map out this deployment of capital, we have collected data and gathered intelligence to produce the a map with all the various connections between aggregators and equity providers below, highlighting the flows of capital and the type of capital that was deployed among some of the most interesting players in the Amazon FBA consolidation space.

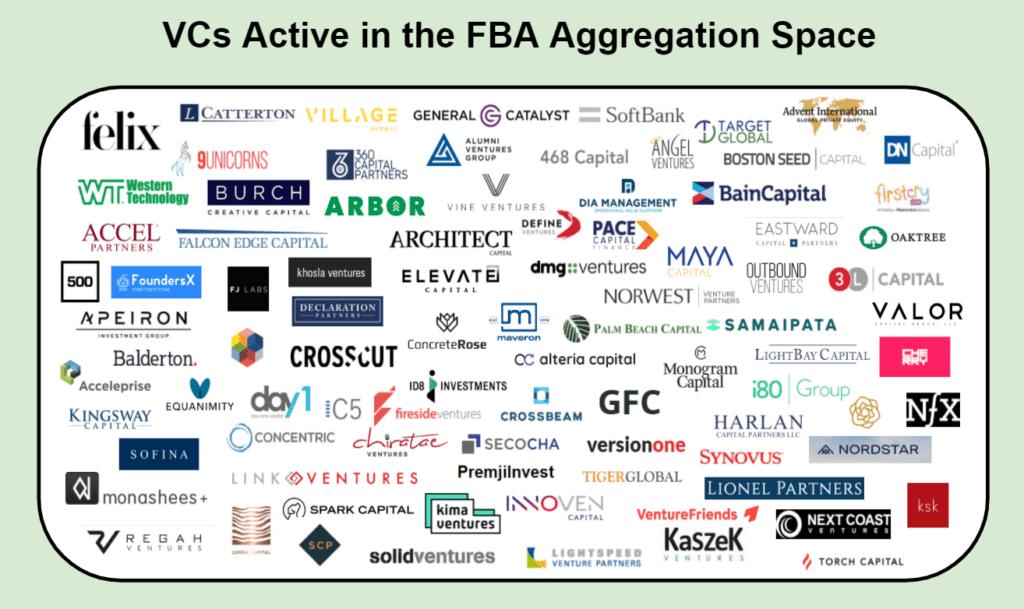

From these “spider webs” we can extract several insights addressing the relationship between venture capitalists and the FBA aggregators space. If we look at the equity financing (the first one of the two spider-webs) one, we can see a few things. First, This is not an isolated phenomenon. There are more than 70 aggregators by now. Most if not all of the major consolidators have received financial backing from more than one Venture group, a clear sign the industry has gained significant Venture Capital attention and investors recognise the validity of the business model as a potentially great investment.

Not only that, what may be even more interesting is the multiple financial support to aggregators from certain groups, with the clear goal of diversifying their investments but still remaining within the Amazon FBA niche. FJ Labs invested in Thrasio, Perch, Razor Group and Dwarfs; Kingsway Capital financed Unabrands, Valoreo and Opontia; and Presight Capital invested in Opontia, Una Brands and Valoreo.

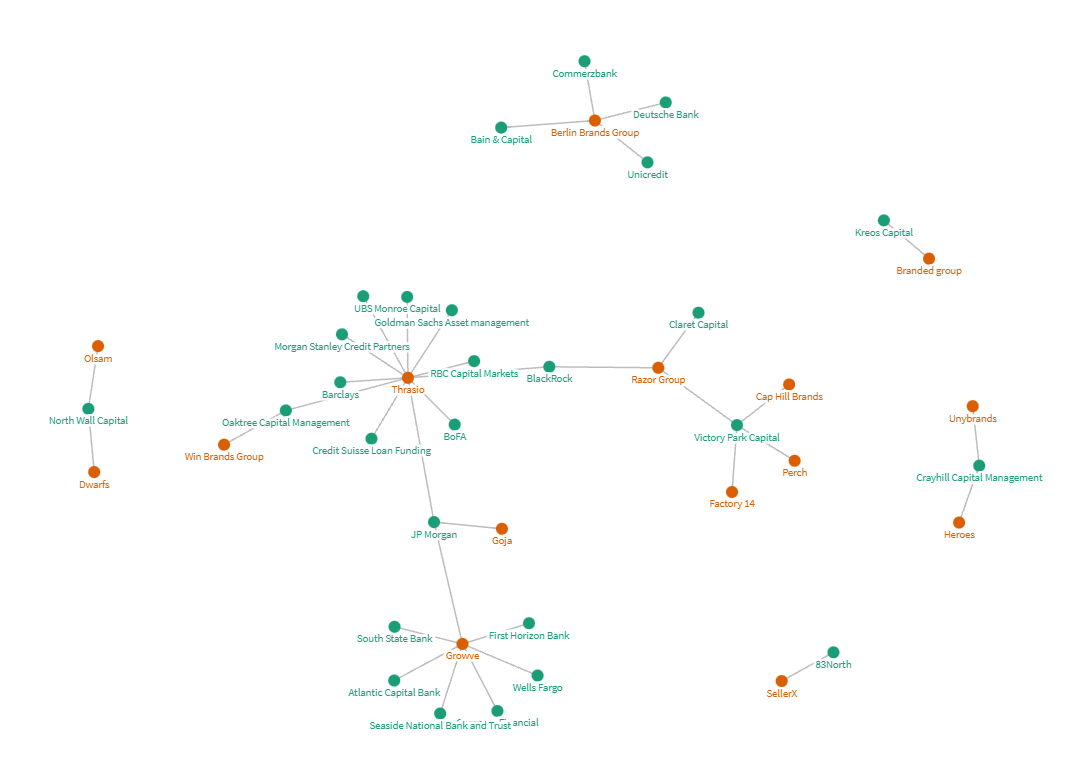

Venture Debt

Venture debt financing provided by dedicated venture debt funds (Claret Capital, Kreos), credit funds (Crayhill, Upper90, North Wall, Victory Park Capital), banks and asset managers, or even several revenue based financing players who are also seeing a big market for them here to provide not only revenue based financing after the target has been acquired, but also acquisition financing.

The debt players are comfortable with higher risk profile projects and tend to look at revenue growth and unit economics vs traditional lending which often is much slower and more risk averse. Some of the debt providers have been disclosed and we tried to map the players. Many of the debt providers back multiple aggregators and the list is far from complete.

The other benefit of debt financing is that it provides a less dilutive way to raise money (and in the case of no warrants present, not dilutive at all).

Usually it is structured as follows:

- One off arrangement fee, usually in the range of 0.5-1.5% of the amount raised

- Annual interest on principal, 10-12% range

- Warrants on the cash raised, in the 10% range as well

Repayment terms also differ from traditional lending as during the first year usually only the interest is paid, while in subsequent years a more standard amortisation schedule is employed.

The advent of consolidators

In the Private Equity industry roll-ups are not a new strategy to significantly scale a business by means of acquisitions. Besides potential challenges arising at the time of acquisition and during the integration process, it is a fairly straightforward and relatively simple strategy. It starts with a business big enough to be considered a platform, a good starting block to which add other, smaller and complementary ones. Additionally, there are a number of favorable external conditions, mainly and foremost a very large and heavily fragmented Total Addressable Market, to complete the picture. Because of the specific combination of factors, the strategy is almost a no-brainer: buy a “platform” business at a reasonable price, identify potential acquisition targets and buy them out, improve operations internally and resell the newly formed group with higher EBITDA for a profit a few years later.

However, what happens if we bring this to the e-commerce space? What would an e-commerce business look like if assume a good number of these smaller companies are run by an owner/part-time operator alone who sees the opportunity to make some extra money but does not necessarily possess a formal business education? More often than not, the answer is under-performing operations. The system may be in place and be conceptually sound too, but because of the limited resources that this solopreneur can devote to this endeavour, beyond a certain point, scaling issues arise and what may have started as a side gig has the potential, but not the means, to become something bigger.

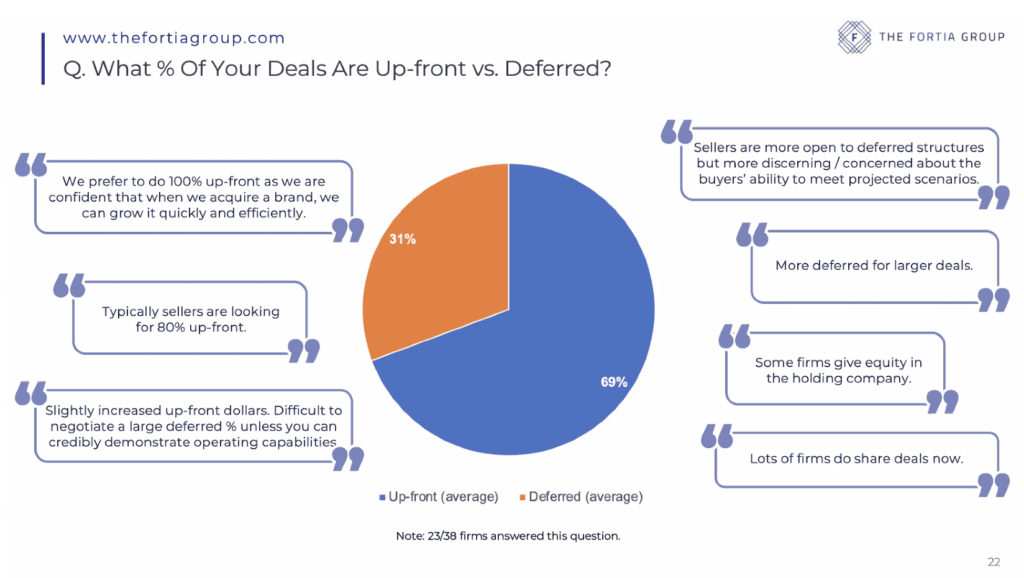

With the advent of consolidators and aggregators, FBA owners who desire to sell their businesses have plenty of choices available to them. Owners should expect to sell a company on a multiple of SDE (seller discretionary earnings, i.e. net profit, to which all owner-related charges, salaries and benefits are added back) and to share the risk with the acquirer via the inclusion of earn-outs and similar structures to share the acquirer’s exposure on future sales. Therefore, perspective sellers can expect to walk away with some cash at the time of close of the deal, and to receive some cash after some time in the form of an earn-out or similar compensation. The Fortia Goup, an investment banking boutique, published results from a survey with 38 firms on what % of deals are up-front vs deferred compensation structure. The results show that 69% of the purchase price is paid upfront:

Cheap money environment to raise and deploy capital

Thanks to the monetary policies implemented in the past 10 years by Central Banks all over the world, one may argue that access to capital has never been easier, and they may be right. This abundance of capital, both as equity and as debt, needs to be deployed itself to become profitable and, among the others, a common way to deploy capital is by acquiring businesses.

Venture capitalists know this and in an environment where they can easily and cheaply deploy capital they have a strong incentive to do so.

Strong tailwinds to the industry

In today’s world, the choice is simple: either you adapt and innovate or you quickly disappear. Since the advent of the internet e-commerce has been a disruptor and a threat to the stable and consolidated brick and mortar retail industry. In 2015 alone it accounted for 13% of all retail sales. Today, 6 years later that number is 20% and on the rise.

Amazon & marketplace growth

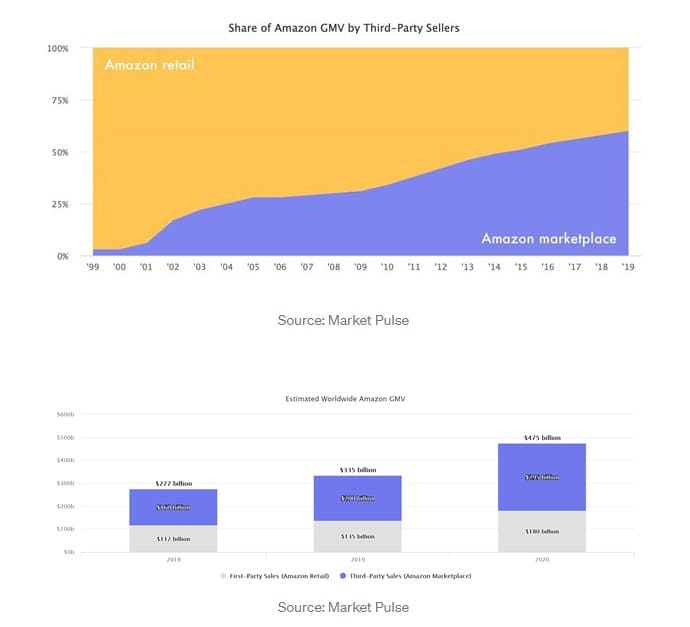

Since it became synonymous with convenience and ease of purchase, Amazon has been on an impressive growth path that helped set it apart from its competitors. Beyond being in an industry with secular tailwinds supporting its existence and operations, the Amazon model has proven its validity on more than one occasion. When it comes to the Amazon Store, we can break it down into Marketplace (for independent sellers) and Retail. Within the marketplace we can then subdivide sellers in two main groups: FBA (fulfilled by amazon) or FBM (fulfilled by merchant), depending on who handles the fulfillment and logistics operations. Because of the different nature of the two business models, the implied requirements and capital constraints, it appears clear that the majority of all FBA shops will likely fit into the SME classification.To have a better sense of the importance of FBA and third party sellers in today’s world, one number speaks volumes: $4.2 Trillion dollars of e-commerce sales, in 2021 alone. Within e-commerce, Amazon is the largest marketplace, and 60% of its sales come from these sellers alone: they are quite literally powering Amazon Marketplace, which is in itself growing at a sustained rate. In 11 years only, and compared to the Retail segment of the store, the Gross Market Value of the goods sold on Amazon Marketplace doubled to roughly 62% of total Amazon Store Gross Market Value.

Growth levers consolidators can pull

Centralized overheads

Instead of having several finance, marketing and customer support departments and their associated costs or the costs for the outsourcing of those functions, value is unlocked when all those functions are centralised under the same roof. Redundancies are eliminated, and with a broader, coordinated and clearer strategy in mind revenues may see an improvement as well.

Know-how & Management team

In the Amazon FBA space, know-how is critically important for success. Beyond a certain level, many different pieces need to fall into the right places to achieve higher growth (marketing strategies, planning, understanding of competition and value levers). For this reason, having a qualified and experienced management team is determinant to achieve success and scale. Single entrepreneurs are not rare in the Amazon FBA space, and they may lack specific knowledge, support network and financial means to be able to scale or compete vs brands with experienced management calling the shots.

Revenue maximization

One of the value levers for businesses, because of the nature of many FBAs, increasing sales is often seen as a low hanging fruit. Some of the most popular:

- Increase the number of sales channel, reaching a broader customer base and diversifying sales channels

- Expand geographies: sell the products in more countries than currently supported

- Product innovation and improvement, to stay relevant and/or capture market share

- Addition of other products (SKUs) to the brand offering

Improve operations

Another measure often considered a low hanging fruit, it is the counter-side to increasing revenue as a lever of value. While one could theoretically grow revenues indefinitely, the marginal effort to cut costs and maximize efficiencies increases progressively and eventually reaches a level of plateau as cost centers get trimmed down and operations are streamlined.

Valuation Multiple expansion

One of the value levers consolidators rely on to complete roll ups and profit at exit. Size grants a premium on exit multiples. Ceteris paribus, over time acquisition multiples can contract and expand depending on the market demand for the industry. Consolidators hope to achieve multiple expansion not only by increasing the size of the entity to be sold, but also by the market-driven forces just described.

Leverage

With the addition of a sustainable level of debt, therefore introducing leverage in the financing mix, a lower equity consideration is paid, boosting returns for investors who essentially “get more bang for their buck”. Of course, too much debt can also choke a company from a financial perspective and as such an intimate understanding of the company’s operations is needed.

Conclusions

The inexorable growth of e-commerce, only definitively accelerated by Covid, together with easy access to cheap capital, is giving a significant push to the industry. Leaders in the acquisition of FBA brands have received enough funding to target the successful completion of 20+ deals each year, and keep moving fast. Each consolidator in the FBA space has specific diligence requirements, but all focus and compete for brands making >$1M sales per year, having high margins and low # of SKUs.

Being able to afford to somewhat overpay for their acquisition targets (in an effort to present the highest offer vs competitors and close the deal) means they in turn need to be able to grow and scale their brands enough to be able to generate the same level of returns. Sure, those who will be able to conclude acquisitions with the best brands will enjoy the benefit of having acquired a potential leader, but it is a play with limits.

Whether all of the aggregators can do well is unknown and the industry expects more specialisation to happen with more strategic players and niche aggregators entering the space. Industry focus and allowing for synergies between the portfolio companies acquired, as well as on the marketing and supply chain side is a big advantage.

One of the more focussed players looking only at the health & wellness space is Alphagreen Group. The group has built Europe’s leading marketplace for alternative healthcare products, launched a sleep brand and has started to acquire Amazon FBA brands.